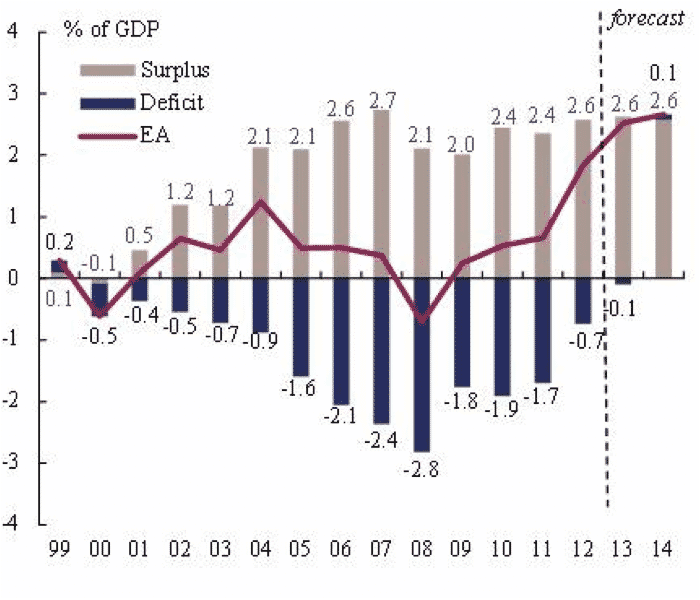

The graph makes it pretty clear that the surge in European surpluses, which was largely matched before the crisis by the surge in deficits in peripheral Europe, is expected to be maintained even as surpluses in China and Japan, the other leading surplus nations, have dropped dramatically, but since these northern European surpluses can no longer be counterbalanced by deficits within peripheral Europe given how indebted and troubled are their European trade partners, the hope is simply to force them abroad. In a world with weak demand and deteriorating trade relationships, in other words, the northern Europeans have decided that rather than boost domestic demand they will resolve their domestic problems by absorbing far more than their share of global demand, to the tune of 2-3% of Europe’s GDP.

This is absurd. If they succeed it will only be temporarily and at the expense of their already-suffering trade partners, and as a consequence it will just be a question of time before global trade relationships get even nastier than they have been. Of course if trade relationships deteriorate enough, and so force the imbalances back onto Europe, the result will be a surge in German unemployment with no corresponding relief in unemployment in the periphery.

Away from Europe the US continues slowly to adjust but I worry that this adjustment will be derailed by a weaker external sector. Meanwhile Japan is still struggling with its debt burden and seems to have no real way of resolving it except by forcing down the currency and interest rates, both of which mean that household sector is expected to reduce consumption to support the debt burden without, it seems, any corresponding increase in investment. In China the good news is that the rebalancing process seems to have become more determined than ever before in the past, although as of yet there has been minimal rebalancing at the expense of a significant reduction in growth rates. This I expect will continue to be the case, but European trade policies are going to put additional pressure on China’s adjustment.

How much slower?

The big worry I have had over the past year is that as China moves to rebalance its economy away from its over-reliance on its investment, with the accompanying investment misallocation, the economy will slow much more quickly than even the reformers expected, so scaring Beijing into backtracking. So far, I am glad to say, this doesn’t seem to have happened.

We keep getting surprised on the downside by the growth numbers, but to anyone who understands the way China’s growth model works and who knows the historical precedents, this should in no way surprise. I don’t think China is yet heading towards an economic crash, but I do think that even current growth rates are too high, and sell-side researchers and the various official entities in China and abroad will continue, as they have in the past, to revise their growth numbers downward almost on a quarterly basis.

And because growth will consistently underperform expectations, many members of the Chinese policymaking elite, and their effective allies among the shrinking but still large contingent of China-bulls, will increasingly argue that the economic rebalancing is being mismanaged, thereby putting pressure on Beijing to go into reverse. This is the real risk. There is no way that China can rebalance its economy even at growth rates of 6-7%, and attempts to keep growth above that level will simply mean that it will take much longer for China to fix the underlying problems in the economy, that the costs will be much greater, and that the risk of a disorderly crisis will increase.

So far Beijing has done a great job in resisting this pressure to backtrack. The increasingly nasty trade spats between China and Europe and between China and the rest of the world, including the US, may make it harder for Beijing to pull off the necessary reforms, but so far they haven’t. It would probably be in everyone’s best interests if policymakers on both sides worked hard to tone down the rhetoric, but as I have been arguing for many years, I think trade disputes are only going to get worse, not better. If Europe and the US truly want to help Beijing transform the Chinese economy into something more stable for China and better for the world, they should create a little more space in the external sector in which Beijing can maneuver.

This process of slower-then-expected growth has been confirmed by the latest set of economic numbers coming out of China last week, which shows that China’s economy is indeed continuing to slow faster than expected as Beijing struggles to get its arms around credit expansion. Here is Sunday’s article from the South China Morning Post:

China’s industrial output expanded at a slightly slower pace in May while big ticket investment growth eased, the government announced Sunday, the latest signs of weakness in the world’s second-largest economy. Industrial production, which measures output at the country’s factories and mines, rose 9.2 per cent year-on-year in May, marginally weaker than the 9.3 per cent increase in April, the National Bureau of Statistics said.

