It’s dangerous to dismiss Washington’s shambolic diplomacy out of hand.

Eric Ciaramella

Source: Getty Images

Western powers may soon find it hard to escape an unpalatable dilemma: either they need to invest heavily in ice-class marine capability, both military and commercial, with unclear payback prospects, or they will have to cede leadership in the Arctic to the Sino-Russian tandem.

Supported in part by a grant from the Open Society Foundations.

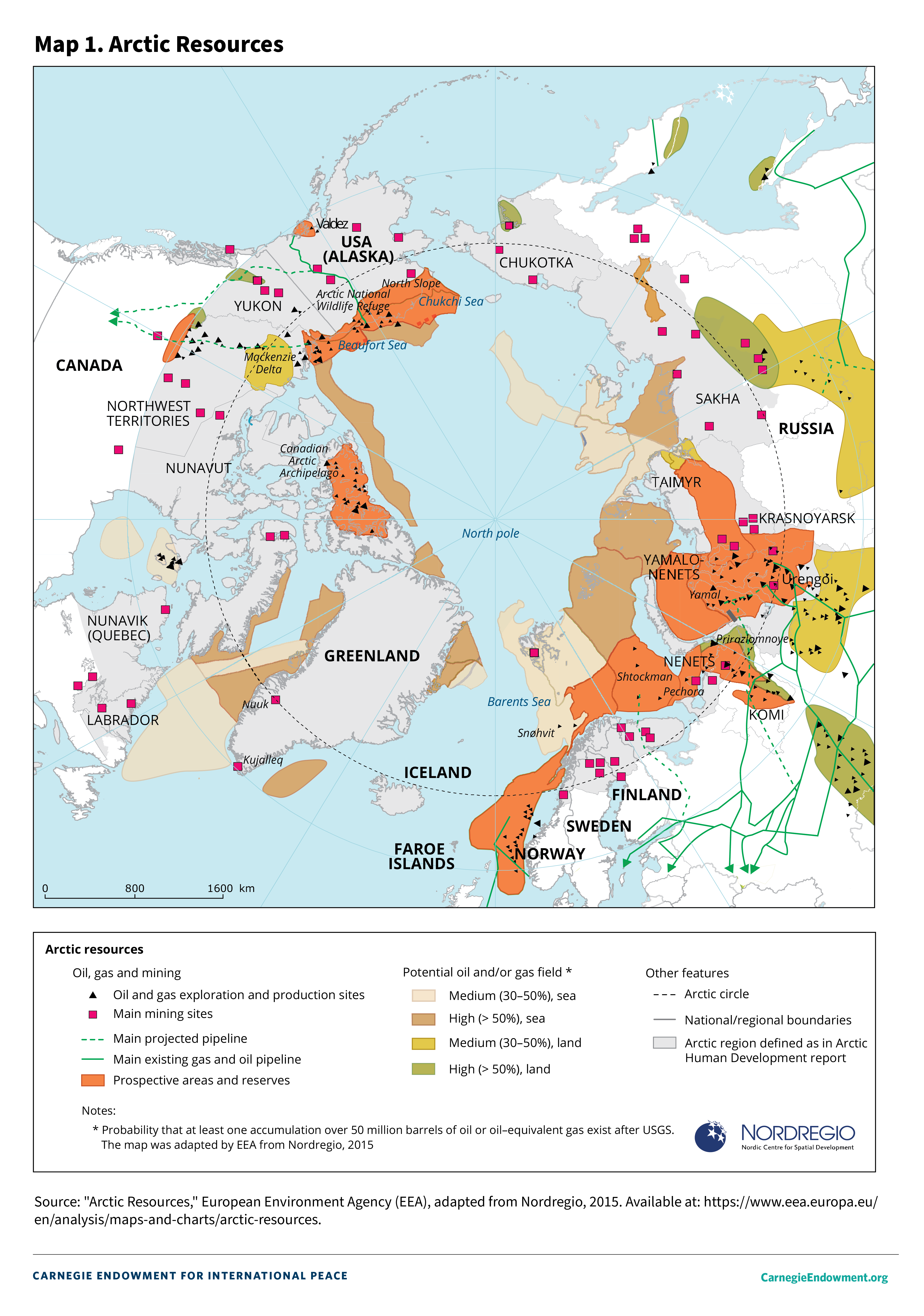

The melting of Arctic ice as a result of climate change, coupled with the advent of new technology, is making the Arctic and its energy resources more accessible and more attractive to a number of states and companies. Thanks to a combination of large reserves of recoverable oil and gas, the emergence of new supply routes through previously unnavigable waters, and growing interest in new sources of critical minerals and renewable energy (mainly wind), the Arctic is widely seen as one of the world’s “last frontiers”: that is, a region whose mineral wealth has not yet been fully developed.

