The Future of Nuclear Power in China: Introduction

The People’s Republic of China is today the biggest platform in the world for the deployment of nuclear technology to generate electric power. In less than twenty years, China has increased its population of operating nuclear power reactors from three to thirty-eight, with eighteen more plants under construction. China currently accounts for more than half of the world’s new nuclear power investment. In 2018, only the United States and France operate more nuclear power plants than China. According to current expectations, Chinese nuclear power production may surpass the United States, which has led the world in nuclear power generation for over half a century, sometime before 2030.

Following from China’s success with nuclear power so far, external experts in government and industry generally anticipate that China will continue to successfully manage and move forward with its nuclear energy program in the coming decades. Especially in that case, decisionmaking in China’s nuclear sector will likely significantly impact the global long-term outlook for nuclear power and the architecture of the nuclear fuel cycle; competition for nuclear exports; nuclear technology holders’ strategic leverage over trading partners; and international nuclear governance.

Regardless of its future outcomes, China will profoundly influence what the rest of the world believes about nuclear power and the nuclear fuel cycle. China aims to transition from conventional nuclear power reactors to a fully closed nuclear fuel cycle based on fast breeder reactors, spent fuel reprocessing, and the use of recycled plutonium fuel. If China fails, it will reinforce conventional thinking in some countries that nuclear fission is a transitional energy technology likely to be replaced this century by other sources. If China succeeds, prevailing low expectations for nuclear power may instead be dramatically revised. Other states may follow China’s lead in projecting that nuclear power will be sustainable for centuries and that the risks associated with an industrial-scale “plutonium economy” are socially, economically, environmentally, and politically acceptable.

China’s industry is poised to invade the world’s nuclear goods markets. Continued Chinese success in nuclear power will add to the challenges faced by a nuclear industry in the West that is in deep trouble. Chinese state-owned enterprises (SOEs)—which were, until recently, expected to become “second tier” suppliers—may penetrate established nuclear power plant export markets. China’s dirigiste business model may give its SOEs supreme competitive advantage over all foreign private sector companies in the nuclear industry. If Chinese business practices prevail, China might eventually become the world’s leading provider of nuclear fuel, nuclear power plants, and nuclear engineering services.

Beijing will obtain strategic leverage where Chinese nuclear firms do business. Chinese success in exporting nuclear equipment, technology, and materials will open the road for China to replicate the success of the United States’ Atoms for Peace program, in spreading its influence into the foreign, energy, and technology policies of China’s nuclear partners and clients. The expense of spreading nuclear commerce, especially to developing countries, might be underwritten by China in support of its strategic interests.

The bigger China’s nuclear power footprint grows, the more say China will have in global nuclear governance. If China in the coming decades becomes the leading nuclear power country, it will demand and obtain a commensurate role in members’ decisionmaking concerning multilateral technical rulemaking compacts and organizations, including the Non-Proliferation Treaty (NPT), the International Atomic Energy Agency (IAEA), and the Nuclear Suppliers Group (NSG). If China closes the nuclear fuel cycle, global governance mechanisms related to nuclear security and nonproliferation may be adjusted to reflect that accomplishment.

While these developments loom on the horizon, the intensified buzzing of China’s nuclear beehive has not escaped the attention of Chinese and international news media. However, the media’s day-to-day focus on new contracts, nuclear industrial partnerships, reactor projects, and record-setting electric power production contribute to a misleading impression that China’s nuclear power program will continue to expand indefinitely and incrementally without challenges, crises, or setbacks.

It is possible that, in the coming years, China’s nuclear industry will not continue on the same robust trajectory as over the last three decades. That may even be likely should other developments transpire, including: the widespread introduction of market reforms into China’s electricity sector that would threaten government subsidies and assistance to the nuclear power industry; a prolonged economic slowdown combined with a deeper shift from capital investment to consumer goods; greater debt and globalization-fed risk aversion; the emergence of nuclear power input bottlenecks; and China’s failure to make the transition from replicating established nuclear technologies to the more advanced, technically complex, and innovative systems that it wants to deploy in the future.

In any event, it would be a mistake to assume that China’s nuclear program will continue on the course it has steered since the 1980s. China built up its nuclear power system under assumptions it made before embarking on profound reforms that tied China to the development of the global economy. Today, the consequences of these reforms—greater wealth, industrial corporatization, economic competition, more diversified growth, and rising expectations for environmental protection and political accountability—will constrain and influence the state’s nuclear energy decisionmaking. To be successful, China’s rulers will have to adjust longstanding nuclear policies and aims to take this evolution into account.

Challenging the West’s Nuclear Industry

The scale of China’s nuclear energy industry alone ensures that how Chinese decisionmakers choose to manage this sector will have a great impact on the world’s nuclear energy systems. By the end of the twentieth century, France’s mature nuclear energy industry operated over fifty nuclear power reactors to supply about 80 percent of the electricity consumed by its population of 60 million people.1 By contrast, when China connects its fiftieth nuclear power reactor to the grid, which is expected in a few years, China’s nuclear power plants will contribute only about 5 percent of the electricity demanded by its population of 1.4 billion.2

Long before China set its sights on exporting nuclear power plants, the global nuclear industry had begun a process of consolidation that is still in progress. Since the 1980s, firms in Belgium, Germany, Italy, Japan, Netherlands, Sweden, Switzerland, the United Kingdom (UK), and the United States have abandoned the nuclear industry. Today, the nuclear engineering sectors of companies in France, Japan, and the United States, which supplied nearly three-quarters of the world’s nuclear reactors, are in decline and their futures are uncertain. These firms are experiencing low-capacity utilization, rising costs, loss of expertise, and waning political support. Westinghouse Electric Company, a firm in the United States whose technology is the basis for over half the power reactors in the world, was selected by China in 2006 to provide the blueprint for a raft of its future nuclear power plants. In March 2017, after Westinghouse had transferred much technology to China and on the eve going forward with new business with China, the company filed for bankruptcy in the United States, saddled by nearly $10 billion of debt resulting from cost overruns amounting to an estimated $18 billion for two nuclear plant construction projects.3 That followed revelations that Toshiba, a leading nuclear power vendor firm in Japan and Westinghouse’s owner, would post a net loss of $9.9 billion for 2016–2017.4 French firm Areva, Europe’s leading nuclear vendor company, which has transferred nuclear power technology to China since the 1990s, recorded cumulative net losses of EUR 7.5 billion from 2014 through 2016.5

Should China’s nuclear development remain on track, its industry’s anticipated massive economies of scale and high turnover will also put foreign competitors under even greater commercial pressure. Under President Xi Jinping, the Chinese state has pushed forward with plans to further support and consolidate its SOEs, including companies in the nuclear industry that may be subject to megamergers. Wedding the might of Chinese industry to the central government’s strategic and diplomatic aims, Beijing ordered its nuclear SOEs to collaborate to design Hualong-1, a national champion power reactor model that Chinese companies, at the behest of the state, are expected to aggressively export. In addition, Beijing planners are counting on exports of nuclear power plants to compensate for a marginal downturn in the domestic order books of equipment makers, engineering firms, and construction companies should demand for more reactors in China slow in the coming decades.

China’s Policy Choices and Strategic Implications

Ever since the mid-1980s, China has prioritized the development of nuclear power technologies because central planners considered them to be strategic. After a September 2016 address by Liu Baohua, the nuclear energy director of the China Atomic Energy Authority (CAEA), Chinese media summarized that nuclear power is “not simply an energy source” but is a technology with “other roles” in the Chinese state. Nuclear energy, they wrote, is “an important cornerstone of strategic power, a vehicle for civilian-military integration, and a ‘China card’ to play in the country’s international cooperation diplomacy.”6

China views nuclear energy as strategic from several perspectives. The technology for nuclear power generation is derived from the same science and engineering pursuits that are the basis for the reactors, uranium enrichment plants, and spent fuel reprocessing plants used to produce nuclear weapons; indeed, the chain-reaction physics is the same for nuclear weapons and power reactors. A country with advanced nuclear fuel-processing technology for power reactors has the means to produce fissile material for nuclear explosives.

Skills developed and experience accumulated in a country’s civilian nuclear energy applications can be put to use in its nuclear defense programs. The human and capital resources required for a successful nuclear energy program are great, and the timeline for nuclear power projects from conceptualization to decommissioning can be a century or more. Nuclear cooperation and the export of nuclear equipment, technology, and materials are vehicles for states to access and influence other countries’ decisionmaking on technology and energy. The greater a country’s nuclear power infrastructure is, the more a country is able to influence global governance standards for nuclear safety, nuclear security, nuclear trade policy, and nuclear nonproliferation.

