Deborah Gordon, Smriti Kumble, David Livingston

{

"authors": [

"David Livingston"

],

"type": "commentary",

"blog": "Strategic Europe",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie Europe"

],

"collections": [],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "",

"programs": [],

"projects": [],

"regions": [

"Middle East",

"Western Europe",

"Europe"

],

"topics": [

"Climate Change",

"EU",

"Economy"

]

}

Source: Getty

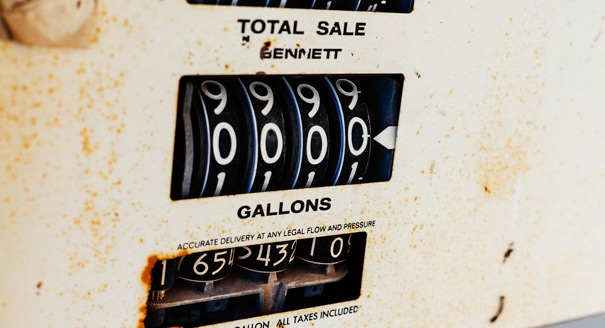

Climate, Oil, and the Shifting Strategic Landscape

The Paris climate deal will help to usher in a “new normal” of low oil prices, bringing with it a number of strategic opportunities—and challenges—for the EU and its allies.

On April 22, representatives from 175 countries signed the Paris climate change agreement at a high-profile ceremony in New York, setting a record for the largest number of countries to sign an international treaty in one day. The signatures are largely symbolic. For the historic pact to enter into force, at least 55 countries representing 55% of global greenhouse gas emissions must formally join. However, at least 35 countries representing around 49% of emissions have already committed to ratification.

The EU, if it can get its house in order and ratify the accord, can and should tip the scales to make the agreement a reality. Of course, the deal’s impact will lie not in its words, but in the actions that follow. And perhaps no actions will have more tangible and strategic benefits—particularly to Europe—than those that reduce the world’s oil demand.

As countries move to fulfill the commitments they made at the Paris climate summit last year, a new raft of measures are poised to emerge—from carbon pricing to efficiency standards to support for electric vehicles and other alternatives—that will collectively deliver a global oil demand trajectory far below that envisioned by many forecasts. Sure, this is beneficial to EU climate priorities. But more notable are the ways in which these efforts will help to usher in a long-term “new normal” of low oil prices, bringing with it a number of strategic opportunities and challenges for the EU and its allies.

A recent Carnegie event in Brussels examined a new study from Cambridge Econometrics and partners, Oil Market Futures, which estimates that as the world implements the Paris accord, cumulative oil demand between 2015 and 2050 may be 260 billion barrels less than a world on a “business as usual trajectory,” leading to prices that are 24 percent lower in 2040 and 33 percent lower in 2050. This points to a future in which demand is as important in determining oil prices as supply, key to keep in mind amid the OPEC-obsessed chatter of today.

Oil demand reductions will bring significant benefits to the EU, whose imports of foreign oil are set to increase as production in the North Sea continues its decline. By 2030, the reduction in the volume of EU oil imports would lower the EU’s annual oil bill by €27 billion from with the lower prices shaving off an additional €12 billion, according to the study. EU employment and GDP would both be expected to receive a boost by the increased consumption on EU goods and services when less is spent on oil.

This would be welcome news for a continent desperately looking for new engines of growth, particularly as the prospects of the TTIP agreement continue to look shaky. Yet EU diplomats and mandarins would be well-advised to put greater thought the knock-on effects of this low oil price world.

Energy security and foreign policy strategies of the last decade were built upon the assumption of ever-increasing oil demand and ever-rising prices. While these foundations have already shown cracks, there has not yet been a comprehensive rethink of what Europe’s proactive, externally oriented stance should be in a world of low oil prices and an increasingly complex web of oil alternatives. The Energy Union project still suffers from an underdevelopment of its external dimensions, and even then the implications of oil prices and volatility receive short shrift.

There are more complex developments to unpack here.