At the same time, it remains to be seen whether future development of that vast endowment of natural resources will live up to the hype. This paper focuses on the dynamics shaping energy competition in the Arctic, aiming to shed light on the key drivers of those efforts and to create an analytical baseline for understanding the priorities, strategies, and practical efforts of leading players.

The development of the Arctic’s resources is shaped by a number of closely intertwined political, economic, technological, and climate trends. Energy is just one area in which great powers such as the United States, Russia, and China are now competing across the economic, military, and legal domains.

Geopolitical factors are already weighing heavily on developments in the energy realm. Major partnerships have been abandoned and new ones are still being formed. Russia’s once-promising relations with the United States, Europe, and Japan have been on a downward spiral following Russia’s assault on Ukraine in 2014. Over the same period, China’s global economic and political power has surged, accompanied by a growing interest in the Arctic’s natural resources. U.S. President Donald Trump’s return to the White House in January 2025 has created new vectors of U.S. policy and sources of uncertainty, given the president’s oft-stated desire to seize control of Greenland.1

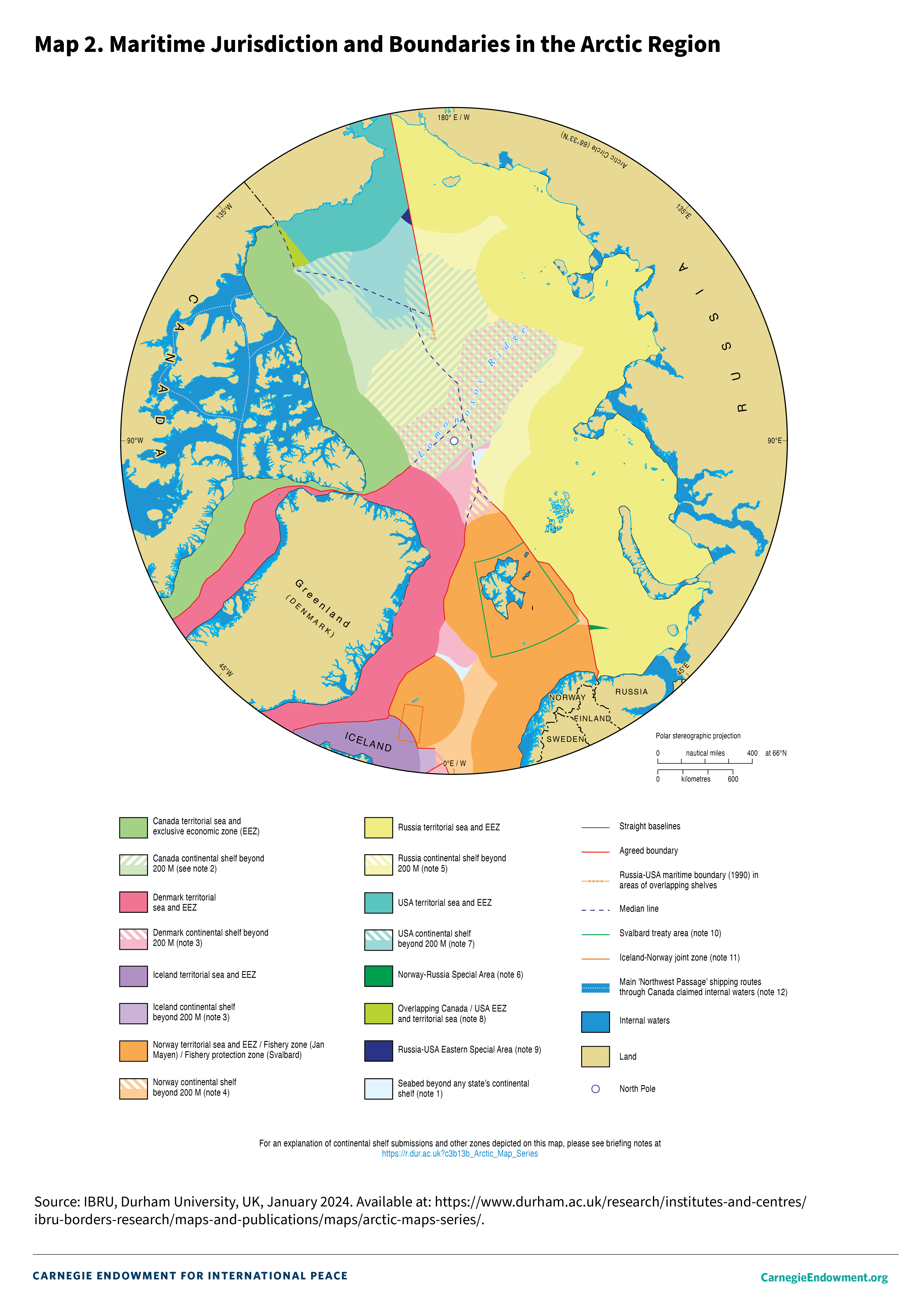

These underlying shifts are just one illustration of how great power competition and rivalry, pursued through a variety of traditional and hybrid forms of military, political, and economic statecraft, are reshaping the Arctic. That interplay is amplified by the lack of a well-established consensus or legally binding agreement between all the Arctic states on the boundaries and limits of the exclusive economic zones that extend into the sea from the coasts of the Arctic nations. That uncertainty is prompting nearly all players to establish their presence and symbolic economic activity as far from their shores as possible, creating competing and overlapping claims to the seabed, waters, and the right to regulate shipping.

International forums designed to create consensus and organize cooperation and interaction among the Arctic states (mainly the Arctic Council) have fared little better. Their work has become paralyzed due to the broader confrontation between their NATO members on one side, and Russia on the other. Arctic Council members have effectively suspended the bulk of their cooperation and interactions with Russia following the full-scale invasion of Ukraine in early 2022.

The energy resources of the Arctic have been the subject of exploitation by international players since the nineteenth century. Long before there was any drilling for shale oil, a small army of British, American, Norwegian, and Dutch whalers were active in the polar regions to obtain whale blubber, which was used for lighting in Europe and America.

LEARN MORE >By 2008, there was a consensus among the Arctic signatory states of UNCLOS that the boundaries of exclusive economic zones in the Arctic were 200 miles from a country’s coastline. The United States, though not a party to the convention, also supports this approach.

