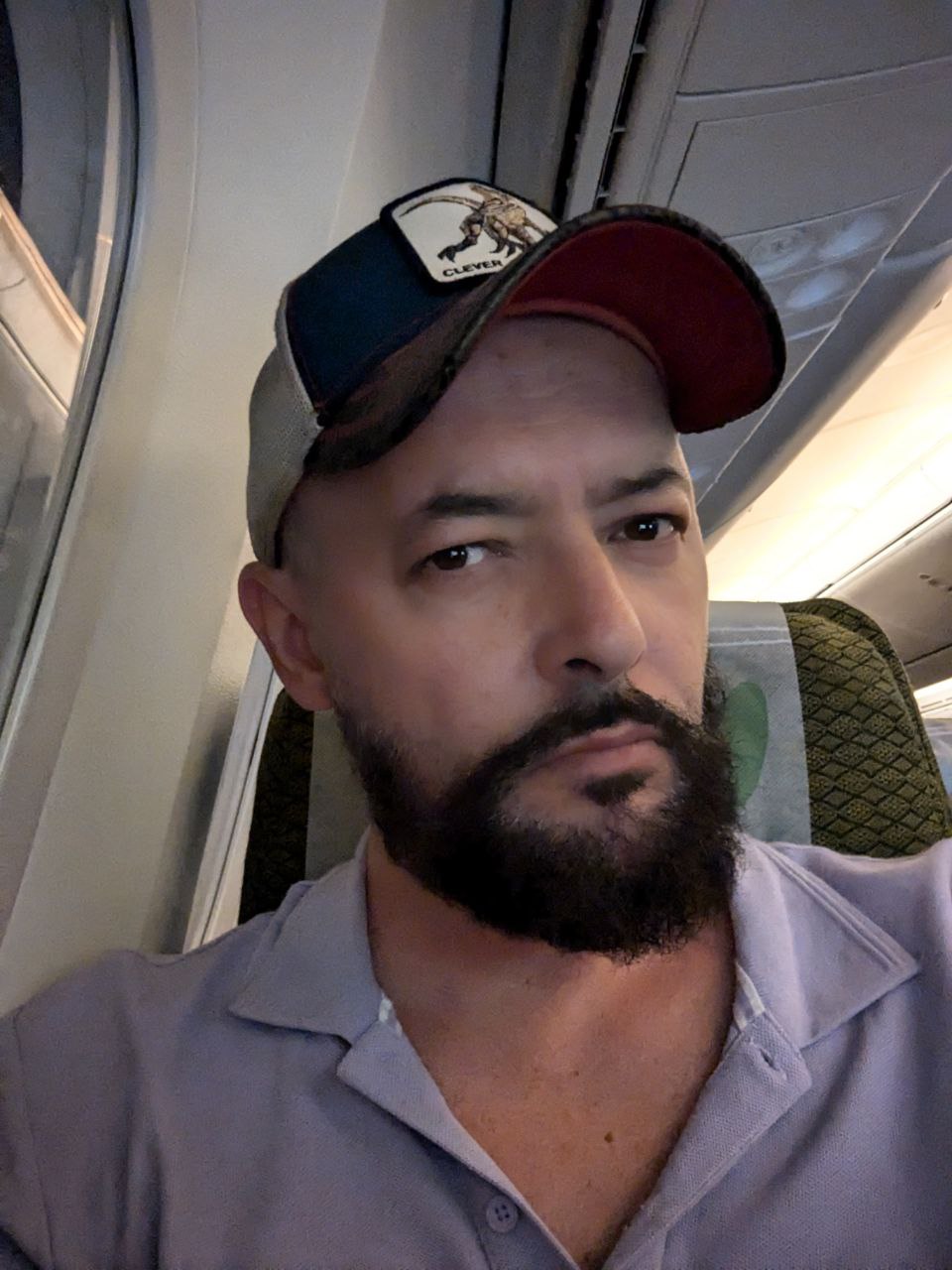

Michael Pettis

{

"authors": [

"Michael Pettis"

],

"type": "commentary",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie China"

],

"collections": [

"Carnegie China Commentaries"

],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie China",

"programAffiliation": "",

"programs": [],

"projects": [

"China’s Reform Imperative"

],

"regions": [

"China"

],

"topics": [

"Economy"

]

}

Source: Getty

China Needs a Very High Consumption Share of GDP Growth

It will require many years of real determination by Beijing to drive the role of consumption to much higher levels if China is to rebalance in a nondisruptive way.

This publication is a product of Carnegie China. For more work by Carnegie China, click here.

“In the first half of this year,” Xinhua noted in a recent article, “final consumption expenditure contributed 60.5 percent to economic growth, driving GDP growth by 3.0 percentage points.” The implication was that—because consumption now accounted for well over half of the period’s GDP growth, and well above the overall GDP share of consumption (53.4 percent in 2023)—Chinese consumption is finally starting to catch up to what is a more “normal” role in driving economic activity.

