Source: East Asia Forum

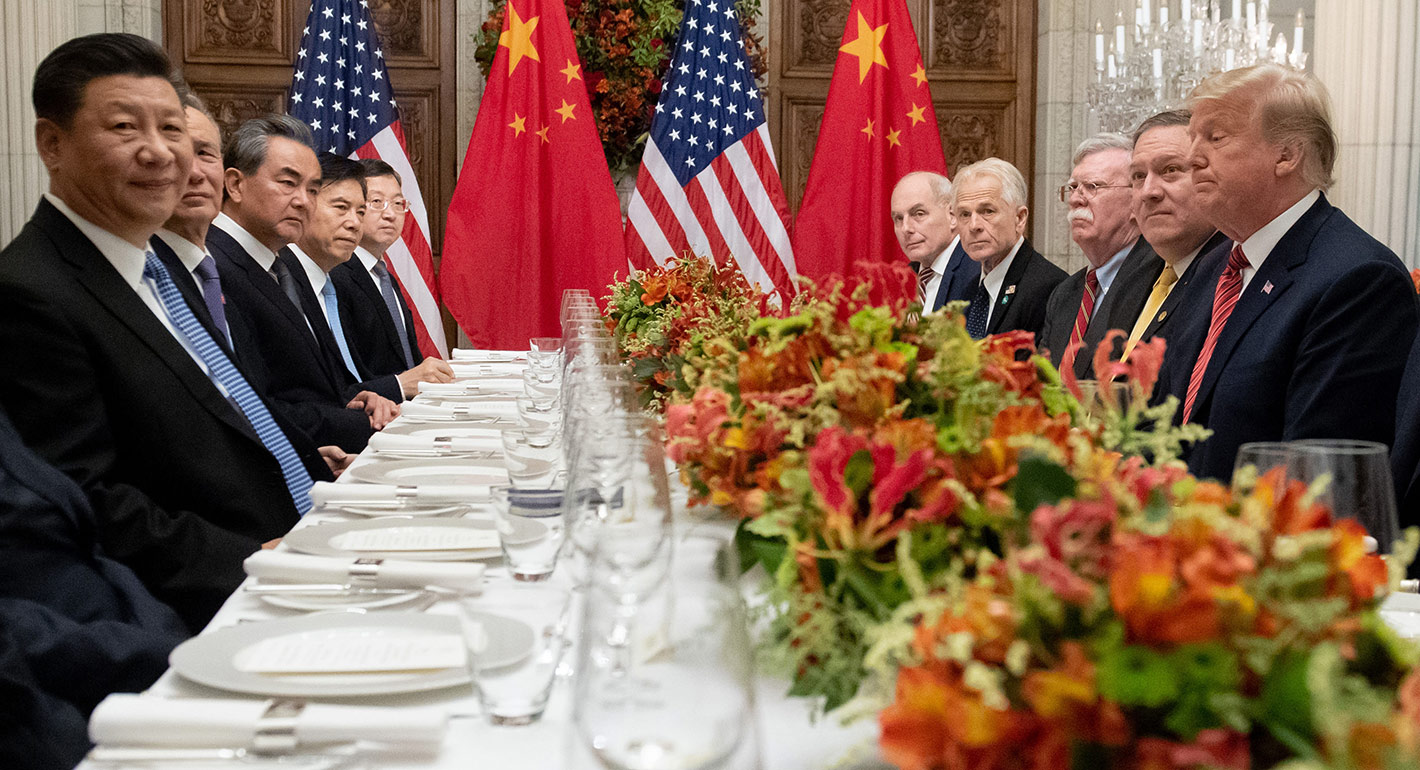

The temporary US–China trade truce reached at the recent G20 meeting follows the same approach that President Trump took in renegotiating NAFTA and pressuring South Korea, Japan and the EU to forge new bilateral trade arrangements. But this strategy of short-term threats of additional punitive tariffs is not a sustainable solution. The US–China impasse comes from much deeper differences in perceptions.

Trump is fixated on the United States’ bilateral trade deficit with China. The US business community worries about China’s ‘unfair’ foreign investment practices. And Washington’s geo-strategists agonise over China’s intentions to become a major technological power and threatening US global dominance. Put all three concerns together and it is easy to see why breaking the impasse is so difficult.

Despite committing to increasing its purchases of US goods, China simply cannot buy enough to significantly narrow the trade deficit. Moreover, neither side has been able to translate Washington’s complaints about China’s technology transfer policies into enforceable measures. China sees innovation as the key to escaping the middle-income trap and its allegedly unfair practices as typical of the commercial policies of developing countries.

Striking a compromise on these issues is all about changing behaviour and adjusting policies in light of experience. And that requires a structured institutional approach rather than one-off meetings or periodic negotiations.

The prisoner’s dilemma tells us that when two seemingly purposeful and equally endowed antagonists confront each other, both sides are worse off and a stalemate is the likely outcome. An outsider is then needed to help break the impasse. The obvious candidates in this scenario are Asia or Europe.