Rights to the continental shelf are important for the development of energy resources—especially rights to the extended continental shelf, the legal concept of which was established by UNCLOS. To declare a particular area of the seabed part of the extended continental shelf, bathymetric data (depth measurements) are required, alongside data proving the continuation of geological structures from a country’s exclusive economic zone into the space claimed as the country’s extended continental shelf. In the 2000s, Arctic states launched a race to declare areas of the Arctic their extended continental shelf. The United States claimed the waters between its 200-mile zone and previously agreed sectoral boundaries with Canada and Russia, while Denmark claimed the waters around the Faroe Islands and Greenland. These claims were primarily aimed at covering as much of the old “sectoral” waters as possible. In 2021, Russia submitted an amended application that significantly expanded its claims around the underwater Lomonosov and Mendeleyev Ridges, which extend toward Greenland.2 That amended application overlaps with the claims of Denmark which, in turn, in its 2014 application, challenged Russia’s claim that the Lomonosov Ridge is an extension of the Russian continental shelf, rather than Greenland’s.

Right now, all of these applications are speculative: there are no real plans for geological exploration, much less the development of minerals in the circumpolar region, given that the technology needed for this does not currently exist.

Rising energy prices have sparked new interest in developing Arctic resources. Technological advances have made year-round operations in the polar seas technically feasible and the costs economically viable, albeit still quite high. At the start of the twenty-first century, the United States was widely predicted to become the world’s largest importer of LNG.3 This assumption created a gap between projected demand and supply in the global LNG market, and extremely bullish price forecasts. At the same time, galloping Chinese demand for oil sent prices to unseen heights. These market dynamics made the costly Arctic offshore projects look potentially profitable. Shale technology was still in its infancy, so projects in the Arctic looked like the only play with sizeable potential and promise. Short shipping distances to the U.S. markets made it even more attractive.

Several Arctic countries offered their potential for exploration and development, most notably Norway, Russia, and the United States.

At the same time, resource-deficient countries—China in particular—looked at the Arctic as a potential strategic supply of hydrocarbons that could be claimed and reserved.

Major market- and technology-related developments since then—namely, the Great Recession and the U.S. “Shale Gale”—changed the price outlook and supply and demand flows, killing some projects and postponing others.

Below is an overview of major energy projects in the Arctic by country.

Norway managed its offshore oil and gas development by gradually opening new parts of its shelf for exploration and production. The Norwegian state oil company Statoil (predecessor of today’s Equinor) had the right to participate in every development. Norwegian fiscal policy was designed to encourage reinvestment of oil and gas profits from shelf projects into subsequent projects. Development started in the 1960s in the Norwegian sector of the North Sea, and then moved up north through the Norwegian Sea, until it reached the Barents Sea in the early twenty-first century.

In 2006, the first Norwegian project in the Barents Sea, Snøhvit, entered the market, consisting of a platform on an offshore gas field in the Barents Sea and an onshore LNG plant with a capacity of 4 million tons per year in northern Norway, connected by a 143-kilometer pipeline.4

Adjacent to the Snøhvit field, the Goliat field has been operational since 2016, with reserves of 175 million barrels, while 100 kilometers to the north is the Johan Castberg field with reserves of 600 million barrels, which is due to start production in 2025.5 Both of these oil projects are being developed from floating semi-submersible platforms.

