Michael Pettis

{

"authors": [

"Michael Pettis"

],

"type": "commentary",

"blog": "Strategic Europe",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie Europe"

],

"collections": [],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "",

"programs": [],

"projects": [],

"regions": [

"Asia"

],

"topics": [

"Climate Change"

]

}

Source: Getty

China Does Not Need to Grow at Current Levels

China’s economy does not need to grow at 7.5 percent a year. What matters is that Chinese households continue to improve their lives at the rate to which they are accustomed.

China’s attitude to GDP growth is changing, but it must change a lot more if China is to avoid a very painful economic adjustment. As the debate in Beijing intensifies over the quality and sustainability of Chinese economic growth, it is clear that a shift in thinking is taking place. China’s most thoughtful economists are increasingly skeptical about the need for high GDP growth rates.

But their skepticism is not universally shared. In March, Beijing established the 2013 target for GDP growth as 7.5 percent. For the past three decades, China’s reported growth has always exceeded the targeted rate, and usually by a substantial margin.

On July 11, however, China’s minister of finance, Lou Jiwei, set off a flurry of nervous excitement when he said that “the 7 percent goal should not be considered as the bottom line” for GDP growth. After two years of sharply declining growth, Lou’s comments seemed to suggest that growth rates were set to drop even more.

For reasons that are not fully understood, his remarks were quickly retracted. On July 12, China’s official Xinhua News Agency corrected Lou’s quote and reestablished the target of 7.5 percent.

Over the past year, as China’s slowdown seemed more serious than originally expected, most Chinese and foreign economists have also reduced their growth forecasts sharply. The current medium-term consensus is that China’s economy will grow at 7–8 percent for the next few years. The more pessimistic projection is that growth rates may slow a little more, but that GDP growth is likely to bottom out this year or next at close to 7 percent.

These forecasts are going to be proven wrong. Growth rates over the next few years of 7.5 percent, or even 7 percent, will be impossible to achieve. Buoyant Chinese growth has been driven by high investment growth and even higher credit growth. With so much of China’s investment now creating less economic value than debt, China has experienced an unsustainable credit expansion that leaves the country increasingly vulnerable to a chaotic adjustment.

This cannot continue. Growth will drop to well below 7 percent one way or another because credit growth must slow sharply. Ultimately, however, that will not matter because GDP growth rates are the wrong target. For China to successfully rebalance its economy toward a healthier and more sustainable model, the growth rate that really matters is average household income.

Why? Consider what it means for China to rebalance. With household consumption at an astonishingly low 35 percent of GDP, if China attempts to engineer a rebalancing that in ten years brings household consumption to 50 percent of GDP, consumption growth must exceed GDP growth by close to four percentage points every year.

This is just arithmetic. An average annual growth rate of 7.5 percent requires growth in consumption to exceed 11 percent if the economy is to rebalance. How can China manage such rapid consumption growth? The reason for China’s low household consumption share is the low household income share of GDP, which, at around 50 percent, is among the lowest ever recorded.

Because household income constrains household consumption, a minimal amount of rebalancing that is compatible with 7.5 percent GDP growth would require a ferocious surge in Chinese household income, even as China and the world slow down. This will be impossible to achieve without a continued, and very dangerous, rise in debt.

But it is not the GDP growth rate that matters for ordinary Chinese people. They, like people everywhere, do not care about their per capita share of the country’s GDP. They care about their real disposable income.

In recent decades, disposable income has grown at well above 7 percent a year, which, although much lower than China’s GDP growth rate, is nonetheless a tremendous feat. This is the growth rate that the country must maintain. Beijing’s policies should aim for average growth in annual household income of 6 or 7 percent, and allow GDP growth to be whatever is required for the economy to rebalance successfully.

This would ensure social stability and would continue to drive China’s economy forward. It implies, however, that if China is to rebalance meaningfully, GDP must grow by “only” 3–4 percent. Although that is low by recent Chinese standards, it is consistent with rapid growth in the income of ordinary Chinese.