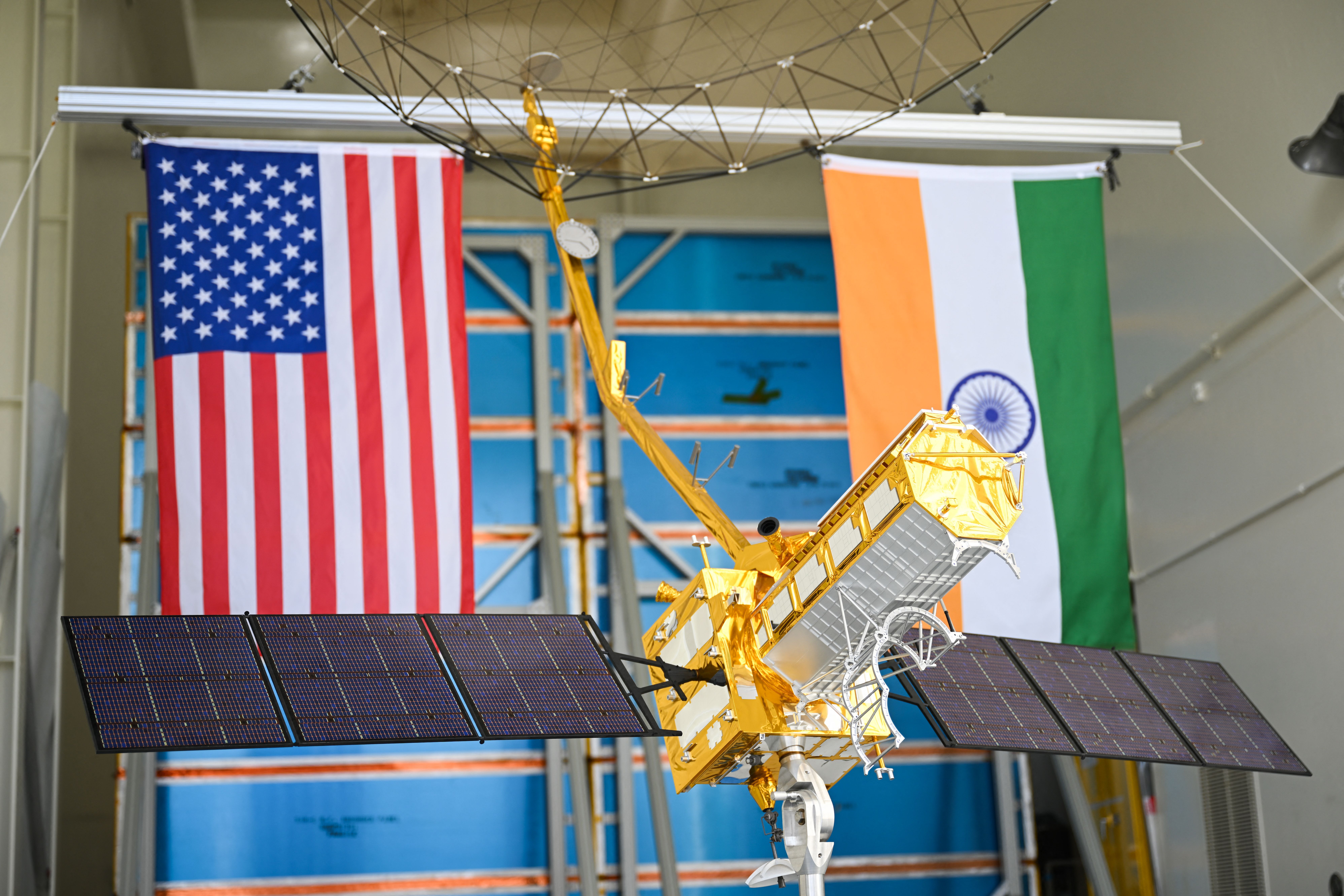

As the most directly affected by the trade dispute, Asia would seem to have more at stake, particularly given the ongoing RCEP negotiations. But ASEAN members have mixed views. Countries such as Vietnam benefit from relocated production from China, while others such as Malaysia lose by reduced demand for their products. Japan, India and South Korea are more concerned with containing China’s foreign policy ambitions than any downside economic risks. These regional powers vacillate between being drawn into arrangements with the US that might moderate China’s assertiveness and cooperative arrangements to remain engaged with Beijing.

The reality is that the region is too splintered to take sides.

Similarly, the major European powers are currently too absorbed with their internal politics to get involved. But this may change. While US–China economic links are extensive, Europe–China links are even deeper. Europe is China’s largest trading partner and China is the primary source of Europe’s imports. Over the past decade, Europe’s annual foreign investment flows with China have been about twice that of the United States despite beginning at similar levels. Europe is also making greater use of China as a base for exporting manufactured goods to the rest of the world. Thus, with a prolonged stalemate, Europe will feel increasing pressure to push for a sustainable solution.