The North Sea, the traditional source of hydrocarbons for Europe, has been producing for many decades and is now in a state of severe decline. The EU decision6 to stop buying Russian oil and gas from the beginning of the full-scale war in Ukraine created an additional market niche and need for Norwegian supplies. Elevated prices also make it possible to pursue more challenging projects in harsher conditions further north and east, in areas with diminishing Gulfstream influence. On the other hand, EU plans for an accelerated shift toward renewables shortens the window for monetizing hydrocarbons from new projects and makes approving them more difficult.

From the early 1990s, Russia tried to develop the Shtokman project located 600 kilometers north of the Kola Peninsula.7 The general development plan was the same as Snøhvit: a platform in the sea, a seabed pipeline, and an LNG plant and export terminal near Murmansk.

Throughout the 1990s and the first half of the 2000s, Gazprom held complex negotiations with potential partners, seeking to secure the most favorable terms. The large distance from the coast, high latitudes, and difficult ice conditions all meant that the project was highly complex and expensive, but the unique size of the field—comparable only to the giants of the Yamal Peninsula and the North Field (South Pars field) in the Persian Gulf—made it a tempting prospect, especially given the projected prices on the U.S. market at that time. Final agreements on the project’s development were reached in early 2008. Its viability was soon thrown into question by the global financial crisis, a sharp drop in oil prices, and the shale revolution in the United States, which would make the United States the largest exporter of LNG. The project was postponed and frozen several times before finally being canceled in 2019.8 Perhaps Gazprom and its partners had a lucky escape: in the current circumstances, it would have been no mean feat to recover the costs of the project.

In 2008, Russia’s Lukoil launched the Varandey terminal in the Pechora Sea with an offloading capacity of 240,000 barrels per day.9 That marked the beginning of Russian oil shipments along the Northern Sea Route. Russia has since implemented two more oil projects in the Barents and Kara Seas: the Prirazlomnaya offshore platform launched in 2013,10 and the Novoport project on the Yamal Peninsula.11

There is a fundamental difference in the operations of the Varandey terminal, Prirazlomnaya, and Novoport from the Norwegian shelf projects—even those located at high latitudes. Due to the Gulf Stream, there is hardly any ice in Norwegian waters, while further to the east the ice can remain in place for up to six months and oil can only be transported when escorted by icebreakers. In addition, tankers and offshore structures must be resistant to the effects of ice. Shipbuilding technologies—in particular, the appearance of icebreaking tankers, acquired experience in organizing transportation in polar winter conditions, and the presence of a large icebreaker fleet (both nuclear and powerful traditional vessels)—have made it possible to scale up Arctic production.

Other Russian energy players sought to ride the wave of enthusiasm for the Arctic in the early 2000s. Rosneft, headed by Putin’s longtime associate Igor Sechin, secured exploration and potential development rights to virtually the entire Kara Sea, a geological extension of the West Siberian oil basin.12 In 2011–13, oil prices were back in triple digits and the potential full cost of production of $80 per barrel or more was not a concern. Rosneft positioned the Kara Sea as a region with billions of barrels of recoverable reserves, accessible only through partnering with Rosneft and offering it the opportunity to participate in projects outside Russia in return. The Russian state company formed several consortiums with the participation of foreign companies. One of them, with ExxonMobil as the main Western partner, managed to drill an exploratory well in 2014,13 but following the annexation of Crimea and downing of flight MH17 that same year, the United States imposed sanctions on Russia that blocked U.S. companies from participating in Russian Arctic projects.14 Before the consortium was able to test the well, ExxonMobil withdrew from the project and ended its ambitious, far-ranging partnership with Rosneft.15 After the sharp drop in oil prices at the end of 2014, projects in the Kara Sea stopped making economic sense, and the consortiums assembled for its exploration fell apart.

Russia’s next major energy ventures in the Arctic were two LNG projects by consortiums led by Novatek at the mouth of the Ob River: Yamal LNG on the Yamal Peninsula, launched in 2017, and Arctic LNG 2 on the Gydan Peninsula, which was launched in 2024 in the face of U.S.-led efforts to kill the project.16

The Yamal region has the world’s biggest gas reserves,17 and they are extremely cheap to extract. Gazprom has been selling Yamal gas through pipelines for decades, but the reserves there are such that it would take more than 100 years to sell it all. Yamal’s cold climate makes LNG production there much more efficient than in the hot climates of the Persian Gulf and the U.S. Gulf Coast. Transportation from Yamal to Rotterdam takes eight to nine days, compared with fourteen days from Louisiana. These factors make LNG production in Yamal extremely competitive—if the challenges associated with Arctic navigation can be overcome.

