The main source of Russian aggression is a profound mistrust of the West and the firm belief that it intends to inflict a “strategic defeat” on Russia. As long as this fear persists, the war will not end.

Tatiana Stanovaya

{

"authors": [

"Alexandra Prokopenko"

],

"type": "commentary",

"blog": "Carnegie Politika",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie Russia Eurasia Center"

],

"collections": [],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Russia Eurasia Center",

"programAffiliation": "russia",

"programs": [

"Russia and Eurasia"

],

"projects": [],

"regions": [

"Russia",

"Caucasus"

],

"topics": [

"Political Reform",

"Economy",

"Domestic Politics"

]

}

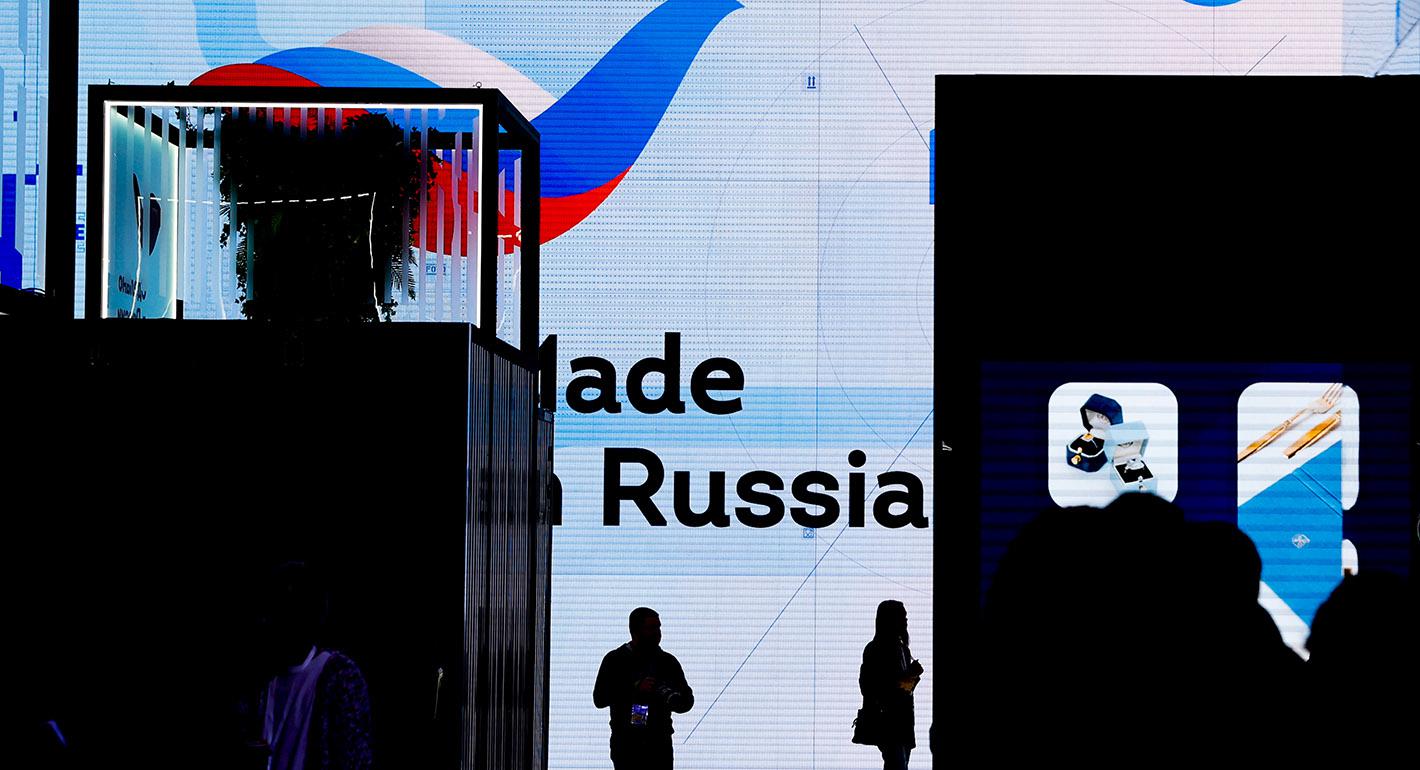

Source: Getty

The economy’s development will be in reverse for at least the next three to five years.

Nine months after Russia’s invasion of Ukraine, the Russian economy is doing better than expected. The predicted collapse has been avoided, and the forecasted 8–10 percent fall in GDP for the year has been reduced to a 3–4 percent drop.

Still, before the war, 3 percent growth was predicted. Recovery is only expected to begin in 2024 at best, and only in the unlikely event that external factors do not significantly worsen. Russia looks set to see yet another lost decade, with a decade of stagnation followed by a decade of regression.

The Russian government and the central bank have softened the economic blow from the war against Ukraine and the sanctions that followed it, not least through the conservative fiscal policies of recent years, such as consistently balancing the budget with an oil price of $45 per barrel and keeping expenditure on a tight leash, even at the cost of economic growth.

In addition, preparations had been made for sanctions. State companies and major banks had carried out stress tests, including scenarios in which Russia was disconnected from SWIFT, the West stopped supplying certain technologies, and correspondent accounts were blocked, though other measures, such as the freezing of gold and currency reserves, were not modeled.

Because of a traditional reluctance to report problems, the reports submitted to the Russian authorities were all fairly optimistic. The most serious sanction expected was an IT and microchip embargo: something that would not have an immediate effect on most sectors.