But the May figure matched the median 9.2 per cent gain predicted in a survey of 14 economists by Dow Jones Newswires. Fixed asset investment – a key measure of government spending – increased 20.4 per cent from January through May compared to the same period last year, the bureau said, slightly weaker than the figure of 20.6 per cent covering the first four months of the year.

Credit expansion continues to be much too rapid, even though May’s numbers show that at least credit is growing more slowly than it has in the past. According to the relevant article in Sunday’s Xinhua:

China’s new yuan-denominated lending fell to 667.4 billion yuan (107.65 billion U.S. dollars) in May, down from 792.9 billion yuan in April and 1.06 trillion yuan in March, according to data released by the central bank on Sunday.The figure was also 125.8 billion yuan less than the same period last year, the People’s Bank of China said in a statement on its website.

The country’s social financing, a measure of funds raised by entities in the real economy, amounted to 1.19 trillion yuan last month, shrinking 576.3 billion yuan compared with that in April. By the end of May the broad measure of money supply (M2), which covers cash in circulation and all deposits, rose 15.8 percent year on year to 104.21 trillion yuan. The increase was 0.3 percentage points lower than that registered in April, according to the central bank.

The good news of course is that credit growth is slowing, but we must put this slowing credit growth in context. Total social financing rose by RMB 1.2 trillion in May, which is roughly 2.3% of GDP. This of course is much better than the 3% of GDP by which TSF rose during the first four months of the year, but the consequence is likely to be an increase in GDP of about 0.6%. Credit growth of 2.3% of GDP (and this does not include credit growth which occurred outside TSF, such as leasing and shadow banking, which may add another 0.5-6% of GDP) generated, in other words, roughly one quarter of that amount on GDP growth. Even this GDP growth is not necessarily real growth – it depends on how much of this activity was genuinely wealth creating and how much was simply caused by more wasted investment.

Can China spend its way to growth?

This is way too much debt, and it continues to imply that real debt servicing costs are growing much faster than the debt servicing capacity. Clearly this cannot be sustained. There are still bulls out there who insist that China is out of the woods and making a strong recovery, for example former Deputy Governor of the Reserve Bank of Australia, Stephen Grenville, who argues in his article (strangely titled “China doomsayers run out of arguments”):

The missing element from the low growth narrative is that unemployment would rise, provoking a stimulatory policy response. China would extend the transition and put up with low-return investment (recall that when unemployment was the issue, Keynes was prepared to put people to work digging holes and filling them in) rather than have unemployment rise sharply. To be convincing, the low-growth scenario needs to explain why this policy response will not be effective.

It seems to me that the reason why simply “provoking a stimulatory policy response” won’t help China has been explained many times, even recently by former China bulls. Of course more stimulus will indeed cause GDP growth to pick up, as Grenville notes, but it will do so by exacerbating the gap between the growth in debt and the growth inn debt-servicing capacity. Because too much debt and a huge amount of overvalued assets is precisely the problem facing China, it is hard to believe that spending more borrowed money on increasing already excessive capacity can possibly be a useful resolution of slower Chinese growth.

Perhaps Grenville is confused by what seems like low government debt and a low fiscal deficit, but these numbers are wholly irrelevant. Most fiscal expansion in China does not occur through the fiscal account but rather through the banking system. In that light recent comments by David Lipton, IMF Deputy Managing Director, are relevant.

Lipton was in China two weeks ago when I had the chance to discuss some of these issues with him, and there is little doubt in my mind that he understands the pressures facing China, especially the growing gap between Chinese debt and its ability to service that debt. He also made clear that he recognizes the confusions in the fiscal account. On June 9, during his press conference, in which he warned of the “important challenges” China was facing, he went on to say:

Fiscal reforms are also an integral part of the agenda to support rebalancing, improve governance and raise the efficiency of investment. Including local government financing vehicles, an estimate of the “augmented” general government debt has risen to nearly 50 per cent of GDP, with the corresponding estimate of the “augmented” fiscal deficit now on the order of about 10 per cent of GDP last year. While part of this deficit is financed through land sales and the “augmented” debt is still at a quite manageable level, it’s important over time to gradually reduce the deficit to ensure a robust and sustainable fiscal position and debt profile.

With an “augmented” fiscals deficit already of 10% of GDP (the IMF explains what it means by an augmented fiscal deficit here), and with so much excess investment in infrastructure, real estate, and manufacturing capacity, it probably isn’t necessary to explain a whole lot more why further fiscal stimulus might create growth in the short term but would be harmful for China in the medium term.

The slew of economic data released last week will have been much discussed and analyzed in the media so I won’t add much more than I already have. Yes, Chinese growth is slowing, but by now this cannot have been a surprise to any but the most determined of bulls. The small possible uptick in retail sales might imply slightly stronger household consumption growth, but this is nowhere near enough to compensate for the decline in the growth of fixed asset investment.

This article originally appeared in China Financial Markets.