Evan A. Feigenbaum

{

"authors": [

"Evan A. Feigenbaum"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie China"

],

"collections": [

"Belt and Road Initiative"

],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"East Asia",

"China",

"Central Asia",

"Turkmenistan"

],

"topics": [

"Economy",

"Foreign Policy"

]

}

Source: Getty

China Didn’t Invent Asian Connectivity, May, 14, 2017

China hopes to use three strengths to make the Belt and Road Initiative a success: its large foreign exchange reserves, dominance in certain infrastructure fields, and unique forms of state backed project finance.

Source: CNBC

Speaking on CNBC, Carnegie’s Evan Feigenbaum explained that China already had major projects underway in Central Asia even before announcing its “One Belt One Road” (OBOR) plan. He noted that China has “upped the game,” in terms of connectivity, but it did not invent the concept of Asian connectivity. This idea, he said, has a long history; it did not begin in 2013 nor, he added, did it spring from the mind of Xi Jinping like Athena emerging from Zeus’s head. Instead, he argued, it needs to be looked at organically as the product of the actions and choices of many players in Asia, including Japan, India, and the international financial institutions.

Feigenbaum argued that China hopes to leverage three main strengths to make its OBOR strategy a success. First, he said, the government has access to a “huge pile” of foreign exchange reserves that it hopes to leverage by ploughing it into direct investments and infrastructure projects; thus vehicles like the Chinese Silk Road Fund are capitalized in part or in whole by the state foreign exchange administrator. Second, Chinese companies dominate certain areas of infrastructure, for example hydropower. Finally, he said, China can employ unique forms of state backed project finance—a model that Beijing knows few other countries or banks can compete with. One area to watch, he noted, is the degree to which China uses OBOR projects to export its indigenous engineering standards and thus make them de facto global standards.

The United States, Feigenbaum continued, is missing in action on connectivity in Asia; it is reactive instead of proactive and on defense instead of offense. He contended that Washington needs to think about how to better deploy its strengths rather than an apples to apples approach to China’s initiatives. The United States has a different model, distinct strengths, more leverage than it thinks, he continued, and doesn’t do state-backed China-style project finance. But ultimately, he said, the inevitably more integrated Asia is making the United States less relevant in large swathes of the region except as a security provider. So Washington had better figure out how to get more skin in the game, and quick, he concluded.

About the Author

Vice President for Studies

Evan A. Feigenbaum is vice president for studies at the Carnegie Endowment for International Peace, where he oversees work at its offices in Washington, New Delhi, and Singapore on a dynamic region encompassing both East Asia and South Asia. He served twice as Deputy Assistant Secretary of State and advised two Secretaries of State and a former Treasury Secretary on Asia.

- Beijing Doesn’t Think Like Washington—and the Iran Conflict Shows WhyCommentary

- The Trump-Modi Trade Deal Won’t Magically Restore U.S.-India TrustCommentary

Evan A. Feigenbaum

Recent Work

Carnegie India does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie India

- The Impact of U.S. Sanctions and Tariffs on India’s Russian Oil ImportsCommentary

This piece examines India’s response to U.S. sanctions and tariffs, specifically assessing the immediate market consequences, such as alterations in import costs, and the broader strategic implications for India’s energy security and foreign policy orientation.

Vrinda Sahai

- India-China Economic Ties: Determinants and PossibilitiesPaper

This paper examines the evolution of India-China economic ties from 2005 to 2025. It explores the impact of global events, bilateral political ties, and domestic policies on distinct spheres of the economic relationship.