Finally, nuclear energy is expected to contribute significantly to China’s intent to further urbanize its population by reducing air pollution in expanding megacities, and to show global leadership in reducing atmospheric carbon emissions. All of these strategic aims will factor into current and future Chinese decisionmaking about its nuclear power program.

From a strategic point of view, there are two reasons in coming decades why China’s most significant nuclear power challenge will be the establishment of an industrial-scale fuel cycle. First, China has since the 1980s aimed to effect a transition from conventional power reactors to a nuclear system based on more advanced fuel cycle technologies, to ensure that nuclear power has a future extending beyond the twenty-first century. Second, the decisions China makes in this area will have profound impact elsewhere. Since the 1960s, efforts to establish a closed fuel cycle in France, Germany, Japan, the UK, and the United States have been shelved or terminated due in large part to public opinion, politics, and market forces. How these same factors will affect Chinese plans to deploy fast reactors and industrial-scale reprocessing plants is not yet known.

This report considers both internal and external factors that can be expected to contribute to Chinese nuclear energy policy making. In addition to overriding and long-term Chinese strategic interests, the most important internal drivers will be China’s industrial policy concerning science and technology development, infrastructure investment, and electricity. The most important external drivers will be the forces of globalization. These could impact China’s nuclear course in two ways: by exposing China’s top-down and technocratic decisionmaking to increased influence from more Chinese stakeholders, and/or by encouraging and strengthening the impact of market forces in China’s economy, including its electricity sector.

Decisionmaking on how China moves forward with nuclear energy development is complex and opaque. There are many actors and many interests. China has on several occasions reshuffled the organizations and hierarchies of its nuclear energy–related authorities and agencies. It can be anticipated that this bureaucratic evolution will continue toward mid-century, beginning with the preparation for China’s next central planning milestones in 2020. Important decisions can be made with little regard for transparency. Indeed Chinese and foreigners have held different views about which Chinese government nuclear agencies are the most important.

So far, the decisions to select and deploy technologies for nuclear power generation have been made by the central government and the Communist Party of China without any significant public input. In recent years, the Chinese public has paid increasing attention to government actions concerning welfare, equity, health, the environment, and safety, including in the nuclear energy sector. Public concerns have multiplied even as Beijing has strengthened nuclear safety oversight. In 2013 and 2016, Chinese authorities canceled plans to build nuclear fuel cycle installations in the immediate wake of local opposition. These cases may be harbingers of greater public intervention in nuclear matters, but it is not a foregone conclusion that the Chinese state will react to public pressure by overturning decisions to proceed with specific nuclear investments—especially if the government considers projects to be in the strategic national interest. Regardless of China’s growing interaction with the outside world, government decisionmaking under Xi has become more centralized, opaque, and unpredictable. His record should caution observers not to expect that a more globalized China will necessarily become more transparent or permit greater public participation in nuclear energy matters.

How China proceeds will likely be decided above all by the central government, as decisionmakers balance policy goals and the interests of actors and institutions, and assess risks and opportunities. This report examines the future of China’s nuclear power development through 2050 by considering both the policy choices and the strategic implications, domestic and global, which include China’s choice of advanced nuclear technology, policymaking in China’s electricity sector, management and assessment of nuclear project and political risk, as well as the prospect for Chinese nuclear exports and China’s nuclear governance.

This report is intended to serve as a vehicle for informing a growing number of stakeholders in China’s nuclear energy program, as well as a broader policy community outside China, about the background, influencing factors, possible outcomes, and significance of the decisions that China will have to make in the coming years. The report does not aspire to predict how China will make these decisions, nor who will make them, nor what the outcomes will be. The report is based on five years of research and information obtained in part from government planning documents, academic studies, financial reports from industry firms, records of conferences and meetings, and Chinese and foreign news media accounts. The report benefitted from uncounted discussions and interviews with government officials, industry executives, economists, scientists, consultants, lawyers, academicians, and civil society experts since 2011. The centerpiece of this project was three annual workshops with Chinese and foreign expert participants concerning the future of China’s nuclear energy program, held from 2014 to 2016 on behalf of the Carnegie Endowment for International Peace, in Beijing, Xiamen, and Berlin.

Notes

1 “History of Nuclear Power in France” [in French], Fondation d’Entreprises Alcen Pour la Connaisance des Énergies, January 11, 2016, https://www.connaissancedesenergies.org/fiche-pedagogique/histoire-de-lelectronucleaire-en-france.

2 David Biello, “China Forges Ahead With Nuclear Energy,” Nature, March 29, 2011, http://www.nature.com/news/2011/110329/full/news.2011.194.html.

3 Mark Hibbs, “Does the U.S. Nuclear Industry Have a Future?,” Carnegie Endowment for International Peace, August 10, 2017, http://carnegieendowment.org/2017/08/10/does-u.s.-nuclear-industry-have-future-pub-72797.

4 Diane Cardwell and Jonathan Soble, “Westinghouse Files for Bankruptcy, in Blow to Nuclear Power,” New York Times, March 29, 2017 https://www.nytimes.com/2017/03/29/business/westinghouse-toshiba-nuclear-bankruptcy.html?_r=0.

5 Michael Stothard, “Areva Posts €665m Net Loss in 2016,” Financial Times, March 1, 2017, https://www.ft.com/content/e38738f3-a4b5-3b90-9c2b-4ec975a60157.

6 Lili Liu, “Administrative Measures for Nuclear Power” [in Chinese], Sina Press, December 9, 2016, http://www.china5e.com/news/news-971094-1.html.

China’s Choice for Nuclear Power and a Closed Nuclear Fuel Cycle

The State Brings Nuclear Power to China

Throughout the thirty-five years that China has built up its nuclear power infrastructure, decisionmakers have been confident that nuclear power is consistent with and contributes to the realization of China’s long-term aspirations and values. Ultimately, most critical decisions have been made by the leadership of the Chinese state and the Communist Party of China. Initiatives launched by hands-on actors—company executives, nuclear scientists, engineers, and planners—to significantly influence the direction of China’s nuclear development have been translated into policy only after they were endorsed at the highest level of government.

China committed to generating electricity using nuclear fission energy with two significant steps. The first, taken in the late 1970s, was to launch initial nuclear power plant construction, and the second was to accelerate it in the mid-2000s. Both times, the country’s supreme leadership took these decisions in consort with technocrats who promoted these actions with specific aims in mind.

China first began investigating nuclear energy during the 1950s, primarily on the basis of bilateral cooperation with the Soviet Union, which led to discussions in the mid-1950s about cooperation on an array of peaceful nuclear research projects including both magnetic fusion energy and fission reactors.7 The Chinese Academy of Sciences (CAS), founded on the Soviet model, included an Institute of Nuclear Physics that during the 1950s was engaged in projects with both military and peaceful potential uses. By 1955, discussions on Sino-Soviet nuclear cooperation sidelined peaceful-use projects in favor of pursuing Chinese production of atomic weapons.8

Beginning in the 1950s, Mao Zedong gave China’s military establishment a green light to develop atomic weapons and ensure, in his view, that China would not be blackmailed by nuclear-armed imperialist adversaries.9 China was by far the poorest and least developed of the states that developed nuclear arms in the years after World War II, and the military defeated advocates of nuclear power in bureaucratic battles waged over the allocation of China’s limited resources for nuclear research and development.10

In 1964, after six years of dedicated work, China became the fifth country to build and successfully detonate a nuclear explosive device, following the United States (1945), the Soviet Union (1949), the UK (1952), and France (1960). Of these states, all but China quickly followed up their nuclear explosive tests with the construction and operation of nuclear fission reactors to generate heat that could be transformed into electric power.

For a decade beginning shortly after China’s first nuclear explosive test, domestic turmoil unleashed by Mao’s Cultural Revolution sidetracked any efforts to establish a nuclear power program.11 China approved the construction of its first nuclear power station only in 1981—eighteen years after France, the last of the first four nuclear-armed states, had begun producing nuclear electricity.12

The road to nuclear power in China was cleared after modernizers and reformers, who had emerged in the Communist Party during the 1970s, took control of the state by the end of the decade. Chinese scientists and electric power technocrats convinced Deng Xiaoping, Zhao Enlai, and other leaders that nuclear power would reduce China’s dependence on polluting coal, boost electricity output in densely populated coastal areas, and permit China to catch up with foreign countries that were far ahead in nuclear technology.13 Encouraged by this thinking, Chinese SOEs backed by provincial and local governments built a handful of nuclear power stations with help from foreign industry partners during the 1980s and 1990s.