China does not need to grow at 7.5 percent. This is a myth that should be discarded. What matters is that ordinary Chinese households continue to improve their lives at the rate to which they are accustomed, and that the Chinese economy is restructured in a real and sustainable way.

If Chinese household income can grow at 6–7 percent during the current administration, while the economy is weaned off its addiction to credit, that will be an extraordinary achievement. If the transition is managed well, ordinary Chinese will hardly notice the sharp economic slowdown, and the risk of a credit crisis will be averted. A truly rebalancing China can and must tolerate much slower growth.

About the Author

Nonresident Senior Fellow, Carnegie China

Michael Pettis is a nonresident senior fellow at the Carnegie Endowment for International Peace. An expert on China’s economy, Pettis is professor of finance at Peking University’s Guanghua School of Management, where he specializes in Chinese financial markets.

- A China Financial Markets PostCommentary

- What’s New about Involution?Commentary

Michael Pettis

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Strategic Europe

- Taking the Pulse: Has Europe Given Up its Leadership on Climate Change?Commentary

COP30 takes place amidst increased pessimism about the world’s commitment to energy transition and ecological protection. Beset by a host of other challenges, can Europe still maintain its role as a driver of global climate action?

Thomas de Waal

- The EU’s 2040 Target Is About Much More Than Just ClimateCommentary

The EU’s ambition to slash carbon emissions by 90 percent by 2040 is challenged by internal divisions and global turmoil. But this target must cement a new era of European climate action, linked to innovation, competitiveness, and security.

Emil Sondaj Hansen

- Europe’s Playbook for Climate Engagement with the United StatesCommentary

Europe should leverage the U.S. climate policy shift and safeguard its green transition goals by building cooperation on geothermal energy among other things and focusing on technologies that enhance security and decarbonization.

Milo McBride

- Rethinking the EU’s Strategic Partnerships in Times of CrisisCommentary

Geopolitical shifts have put into question the effectiveness of the EU’s strategic partnerships. Crises in its vicinity present the union with an opportunity to reassess this foreign policy framework.

Meltem Müftüler-Baç, Ezgi Uzun-Teker

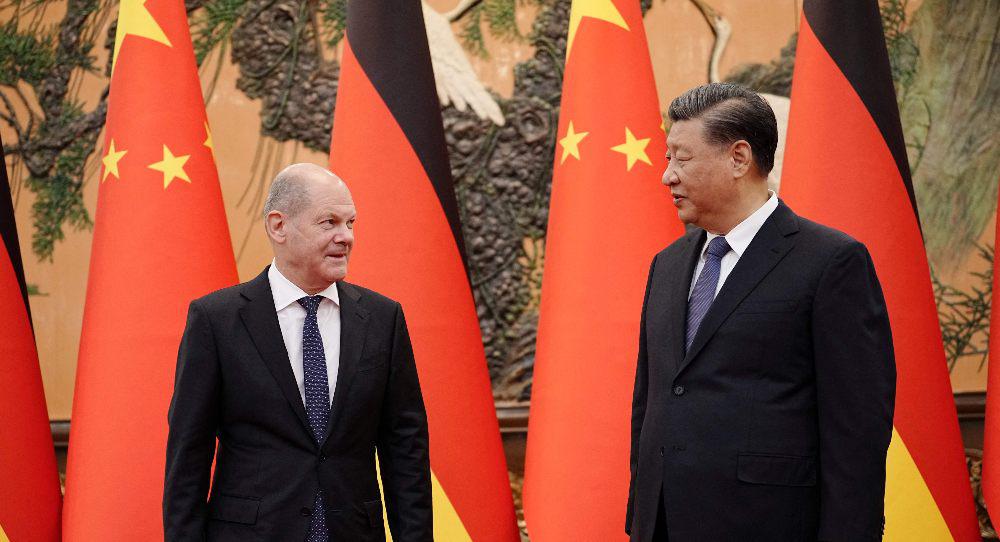

- Scholz’s Visit to China Confirms Germany’s Political WeaknessCommentary

Germany could shape the outcomes of the wars in Ukraine and Gaza. Its reluctance to do so reveals a leadership unwilling to match its economic strength with political influence.

Judy Dempsey