Yukon Huang, Isaac B. Kardon, Matt Sheehan

{

"authors": [

"Yukon Huang"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"East Asia",

"China"

],

"topics": [

"Economy",

"Trade"

]

}

Source: Getty

Place Reform on The Agenda

Seven percent is a reasonable GDP growth rate for the Chinese economy that will also give give room for the Chinese central government to enact institutional reform.

Source: China Economic Net

Seven percent is a reasonable GDP growth rate for the Chinese economy, which would give room for institutional reform, said Yukon Huang, a senior associate at the Carnegie Endowment for International Peace.

"I think the government is quite right to say our target growth rate for this decade is 7 percent, not 8 percent. They can be a bit relaxed right now because the economy is actually growing at 7.7 to 7.8 percent," Huang said.

"My view is the growth will still go down but it (the central government) can be relaxed because the floor is 7. In the past, the floor was not meaningful. China always grew well above the floor. Now the floor is becoming more meaningful," he added.

Huang, who was the World Bank 's country directo r for China from 1997 to 2004, said monetary expansion is not going to solve China's economic problems, given the recent contradiction between the surge in money supply and sluggish economic growth."The banks are flush with funds. Lots of successful companies have a lot of internal earnings. They don't really need to borrow for industrial expansion. The inventory levels in China are relatively high and companies do not feel an urgent need to expand capacity. Some people do want to borrow for property speculation but the government is trying to control that," he said in an explanation of the reasons behind the dampened credit demand.

In addition, China's local governments are financially under strain because they spent too much in the previous stimulus program. Property credit and investment is also restricted so the credit expansion did not generate many other activities, said Huang.

By the end of May, China's broad money supply (M2) grew by 15.8 percent over a year ago to reach 104.21 trillion yuan ($17 trillion), or 200 percent of GDP. However, GDP growth eased to 7.7 percent in the first quarter and is expected to remain relatively weak in the second quarter.

"What does it tell the government? Monetary expansion is not going to solve the problem. I think the government is quite correct to put reform issues on the agenda, including an overhaul of the financial system, hukou (household registration) system reform, urbanization and the liberalization and streamlining of administrative procedures," he said.

"But the problem is, will the reform have a short-term effect on the economy? If structural reform is beneficial to medium and long-term growth, how soon will it take effect?" he asked.

In answer to the question, he said first it should be recognized that the Chinese economy is a maturing economy and therefore growth must moderate.

"If you look at the two economies of South Korea and Taiwan , they all slowed down when they joined the high-income club. So the slowdown of the Chinese economy is not a problem. The real question is, how fast should China need to grow to achieve high-income status?" he asked.

"Of course the government doesn't want to slow down prematurely. China needs to grow 7 to 8 percent for the rest of this decade. Then it can afford to grow at 5 to 6 percent from 2020 to 2030. Then it would become a high-income nation and the largest economy in the world."

However, the problem is whether China can grow at 7 percent or a little more for the next seven years. The economy does not now have the impetus of entry into the World Trade Organization to give it the drive it posse ssed before its admission into the body in 2001. Furthermore, exports to the US and Europe are falling as their economies suffer.

This is why China's urbanization program is so important, according to Huang.

"When Premier Li Keqiang talks about urbanization, he is talking about something different from the past," he said. "You cannot think of urbanization as just more building. That's dangerous. The critical question is, how can you support urbanization in ways that generate what I call 'sustainable demand': investment that is needed, consumption that will continue?"

What is "sustainable demand"? In Huang's view, subsidizing refrigerators is not sustainable because the raised consumption comes at the expense of future demand. In fact, there are a lot of aspects of China's urbanization that could be more sustainable.

For example, Huang said although the country's commercial housing development received a boost over the past decade, government-subsidized affordable houses remain insufficient. They are supposed to be rented to low-income residents who cannot afford to buy in the commercial market.

"You need to figure out a way to build affordable housing that is financially sustainable. It is not being done because builders don't find it profitable. But the reason is the way the land is being managed in these cities make it excessively costly," Huang said.

"About 50 to 60 percent of cities' housing stock is what I call old socialist housing. That land is potentially usable for affordable housing. The problem right now is they are developed by city officials in ways that often lead to inappropriate practices and excessively high prices," he said.

Huang said the way forward is for homeowners to partner with builders to share the development process so both sides are happy. And the city will make more money by levying construction and property tax es.

Currently common practice in China is for land or old buildings to be taken over by the government before they are developed. Owners are offered compensation, which is often regarded by owners as too low. Mandatory resettlements often lead to social grievances.

"Right now it is not possible for the owner of the socialist stock building and the tenant to actually develop the building. This is not an appropriate model by which to develop affordable housing. Moreover, a majority of affordable houses should be rentals and not for purchase. If you could do this, you generate construction building which is sustainable," said Huang.

There is also enormous demand to improve public transport in the urbanization program, he added.

"I often tell people Beijing is actually too small. It is not as densely populated as it should be. You look around Beijing and you see a lot of land that is not utilized or only half utilized. They are held by State-owned enterprises or as affordable housing for employees. Once they are redeveloped, considerable room could be made for affordable homes," said Huang.