Thanks to these preparations, the effect of sanctions proved weaker than predicted in the short term, but it has also been more prolonged. The budget, buoyed in the first few months by oil and gas revenues, has begun to shrink. Non-oil and gas revenues fell by 20 percent in October in annual terms, and almost all the growth in oil and gas revenues came from the increase in the mineral extraction tax on Gazprom.

The fall in industrial production in the first ten months of this year turned out to be relatively small at 0.1 percent. This, however, is largely down to increased military expenditure, which provided growth in sectors such as clothing and metal goods (including tanks and missiles), masking a fall in civilian sectors, such as automobile production (which almost halved), timber processing, and machine-building.

The recession is likely to continue because Russian industry—even the military sector—is highly dependent on the import of high-tech goods, predominantly from the West. Technology imports from all countries have fallen, with the exception of Turkey. A collapse in those imports will reduce production and make it more primitive, a process that is already under way. Import substitution is now required in almost all sectors, but as a result of the sanctions it is regressive, with worn-out components being replaced with less advanced options.

The voluntary departure of many Western companies and the total break in trade with Europe in energy commodities, along with an absence of equivalent alternatives, will continue to hold the Russian economy back. It can also count on little in the way of support from within.

Amid the atmosphere of uncertainty, investment is at risk of being slashed. Private business was already limiting investment due to the unfavorable business climate. Now the war and sanctions have killed it off completely. Even the most pro-state business will not invest in a warring country where the company can at any time be forced to contribute to the war effort through new taxes or even directly.

Large-scale investment on the part of the state is also problematic. Judging by the three-year budget that has been passed, the government’s priority is undoubtedly financing the war. The budget’s main areas of expenditure are the security sectors, which will account for almost a third of all expenditure (9.3 trillion rubles) in 2023. Expenditure on the economy, on the contrary, is being reduced from 4.5 trillion rubles in 2022 to 3.5 trillion in 2023. A record quarter of all expenditure is classified.

The total volume of expenditure will effectively remain unchanged (29 trillion rubles) in nominal terms, which means a noticeable reduction in real terms. Expenditure on military needs, however, is protected from any fall in income, so it is expenditure on the development of the economy and the expansion of social programs that will be slashed if cuts are needed.

The government simply can’t afford to have the investment climate as one of its priorities: it is focused on the needs of the army. Three hundred thousand people aged between twenty-two and fifty have already been mobilized, lowering GDP by 0.5 percent, and there may be more waves of mobilization ahead.

It’s harder to calculate the long-term losses from the vast number of people who have left Russia since the beginning of the war, which is estimated at 500,000 to a million. A shortage of qualified personnel resulting from the brain drain will put pressure on the labor market, driving up wages faster than productivity and leading to inflationary risks.

Major difficulties arise from the reorientation of Russian production toward new markets. The throughput capability of infrastructure linking Russia with the East is limited: port, rail, and pipeline capacities are already overloaded, and the creation of new capacity requires resources and technology. Meanwhile, the infrastructure that serviced trade with Europe lies idle as a result of sanctions.

Supplies of non-sanctioned goods, even to friendly states, are being impeded by the refusal of international container shipping companies to work with Russia. Problems arise not only with delivering the goods, but also in paying or receiving payment for them. Transactions in euros and dollars can be blocked or take a long time. Even in “friendly countries,” banks refuse to open accounts for Russian companies and correspondent accounts for Russian banks.

Russia is also under pressure to make compromises and offer discounts on its goods to those who are still prepared to buy them: right now, Russia needs those markets more than they need Russia. A U-turn back to the domestic market can only provide partial support to manufacturing: it’s simply too small.

The state has not been able to aid business with systemic solutions, only undertaking targeted measures, such as allowing payments in cash for foreign trade operations in order to avoid the use of dollars and euros.

Russian firms are mostly finding their own ways to adapt to the new conditions. If the government continues to resist the temptation of stooping to a state plan with rigid restrictions on who supplies what to whom, the Russian economy will probably survive and the adaptation period will end by about September 2023.

The Russian economy’s prewar potential was not overly large, with growth at 2–3 percent per year. The war against Ukraine and external restrictions have lowered it to about 1 percent. For now, the economy’s development will be put into reverse and it will take three to five years for that decline to come to a halt.

The government and President Vladimir Putin like to repeat that Russia already has everything it needs for development. But a transition to growth based on internal resources would require an end to the war in Ukraine. It would also need less unpredictability overall, increased competition, the decriminalization of economic infringements, and effective safeguards for property rights. The Russian authorities and president have consistently failed to provide those conditions.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

The main source of Russian aggression is a profound mistrust of the West and the firm belief that it intends to inflict a “strategic defeat” on Russia. As long as this fear persists, the war will not end.

Tatiana Stanovaya

Despite its reputation as an island of democracy in Central Asia, Kyrgyzstan appears to be on the brink of becoming a personalist autocracy.

Temur Umarov

The Russian army is not currently struggling to recruit new contract soldiers, though the number of people willing to go to war for money is dwindling.

Dmitry Kuznets

Having failed to build a team that he can fully trust or establish strong state institutions, Mirziyoyev has become reliant on his family.

Galiya Ibragimova

Insisting on Zelensky’s resignation is not just a personal vendetta, but a clear signal that the Kremlin would like to send to all its neighbors: even if you manage to put up some resistance, you will ultimately pay the price—including on a personal level.

Vladislav Gorin