In 2005, China dramatically magnified its nuclear construction program. As with the initial decision to build power reactors a quarter-century earlier, leaders and technocrats were in agreement. This time, then premier Wen Jiabao shared experts’ view that nuclear energy production should be greatly accelerated and that a nuclear power renaissance was about to take off in advanced countries. Behind the scenes, China’s central planners increasingly advocated nuclear power as an answer to the problems of energy security and pollution that had been unleashed by China’s economic growth.

In March 2005, Wen adjusted the government’s policy on China’s level of nuclear development from “appropriate” to “energetic.” This decision of principle was promptly incorporated into the fine print of China’s Eleventh Five-Year Plan for 2006 to 2010 and then into a newly conceived Medium- and Long-Term Plan for Nuclear Power Development for 2005 to 2020.14 China set the target of expanding nuclear power generation capacity from seven gigawatts (GWe), achieved in 2005, to 70 GWe in 2020.15 French, Russian, and U.S. firms were encouraged to compete with each other for the prize of providing the technological blueprint for a series of future nuclear power plants in China. Beijing selected Westinghouse Electric Company and, in 2006, gave the State Nuclear Power Technology Corporation (SNPTC)—a company set up by the State Council of Ministers, the chief administrative authority of China’s central government, to take charge of foreign nuclear power plant technology—approval to sign a contract with Westinghouse for the first four units. In parallel, the leadership of the China National Nuclear Corporation (CNNC), the most important nuclear SOE, prepared to build as many as thirty reactors under the government’s expanding nuclear horizons.

During the two decades between the launch of China’s first nuclear power plant projects and its decisions to accelerate nuclear development, the successive Chinese premiership transitions from Li Peng to Zhu Rongji and then to Wen Jiabao underscored how essential it was that support from the top leadership match technocrats’ advocacy of nuclear power. Li became premier in 1988 after a long career as an electricity manager and vice minister for power, and he unflinchingly championed nuclear energy projects. Zhu, who succeeded Li in 1998, did not share Li’s enthusiasm for nuclear energy. Zhu instead shifted new investment away from nuclear projects and he favored building up China’s petroleum sector and making electric grid improvements. At the end of the 1990s, he imposed a three-year moratorium on power plant construction. In 2003, Wen Jiabao succeeded Zhu and reversed Zhu’s policies on atomic energy. Wen revved up nuclear power plant building, having been convinced by nuclear advocates in the planning and science bureaucracies that this was necessary to put an end to crippling coal transport bottlenecks that led to electricity shortages.16 Wen’s decisions in the mid-2000s were in some quarters criticized as an overreaction to short-term events, but they initiated a crash program to rapidly build up China’s nuclear power infrastructure.

China’s top leadership once again directly intervened in the country’s nuclear development six years later, after the severe accident at the Fukushima Daiichi nuclear power plant in Japan in March 2011. This marked the first time that China made decisions about its nuclear program in reaction to external nuclear developments. China’s rulers were not prepared for the self-inflicted destruction of three reactors in Japan. With two dozen reactors operating or under construction in China, the leadership promptly ordered technocrats to take the necessary steps to ensure that a similar accident would not happen.17

Five days after the accident in Japan, the State Council of Ministers suspended approvals of new nuclear power projects in China and postponed construction of a number of previously approved nuclear power stations. In October 2012, following an internal government debate about nuclear safety that spilled over into the more visible National People’s Congress, China officially proclaimed that construction of nuclear power plants at inland sites—an essential element in China’s plan since the mid-2000s to greatly expand nuclear power beyond China’s crowded coastal perimeter—would be suspended until 2015.

As of 2018, the Fukushima accident has not affected the overall direction of Chinese policy but it nearly immediately precipitated a more conservative approach by the government toward project approval. According to a former Western government official who at the time conferred with Chinese counterparts, the Japanese disaster initially prompted China’s leadership to seriously consider, but ultimately decide against, reversing the course set by Wen in 2005 to build up China’s nuclear power capacity.18 In the end, the leadership’s response to the accident was a compromise: Beijing halted construction of reactors based on older technology and ordained that only projects featuring new reactor models would be approved. As a result of these decisions, nuclear power plant construction targets for the Thirteenth Five-Year Plan (2016–2020) might not be met on time.

Should plans to build nuclear power plants on inland sites be restored in the Fourteenth Five-Year Plan, China’s nuclear power program may remain on track to cross the 100-reactor threshold sometime during the 2020s. But in the meantime, the State Council’s 2011 decision to selectively suspend nuclear construction and probe the safety of all of China’s nuclear power plants has provided political cover for some officials in central government ministries and industry to assert more openly than at any time since 2005 that the ambitious pace is too risky and should be slowed down.19 As of 2018, the government had reached no consensus about how many more nuclear power plants China will build in the coming decades. Chinese government agencies, research and development (R&D) organizations, and their consultants project capacity figures for 2050 in a broad range between 150 GWe and 500 GWe. Projections made before Fukushima were more frequently in the 400–500 GWe range. Some projections made after the accident are considerably lower, between 150–250 GWe.

Steadfast Nuclear Policy Components

From the outset, Beijing aimed to establish a stable organizational structure and hierarchy for its nuclear power activities. Over four decades, the central government has called into being, rearranged, and in some cases dissolved a panoply of ministries, commissions, agencies, interagency “leading groups,” and SOEs in an effort to juggle the competing interests of various actors including academic research institutions, nuclear weapons scientists, the military, the mining sector, the power industry, state government central planners, and the Communist Party.

Currently, the State Council of Ministers is the most important authority responsible for making decisions concerning the future direction of nuclear power in China—but its subsidiary agencies have very different interests. During the last two decades, the state has created a number of bodies responsible for nuclear power decisionmaking under the State Council. These include the National Energy Administration (NEA), which is responsible for policy implementation and represents a score of government bodies and departments; the National Development and Reform Commission (NDRC), responsible for planning and infrastructure development; and the National Nuclear Safety Administration (NNSA), which is China’s nuclear power regulatory body. It began as a politically weak department of China’s Ministry of Environmental Protection and has been elevated in status over the last decade. Since 2010, policymaking has been coordinated by a National Energy Commission representing over twenty government departments.

China’s nuclear bureaucratic structure for many years has been sufficiently opaque that foreign governments and Chinese officials involved could not even agree which agencies were in charge. According to one researcher, Western observers were misled for over two decades to believe that nuclear energy policy is largely determined by CAEA. Over time, it claimed for itself numerous policy-related functions. “In practice, none of these functions or categories of work are taken by or carried out by CAEA, except when representing China at the IAEA.”20

Independent of how Beijing arranges and rearranges its official nuclear energy competencies, several overarching energy policy aims with strategic significance have consistently figured in China’s decisions concerning nuclear power development: to assure that a growing China would have sufficient energy; to diversify and more efficiently manage China’s energy fuel resources; to centrally control the process and direction of industrial application of technology; and to reduce atmospheric pollution by reducing the consumption of coal for electricity production.

Regional Development and Fuels Diversification

From the outset, a continuous thread in Chinese nuclear energy planning has been the aim to reduce China’s reliance on burning coal for electricity production and to redress imbalances in the distribution of the country’s energy resources.

