Evan A. Feigenbaum

{

"authors": [

"Evan A. Feigenbaum"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"East Asia",

"China"

],

"topics": [

"Political Reform",

"Economy"

]

}

Source: Getty

China’s Great Rebalancing Act

The Chinese growth model is delivering diminishing returns. China's cautious leaders face a choice between doubling down on needed reforms or continuing to muddle through on the current path.

Source: Eurasia Group

Why is China’s growth model delivering diminishing returns? The global economic crisis provided clear evidence that China’s export-driven economy is vulnerable to dips in demand in the rest of the world. Meanwhile, its dependence on investment has introduced distortions and imbalances into the Chinese economy. China’s rebalancing agenda is not merely about economics but, ultimately, the political viability of the Chinese system. Beijing has delivered economic prosperity to many Chinese citizens. But those very successes have yielded numerous problems—some large—that could undermine the regime’s legitimacy if left wholly unattended.

In this comprehensive look at the future of China’s political economy, Eurasia Group’s China team examines the maladies that confront Chinese leaders and the solutions they have prescribed to remedy them. Their blueprint is the 12th Five Year Plan, a set of strategic goals and binding economic targets through which they aim to alter China’s macroeconomic landscape in far-reaching ways, with effects that are likely to be felt for a decade to come.

But the report argues that China’s economic landscape will not change as fundamentally as the 12th FYP’s designers (and many foreigners) hope. And that, in turn, means that China in five years will be more brittle and beset by social difficulties. Although China should have little trouble muddling through until then, Chinese leaders will likely face starker choices when the plan has run its course in 2015 than they do today. They can double down on rebalancing—creating a more sustainable (long-term) growth model, but exacerbating (short-term) economic pain. Or, they can continue their attempt to muddle through and risk heightened political instability as a result of the widening gap between haves and have-nots. Eurasia Group is not optimistic that China’s cautious leaders have the stomach for bold reform. Thus, the next decade is likely to be more fraught than conventional wisdom suspects. This comprehensive new report explains why.

About the Author

Vice President for Studies

Evan A. Feigenbaum is vice president for studies at the Carnegie Endowment for International Peace, where he oversees work at its offices in Washington, New Delhi, and Singapore on a dynamic region encompassing both East Asia and South Asia. He served twice as Deputy Assistant Secretary of State and advised two Secretaries of State and a former Treasury Secretary on Asia.

- The Trump-Modi Trade Deal Won’t Magically Restore U.S.-India TrustCommentary

- Unpacking Trump’s National Security StrategyOther

- +18

James M. Acton, Saskia Brechenmacher, Cecily Brewer, …

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

- The Kremlin Is Destroying Its Own System of Coerced VotingCommentary

The use of technology to mobilize Russians to vote—a system tied to the relative material well-being of the electorate, its high dependence on the state, and a far-reaching system of digital control—is breaking down.

Andrey Pertsev

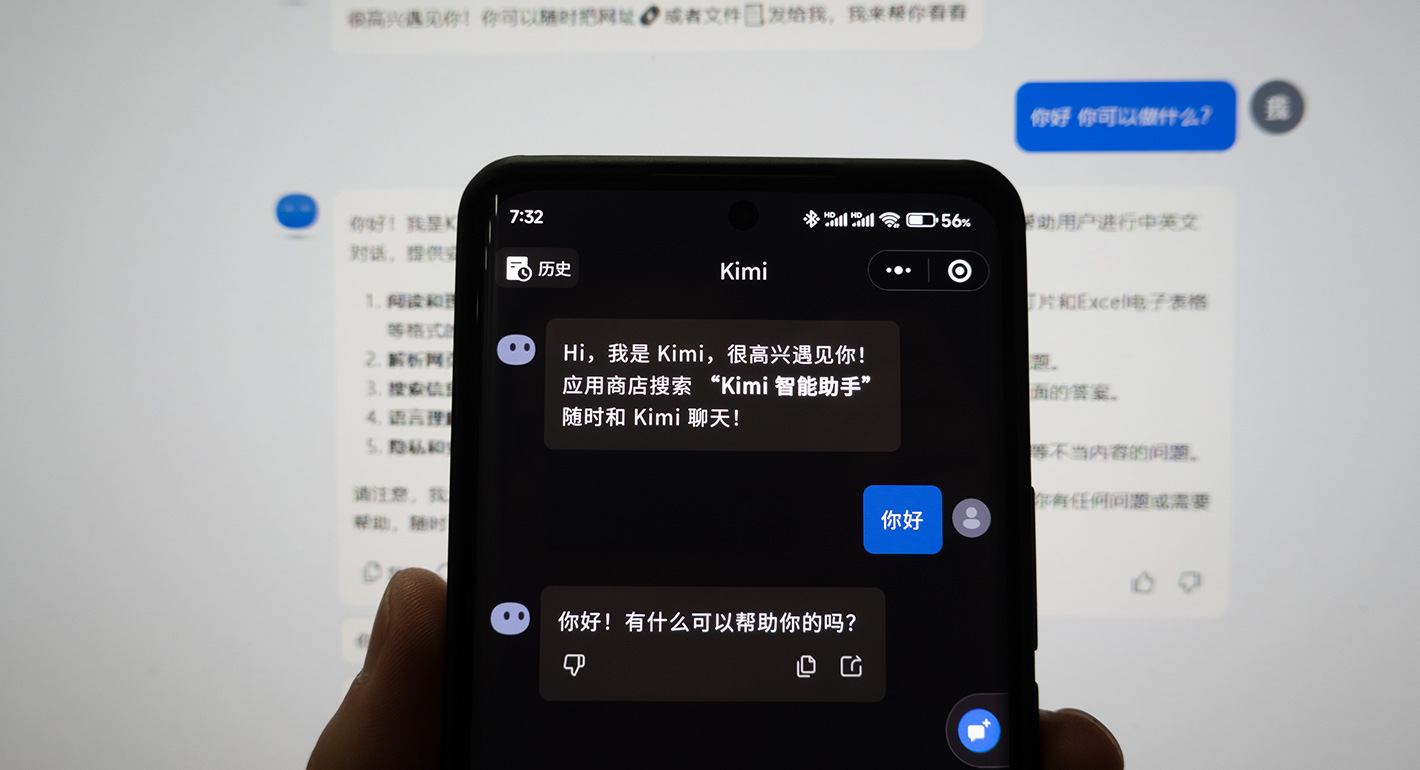

- China Is Worried About AI Companions. Here’s What It’s Doing About Them.Article

A new draft regulation on “anthropomorphic AI” could impose significant new compliance burdens on the makers of AI companions and chatbots.

Scott Singer, Matt Sheehan

- Getting Debt Sustainability Analysis Right: Eight Reforms for the Framework for Low-Income CountriesPaper

The pace of change in the global economy suggests that the IMF and World Bank could be ambitious as they review their debt sustainability framework.

C. Randall Henning

- Notes From Kyiv: Is Ukraine Preparing for Elections?Commentary

As discussions about settlement and elections move from speculation to preparation, Kyiv will have to manage not only the battlefield, but also the terms of political transition. The thaw will not resolve underlying tensions; it will only expose them more clearly.

Balázs Jarábik

- How Middle Powers Are Responding to Trump’s Tariff ShiftsCommentary

Despite considerable challenges, the CPTPP countries and the EU recognize the need for collective action.

Barbara Weisel