Transporting liquefied gas to China and Japan via the Bering Strait also looks extremely appealing in terms of distance, especially compared with the distances to those markets from Qatar and the United States, but it involves passage through the seas of the Eastern Arctic Sector with difficult ice conditions.

Novatek has demonstrated its ability to organize gas transportation to both European and Asian markets, and Yamal’s location in the middle of those markets has created certain commercial benefits: Asia is predominantly a summer market, with gas mostly consumed there to generate electricity for air conditioning and cooling, while Europe is a winter market where peak demand for gas stems from the need for heating. Eastward passage along the Northern Sea Route in the summer is also easier and faster, so geography and climate are favorable to this project. To increase the efficiency of transportation, Novatek has created two transshipment bases on the Kola and Kamchatka peninsulas18 (at the eastern and western ends of the Northern Sea Route) in order to use special ice-class tankers for passage through waters where they are needed, while using traditional tankers for transportation in easier conditions. This approach should reduce the overall cost of transport and make it possible for Novatek to rely on a smaller number of specialized tankers.

Russia now has a whole range of Arctic oil and gas projects that operate year-round and benefit from fine-tuned logistics schemes and operational approaches. Soon after the completion of the pioneering Yamal LNG project, Novatek launched another project of similar proportion, Arctic LNG 2, across the Ob River estuary from Yamal LNG, with Gydan peninsular gas fields serving as its resource base.19 For this project, Novatek introduced technology that can speed up and reduce the cost of construction in the Arctic coastal zone: large modules of the LNG plant were assembled on the outskirts of Murmansk, after which they were delivered to the site of the future plant on pontoons, which were then sunk next to the shore and other modules. Thus, the plant was built on an artificial peninsula, with most of the workforce operating in the vicinity of Murmansk, a developed region with a relatively mild climate compared to the mouth of the Ob. That approach led to substantial cost savings and schedule compression.

All the innovation and project management prowess of Novatek and Gazprom Neft is still dependent on the long list of equipment needed to create an LNG plant or an ice-resistant Single Buoy Mooring loading facility. With rare exceptions, these items are not produced in Russia, and it is extremely difficult for Russian companies to obtain equipment under the current sanctions regime. Some elements, such as turbine drives of electric generators (similar in design to aircraft engines), have a limited service life, after which they are subject to replacement. Even before that stage, the turbine blades must be replaced, so purchasing components is an ongoing challenge.

Transit and transportation through Arctic waters present additional challenges. Vessels for working in the Arctic—oil and gas tankers, icebreakers with non-nuclear propulsion, ice-class service and port work vessels—are built to Russian designs, but at shipyards in South Korea20 and Finland.21 Since 2022, this economic cooperation has stopped due to sanctions.

China is developing its shipbuilding capabilities to be able to operate in the Arctic, but some key technologies still need to be licensed from European, American, or Japanese developers.

Until 2022, the main Russian oil and gas companies had planned to move east from the Ob to the Yenisei River and further along the Arctic coast. Although no major oil and gas fields had yet been discovered there, the geology of the region is very promising. No targeted oil and gas exploration had been done there until recently, and it was considered impossible or unprofitable to organize the shipment of hydrocarbons from the Central Arctic on a commercial scale. Successful projects over the last decade in the Barents and Kara Sea basins have shown that such opportunities do exist. Russian companies envisaged that these new projects on the Arctic coast would make it possible to maintain and increase the level of oil production, compensating for the decline in production at the Volga-Ural and West Siberian fields.

Those plans were scrapped with the outbreak of the full-scale war in Ukraine. Each of these projects requires the long-term investment of capital to the tune of several billion dollars. Tapping such capital is now far too expensive from inside Russia, and Western capital markets are effectively shut as a result of U.S./EU sanctions. In addition, Russian firms would need a significant labor force and unfettered access to imported equipment and international contractors and suppliers, all of which is now unavailable.

The only “live” project in the region is Rosneft’s Vostok Oil, which is supposed to produce 500,000 barrels per day in the near future and up to 2 million barrels per day by 2030.22 In practice, the project consists of building a pipeline to the Arctic coast from a cluster of existing projects—Vankor, Suzun, Tagul, and Lodochnoye—and estimated production volumes from this project, at least in the first stage, are the result of double counting, in other words, attributing production volumes to it from fields that are already operating. An increase of 1.5 million barrels per day would require the construction of significant oil processing facilities and the drilling of dozens, if not hundreds of wells, and there is currently nowhere near this level of activity at the project. Most likely, instead of transporting oil from the Vankor cluster via the Transneft system through the Baltic and Black Sea ports, Rosneft will send it through a port in the Kara Sea.

