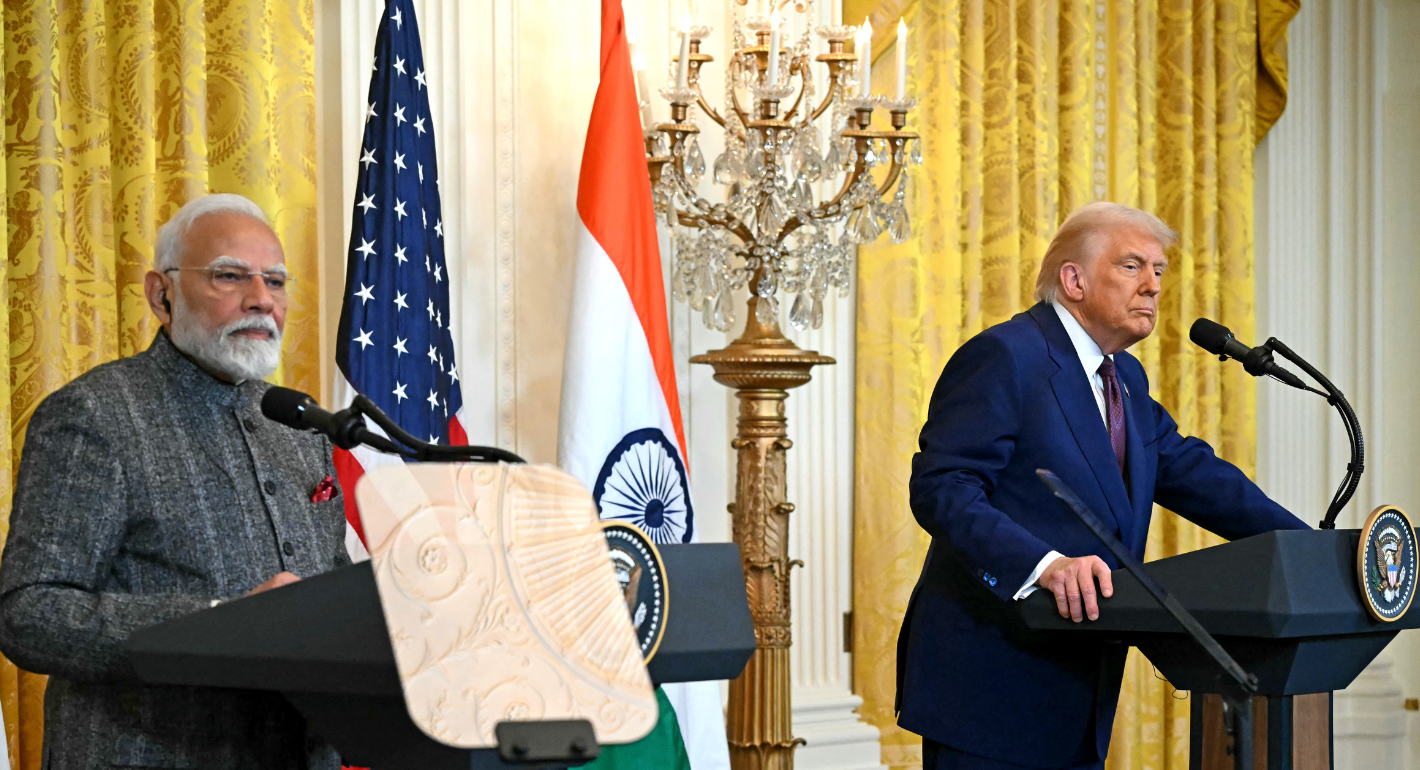

This piece examines India’s response to U.S. sanctions and tariffs, specifically assessing the immediate market consequences, such as alterations in import costs, and the broader strategic implications for India’s energy security and foreign policy orientation.

Vrinda Sahai