In an interview, Ishac Diwan looks at the merits and flaws in the draft legislation distributing losses from the financial collapse.

Michael Young

{

"authors": [

"Dalia Ghanem",

"Lina Benabdallah"

],

"type": "commentary",

"blog": "Diwan",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace",

"Malcolm H. Kerr Carnegie Middle East Center"

],

"collections": [],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Malcolm H. Kerr Carnegie Middle East Center",

"programAffiliation": "",

"programs": [

"Middle East"

],

"projects": [],

"regions": [

"Maghreb",

"Algeria",

"North Africa",

"East Asia",

"China"

],

"topics": [

"Political Reform",

"Economy"

]

}

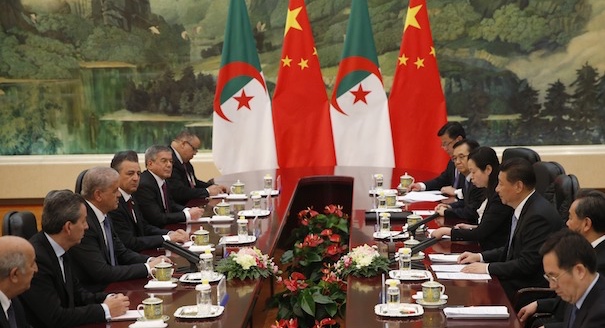

Algiers and Beijing have improved their economic ties, but Algeria can certainly benefit more.

On October 8, 2016, the China Petroleum and Chemical Corporation (Sinopec) announced the completion of the TOUAL 3D seismic acquisition project, in Ouargla and Illizi, Algeria.

The news reflected a trend of rising exchanges between Algeria and China. In 2014, China surpassed France to become the largest importer into Algeria, supplying over 14 percent of imports. Bilateral trade rose from $608 million in 2003 to $9 billion in 2013, making Algeria China’s top trading partner in the Maghreb. To that effect, in 2014 both countries signed a five-year plan for a comprehensive strategic partnership, the first of its kind in the Arab world.

However, given Algeria’s resource wealth, relative financial leverage, and political stability in the last decade, one would have expected to see higher levels of Chinese investment and trade in the country. However, that is not the case. Investment has been mostly limited to commercial loans, while Chinese Foreign Direct Investment (FDI) in Algeria, estimated at $1.5 billion, did not surpass 0.3 percent of total overseas Chinese FDI.

China is aiming for a deeper and stronger presence in Africa. It is seeking political support from the continent at the international level, greater access to African markets, new export destinations, and it is attempting to secure supplies of oil and minerals. In pursuit of such objectives, Chinese firms have been particularly involved in the Algerian construction sector. As of 2014 Algeria became the second largest market for Chinese infrastructure investments and contracts in Africa (after Nigeria), and is among the top fifteen worldwide.

Indeed, since 2000 the Algerian state has been focusing on the development of infrastructure and Chinese firms have profited from these plans, bringing in some $22 billion in contracts between 2005 and 2016. The Chinese, first, benefited from the Economic Support and Recovery Plan (PSRE) between 2001 and 2004, which aimed at renovating basic infrastructure. Likewise, between 2005 and 2010, Chinese companies took advantage of the Complementary Growth Support Program (PCSCE), designed to modernize roads and build housing.

Between 2010 and 2014 Chinese contractors were brought into a government development plan to complete all ongoing infrastructure programs. Among the major contracts there was the East-West highway project, launched in 2007 and completed in 2015, built by both Chinese and Japanese consortiums. There was also the construction of the Sheraton hotels in Oran and Algiers, a new terminal at Houari Boumediene Airport in Algiers, and low-cost housing projects (since 2000, some 250,000 units have been built). Finally, there is the new mosque of Algiers, the third largest in the world, which will be completed in 2020.

In addition, fifteen new memorandums of understanding were signed with China in April 2015 by Prime Minister Abdel-Malek Sellal, in order to increase investment partnerships and economic relations between the two countries.

As a consequence of these growing ties, Chinese migrants are more present than ever in Algeria. Indeed it is the country in Africa with the most Chinese workers. Official numbers indicate an increase in the numbers of Chinese workers from 22,000 in 2013, to 24,000 in 2014, to 55,000 in 2015. There is even a Chinese quarter in Algiers, and as many as 2,000 Chinese are believed to have been given the Algerian nationality, which is notoriously difficult to obtain.