In addition, a project to build a pipeline to Murmansk is already under discussion in Russia, with the aim of creating a backup route for oil that would bypass the bottlenecks of the Turkish and Danish straits. Amid ever-growing sanctions pressure on the transport of Russian oil and attempts to enforce the price cap mechanism—including by making navigation in the Baltic difficult for vessels that help Russian companies to circumvent that cap—a large export point on the Kola Peninsula may prove critical. Murmansk, although it is located on the Arctic Ocean, is an ice-free port, and ordinary (non-ice-class) tankers can be used to export oil from it.

China is not an Arctic state, but declared itself a near-Arctic state in a government memorandum in 2018.23 China sees the Arctic as an important transport and industrial corridor and has suggested establishing a “Polar Silk Road” similar to its Belt and Road Initiative. China would like to see the Arctic as an internationalized area, open to activities by all countries, assuming that it would have a strong advantage in an open and unhindered competition.24 Ironically, this contradicts Russian views on the Arctic, which are predominantly sectoral, particularly considering that Russia is the main conduit for China into the Arctic, and most Chinese activities in the region have been conducted with Russian assistance and participation.

In 2013, the Chinese state-owned oil company CNOOC was pursuing an exploration venture off the coast of Iceland, but it followed the fate of many other Arctic offshore projects when oil prices collapsed in 2014.25 CNPC and CNOOC expressed interest in Greenland offshore exploration projects before Greenland announced a moratorium on oil and gas exploration in its waters.26

Several Chinese companies are also active in both iron ore and nonferrous metals (including rare earth and uranium mining projects) in Greenland.27

Chinese state-owned companies are shareholders in both of Novatek’s LNG projects and are major recipients of liquefied gas from those projects.28 The Chinese state-owned COSCO Shipping and the Silk Road Fund are major shareholders (together with Novatek and Sovcomflot) in a joint venture created to manage a fleet of LNG tankers transporting gas from the Arctic LNG 2 project. Chinese companies were also major suppliers of equipment for Arctic LNG 2 and transported large-capacity modules from a factory outside Murmansk to the construction site of the plant. They had to scale back their level of participation in Arctic LNG 2 after the January 10, 2025, U.S. sanctions package.

China has also become the major supplier for Russian Arctic projects, replacing Western providers of crucial equipment. Russia is becoming dependent on Chinese-built sea vessels, drilling rigs, turbines, and cryogenic equipment for LNG plants.

Exploratory wells were drilled in the waters surrounding Greenland in 2010–2011, but to no avail.29 In 2018, state-owned Chinese companies expressed interest in a possible bid to explore sites on Greenland’s western shelf,30 but declined to participate further. In 2021, Greenland’s government banned offshore drilling.31

In 2008, Shell won a U.S. lease sale, which gave it exploration licenses for the Arctic shelf.32 But in 2015, faced with technical difficulties, protests by activists, and falling oil prices, the company mothballed the project.33 With the exception of production in the immediate vicinity of the shore, there are currently no active licenses on Alaska’s North Slope, and no offshore production or exploration is underway. The focus of oil and gas companies in the United States is on developing shale reserves in forty-eight states where the opportunities are virtually unlimited, production costs are lower, and capital turnover is faster. One of the Trump 2024 presidential campaign’s promises was to open Alaska North Slope for oil and gas exploration as part of his “Drill, baby, drill” policy, and one of the first executive orders,34 signed on January 20—the first day of Trump’s second presidency—addressed Alaska’s oil and gas potential.

The State Department announced plans to claim vast areas of sea shelf in the Bering Sea and the Beaufort Sea back in 2023,35 and in 2025 the Bureau of Ocean Energy Management, the federal body administering offshore leases for oil and gas exploration and production, took its first steps toward making these areas of water available for commercial exploitation.36

In 2014, with the start of the Russia-Ukraine conflict and the annexation of Crimea, U.S. authorities began imposing sanctions on the Russian oil and gas industry. Since the Arctic shelf was often mentioned—both in company communications and government reports—as an area of growth and development for the Russian oil industry, it became a target for sanctions, along with shale oil. At that time, the sanctions were relatively mild: neither companies nor projects were put on sanctions lists, but U.S. companies were prohibited from supplying such projects with equipment and services. Those sanctions stopped Kara Sea projects in which ExxonMobil was due to take part (though they would most likely have been stopped anyway for economic reasons amid reduced oil prices), but did not impact the Prirazlomnaya and Novoport projects. Nor were sanctions imposed on the Yamal LNG project, in which France’s Total was involved.

