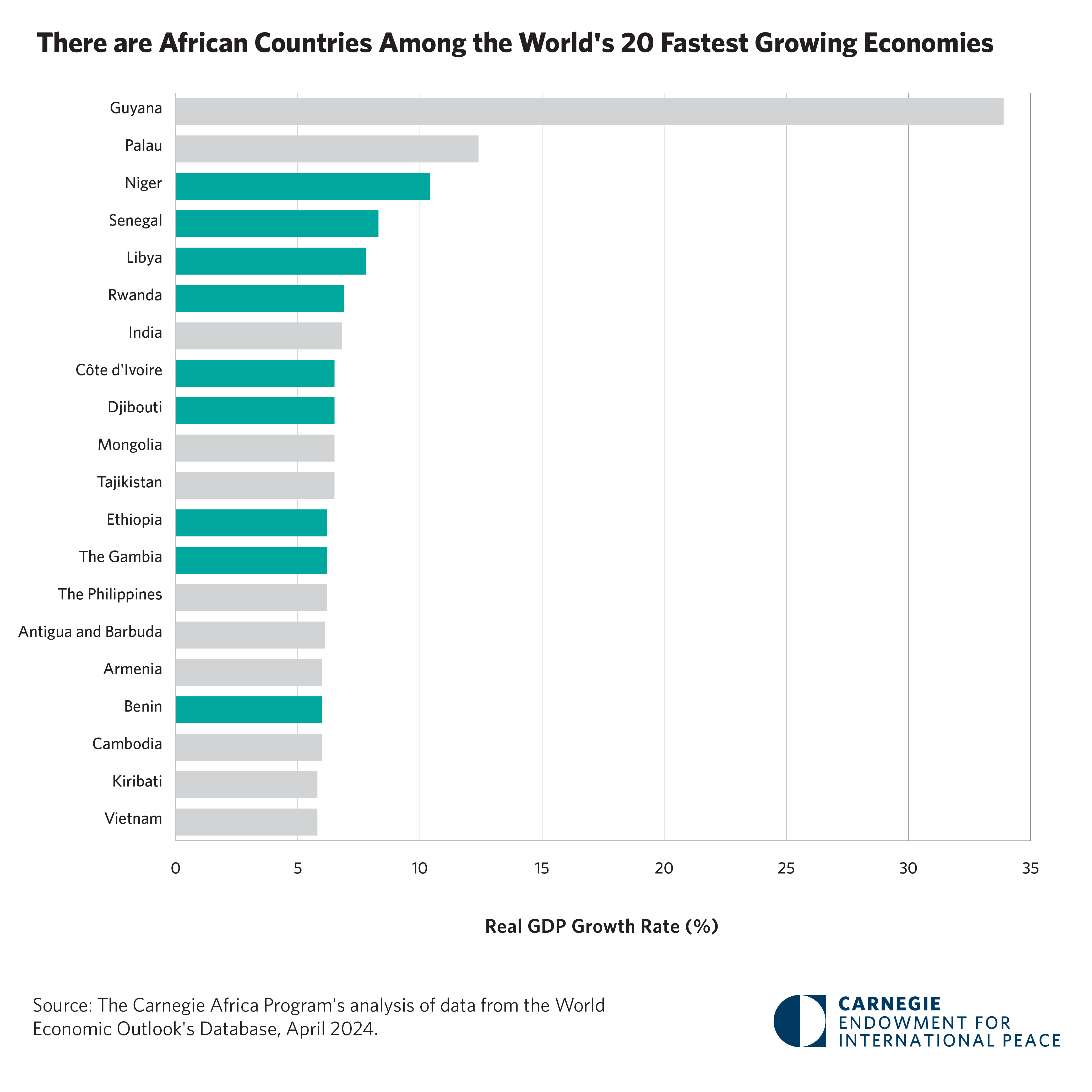

9 of the 20 Fastest-Growing Economies Worldwide in 2024 Will Be in Africa

This month in the Africa Program, we are looking at the continent’s growth prospects following the release of the IMF World Economic Outlook for April 2024.