About the Author

Senior Fellow, Asia Program

Huang is a senior fellow in the Carnegie Asia Program where his research focuses on China’s economy and its regional and global impact.

- Three Takeaways From the Biden-Xi MeetingCommentary

- Europe Narrowly Navigates De-risking Between Washington and BeijingCommentary

Yukon Huang, Genevieve Slosberg

Recent Work

More Work from Carnegie Endowment for International Peace

- Beijing Doesn’t Think Like Washington—and the Iran Conflict Shows WhyCommentary

Arguing that Chinese policy is hung on alliances—with imputations of obligation—misses the point.

Evan A. Feigenbaum

- A China Financial Markets PostCommentary

Description of the post.

Michael Pettis

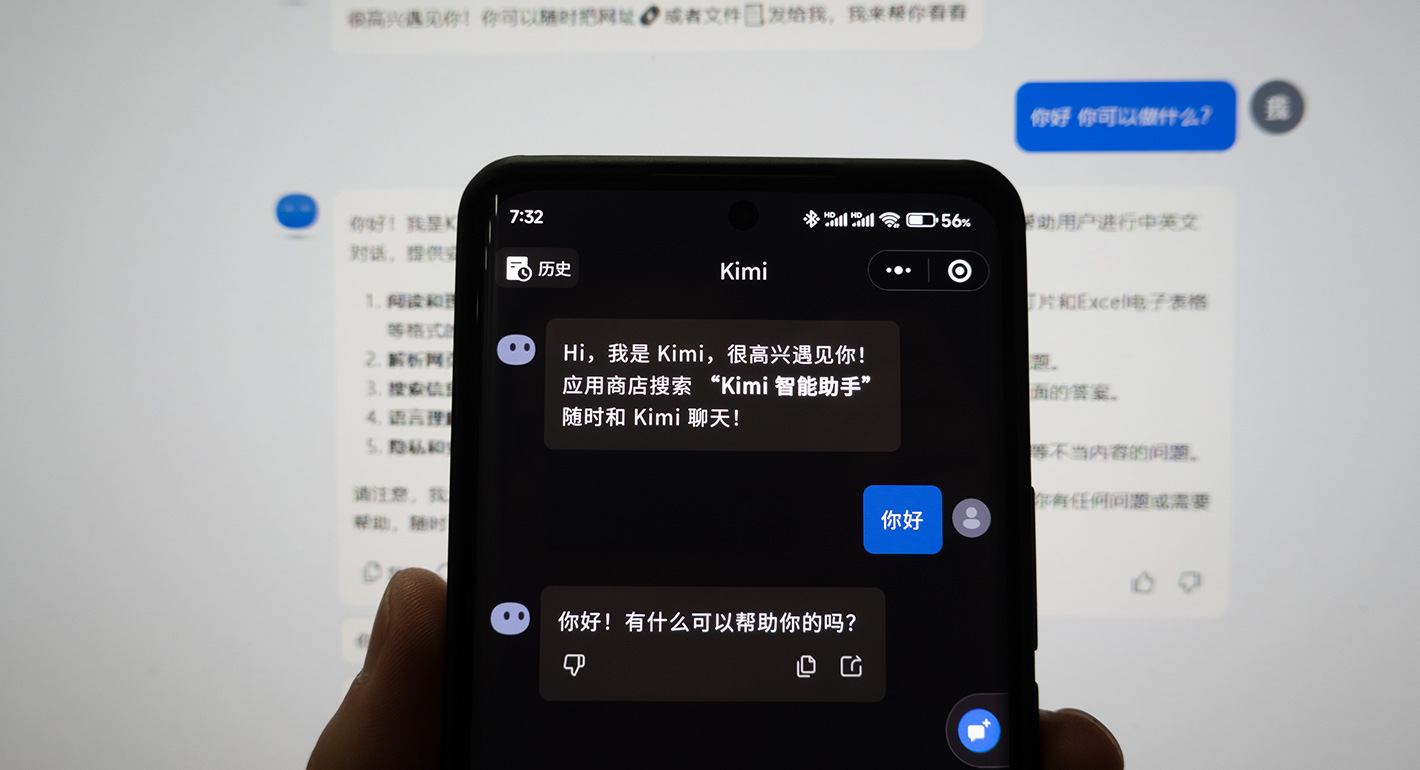

- China Is Worried About AI Companions. Here’s What It’s Doing About Them.Article

A new draft regulation on “anthropomorphic AI” could impose significant new compliance burdens on the makers of AI companions and chatbots.

Scott Singer, Matt Sheehan

- Getting Debt Sustainability Analysis Right: Eight Reforms for the Framework for Low-Income CountriesPaper

The pace of change in the global economy suggests that the IMF and World Bank could be ambitious as they review their debt sustainability framework.

C. Randall Henning

- How Middle Powers Are Responding to Trump’s Tariff ShiftsCommentary

Despite considerable challenges, the CPTPP countries and the EU recognize the need for collective action.

Barbara Weisel