For example, the recent crash in oil prices has provided the world a glimpse of what to expect in a lower oil price world, raising questions over whether such low prices undermine global stability, offer windows of opportunity for meaningful reform, or something in between.

The persistence of low(er) oil prices over coming decades will also likely reshape the composition, behavior, and political implications of the industry itself. There is no single Rosetta Stone for divining how this will play out. Saudi Arabia is leading a plan to partially privatize the nation’s state-owned oil major and end “an addiction to oil,” just as Russia may be forced to consider renationalizing its petroleum assets. And what will come of shale oil in North America, the boom of which has led to a new, more hands-off U.S. approach to the Middle East? Will Washington get sucked back into the region if U.S. oil production declines, with the budgets and stability of certain producers in the region coming under pressure?

This also means that Iran’s return to the market comes at a consequential moment in the oil market’s history, representing yet another producer who will likely look at future oil demand destruction and continue to produce today as if there’s no tomorrow. Consensus within OPEC will be yet harder to come by. This will have to inform the efforts of Europe’s oil companies as they seek entrée into Iran, but the Paris agreement and its reverberations on energy markets should also encourage the EU to seek a foothold for the continent’s renewables sector in Tehran’s future plans. Given Iran’s significant solar potential and China’s keen interest in capitalizing upon it, this may be as strong a play for the EU as commercial petro-diplomacy.

The knock-on effects also include a reshaping of the defense landscape, as petrodollars have reliably been recycled into weapons for years. It took several years for the 1980s oil price crash to translate into reduced defense spending, but the effects were ultimately felt quite acutely. Today, lower prices are already eating into Gulf defense spending, while Russia’s procurement budget has already fallen by 10 percent and is mulling further strategic cuts.

Addressing climate change in coming decades will put further pressure on oil prices, making a return to previous highs less probable. Prices and volatility will be lower, on average, than a world without climate action. The shifting of the strategic landscape wrought by lower oil prices—in terms of regional stability, petrodollar recycling, and the transfers of wealth that shape power and capabilities—is a consideration not only for energy and climate communities, but for foreign policy and security strategists as well. The impact of the Paris agreement may not be felt immediately, but it will be felt. A tactical orientation would ignore this; a strategic one should pay it heed.

About the Author

Former Associate Fellow, Energy and Climate Program

Livingston was an associate fellow in Carnegie’s Energy and Climate Program, where his research focuses on emerging markets, technologies, and risks.

- Advancing Public Climate Engineering DisclosureArticle

- Working Around Trump on ClimateCommentary

Erik Brattberg, David Livingston

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Strategic Europe

- Taking the Pulse: Can European Defense Survive the Death of FCAS?Commentary

France and Germany’s failure to agree on the Future Combat Air System (FCAS) raises questions about European defense. Amid industrial rivalries and competing strategic cultures, what does the future of European military industrial projects look like?

Rym Momtaz, ed.

- Macron Makes France a Great Middle PowerCommentary

France has stopped clinging to notions of being a great power and is embracing the middle power moment. But Emmanuel Macron has his work cut out if he is to secure his country’s global standing before his term in office ends.

Rym Momtaz

- How Europe Can Survive the AI Labor TransitionCommentary

Integrating AI into the workplace will increase job insecurity, fundamentally reshaping labor markets. To anticipate and manage this transition, the EU must build public trust, provide training infrastructures, and establish social protections.

Amanda Coakley

- Can Europe Still Matter in Syria?Commentary

Europe’s interests in Syria extend beyond migration management, yet the EU trails behind other players in the country’s post-Assad reconstruction. To boost its influence in Damascus, the union must upgrade its commitment to ensuring regional stability.

Bianka Speidl, Hanga Horváth-Sántha

- Taking the Pulse: Can the EU Attract Foreign Investment and Reduce Dependencies?Commentary

EU member states clash over how to boost the union’s competitiveness: Some want to favor European industries in public procurement, while others worry this could deter foreign investment. So, can the EU simultaneously attract global capital and reduce dependencies?

Rym Momtaz, ed.