This might seem all the more likely when we consider that, in 2023, consumption accounted for a much higher share of GDP growth. By comprising 4.3 percentage points of last year’s 5.2 percent GDP growth, the growth in consumption contributed 82.5 percent of the period’s GDP growth. In most years, however, the contribution that the growth in consumption makes to total GDP growth has been much lower. Table 1 below lists the consumption contribution to GDP growth in recent years.

Still, what is clear from the table is that the growth in consumption over the past decade has comprised a higher share of GDP growth than it does of GDP. Does this imply that China is sustainably on its way to rebalancing its economy?

Probably not, and the urgency of this question lies in the fact that, once the rest of the world is no longer willing or able to accommodate a China in which much of its growth is driven by a surging trade surplus, if China cannot sharply increase the role of consumption in its economy, it will either have to accommodate explosive growth in debt (to fund increasingly nonproductive investment) or it will have to adjust rapidly and disruptively in the form of a contraction in GDP.

The problem is that Chinese consumption levels are so low, relative to what is considered normal, that to rebalance the role of consumption in the overall economy to a meaningful level requires many more years during which consumption must contribute a much higher share to GDP growth than we have so far seen.

Japan’s experience might shed some light on that process. In the 1980s, the Japanese economy suffered from many of the same imbalances that China’s does today (although not nearly to the same extent). In 1986, Tokyo formally recognized the problem with the Maekawa Commission report, which proposed that Japan substantially rebalance its economy toward consumption. The consumption share of Japan’s GDP, however, didn’t bottom out until 1991, at 63.3 percent (compared to a consumption share of roughly 74–75 percent of global GDP).

Over the next few years, Japan struggled to rein in debt, reduce nonproductive investment, bring down its trade deficit, and rebalance the economy toward a greater role for consumption. It nonetheless took 17 years for the consumption share of GDP to rise by ten percentage points—in 2008, it reached 73.8 percent.

So how long would it take for Chinese consumption as a share of GDP to reach a normal level? To answer the question, let us assume that a sustainable level of consumption would be 63–64 percent of GDP, or ten percentage points higher than it is today. Note that this would still leave China with one of the lowest consumption rates in the world.

But while this target may be low, it nonetheless helps illustrate how far China has yet to go. Given this assumption, it is reasonably easy to calculate how long it would take for China to reach the target of 63–64 percent, assuming various growth scenarios. (We will assume a range of possible nominal annual GDP growth rates—either 2 percent, 4 percent, or 6 percent—and we will assume various rates at which consumption growth contributes to GDP growth, ranging from 65 percent to 90 percent in increments of 5 percentage points.) The calculations show the following:1

This exercise tells us, for example, that if China were to grow at an average rate of 4 percent, and if it could raise the share that consumption contributed to future GDP growth to an average of 80 percent, it would take twelve years for the consumption share of GDP to rise from 53–54 percent of GDP to 63–64 percent of GDP.

Alternatively, to take another scenario, if growth in consumption accounted for 70 percent of China’s future GDP growth, and if China’s nominal GDP grew by 6 percent on average, it would take 16 years for the consumption share of China’s GDP to rise to 63–64 percent of GDP. Even if we allowed for exceptional circumstances, with an annual average GDP growth rate of 6 percent and the growth in consumption accounting for nearly all of the country’s future GDP growth (90 percent), it would still take 6 years for the consumption share of China’s GDP to rise to 63–64 percent of GDP.

The point of this exercise is to show that, when the country is starting from such a low base, it is not enough that the consumption share of GDP growth is above average (say 60 to 70 percent) for a few years for China to really catch up to a more sustainable consumption share of GDP. It will instead require many years of real determination by Beijing to drive the role of consumption to much higher levels if China is to rebalance in a nondisruptive way.

Notes

About the Author

Nonresident Senior Fellow, Carnegie China

Michael Pettis is a nonresident senior fellow at the Carnegie Endowment for International Peace. An expert on China’s economy, Pettis is professor of finance at Peking University’s Guanghua School of Management, where he specializes in Chinese financial markets.

- What’s New about Involution?Commentary

- Using China’s Central Government Balance Sheet to “Clean up” Local Government Debt Is a Bad IdeaCommentary

Michael Pettis

Recent Work

Notes

- 1For each GDP growth assumption, and each assumption about the consumption contribution to GDP growth, I multiplied the two and added it to the last period’s consumption. I then added the GDP growth assumption to the last period’s GDP. The ratio between the two, of course, is this period’s consumption share of GDP. When I tried to do the same calculations on past data, however, the results are broadly in line but very uneven. As is often the case, it is very hard to get past Chinese data to reconcile.

More Work from Carnegie Russia Eurasia Center

- Does Russia Have Enough Soldiers to Keep Waging War Against Ukraine?Commentary

The Russian army is not currently struggling to recruit new contract soldiers, though the number of people willing to go to war for money is dwindling.