Under former U.S. president Barack Obama, U.S. sanctions were aimed at limiting the development opportunities of the Russian oil industry and were formulated more as a warning.37 After February 24, 2022, the goal of U.S./EU sanctions shifted to limiting Russia’s current income. For European governments, the 2022 gas supply shortage was particularly painful. For this reason, neither European countries nor Washington sanctioned existing LNG projects, first and foremost Yamal LNG. During the initial phase of sanctions in 2023, the Arctic LNG 2 project was spared in order to avoid divisions within the United States, EU, and G7–led pressure campaign against Moscow. However, U.S. entreaties to the Japanese government to abandon the project, whose construction was completed after the war began, were persistent. U.S. officials argued that the project would be a net addition to the global gas balance and eventually secured tacit support from Tokyo, notwithstanding the involvement of prominent Japanese conglomerates such as Mitsui, alongside French and Chinese companies.

In order to kill the project, sanctions were also imposed on new LNG tankers purchased to service the project, and on the Saam and Koryak floating LNG storage vessels off the coast of the Kola Peninsula and Kamchatka, which are used to transfer LNG from icebreakers to conventional tankers.38 The rationale behind these measures balanced the Biden administration’s willingness to tolerate the presence of fully operational Russian-origin LNG projects on the market to preserve predictable LNG flows to major importers such as Japan with staunch opposition to any increase in Russia’s role in the market.

Through the end of former president Joe Biden’s term, his team sought to create multiple levels of obstacles that would prevent the Arctic LNG project from becoming fully operational and increase the cost and sanctions risk for Western and Chinese providers of important technologies, transportation, and logistics support. Going forward, it appears that as additional LNG plants come online in the United States in 2025–2026, there will be a temporary surplus of LNG on the market. At that point, Washington will no longer need to tolerate Russian LNG on the market in order to prevent price increases. As a result, there will be commercial reasons as well as political reasons for eliminating Russian LNG from the global balance.

The Trump administration’s policy is not yet clear. There are several competing sets of interests at play: namely, Trump’s long-stated desire to bring an end to the war in Ukraine; a deep-seated reluctance to impose additional political and economic pressure on the Putin regime and a clear desire to normalize relations with Russia; persistent talk of identifying ways for U.S. business interests to participate in flagship Russian energy projects; and mercantilist interests aimed at reducing competition for U.S. energy exporters. These competing interests have created a mishmash of policy initiatives and impulses. It is conceivable, for example, that Trump might at some point threaten to sanction Yamal LNG. However, quiet exchanges with Kremlin representatives suggest that U.S. participation in such projects could become a new source of ballast for the overall relationship. At the same time, Trump’s stated desire to promote U.S. “energy dominance” would appear to conflict with allowing significant amounts of Russian gas to be sold on global markets, and he might want to see the project sanctioned for good.

According to data from the International Renewable Energy Agency (IRENA), some polar regions—in particular the entire coast of Norway, Iceland, the Kola Peninsula, the Pechora Sea, and the entire south of Greenland—are areas with extremely high wind energy density.39 The low population density and abundance of available land mean that the construction of wind farms in these areas is easier than in developed regions. On the other hand, the remote nature of these areas may make servicing wind farms more complicated and expensive, while the erection of pylons for wind turbines in permafrost soil can also create additional, though not insurmountable, difficulties.

The EU energy strategy envisages that Europe will remain an energy-deficient region, and although Europe wants to move away from fossil fuels entirely, it will still have to import energy. It is therefore important for Europe to find regions with excess renewable energy that could be imported, such as solar energy from African countries. Until 2022, Europe was ready to negotiate with Russia on the joint development of export-oriented renewable energy projects from the Russian Arctic. Projects discussed included the laying of direct current cables to transport electricity over long distances, the import of hydrogen or ammonia produced using green electricity, or the import of hydrogen produced from natural gas without releasing carbon dioxide into the atmosphere—either by capturing the CO₂ and injecting it into depleted natural gas fields, or by using processes that break down methane into hydrogen and elemental solid carbon.

Depleted gas fields and the pipelines connected to them are considered important sites for storing captured carbon dioxide in order to reduce the carbon footprint of CO₂-emitting industrial processes. They could serve as part of direct air capture projects fueled by electricity generated by wind farms. With the world and Europe running chronically behind on emissions reduction targets, and atmospheric carbon dioxide concentrations rising at an alarming rate, such projects may be needed to try to limit climate change.

The 2022 gas crisis significantly reduced Russia’s appeal as an energy supplier to Europe, especially in a model that involves a fixed connection, such as a high-capacity transmission line or pipeline, whether for methane or hydrogen. It will take considerable time and changes in the nature of Russia’s political regime for concerns about Russia’s reliability as a supplier to stop hindering large-scale energy cooperation between Russia and Europe.