China has over 10 percent of the world’s coal reserves but very few other fossil fuel resources, and for many decades it has generated a huge share of its electricity by burning coal.21 Nearly three-quarters of China’s coal reserves are in the country’s north and northwest, far from the electricity load centers on China’s eastern seaboard. Between 1975 and 2000, the share of electric power that was generated by China’s coal-fired plants steadily rose from 56 percent to 78 percent.22 Anticipating this trend at the outset of modernization, Chinese nuclear scientists argued that using nuclear energy might mitigate difficulties in transporting ever-greater amounts of coal from China’s interior to urbanizing coastal areas. Zhou Enlai, who was an early convert to this vision, said in February 1970 that, “from a long-term point of view, nuclear power is the only solution for the shortage of electricity in Shanghai and East China.”23

Zhou’s remarks were prompted by an acute power shortage in Shanghai. Thirty-five years later, another power crisis on China’s seaboard, likewise triggered by inadequate coal supply, encouraged then premier Wen to ramp up nuclear construction. Wen was pressed hard by a key figure, then vice premier Zeng Peiyan, who was convinced that shortages would get worse unless measures were taken to strengthen electricity production not based on coal. That logic implied that China would have to expand both nuclear power and hydroelectric power. Zeng, supported by the nuclear power industry, argued that a nuclear power expansion for the east coast was necessary because most of China’s coal resources were in the north and most hydropower sources were in the southwest, so it took half of China’s rail transport capacity and one third of its river transport capacity to supply seaboard cities with coal to be burned for electricity production.24

Technology and Industrial Policy

At the same time, China’s leadership was wary of political risks associated with unbridled nuclear power development. During the late 1970s and beyond, Chinese policymakers debated whether China should develop its nuclear power infrastructure on the basis of indigenous capabilities—implying that progress would take longer—or instead rely on fast-track cooperation from foreign governments and industries that already commanded the essential technologies and expertise that China sought. Advocates of home grown development included experts from China’s nuclear weapons program who sought to expand into profitable industrial projects. They also felt betrayed by the Soviet Union’s decision to not provide China with a nuclear weapon design in 1959.25 Ultimately, China embarked on a compromise two-track plan in the 1980s that attempted to reap the benefits of foreign technology transfer but also protect the interests of China’s industry.

This dual-track approach also informed the establishment of what would become China’s two most important nuclear SOEs. The first, CNNC, was hived off from Beijing’s former nuclear industry ministry in 1988. CNNC was critical of foreign influence in China’s nuclear development and was selected to spearhead nuclear power plant construction in the Shanghai region. The second firm, China General Nuclear Power Holding Company Limited (CGNPC), was formed in 1994 on orders from Beijing policymakers expressly to facilitate nuclear power development with foreign companies—particularly with French industry—as a counterweight to CNNC.

CGNPC set up a nuclear power plant at the Daya Bay site in Guangdong based on French technology. During this project and immediately after, managers and politicians in Guangdong aimed to expand nuclear construction with French industry to sustain rapidly growing wealth and electric power demand in southeast China. During the 1990s, their efforts were deflected by suspicious central government officials in Beijing; they were concerned that the decisionmaking freedom secured by Hong Kong as a condition of the UK’s 1997 handover to China would spread to adjacent Guangdong.26 These foreign-indigenous and center-periphery tensions and debates inhibited China’s nuclear development throughout the 1990s.

By the end of the century, China’s central government had resolved these issues to its satisfaction. Beijing was thereafter willing to assume the residual risk that more nuclear power plant construction in Guangdong and elsewhere might empower increasingly wealthy and globalized actors to wrest autonomy from or destabilize the central government. In parallel with decisions in the early 2000s that opened China’s nuclear power sector to greater foreign participation, the central government ruled that decisions on making investments in electricity production must be approved by Beijing. Further, the central government presided over an ongoing restructuring of China’s nuclear power industrial sector, which in practice assured that CNNC and its subsidiaries would own shares in virtually all important companies (including rival CGNPC) that were being set up to serve an increasingly technologically deep and geographically broad Chinese nuclear industry sector.27

Since the beginning of its nuclear power program, China’s leaders have made sure that, through SOEs, the central government firmly controls the future direction of nuclear power development, even if the details were left to company executives whose interests might differ. The State Council’s establishment of CNNC and then CGNPC was part of a more general process of reorganizing strategic economic activities under its control; it broke up former defense industry ministries and established SOEs responsible for aviation, aerospace, arms production, shipbuilding, and nuclear energy. In setting up its first nuclear SOE, the State Council tasked CNNC to construct and design nuclear power plants; produce nuclear fuel, isotopes, and military nuclear hardware; and manage nuclear waste. As the nuclear program expanded, the state created more SOEs in the 1990s, including CGNPC.

The State Council’s decisions set in motion a process of corporatization that in some areas has profoundly altered the relationship between the state and China’s nuclear industry. China’s leaders had intended to decentralize, “civilianize,” and render profitable China’s military-industrial complex. In fact, their decisions had the unintended consequence of setting up a contradiction between the state’s intent to open China’s economy to competition while maintaining firm political control over key strategic sectors. Whereas the state aimed to protect its interests in the companies it set up, bargaining relationships formed and persisted “between the state enterprises and their bureaucratic superiors.”28 As time progressed, nuclear firms eventually established parallel decisionmaking structures, and the companies formed relationships with local and provincial governments that had been freed by reforms from Beijing’s tight grip. These developments encouraged nuclear SOEs to develop their own unique interests that were distinct from the state’s, aimed at limiting financial accountability and oversight and promoting overemployment and protectionism.29

Beginning in 1985, the project to set up a small cluster of nuclear power reactors in Guangdong committed French industry to contribute to China’s aggressive localization drive for nuclear power plant construction, equipment manufacture, and operations. In addition, the French side carried out an extensive workforce development program to prepare CGNPC to take over all aspects of the management of nuclear power stations in Guangdong.30 Similar agreements were pressed upon partners in the United States to transfer the technology for Westinghouse-design power reactors to China. More limited localization agreements with similar workforce development programs were forged with partners in Russia and Canada.

Over the course of twenty years, Chinese policy on nuclear technology choice followed most other nuclear power–generating countries by focusing nearly exclusively on light water reactors (LWRs), which were considered the safest bet and in line with international trends. By the mid-2000s, safety concerns about the 400 LWRs operating in the world were diminishing as these units amassed operating experience. China accordingly prioritized obtaining independent intellectual property for this technology.

Electricity and Growth

China’s decision to greatly accelerate nuclear power plant construction in the mid-2000s was prompted in part by broader energy security concerns. Planners remained convinced that China’s capital investment–led growth model would continue to assure high economic growth, provided it was underpinned by a commensurate and increasing supply of base load electricity.

The severe wintertime coal and power shortages on the east coast, which in the 1970s had propelled China’s first nuclear investments, prompted leaders in the early 2000s to overreact. Inside of a year after decisions were made to ramp up, central planners were predicting that China would instead soon face a power surplus.31 However, the leadership, true to form, dismissed the surplus as a short-term adjustment and remained confident that the economy—and with it electricity demand—would continue to expand as it had during the last decade. In 1996, then premier Li told the National People’s Congress that China’s 1980 expectation that gross domestic product (GDP) would quadruple by 2000 had been “fulfilled five years ahead of schedule.”32 The next planning targets, in China’s Tenth Five-Year Plan (2001–2005), were accordingly based on expected annual GDP growth of 7 percent, and the Eleventh Five-Year Plan (2006–2011) predicted GDP growth of 9 percent. Both goals were, in fact, exceeded.

With continued high economic growth putting China’s energy resources under strain, planners aimed to reduce China’s overall energy intensity of GDP—the Eleventh Five-Year Plan called for a reduction in energy intensity by 20 percent. But they cautiously anticipated that, as the Chinese got richer and continued to urbanize, the electricity intensity of GDP would comparatively decline far less. Economists employed by China’s power sector expected a long-term close correlation between electricity consumption, urbanization, and GDP, as has been the historical experience of Western industrial economies.33

Chinese data substantiated this expectation. The percentage of China’s urban population rose from 19 percent in 1980, to 36 percent in 2000, to 56 percent in 2015. China’s per capita consumption of electricity during the same period rose from 281 kilowatt-hours (KWh) in 1980, to 993 KWh in 2000, to about 4,000 KWh in 2015.34 During China’s first two nuclear power decades, growth in Chinese electricity demand very closely matched growth in GDP. By 1995, China overtook the United States as the world’s biggest consumer of electric power. During most of the period following Deng’s reform initiative, China recorded an annual increase in power consumption of about 10 percent. Between 1980 and 2014, Chinese industry actually increased the country’s electricity generating capacity twenty-three-fold, from 60 GWe to 1,360 GWe, an average annual increase of 9 percent.35