Dmitry Kuznets

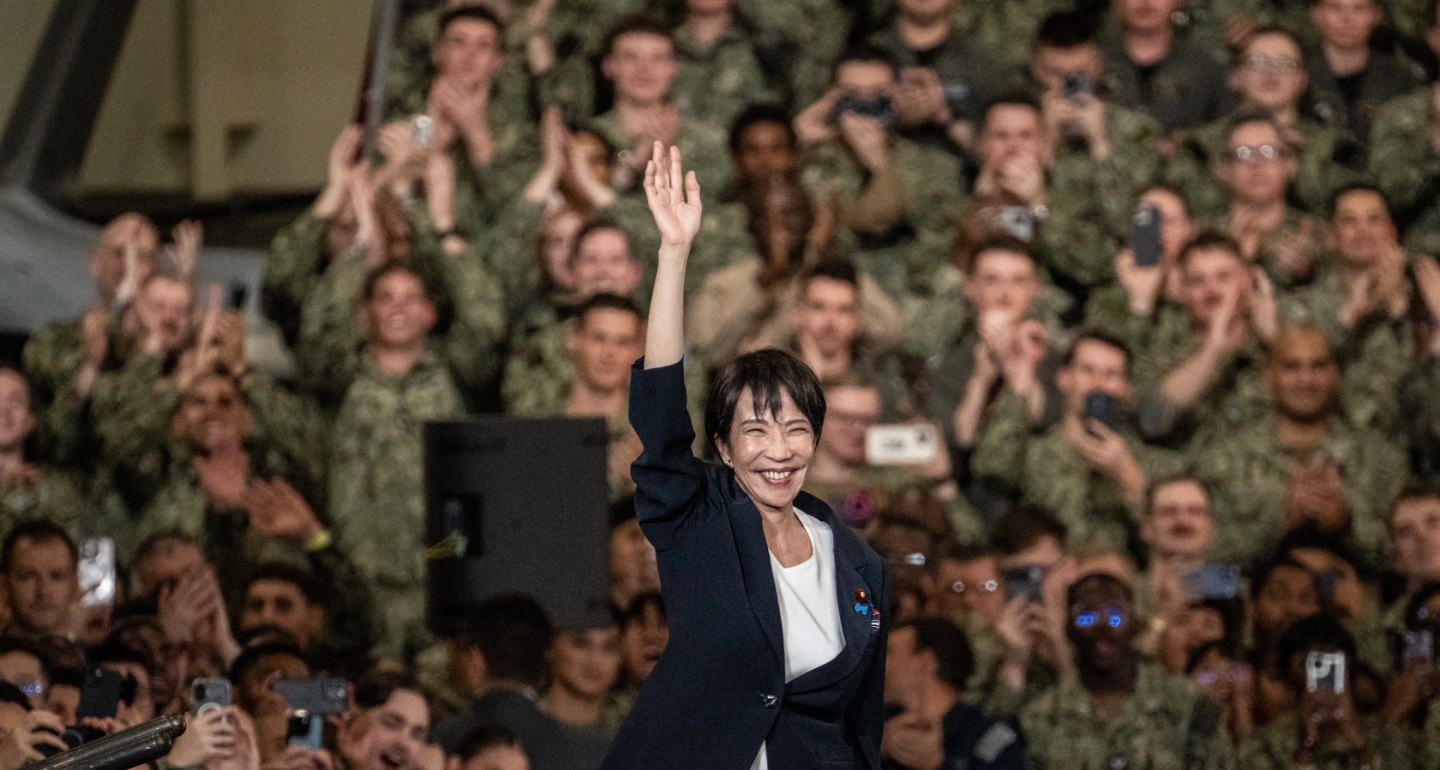

- Japan’s “Militarist Turn” and What It Means for RussiaCommentary

For a real example of political forces engaged in the militarization of society, the Russian leadership might consider looking closer to home.

James D.J. Brown

- A New World Police: How Chinese Security Became a Global ExportCommentary

China has found a unique niche for itself within the global security ecosystem, eschewing military alliances to instead bolster countries’ internal stability using law enforcement. Authoritarian regimes from the Central African Republic to Uzbekistan are signing up.

Temur Umarov

- Is There Really a Threat From China and Russia in Greenland?Commentary

The supposed threats from China and Russia pose far less of a danger to both Greenland and the Arctic than the prospect of an unscrupulous takeover of the island.

Andrei Dagaev

- Including Russia on the EU Financial Blacklist Will Hurt Ordinary People, Not the KremlinCommentary

The paradox of the European Commission’s decision is that the main victims will not be those it formally targets. Major Russian businesses associated with the Putin regime have long adapted to sanctions with the help of complex schemes involving third countries, offshore companies, and nonpublic entities.

Alexandra Prokopenko