Santosh Pai

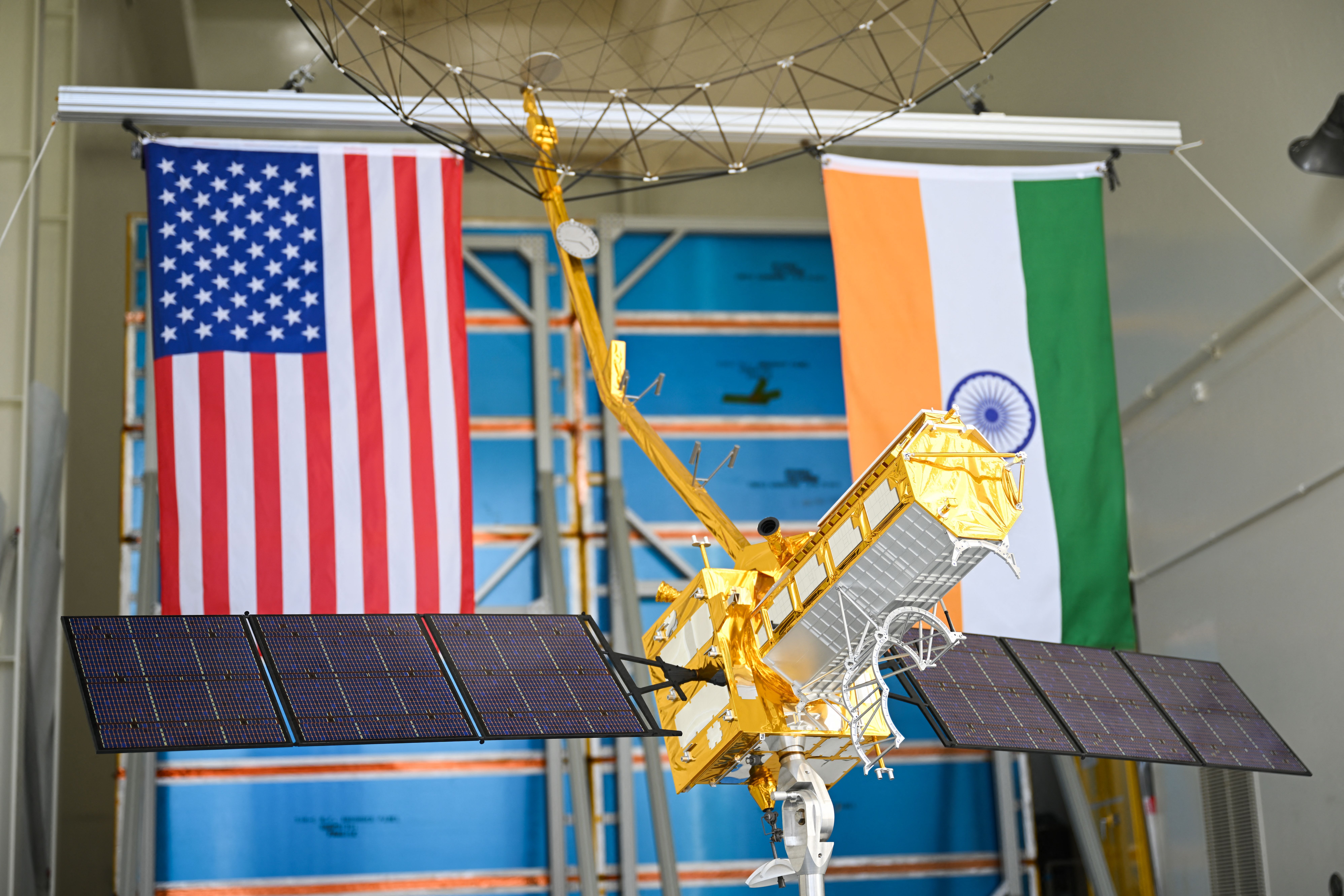

- NISAR Soars While India-U.S. Tariff Tensions SimmerCommentary

On July 30, 2025, the United States announced 25 percent tariffs on Indian goods. While diplomatic tensions simmered on the trade front, a cosmic calm prevailed at the Sriharikota launch range. Officials from NASA and ISRO were preparing to launch an engineering marvel into space—the NASA-ISRO Synthetic Aperture Radar (NISAR), marking a significant milestone in the India-U.S. bilateral partnership.