Dear Friends,

This month in the Africa Program, we are looking at the continent’s growth prospects following the release of the IMF World Economic Outlook for April 2024. Our Chart of the Month, below, illustrates an important dynamic: of the top twenty economies that are projected to experience the fastest growth rates in 2024, nine are African countries. These are Niger, Senegal, Libya, Rwanda, Côte d’Ivoire, Djibouti, Ethiopia, the Gambia, and Benin. Niger will be not only the third-fastest-growing economy in the world but also, surprisingly, the fastest-growing in Africa. Following a coup d’état at the end of July 2023, Niger faced numerous economic sanctions, leading to its exit from the Economic Community of West African States (ECOWAS). However, Niger possesses significant oil deposits, and with the completion of a 2,000-kilometer pipeline between Niger and Benin, the oil industry is predicted to generate a quarter of the country’s GDP. Senegal, despite recent—now resolved— political unrest, will be the second-fastest-growing African economy, likely due to its rapidly growing hydrocarbons industry. The years 2014 to 2017 saw the discovery of more than 40 trillion cubic feet of natural gas. Overall, "sub-Saharan" Africa’s predicted growth—3.8 percent—is higher than the global average of 3.2 percent and makes it the second-fastest-growing region in the world (after Emerging and Developing Asia, which has a growth rate of 5.2 percent). However, this aggregate number masks an important divergence in income growth between Africa and other developing regions. Finally, currency depreciations alongside reduced export earnings and inflation have conspired to knock Nigeria off from the position of Africa’s largest economy to number four, after South Africa, Egypt, and Algeria. Trade is an important mechanism for accelerating and expanding the sources of growth in African economies. And on this front, discussions around the future of the U.S. trade preference program with Africa, the African Growth and Opportunity Act (AGOA), continue in Washington, D.C. Consequently, we just published a policy outlook that presents three options for utilizing the AGOA reauthorization process to facilitate the expansion of U.S.-Africa trade in minerals that are critical to the clean energy transition. Our recommendations include: (1) exempting eligible African mineral producers from Inflation Reduction Act (IRA) restrictions in order to diversify U.S. supply chains and advance African value-addition objectives, (2) reframing the U.S.-Africa trade relationship into a strategic economic partnership for a new era, and (3) negotiating a new critical minerals agreement (CMA). Several other new publications across the Carnegie Africa Program address key issues for the continent. Nonresident scholar David McNair’s piece from early April argues that advocates for global financial architecture reform should propose a comprehensive, viable reform plan for people and planet. Writing in World Politics Review, our tech fellow Jane Munga considers Africa’s unique approach to Artificial Intelligence. Nonresident scholar Katie Auth’s latest piece considers the tools at the United States' disposal to support Africa's infrastructure development. In early April, I had the privilege of visiting SOAS University of London for their workshop on “Industrial Policy for Economic Development in an Age of Ecological Crisis.” I co-delivered a lecture on critical minerals as part of the green transition and economic diversification. On April 18, as part of Semafor’s World Economy Summit 2024, I discussed how low-and-middle-income economies, particularly in Africa, can be brought into the clean energy supply chain, alongside the CEO of World Resources Institute, Ani Dasgupta. We emphasized the clear desire of African countries to move from sourcing raw critical minerals to higher value activities in domestic processing and refining. Watch the video replay here.

I am thrilled to announce three new nonresident scholars who will be joining the Carnegie Africa Program this spring. Mr. Anthony Carroll is the founding managing director of Acorus Capital, a private equity fund investing in Africa, and senior advisor Manchester Trade, Ltd., a Washington, D.C.-based trade and policy investment advisory firm. He was instrumental in the design and passage of AGOA, and the President’s Emergency Plan for AIDS Relief (PEPFAR). His work with the Africa Program will focus on U.S. economic and political engagement with Southern African countries. Mr. Ramsey Day is the head of strategy and business development at Lumenix USA, a leading AI technology firm. Previously, he was the assistant administrator for Africa at USAID, where he spearheaded foreign assistance policy development, budget planning, and program operations across sub-Saharan Africa, as well as overseeing government-wide initiatives such as Power Africa and Prosper Africa. His work with the Africa Program will focus on U.S. government announcements, initiatives, and developments relating to economic engagement with African national and subnational actors. Finally, Dr. Nicolas Lippolis is a postdoctoral researcher at the Columbia Climate School where his research examines how countries in Africa and Latin America navigate financial constraints, a decarbonizing world economy, and China’s global presence to chart strategies for energy transitions and green industrialization. He has consulted with the World Bank and previously worked in emerging markets macroeconomic research at Goldman Sachs in London. His work with the Africa Program will focus on Angolan external relations with the U.S., Asia, Europe, and other African countries.

We are excited to expand our network of scholars and look forward to the valuable work they will contribute to the Africa Program. Finally, this week I am attending the 2024 U.S.-Africa Business Summit in Dallas, Texas, hosted by the Corporate Council on Africa. On Wednesday, May 8, I will participate in a panel discussion on Africa's Special Economic Zones, including how they can benefit from the African Continental Free Trade Area and how they can drive industrialization on the continent.

To stay up to date on our publications and programming, be sure to subscribe to our newsletter and follow us on X (formerly Twitter) at @AfricaCarnegie.

Sincerely,

Zainab Usman

Director, Carnegie Africa Program

CHART OF THE MONTH

This month's Chart of the Month, below, details the projected fastest growing economies in the world, following the release of the IMF World Economic Outlook for April 2024.

CRITICAL MINERALS

How the AGOA Reauthorization Process Could Help Diversify U.S. Critical Mineral Supplies

The ongoing African Growth and Opportunity Act reauthorization process could facilitate the expansion of U.S.-Africa trade in critical minerals.

Zainab Usman and Alexander Csanadi

INFRASTRUCTURE

Getting Real: How the United States Can Deliver on Its Commitment to African Infrastructure

Ambitious U.S. rhetoric and commitment to African infrastructure requires follow-through. By taking a few concrete steps, the United States can make real progress on this worthy goal.

Katie Auth

AFRICA AND AI

Africa Has Its Own Approach to AI

Policymakers and legislators around the world are debating how to regulate artificial intelligence. Although the U.S., the European Union and China dominate coverage of this effort, a less-publicized but vital discourse about AI is taking place throughout Africa.

Aubra Anthon and Jane Munga

FINANCIAL REFORM

Tomorrow’s Global Financial Architecture: A Reform Plan for People and Planet

As calls for global financial architecture reform grow louder, advocates risk overloading policymakers. They should instead propose a comprehensive viable reform plan for People and Planet.

David McNair

DEVELOPMENTS ON OUR RADAR

- Zimbabwe launches 'gold-backed' currency to replace collapsing dollar [Financial Times]

- Moderna pauses Kenya plant plans as COVID vaccine demand wanes [Reuters]

- South Africa: Post-election uncertainty increases risk profile [The Africa Report]

- U.S. Loses Soft Power Edge in Africa [Gallup]

- US pulling troops from Chad, Niger [The Hill]

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.