Venezuelans deserve to participate in collective decisionmaking and determine their own futures.

Jennifer McCoy

{

"authors": [

"Uri Dadush"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "",

"programs": [],

"projects": [],

"regions": [

"Western Europe",

"France",

"Germany",

"North America"

],

"topics": [

"Economy"

]

}

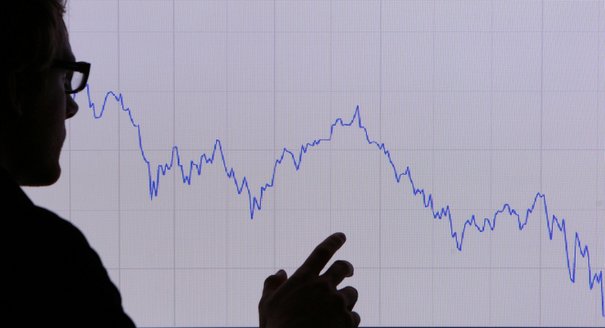

To save the euro, Europe must not only put out the immediate fire, but also act to prevent future fires by layering both fiscal and political unions on top of its currency union.

Source: Il Sole

First, saving the euro requires putting out the fire before we revise the fire safety code. As has become painfully evident, last week’s Brussels agreement has simply failed to provide markets with the assurance that the fire brigade (the European Financial Stability Facility, or EFSF) has enough water. Sensible people also know that relying on the European Central Bank to backstop Italian and Spanish bonds—i.e. printing money—is a false solution: it does not deal with the underlying problem, reduces the incentive to deal with it, is inflationary, undermines the balance sheet of the Central Bank, and risks a break-up of the eurozone when the countries at the core say enough is enough. Right now, there is no substitute for a bigger EFSF complemented by resources external to the eurozone and carrying tough conditions on the countries that draw on it.

Second, saving the euro requires, above all, reforms in the crisis countries. That is why former prime minister and president Ciampi’s call on these pages that reforms are “up to us” (“sta in noi”) is so apt. Especially in the case of Italy, the needed reforms are not only fiscal, though these are vital—but also reforms to facilitate the workings of markets, increase competition and flexibility—in short, to promote competitiveness and sustained growth. Prime Minister Berlusconi’s letter to the G20 contains many of these reforms. There is no mystery to them—it is just that they have been ignored for far too long. Countries that are not willing or able to deal with them should take the inevitable but tragic consequence, prepare sooner or later to leave the euro, and deal with five years of chaos and depression.

Third, Germans need to take more responsibility. The euro’s institutional deficit is their fault too, and it is certainly now their problem as much as anyone else’s. This means they must promote more expansionary policies at home, support more expansionary policies by the European Central Bank, and put more money in the EFSF—while insisting on corresponding commitments in the crisis countries.

As for the five measures included in the manifesto, the new eurozone economic governance mechanism is the crucial missing part of the puzzle, and all others flow from it. To speak clearly, this is about taking a big step toward a United States of Europe. What does that mean? It does not mean that people in Berlin and Rome speak the same way, have the same culture, or the same prejudices (inhabitants of Boston and Dallas certainly do not). It does mean, however, that a much larger share of their taxes and their public spending belongs in a common pool, that they are able to fund common infrastructure, and that they are able to compensate for asymmetric shocks with transfers, and workers move more freely. And it means that a common set of regulations governs the financial system and a lender of last resort exists so that a local banking problem is prevented from infecting the system.

A eurozone economic governance mechanism does not, however, imply that the European Central Bank stands behind the bonds of constituent nations—certainly the Federal Reserve Bank of the United States does not stand behind the bonds of New York State or Texas. Instead, a combination of tough balanced budget provisions (independently adopted by states themselves) and market disciplines ensure that individual states toe the line. Implicitly, but not explicitly, the Federal Reserve Bank stands behind the bonds issued by the U.S. federal government, but their yield may reach great heights (as they have in the past) before the Federal Reserve intervenes, exercising discipline.

The United States did things in the correct order—first it established a political union, then the fiscal union, and the common currency followed. The Sole manifesto is correctly calling for the fiscal union to follow the European common currency. What it does not say is that Europe also needs a much tighter political union for that to succeed. It took about 150 years for the United States to arrive at its current institutional set up (the Federal Reserve Bank was only established in 1913), requiring many plebiscites, and at the cost of a civil war. Europe has only a few years to travel the same path, without the war.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

Venezuelans deserve to participate in collective decisionmaking and determine their own futures.

Jennifer McCoy

German manufacturing firms in Africa add value, jobs, and skills, while benefiting from demand and a diversification of trade and investment partners. It is in the interest of both African economies and Germany to deepen economic relations.

Hannah Grupp, Paul M. Lubeck

As European leadership prepares for the sixteenth EU-India Summit, both sides must reckon with trade-offs in order to secure a mutually beneficial Free Trade Agreement.

Dinakar Peri

Global development needs imagination to update the purposes, structures, and systems of outmoded institutions to make them fit for today’s world.

David McNair

African countries need to adapt to a new era of U.S. trade relations.

Kholofelo Kugler, Georgia Schaefer-Brown