China’s aggressive nuclear expansion in 2005 should be viewed considering growth, demographics, and energy fuel security. Inside the government, technocrats who were convinced that China would need more nuclear power worked to prevent more cautious planners at the NDRC from derailing Wen’s “energetic” nuclear development. In 2008, technocrats who strongly believed that China needed a dedicated central government agency to strategically evaluate and coordinate the nation’s energy policies created a National Energy Administration (NEA) staffed at first with fewer than 100 people. According to government sources in China, while initially NEA was not endowed with any real authority, it has since assumed from NDRC the task of outlining future electricity planning targets. Today, NDRC generally follows what NEA proposes.36

Environmental Policy

Modernizers who advocated nuclear energy beginning in the 1970s argued that nuclear power, unlike coal, would not pollute the air. In deciding to accelerate China’s nuclear program, technocrats and the political leadership agreed that nuclear power would marginally reduce growing levels of particulates emitted by coal-fired power plants that were polluting China’s air as a consequence of uninhibited economic growth. Over the ensuing twenty years, China’s leaders demonstrated greater concern about increasing pollution levels and then gradually followed the trend of promoting global awareness of the threat of greenhouse gas emissions. China refrained from committing to reducing carbon emissions during negotiations of the 1999 Kyoto Protocol. But five years later, China singled out nuclear power as a carbon-free energy source worthy of greater investment in the 2004 Medium- and Long-Term Planning Outline for Energy Development, permitting future nuclear technology “leapfrogging.”37

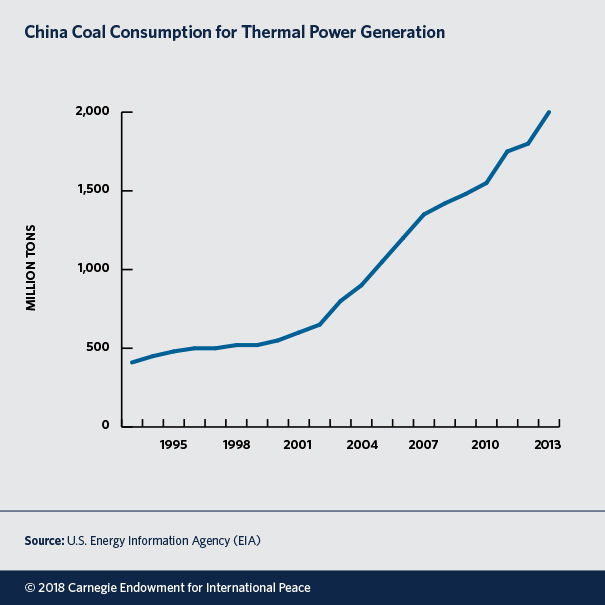

Nuclear power advocates who aimed to fight coal-fired emissions argued that many more nuclear power plants would be required to make a difference. They were right. Through China’s first three nuclear power decades, reactors accounted for less than 3 percent of China’s consumption of electricity fuels. Even after nuclear power deployment was accelerated, China has continued to build many coal-fired power stations. In just five years—between 2005 and 2009—China added coal-fired power-generating capacity equivalent to the total coal-fired capacity in the United States. Between 2010 and 2013, China added another 50 percent of the total U.S. capacity.38 Currently, China burns about four billion tons of coal per year, and for many years will continue to burn tremendous amounts. After fifteen years of forced nuclear power reactor construction and renewable energy technology deployment, the reality is that burning coal will still account for two-thirds of China’s electricity production in 2020.39

In the five-year period before the 2005 decision to speed up nuclear development, coal burning in China had increased by 75 percent, which contributed to China’s failure to meet ten of thirteen pollution control targets for its Tenth Five-Year Plan (2000–2005). China was, by then, the biggest emitter of atmospheric sulfur dioxide (SO2) in the world. In 2005, China exceeded the emissions ceilings for SO2 and soot set at the beginning of the plan by, respectively, 42 percent and 11 percent. World Bank data published a year later shows that, by 2005, atmospheric particulate levels in Chinese cities were four times higher than in comparative metropolitan areas in North America and Western Europe.40

China’s Nuclear Fuel Cycle

Beginning in the 1980s, in addition to building nuclear power reactors, China made preliminary decisions about what to do with the used fuel and waste that its nuclear power plants would generate. From the outset, China mirrored foreign nuclear programs’ visionary considerations about energy resource management and technological development.

Currently, all the reactors China has built for power generation—like nearly all power reactors worldwide—are so-called thermal reactors that use neutrons that are slowed by a moderator, usually water, in the core of the reactor. Nearly all of these thermal power reactors are LWRs, and all of China’s LWRs are pressurized water reactors (PWRs), the most common type of LWR. Slowing down the neutrons in these reactors increases the likelihood that their collisions with nuclei in the core will result in fission reactions that produce heat, radioactive fission products, and a number of heavy, transuranic elements. The heat is harnessed to produce steam that drives an electric generator. When the concentration of chain-reacting isotopes in the fuel becomes depleted during reactor operation, the highly irradiated (or spent) fuel assemblies, containing the fission products and transuranic matter, are removed from the reactor core and placed into pools filled with water, where the fuel assemblies lose residual heat and radiation levels gradually decrease. When the spent fuel is removed, it is very hot and intensely radioactive, requiring active cooling for several years after it is taken out of the reactor.

Like other countries, China has two basic options for managing its spent fuel from these reactors. China may store the spent fuel indefinitely in water-filled pools and/or in air-cooled dry casks, either at the reactor site where pools are located or at a centralized storage facility serving a number of nuclear power stations. Eventually, the spent fuel must be disposed of in an underground geological repository. Alternatively, China may remove some or all of the spent fuel from storage after a few years and bring it to a reprocessing plant, where the fuel is broken up and dissolved, and various components—uranium, plutonium, other transuranic elements and fission products—are separated and recovered. The plutonium and uranium may then be used to make new fuel. All other materials from the reprocessed spent fuel are collected, stored, and disposed of as waste in a geological repository.

Worldwide, currently about 300,000 metric tons of heavy metal (MTHM) of power reactor spent fuel is being stored, mostly at reactor sites, from over 400 power reactors that have operated since the 1950s.41 About 90 percent of this spent fuel is stored in water-filled pools and the rest in dry casks. Every year, the world’s power reactors add about 12,000 MTHM to the world’s spent fuel inventory. By 2030, an additional 400,000 MTHM in spent fuel may be generated.42

A small fraction of this spent fuel is annually reprocessed; in the recent past, as much as about 3,000 MTHM per year, but the amount is currently less.43 The reprocessing of power reactor spent fuel involves chopping up the fuel assemblies to expose the uranium dioxide (UO2) fuel matrix. The fuel is then dissolved in hot nitric acid. The dissolved components of the fuel are then separated from the undissolved residue of fuel cladding and some waste fission products. The dissolved fuel is contacted with organic solutions to separate the nuclear materials. Ideally, these materials, particularly the uranium and plutonium, are recovered. The residual wastes are separately concentrated and mixed with a solid medium, such as vitrified glass, and stored until they can be permanently disposed of in a geological repository. The recovered uranium and plutonium can be recycled as reactor fuel.

In a few countries, led by France, recycling nuclear materials from spent power reactor fuel is a mature industrial activity. During a period of more than twenty years, France has reprocessed over 26,000 MTHM of spent UO2 fuel. The plutonium extracted from this spent fuel has been combined with uranium and recycled as mixed oxide (MOX) fuel in twenty-two French LWRs and forty reactors worldwide, resulting in natural uranium savings of about 17 percent.44

In the majority of countries, governments and industries launched nuclear power programs without initiating specific investments or concrete actions concerning the long-term management of their spent fuel. China was no exception. Beijing, during the late 1970s, looked forward toward the construction of its first nuclear power plant without a plan for managing its spent fuel beyond storing it at the reactor site. For several decades, spent fuel from China’s growing number of power reactors has been stored in water-filled pools located at the plant sites.

When China’s first nuclear power plants were still on the drawing board, the leadership in Beijing was only dimly aware that the discharged spent fuel must be carefully managed for hundreds or thousands of years. By the mid-1980s, as reforms continued unabated under Deng Xiaoping, that situation had considerably changed. Leading technocrats—the most important of whom had been part of China’s nuclear weapons development drive a generation before—had convinced the leadership that nuclear energy technology was critical to China’s long-term future. Beyond the program approved by Deng to build a few power plants equipped with PWRs, these officials crafted a visionary narrative: fast breeder reactors, fueled with plutonium recovered by reprocessing China’s expanding inventory of spent fuel, would provide a potentially unlimited source of energy.