But Europeans also harbour similar concerns about China’s restrictive investment practices. At various times, Germany, France and the United Kingdom have expressed concern about China’s acquisitions of their hi-tech companies. Europe nevertheless differs from the United States in not being as obsessed with great power rivalries and security concerns such as the South China Sea. Europe is also more directly affected by China’s Belt Road Initiative but is thus far taking a wait and see attitude.

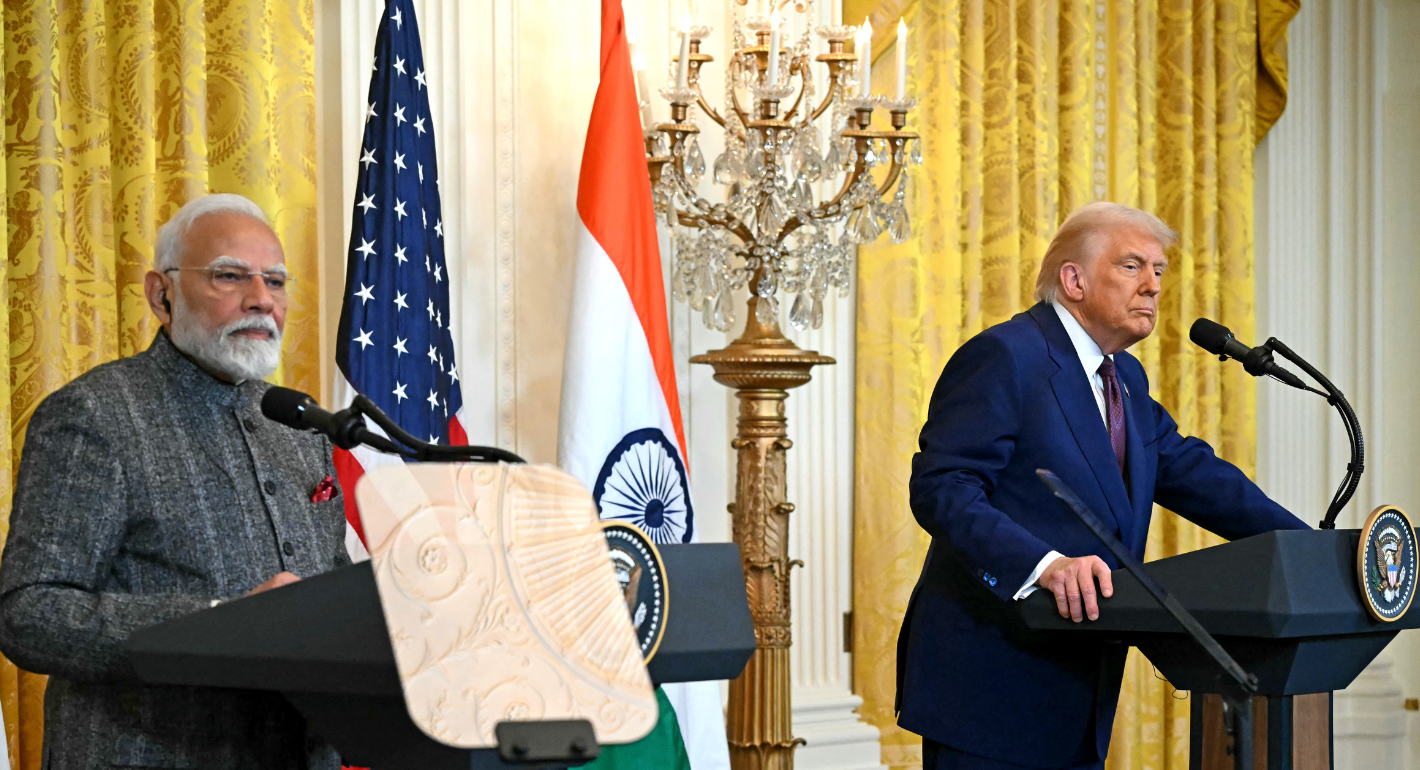

So can Europe forge a new relationship with China without jeopardising its US relationships? The White House did China a favour in calling the EU a trade foe and snubbing its leaders. The July 2018 EU–China Summit in Beijing also reaffirmed their commitment to a bilateral investment agreement and support for rules-based negotiations to counter US tariffs. But much of this momentum was lost given the July US–EU agreement to put on hold additional tariffs and initiate discussions for a free trade pact.

Beijing needs to persuade Europe that it is committed to reforms if there is to be any chance of jointly challenging Trump. Thus, it is not surprising that in the run up to the G20 meeting President Xi and Vice Premier Liu He visited Spain and Germany, respectively. Both emphasised the need to combat protectionism and find a rules-based solution to trade issues.

China and the EU have both expressed strong support for a strengthened World Trade Organisation to deal with trade and investment tensions, contrasting Washington’s efforts to undermine the institution. If Beijing and Brussels accelerate their discussions on a bilateral investment treaty, they could show Trump that there is a better way to deal with trade disputes than relying on punitive tariffs.

This was originally published in the East Asia Forum.