However, cultural cooperation between the two countries is limited. There is not a single Confucius Institute or a Confucius Classroom in Algeria, both geared toward Chinese cultural outreach. In comparison, there are no less than 46 Confucius Institutes present across the African continent and 23 Confucius Classrooms. Moreover, tourism as well as business opportunities remain limited because of Algeria’s complicated entry requirements.

Sino-Algerian cooperation seems to be more beneficial for China. First, the trade balance is in China’s favor and the Algerian state funds most projects undertaken by Chinese companies. Chinese FDI in Algeria accounts for only 6 percent of China’s FDI in Africa. Algeria is in need of foreign investment, however its strict regulations are partially responsible for discouraging investment. A stringent law on visa requirements from 2007 and a complementary finance law from 2009 requiring joint ventures with outside investors to be 51 percent owned by Algerian companies are but two examples of unfavorable legislation.

Second, there is very little transfer of technology or expertise from the Chinese, as Algerians have little access to managerial positions. That’s because assigned employment quotas do not stipulate the kind of positions Algerians are supposed to occupy in joint projects. Hence, Algerians tend to hold blue-collar positions as janitors, security guards, drivers, and so on. Similarly, the Algerian private sector’s ability to grow is hindered by the presence of giant Chinese state-owned companies. Small and medium private enterprises have a hard time competing with the more established Chinese companies, which end up winning bids and taking most contracts.

Third, construction deals with Chinese companies for the most part have a limited impact on the economy in terms of employment. Despite regulations requiring the employment of Algerian workers, a majority remains Chinese. There is no oversight when it comes to implementing employment policies, as the Algerian state has sought quick solutions in order to resolve the housing crisis, which was one of the causes of social unrest during the 1990s.

So, for instance, when the $1.1 billion project of the mosque in Algiers was signed, both Algeria and China agreed that out of the 17,000 jobs the project would generate, 10,000 would be reserved for Algerians. However, reports indicate that at least 10,000 Chinese workers were on-site when the project began. The high competence and efficiency of Chinese workers was the explanation used by both sides to justify such a violation.

In addition to this, scandals have sullied the reputation of Chinese companies in Algeria. In one case, the China Railway Construction Corporation (CRCC) paid checks to subsidiary enterprises that bounced, while there have been allegations that Chinese companies are withholding over $4.2 million in wages. Most important, the lack of oversight from the Algerian authorities has diminished the incentives among the Chinese for transparency and accountability. A salient example of this is the East-West project, in which portions of the highway had to be closed weeks after it was inaugurated because they were already in need of repairs.

Although Sino-Algerian relations are not necessarily mutually beneficial, there is still a great deal of potential for more prosperous cooperation. On the Algerian side, the government has the means and the resources to build more effective partnerships and negotiate better deals with Chinese companies. The Algerian government should also think about ways of becoming more competitive in attracting FDI flows from China. An example of how to go about this can be found in Morocco, where the authorities recently removed visa requirements for investors from China, which will boost the number of Chinese tourists and investors in the kingdom.

Second, the Algerian government should push for more deals with China that play to Algeria’s competitive advantage in renewable energy sources rather than natural resource extraction deals. Particularly in the solar power and wind power industries, China’s expertise in these alternative energy sources and Algeria’s vast empty spaces in the Sahara could create opportunities for win-win cooperation.

Third, where diaspora communities feel at home they tend to invest and consider long-term profitable projects. On the other hand, when they do not feel integrated into their host environments, they’re more disposed to think about short-term gains and temporary projects which may not be sustainable. In the case of China-Algeria relations, cultivating cultural and people-to-people connections is vital to having a Chinese diaspora in Algeria that is invested in the local environment and cares about contributing to the greater good.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

In an interview, Ishac Diwan looks at the merits and flaws in the draft legislation distributing losses from the financial collapse.

Michael Young

Mustaqbal Misr has expanded its portfolio with remarkable speed, but a lack of transparency remains.

Yezid Sayigh

The burden of environmental degradation is felt not only through physical labor but also emotional and social loss.

Yasmine Zarhloule, Ella Williams

The country’s youthful protest movement is seeking economic improvement, social justice, and just a little hope.

Yasmine Zarhloule

The Moroccan-Algerian rivalry is playing itself out in ties with Burkina Faso, Niger, and Mali.

Yasmine Zarhloule