Reprocessing

In 1986, Deng, supported by leading scientists and technocrats from China’s strategic weapons programs, established the National Program for High Technology Development, the so-called 863 Program, to accelerate China’s technological development.45 This R&D program financed pilot projects for what was then called “reprocessing for the thorium-uranium fuel cycle” and for development of a fast neutron reactor.46 These two projects emerged as cornerstones of China’s ambition to establish a closed fuel cycle.

In 1987, in tandem with preparations for the construction of China’s first two nuclear power plants—the Qinshan-1 station in Zhejiang Province and the two-reactor Daya Bay station in Guangdong Province—Beijing made known that China, like Japan, Russia, and other leading nuclear power countries, would reprocess rather than dispose of its spent fuel, recover the plutonium and uranium, and use these nuclear materials as fuel for reactors. The Bureau of Nuclear Fuel in China’s Ministry for Nuclear Energy informed the IAEA that China would begin by setting up a pilot reprocessing plant by the mid-1990s, followed by an industrial-scale reprocessing plant by the early 2000s, to accommodate spent fuel from Qinshan, Daya Bay, and future Chinese nuclear power plants. Before reprocessing, spent fuel from China’s east coast nuclear power stations would be stored in water-filled pools at nuclear power plant sites for between three and five years. After, the spent fuel would be shipped to a central storage site in “northwest China,” where the spent fuel would be reprocessed in the pilot plant.47

China’s plans to set up reprocessing plants closely tracked with advanced nuclear countries’ rationales. All professed that, in the long term, fresh uranium fuel would become expensive and that reprocessing would ultimately lead to safer nuclear waste management, thanks to new techniques for partitioning and separation of radioactive isotopes that would limit the amount of nuclear waste and permit maximum recycling of nuclear materials. Accordingly, officials from the Ministry of Nuclear Energy told the IAEA that China would reprocess its spent fuel for four reasons: 1) to recover uranium and plutonium from spent fuel and use it for nuclear fuel (without reprocessing, “nuclear resources are not utilized in full”); 2) because of high costs for uranium mining, processing, and enrichment in China; 3) because “the ultimate disposal of high-level vitrified [radioactive] wastes is safer”; and 4) to take advantage of the future recovery of other transuranic elements, including neptunium, americium, curium, “and some valuable fission products such as palladium and rhodium, from reprocessing effluents to meet various needs.”48

China proceeded with the design and construction of its pilot reprocessing plant, completing and, according to Chinese experts, successfully commissioning it in December 2010—fifteen years later than originally foreseen in the 1980s. Stepwise commissioning of the installation, set up at the military Plant 404 site at Jiuquan in Gansu Province in remote western China, began in 2004 and took seven years. Some delays were administrative, while others were due to difficult cooperation with Russian counterparts after the collapse of the Soviet Union and by quality control issues experienced during plant construction.49 Officials at the China Institute of Atomic Energy (CIAE), an R&D institution that since the 1950s had been a leader in China’s nuclear materials science, predicted in 2005 that Wen’s decision to accelerate nuclear power plant construction would delay fuel cycle development further because China would prioritize ongoing PWR-based power plant construction instead.50 Chinese experts said after commissioning of the reprocessing plant that the project had benefited from twenty years of R&D experience and China’s successful operation of three reprocessing plants that were built in the late 1950s to separate plutonium for China’s nuclear weapons program and operated until decommissioning in the 1980s.51

Over two decades, the pilot plant project served as a test bed for certain technical innovations that went beyond the 1950s-vintage technology of China’s decommissioned military reprocessing plants. Beginning in 2004, the pilot plant demonstrated a Chinese-designed bundle shear used to chop the spent fuel. It also tested the process chemistry equipment used to dissolve the spent fuel; it controlled key parameters such as pressure, temperature, feed rates, and separation speed, including by centrifugation; it calculated accounting mass balances for the nuclear materials in the system; it tested the behavior of process chemical equipment for separation; and it measured the rates of plutonium and uranium recovery, decontamination, and purification.52

Some technologies chosen for solvent extraction and purification technology in the pilot plant were different than what had been used in China’s military reprocessing plants. As intended, China has used the plant to develop experience in design and construction of reprocessing installations, train operations personnel, and recover highly enriched uranium from spent fuel irradiated in Chinese materials testing reactors (MTR), as well as recover materials intended for use in future power reactors. According to Chinese experts, the Ministry for Nuclear Energy projected a quarter century earlier that these activities should be carried out in the pilot plant soon after it was commissioned.53

Open-source data suggest that the pilot reprocessing plant was originally conceived to separate at least several tons of plutonium to be used as nuclear fuel during its lifetime operation. The plant’s design, for example, included a head end featuring a pool storage area to accommodate 500 MTHM in spent LWR fuel and 50 MTHM in spent MTR fuel, from versatile high-power research reactors.54 Most nonofficial sources estimate the design throughput of this plant as 50 MTHM per year, consistent with the dimension of the spent fuel storage area under the assumption that the plant would routinely operate to recover plutonium and uranium.55 However, at some point during its initial operation phase, the pilot plant was no longer intended to routinely or continually generate recovered nuclear fuel materials. In early 2016, a Chinese scientist close to the project said that 50 MTHM would be the maximum amount of spent fuel reprocessed over the plant’s entire lifetime. Other experts said later that year and in 2017 that the cumulative lifetime throughput of the plant will probably be far less than 50 MTHM, perhaps even a small fraction of that amount, depending on whether the plant would be modified. If so, some upgrades would be intended to address unusually high measurement uncertainties for the plant’s nuclear material inventory, attributed to a combination of measuring and process engineering issues.56 These statements from Chinese experts are consistent with data reported annually by China to the IAEA on the status of its civilian plutonium inventory, suggesting that the pilot plant has operated infrequently, that very little spent fuel has been reprocessed, and that operation may have been indefinitely halted in 2014.57

Fast Neutron Reactors

In 1987, the Ministry for Nuclear Energy reported to the IAEA that an important objective of the pilot reprocessing plant would be to recover plutonium to be made into fuel containing both plutonium and uranium—so-called mixed-oxide or MOX fuel—for future fast breeder reactors.58

China’s LWRs are fueled with low-enriched uranium and use water to cool the fuel and slow down (or moderate) the neutrons emitted by the fuel in the core of the reactor to increase the probability that they will cause exothermic fission reactions. Fast reactors do not use water or another substance to moderate the neutrons and so these remain high-energy, or “fast,” neutrons. To use fast neutrons, these reactors need fuel with a higher content of fissile material, either highly enriched uranium or plutonium. If the fuel in the core is surrounded by a “blanket” made of the isotope uranium-238, that so-called depleted uranium can capture fast neutrons emitted by the fuel, and the uranium-238 will be converted to plutonium-239. In this way, a fast neutron reactor can be operated to “breed” large amounts of plutonium that, in turn, can be used as fuel for more fast breeder reactors. Most of the world’s fast reactors have been cooled with liquid sodium, which efficiently transfers the heat generated by fission energy to a turbine-generator system to produce electric power.

China’s resolve to set up fast breeder reactors also tracked decisions that had previously been taken by advanced nuclear power countries beginning in the 1950s. By the time China initiated construction on its first LWRs in the late 1980s, France, Germany, India, the Soviet Union, the UK, and the United States had all embarked on ambitious fast breeder reactor development and construction projects meant to point the way toward a future transition from LWRs to more advanced, complex technologies. Several of these countries had in parallel prepared for the production of MOX fuel for future fast reactors.

Hand in hand with the central government’s 1986 approval of the pilot reprocessing project under the 863 Program, China simultaneously embarked on a project for a pilot fast breeder reactor.

During the 1960s, Chinese researchers interested in fast reactors set up a sodium circuit test loop, a mock-up of a fast reactor circuit that contains hot liquid sodium, and constructed a zero-power installation using uranium. It reached criticality in June 1970, despite political turmoil brewing in China. In the 1970s, technocrats from China’s defense nuclear program persuaded Deng and other leaders that, together with reprocessing, the breeder reactor was justified because the supply of uranium was limited and the cost of processing uranium was high. The same arguments had been put forth by breeder reactor advocates in other countries, under the assumption that nuclear power generation would rapidly expand worldwide and that the United States would establish a uranium cartel to control access to the world’s nuclear fuel supply.

