Michael Pettis

{

"authors": [

"Michael Pettis"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie China"

],

"collections": [],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"East Asia",

"China"

],

"topics": [

"Economy"

]

}

Source: Getty

China’s Many Economies

It can be tempting to overgeneralize about patterns in China’s economic development—even for scholars who acknowledge the country’s great diversity.

Source: Stanford Social Innovation

Yuen Yuen Ang’s book, How China Escaped the Poverty Trap, has two great strengths. First, it develops a consistent frame work for thinking about the development process without resorting to China-is-different trickery every time there is a gap between China’s reality and the logic of the framework. This is in sharp distinction to the work of most economists, both Chinese and foreign, who generally try to explain China by shoehorning it into their models, even as they sternly admonish against ignoring the specific characteristics that make China different. This avoidance of sleight-of-hand makes Ang’s book useful not just to China specialists but also to anyone interested in the very messy process of economic development, which, as Ang correctly suggests, is as much political and social as economic.

“For a long time, pundits have searched for particular models of economic success; the common assumption has been that if the right model can be replicated in other settings, growth will follow,” Ang writes. In reality, though, “particular solutions for market promotion vary over the course of development, within countries, and even within locales of a single country.” She shows the signifi cance of these variations through hugely detailed interviews and descriptions of the ways policies are initiated, adapted locally, implemented, and revised in China’s many different political and economic environments. This in-depth research represents the book’s second great strength. It is hard to finish reading it with any confidence about the monolithic nature of China, its economic progress, and its political system.

In fact, the one consistency Ang finds in China’s modern development is the very willingness to adopt a range of approaches based on local conditions. “Conventional theories that posit accelerated growth as a result of strong institutions are tailored to middle- and high-income economies,” she writes. China, on the other hand, has taken an approach she calls “directed improvisation,” a result, in part, of weak institutions and an inability to enforce standard practices across its whole territory. Ang believes this approach offers a useful example for other developing economies. “Poor countries begin with an abundance of so-called weak institutions; they need theories of development that occur through weak institutions,” rather than the centralized, high-theory models often imposed by international development agencies.

The weakness of the book may be in its failure to see that China’s period of real and sustained growth had ended long before it was written. By the late 1990s, China’s economic model was already in trouble, and within a few years it was delivering not miraculous growth but rather feverish increases in economic activity (which is what GDP actually measures), driven by a rapid and clearly unsustainable increase in debt, as a consequence of systematic investment misallocation on a massive scale.

Ang’s misreading of this growth model leads her to explain success where there is no success. This is evident in her discussion of the uneven process of development in which certain provinces and regions, mostly along the eastern and coastal provinces, advanced rapidly during the very beginning of China’s period of reform and opening up in the 1980s, while others, mainly in the country’s deep interior, remained very poor and economically backward decades later. According to Ang, the specific conditions that allowed the coastal cities to get their rapid start—local officials and business owners with relatives in nearby Taiwan and Hong Kong and ready access to a network of local entrepreneurs—enabled them to court investment in quantity rather than quality. Their success in attracting investment then enabled the transfer of capital and jobs to the country’s poorer, inland areas, which Ang argues are now experiencing an “unprecedented economic boom.”

In reality, development of institutions has varied so much across China over the centuries that the inland provinces still lack the legal, financial, cultural, and business practices that allowed the coastal cities to productively absorb high levels of investment. Without significant reforms to these institutions, the inland provinces will never be able to develop in the way of the coastal cities. Their “unprecedented economic boom” is no such thing. It is simply the surge in economic activity that must inevitably follow when enormous amounts of debt are used to fund an orgy of investment. Once the investment stops, growth will collapse, leaving only un-repayable debt. This is already evident in the very poorest provinces.

We have seen many other countries employ this growth model, and in every previous case, the dangerous reliance of continued economic growth on debt ultimately has forced the economy into an extremely difficult adjustment, one that we are only just beginning to see in China. Ang acknowledges near the end of the book that “new pressures have mounted to a near tipping point” in China. But she passes quickly over these troubles, ignoring her own warning about the dangers of applying a broad framework of development to widely disparate local conditions.

Nonetheless, Ang’s book is one of the more useful additions to the growing literature on China’s growth model, in part because it does not shy away from acknowledging the varied nature of Chinese institutions. The book might be too specialized to be widely enjoyed, but it should be read by anyone with particular interests in China’s recent economic history, or those interested in economic development more generally.

This article was originally published by Stanford Social Innovation.

About the Author

Nonresident Senior Fellow, Carnegie China

Michael Pettis is a nonresident senior fellow at the Carnegie Endowment for International Peace. An expert on China’s economy, Pettis is professor of finance at Peking University’s Guanghua School of Management, where he specializes in Chinese financial markets.