The growing value of low-carbon energy and energy sources, and the emergence and commercialization of Power to X schemes that convert electricity into other energy sources, could make other Arctic regions with high potential for low-carbon energy—Greenland and Iceland (the latter of which has high geothermal potential)—significant exporters of next-generation energy.

In recent decades, if not the past century, the energy game in the Arctic has looked like a race by various players to expand their influence over the Arctic region as a whole. At the strategic level, all players are convinced of the importance and significance of the region, a thesis that does not require proof. With that in mind, they are consistently striving to expand their presence, develop capabilities, stake out areas, and create options for the future. This is a relatively low-cost course of action, and the cost of holding these options is also relatively small. In layman’s terms, FOMO—the fear of missing out—creates persuasive logic for policy makers to invest in these options.

But once a given player moves from creating such options to actually developing them, the picture changes. Arctic energy resources may be potentially vast, and shipping distances might be short, but in many cases, they are still far too expensive. As a result, the Arctic has failed to develop into a big deal for the global energy industry, unlike shale oil or ultra deep water. At various points in time, several projects have been developed on their own economic merits, and there will surely be successor projects. But that might be it. Thirty years ago, there was a similar wave of hype over the oil and gas resources of the Caspian region. The Caspian was portrayed as a major geopolitical nexus and possibly the next Persian Gulf. It did not amount to nothing, of course. Today the Caspian is home to several important multi-billion-dollar and multi-billion-barrel oil equivalent projects, but it is not nearly as important as it might have seemed in the past.

Forty years ago, and twenty years ago, the Arctic looked increasingly interesting. In the absence of better alternatives, the world was facing exploding demand for motor fuels and the depletion of traditional sources. It looked like the required new sources, even those which might need substantial upfront costs to jump-start development, could then serve as a reliable source for decades to come, which would allow countries and oil firms to recoup those initial investments.

Since then, the shale revolution has drastically changed the projections for remaining production in traditional areas, while the ongoing clean energy transition is changing the projections for ultimate hydrocarbon demand. While that transition will probably not be as fast or drastic as some might have hoped a few years ago, the associated changes are coming surely and steadily. This shortens the probable payback timeframe for any upfront costs, which makes investment decisions all the more difficult.

At the same time, it is certainly the case that the Arctic is still strategically important for military planners. It may become an important transportation corridor, and energy trade and development traffic would be useful to create a presence and baseload to alleviate and spread the costs. The chances are that new Arctic energy projects will be incremental rather than game-changing efforts, and not necessarily worth struggling for, either offensively or defensively. U.S. sanctions on Russian Arctic projects enacted in 2014 did not manage to stop the Prirazlomnaya, Novoport, or Yamal LNG projects. While they did kill ExxonMobil’s high-profile work with Rosneft in the Kara Sea, the economics of such a project today would probably leave it dead in the water.

Right now, Russia is the dominant energy player in the Arctic Ocean, followed by Norway. Other countries have been substantially reducing or shutting down their Arctic projects because of high costs and competition from other opportunities in easier conditions. In Russia, energy projects initially oriented on U.S. and European markets and developed with the help of Western technologies are now targeting Chinese markets and retooling with Chinese drilling rigs and ice-class vessels. Cooperation in the Arctic has turned into a set of isolated projects. Over time, it is possible to envision such projects becoming part of the wider rivalry between NATO countries and an increasingly close nexus between Russian and Chinese players. In a similar vein, business considerations regarding the project pipeline, technical choices, and modus operandi may become increasingly subservient to the logic of confrontation and rivalry.

Moreover, unsettled disputes over shelf development zones in the High North might become a bone of contention, leading to attempts to create facts on the ground (or under ice). Western powers may soon find it hard to escape an unpalatable dilemma: either they need to invest heavily in ice-class marine capability, both military and commercial, with unclear payback prospects, or they will have to cede leadership in the Arctic to the Sino-Russian tandem.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

It’s dangerous to dismiss Washington’s shambolic diplomacy out of hand.

Eric Ciaramella

EU member states clash over how to boost the union’s competitiveness: Some want to favor European industries in public procurement, while others worry this could deter foreign investment. So, can the EU simultaneously attract global capital and reduce dependencies?

Rym Momtaz, ed.

Europe’s policy of subservience to the Trump administration has failed. For Washington to take the EU seriously, its leaders now need to combine engagement with robust pushback.

Stefan Lehne

As Gaza peace negotiations take center stage, Washington should use the tools that have proven the most effective over the past decades of Middle East mediation.

Amr Hamzawy, Sarah Yerkes, Kathryn Selfe

Insisting on Zelensky’s resignation is not just a personal vendetta, but a clear signal that the Kremlin would like to send to all its neighbors: even if you manage to put up some resistance, you will ultimately pay the price—including on a personal level.

Vladislav Gorin