To enhance their claim that nuclear energy belonged in the suite of technologies deemed strategic for China and hence qualified for support under the 863 Program, nuclear scientists mapped out a three-stage, long-term vision for the development of nuclear technology. They forecast that China’s (and the world’s) current LWR-based nuclear power infrastructure would be succeeded by fast breeders fueled by recovered plutonium and uranium, and that this nuclear power system would in turn be succeeded by a still-more-advanced system based on nuclear fusion energy.59 Similar visions had been put forth by breeder reactor advocates in other countries, notably India.60

In 1986, China included the fast reactor in the 863 Program and built about twenty experimental sodium loops, including two imported from an abandoned fast reactor program in Italy. CIAE and the Beijing Institute for Nuclear Engineering set to work designing the China Experimental Fast Reactor (CEFR). By 1997, assisted by a bilateral cooperation on fast reactors with Russia, the initial design of the CEFR was complete.

The CEFR was the centerpiece of the fast breeder reactor program, designed for an electric power rating of 20 megawatts (MWe). As in the case of the pilot reprocessing plant, China’s pilot fast reactor cooperation with Russia proved challenging and the project experienced severe delays. After twenty years of construction, parallel detailed design engineering work, and equipment procurement, the CEFR finally went critical in July 2010 and was connected to the power grid in July 2011. CIAE announced at the time that the CEFR would make it possible to increase the utilization of uranium fuel by 60 percent compared to current LWRs.61

Like the pilot reprocessing plant, the CEFR project was carried out to master technology intended for later deployment at an industrial scale. The CEFR was meant to provide China with experience and operations data concerning fuel and material irradiation, safety, and reliability; design feedback; data and experience for equipment development; and experience conducting lab-scale trials of process steps needed for China’s future closed fuel cycle.62 Like the reprocessing plant, the CEFR has not routinely operated since it was commissioned, including for reasons related to technical impediments such as clogging in plant circuits.

Strategic Takeaways

When the Cultural Revolution ended, China’s new leaders pursued nuclear power as one of many vehicles to achieve modernization and economic development in their bid to catch up with Western nations. The focus was on nuclear power’s near-term benefits—reliable electricity supply and cleaner air. Officials in China’s nuclear defense program approved Beijing’s plans to reward them with lucrative business opportunities in exchange for downsizing China’s nuclear military-industrial complex, enhancing the concentration on peaceful uses of nuclear power.

Beginning in the 1980s, the prospect of building many more nuclear power plants prompted China’s leadership to consider more strategic and national security aspects in their decisionmaking. Nuclear technologies for power generation and reprocessing were branded as strategic. China’s nuclear R&D sector supported this by arguing that plutonium produced for weapons could provide an infinite supply of electricity, allowing China to match the prowess of advanced technology countries, especially the Soviet Union and the United States.

China’s nuclear military-industrial complex was bundled together by the end of the 1980s. But as economic reforms progressed, the interests of SOEs, central government departments, and provincial governments came to the fore. Beijing viewed the SOEs’ cooperation with foreign firms suspiciously until the end of the 1990s, when it resolved center-periphery conflicts with fast-developing coastal regions in its favor.

Since the 1980s, strategic thinking has predominated in program planning for the development of nuclear fuel cycle know-how and infrastructure in China. For three decades, China focused on pilot projects for fast reactors and reprocessing intended to create a cadre of experts that could match the achievements of foreign advanced nuclear programs. Although this took longer than anticipated, China’s investment in these strategic technologies during this period represented just a small fraction of its massive commitment to conventional power reactor technology.

Notes

7 Mori Kazuko, “A Brief Analysis of the Sino-Soviet Alliance: The Political Process of 1957-1959,” Parallel History Project on NATO and the Warsaw Pact, June 2005, http://www.php.isn.ethz.ch/lory1.ethz.ch/publications/areastudies/documents/sinosov/Mori.pdf; Yuanxi Wan, Jiangang Li, and Yican Wu, “Energy Demand and Possible Strategy of Fusion Research in China,” International Atomic Energy Association (IAEA),

http://www-pub.iaea.org/MTCD/publications/PDF/P_1356_CD_web/Papers/Wan%20Paper%20EP%20I-4.pdf.

8 John Wilson Lewis and Xue Litai, China Builds the Bomb (Stanford, CA: Stanford University Press, 1988), 65–72.

9 Ibid., 35–7.

10 Xu Yi-chong, The Politics of Nuclear Energy in China (Basingstoke, UK: Palgrave Macmillan UK, 2010), 16–22.

11 The Cultural Revolution did not terminate all Chinese government programs related to high technology development. In 1970, China successfully launched its first space satellite. See Chunjuan Nancy Wei and Darryl E. Brock, eds., Mr. Science and Chairman Mao’s Cultural Revolution: Science and Technology in Modern China (Plymouth, UK: Lexington Books, 2013), 82–4.

12 Lewis and Xue, China Builds the Bomb, 104–36.

13 Xu, The Politics of Nuclear Energy in China, 20–4, 26–7.

14 Ibid., 60–4.

15 Hou Jianchao et al., “Government Policy and Future Projection for Nuclear Power in China,” Journal of Electrical Engineering 37, no. 3 (September 2011). After the accident at Fukushima-Daiichi in Japan, the target of 70 GWe by 2020 was reduced to 58 GWe.

16 Mark Hibbs, “With Demand Below Projections, China May Drop Nuclear Projects,” Nucleonics Week, March 4, 1999; Kevin Platt, “China’s Nuclear-Power Program Loses Steam,” Christian Science Monitor, July 21, 2000, http://www.csmonitor.com/2000/0721/p7s1.html; see also Xu, The Politics of Nuclear Energy in China, 51.

17 Author communication with Chinese government official, June 2013.

18 Author communication with Western government official, February 2017.

19 Author communication with Chinese state-owned enterprise official,

May 2014.

20 Xu, The Politics of Nuclear Energy in China, 82–3.

21 Kevin Jianjun Tu and Sabine Johnson-Reiser, “Understanding China’s Rising Coal Imports,” Carnegie Endowment for International Peace, February 16, 2012, http://carnegieendowment.org/files/china_coal.pdf, 3; China Industrial Map Editorial Committee, Industrial Map of China’s Energy (Singapore: World Scientific Publishing Co. Pte. Ltd., 2011), 7.

22 “Electricity Production From Coal Sources (China, 1971–2014),” World Bank, http://data.worldbank.org/indicator/EG.ELC.COAL.ZS?locations=CN.

23 Cai Jianping, “Progress of China’s Nuclear Power Programme,” Shanghai Nuclear Engineering Research & Design Institute, 1996, http://www.iaea.org/inis/collection/NCLCollectionStore/_Public/29/024/29024315.pdf, 67.

24 Author communication with French nuclear industry executive, Beijing, 2005; Mark Hibbs, “Chinese Officials Don’t Expect Zhu to Approve New PWR Project,” Nucleonics Week, April 4, 2002, 12–13; Mark Hibbs, “Foreign Vendors Say They Expect China in 2001 to Plan 4-6 Units,” Nucleonics Week, March 30, 2000, 4–6; Ann MacLachlan and Mark Hibbs, “Chinese Industry Reorganization May Continue,” Nucleonics Week, January 6, 2005, 11–12. See also Cai, “Progress of China’s Nuclear Power Programme,” 68.

25 Lewis and Xue, China Builds the Bomb, 60–5.

26 Author communications with Western government officials, London, 1998, and Beijing, 2000.

27 Mark Hibbs, “CNNC Battling With State Council Over Direction of China’s Program,” Nucleonics Week, June 16, 2005, 14.

28 Chao Chien-min and Bruce Dickson, Rethinking the Chinese State: Strategies, Society, Security (London: Routledge, 2001), 11.

29 Ibid., 21.

30 IAEA, Workforce Planning for New Nuclear Power Programmes (Vienna: IAEA, 2011), http://www-pub.iaea.org/MTCD/publications/PDF/Pub1477_web.pdf, 53–62.

31 Richard McGregor, “China Heads for Power Glut by 2006,” Financial Times, August 9, 2005, http://www.ft.com/cms/s/0/4f3b629a-090c-11da-880b-00000e2511c8.html.

32 Li Peng, “Report on the Outline of the Ninth Five-Year Plan (1996-2000) for the National Economic and Social Development and the Long-Range Objectives to the Year 2010,” Ninth Five-Year Plan in Retrospect, March 5, 1996, http://www.china.org.cn/95e/95-english1/2.htm.