Tejas Bharadwaj

- Hidden Tides: IUU Fishing and Regional Security Dynamics for IndiaArticle

This article examines the scale and impact of Chinese IUU fishing operations globally and identifies the nature of the challenge posed by IUU fishing in the Indian Ocean Region (IOR). It also investigates why existing maritime law and international frameworks have struggled to address this growing threat.

Ajay Kumar, Charukeshi Bhatt

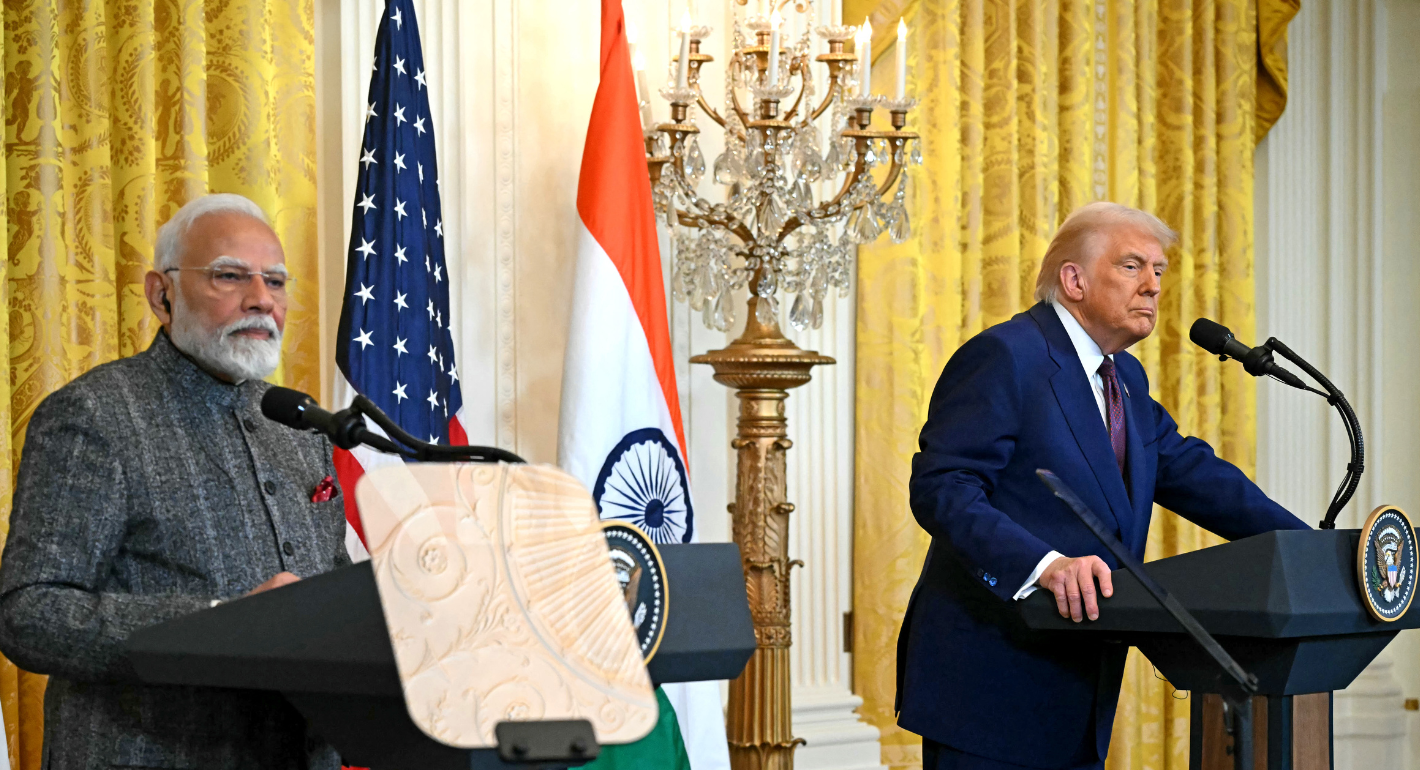

- TRUST and TariffsCommentary

The India-U.S. relationship currently appears buffeted between three “Ts”—TRUST, Tariffs, and Trump.

Arun K. Singh