- A China Financial Markets PostCommentary

- What’s New about Involution?Commentary

Michael Pettis

Recent Work

More Work from Carnegie Endowment for International Peace

- Governing Aging Economies: South Korea and the Politics of Care, Safety, and WorkPaper

South Korea’s rapid demographic transition previews governance challenges many advanced and middle-income economies will face. This paper argues that aging is not only a care issue but a structural governance challenge—reshaping welfare, productivity, and fiscal sustainability, and reorganizing responsibilities across the state, private sector, and society.

Darcie Draudt-Véjares

- Beijing Doesn’t Think Like Washington—and the Iran Conflict Shows WhyCommentary

Arguing that Chinese policy is hung on alliances—with imputations of obligation—misses the point.

Evan A. Feigenbaum

- A China Financial Markets PostCommentary

Description of the post.

Michael Pettis

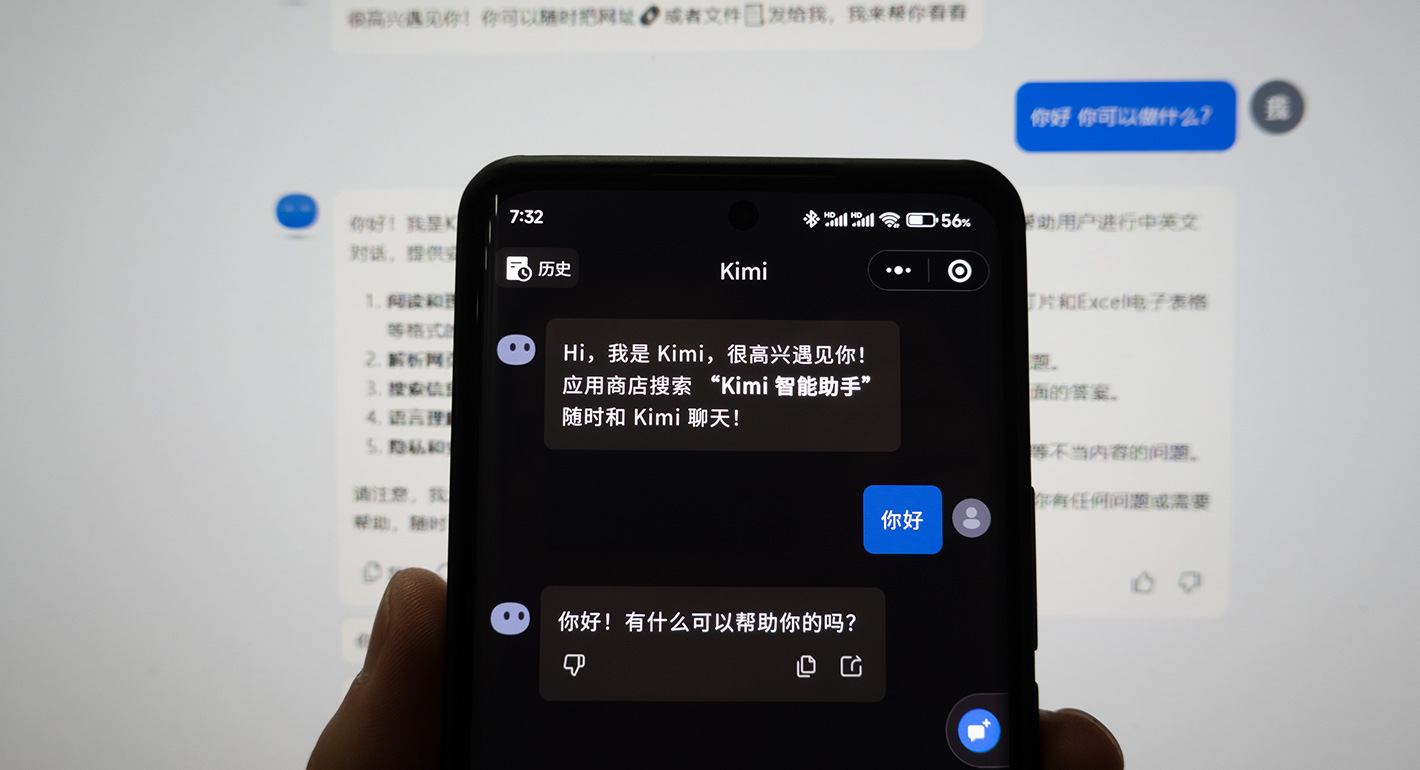

- China Is Worried About AI Companions. Here’s What It’s Doing About Them.Article

A new draft regulation on “anthropomorphic AI” could impose significant new compliance burdens on the makers of AI companions and chatbots.

Scott Singer, Matt Sheehan

- Getting Debt Sustainability Analysis Right: Eight Reforms for the Framework for Low-Income CountriesPaper

The pace of change in the global economy suggests that the IMF and World Bank could be ambitious as they review their debt sustainability framework.

C. Randall Henning