33Zhaoguang Hu, Xiandong Tan, and Zhaoyuan Xu, An Exploration Into China’s Economic Development and Electricity Demand by the Year 2050 (Beijing: China Electric Power Press), 3–6.

34 “Electric Power Consumption (China, 1971-2014),” World Bank, http://data.worldbank.org/indicator/EG.USE.ELEC.KH.PC?locations=CN.

35 Gang He, Jiang Lin, and Alexandria Yuan, “Economic Rebalancing and Electricity Demand in China,” Lawrence Berkeley National Laboratory, November 2015, https://china.lbl.gov/sites/all/files/lbnl-1003799.pdf.

36 Mark Hibbs, “Chinese Industry Reorganization May Continue,” Nucleonics Week, January 6, 2005, 11. Foreign nuclear industry executives told the author that when NEA was created, Chinese nuclear experts were “puzzled about what it was supposed to be doing” since other agencies, especially NDRC, were responsible for important matters including project licensing and electricity pricing. Eventually, NEA assumed nuclear planning tasks previously carried out by NDRC and, according to Beijing government officials in July 2017, NEA is currently responsible for establishing nuclear energy planning targets.

37 Institute for New and Nuclear Energy Technology, “Energy Development Strategy,” in China’s Energy Outlook 2004 (Beijing: Tsinghua University Press), 36.

38 According to a research organization close to the fossil fuel exploiting industry, China in recent years has added new coal-fired power plants to the grid at the rate of one plant every ten days: “As U.S. Shutters Coal Plants, China and Japan Are Building Them,” Institute for Energy Research, April 23, 2015, http://instituteforenergyresearch.org/analysis/as-u-s-shutters-coal-plants-china-and-japan-are-building-them/.

39 Xu Xiaojie, “China Energy Outlook 2020,” Chinese Academy of Sciences, https://www.eia.gov/conference/2014/pdf/presentations/xu.pdf.

40 State Environmental Protection Administration/World Bank, Cost of Pollution in China: Economic Estimates of Physical Damages (Beijing: World Bank/State Environmental Protection Administration, February 2007), http://siteresources.worldbank.org/INTEAPREGTOPENVIRONMENT/Resources/China_Cost_of_Pollution.pdf.

41 “Current Status of Spent Nuclear Fuel,” Australian Nuclear Association, March 2015, http://www.nuclearaustralia.org.au/wp-content/uploads/2015/04/ANA-Information-Sheet-20150331-Spent-Nuclear-Fuel1.pdf.

42 Christophe Poinssot, Bernard Boullis, and Stephane Bourg, “Role of Recycling in Advanced Nuclear Fuel Cycles,” in Reprocessing and Recycling of Spent Nuclear Fuel, ed. Robin Taylor (Cambridge, UK: Woodhead Publishing/Elsevier, 2015), 35.

43 Ibid. Especially as a consequence of Germany’s nuclear phase-out policy and the indefinite post-Fukushima idling of most Japanese nuclear power plants since 2011, it can be anticipated that the amount of spent fuel reprocessed worldwide will decrease through the 2020s.

44 “Avis sur la Transparence de la Gestion des Matieres et de Dechets Nucleaires Produits aux Differents Stades du Cycle du Combustible,” Haut Comite Pour la Transparence et L’Information sur la Securite Nucleaire, July 2010, http://www.hctisn.fr/IMG/pdf/hctisn_rapport_cycle_cle31BE65.pdf.

45 “National High-Tech R&D Program (863 Program),” Ministry of Science and Technology of the People’s Republic of China http://www.most.gov.cn/eng/programmes1/.

46 D. Zhang, “Generation IV Concepts: China,” in Handbook of Generation IV Nuclear Reactors, ed. Igor Pioro (Cambridge, UK: Woodhead Publishing, 2016), 373–408.

47 Jiang Yunqing et al., “Preparing for Reprocessing of Spent Fuel From Nuclear Power Plants in China,” in Nuclear Power Performance and Safety vol. 5: Nuclear Fuel Cycle (Vienna: IAEA, 1987), 639, http://www.iaea.org/inis/collection/NCLCollectionStore/_Public/20/037/20037987.pdf?r=1.

48 Ibid., 640.

49 Author communications with Western government and Chinese industry officials, Beijing, 2005; Mark Hibbs, “China’s Plutonium Separation Program at Least Three Years Behind Schedule,” Nuclear Fuel, May 1, 2000, 3.

50 Mark Hibbs, “Chinese Breeder Reactor Criticality Delayed Until 2008,” Nucleonics Week, August 18, 2005, 6.

51 Author communications with Chinese nuclear fuel cycle experts, 2011, 2015, and 2016.

52 Ibid.; Zhang Tianxiang et al., “The Active Commissioning Process for a Power Reactor Spent Fuel Reprocessing Plant in China,” Chinese Science Bulletin 56, no. 23 (August 2011 ): 2,411–15.

53 Ye Guoan and Yan Taihong, “Development of Closed Nuclear Fuel Cycles in China,” in Reprocessing and Recycling of Spent Nuclear Fuel, ed. Taylor, 534–5; Zhang et al., “Active Commissioning Process.”

54 See, for example: Liu Xuegang, “China’s Nuclear Energy Development and Spent Fuel Management Plans,” NAPSNet Special Reports, October 16, 2012, http://nautilus.org/napsnet/napsnet-special-reports/chinas-nuclear-energy-development-and-spent-fuel-management-plans/; and

Yun Zhou, “China’s Spent Fuel Management: Current Practices and Future Strategies,” Center for International and Security Studies, School of Public Policy, University of Maryland, March 2011, https://www.files.ethz.ch/isn/127378/china_spent_fuel_management_and_reprocessing_draftfeb_2011.pdf.

55 “Plutonium Separation in Nuclear Power Programs,” International Panel on Fissile Materials, 2011, http://fissilematerials.org/library/rr14.pdf, 19–29; one 1988 source claimed on the basis of published Russian information that the future plant would have a throughput of 100 kilograms of spent fuel per day: Jason Puckett, “The Status of Nuclear Power Plants in the People’s Republic of China,” U.S. Department of Energy, 1991, http://www.osti.gov/scitech/servlets/purl/5823192.

56 Author communications with Chinese and foreign experts, 2015 and 2016.

57 China reported in 2015 that, in 2014, its separated civilian plutonium inventory had increased by about 11 kilograms; it reported that no additional plutonium had been recovered during 2015: “Communication Received From China Concerning Its Policies Regarding the Management of Plutonium,” IAEA, September 19, 2016, https://www.iaea.org/sites/default/files/infcirc549a7-15.pdf; and “Communication Received From China Concerning Its Policies Regarding the Management of Plutonium,” IAEA, August 28, 2015, https://www.iaea.org/sites/default/files/infcirc549a7-14.pdf.

58 Jiang et al., “Preparing for Reprocessing of Spent Fuel,” 641

59 Xu Mi, “Fast Reactor Technology Development in China; Status and Prospects,” Engineering Sciences, July 18, 2007; Xu Mi, “The Status of Fast Reactor Technology Development in China” (35th Annual Meeting of the Technical Working Group on Fast Reactors, April 22–26, 2002), IAEA, http://www.iaea.org/inis/collection/NCLCollectionStore/_Public/33/046/33046593.pdf; and Xu Mi, “Fast Reactor Technology Development for Sustainable Supply of Nuclear Energy in China” (China International Nuclear Symposium, November 23–25, 2010, Beijing), Brave New Climate, https://bravenewclimate.files.wordpress.com/2011/11/fast-reactors-xu.pdf.

60 Rahul Tongia and V.S. Arunachalam, “India’s Nuclear Breeders: Technology, Viability, and Options,” Carnegie Mellon University, December 15, 1997, http://www.contrib.andrew.cmu.edu/~tongia/breeder_Report.pdf.

61 Xinhua, “China Makes Nuclear Power Progress,” China Daily, October 31, 2012, http://usa.chinadaily.com.cn/china/2012-10/31/content_15862248.htm.

62 Zhang Donghui, “Fast Reactor Development Strategy in China” (International Conference on Fast Reactors and Related Fuel Cycles, Paris, January 25, 2013), IAEA, https://www.iaea.org/NuclearPower/Downloadable/Meetings/2013/2013-03-04-03-07-CF-NPTD/5.zhang.pdf.

A Three-Step Strategy: Technology Options and Challenges