Yukon Huang, Isaac B. Kardon, Matt Sheehan

{

"authors": [

"Yukon Huang"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie China"

],

"collections": [],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie China",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"East Asia",

"China"

],

"topics": [

"Economy"

]

}

Source: Getty

The Real Risks to China's Financial System

Beijing has been using the financial system to fund public expenditure needs, many of which are not commercial in nature and would normally be undertaken through the budget.

Source: Financial Times

But focusing on emerging financial risks is a case of treating the symptoms of the problem, rather than understanding and dealing with its origins. When Deng Xiaoping launched his efforts decades ago to boost economic growth, he needed to secure the resources to ramp up investments along the coast. But the Communist party leader faced the reality that government revenues had fallen to only 11 per cent of gross domestic product by the mid-1990s and the only alternative was to tap household savings in the banking system. Although revenues have been increasing steadily, China’s national budget still amounts to only 25 per cent of GDP, compared with an average of 35 per cent for other middle income countries and over 40 per cent for OECD economies.

About the Author

Senior Fellow, Asia Program

Huang is a senior fellow in the Carnegie Asia Program where his research focuses on China’s economy and its regional and global impact.

- Three Takeaways From the Biden-Xi MeetingCommentary

- Europe Narrowly Navigates De-risking Between Washington and BeijingCommentary

Yukon Huang, Genevieve Slosberg

Recent Work

More Work from Carnegie Endowment for International Peace

- Resetting Cyber Relations with the United StatesArticle

For years, the United States anchored global cyber diplomacy. As Washington rethinks its leadership role, the launch of the UN’s Cyber Global Mechanism may test how allies adjust their engagement.

Patryk Pawlak, Chris Painter

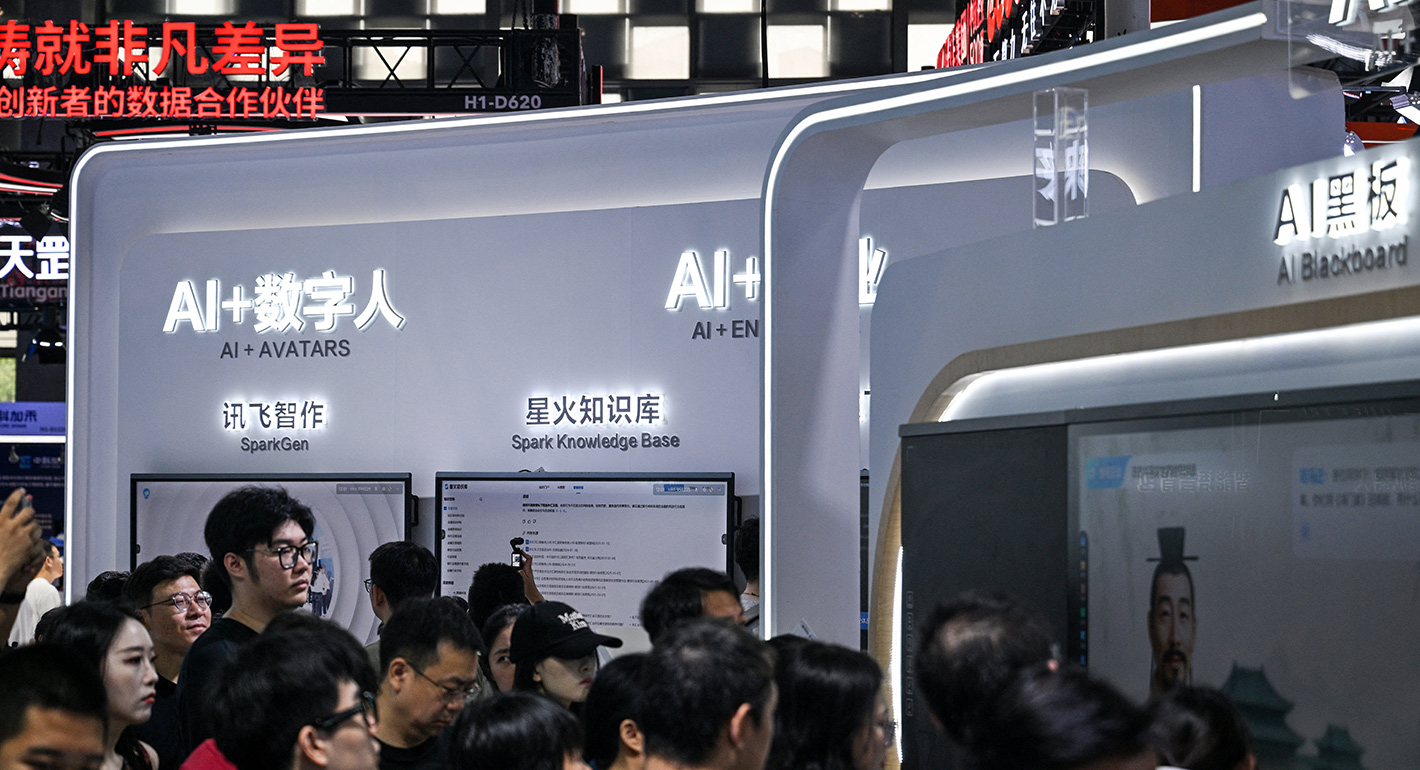

- China’s AI-Empowered Censorship: Strengths and LimitationsArticle

Censorship in China spans the public and private domains and is now enabled by powerful AI systems.

Nathan Law

- Why Are China and Russia Not Rushing to Help Iran?Commentary

Most of Moscow’s military resources are tied up in Ukraine, while Beijing’s foreign policy prioritizes economic ties and avoids direct conflict.

Alexander Gabuev, Temur Umarov

- How Trump’s Wars Are Boosting Russian Oil ExportsCommentary

The interventions in Iran and Venezuela are in keeping with Trump’s strategy of containing China, but also strengthen Russia’s position.

Mikhail Korostikov

- Iran Is Pushing Its Neighbors Toward the United StatesCommentary

Tehran’s attacks are reshaping the security situation in the Middle East—and forcing the region’s clock to tick backward once again.

Amr Hamzawy