Michael Pettis

{

"authors": [

"Michael Pettis"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"North America",

"United States",

"Western Europe",

"Germany"

],

"topics": [

"Economy",

"Trade"

]

}

Source: Getty

On Capital Flows and Debt Crisis

Large concentrations of capital into a single market can eventually lead to a debt crisis and rising unemployment, making large infrastructure investment a necessity in both the United States and Europe.

Source: Financial Sense

In a recent podcast with Financial Sense, Michael Pettis discussed the wider implications of large capital concentrations in single markets, such as in the current U.S. economy. Such concentrations arguably can lead to major debt crises and unemployment; Pettis offered German trade surpluses in the pre-2008 era as an example. Germany’s huge surpluses and the Eurozone’s restraints on monetary policies for countries such as Spain and Italy led to negative real interest rates in high inflation European countries. This negative interest rate, he explained, contributed to real estate and stock market booms, as well as large consumption binges, all of which rapidly increased debt and played a role in the financial crisis. Pettis argued that Germany continues to have large surpluses that are now being absorbed outside of Europe, such as in the United States, which could lead to economic problems in the future.

To address various concerns of concentration in capital, Pettis explained that both the United States and Europe should make large infrastructure investments. He forecast that the industrial commodity sector—including iron ore and steel—have not in fact bottomed out, and may drop in price even further.

About the Author

Nonresident Senior Fellow, Carnegie China

Michael Pettis is a nonresident senior fellow at the Carnegie Endowment for International Peace. An expert on China’s economy, Pettis is professor of finance at Peking University’s Guanghua School of Management, where he specializes in Chinese financial markets.

- A China Financial Markets PostCommentary

- What’s New about Involution?Commentary

Michael Pettis

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

- India Signs the Pax Silica—A Counter to Pax Sinica?Commentary

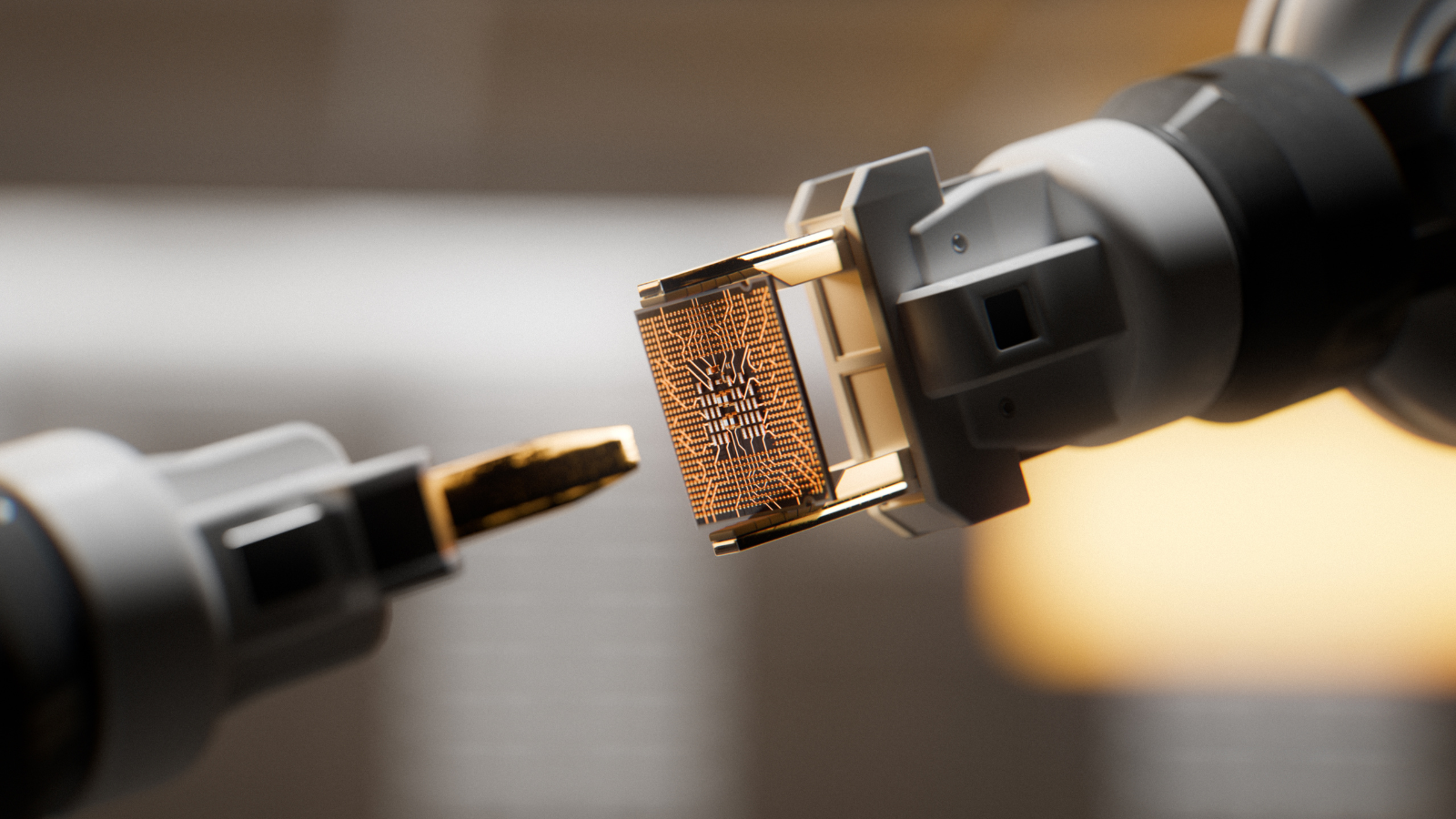

On the last day of the India AI Impact Summit, India signed Pax Silica, a U.S.-led declaration seemingly focused on semiconductors. While India’s accession to the same was not entirely unforeseen, becoming a signatory nation this quickly was not on the cards either.

Konark Bhandari

- What We Know About Drone Use in the Iran WarCommentary

Two experts discuss how drone technology is shaping yet another conflict and what the United States can learn from Ukraine.

Steve Feldstein, Dara Massicot

- Beijing Doesn’t Think Like Washington—and the Iran Conflict Shows WhyCommentary

Arguing that Chinese policy is hung on alliances—with imputations of obligation—misses the point.

Evan A. Feigenbaum

- A China Financial Markets PostCommentary

Description of the post.

Michael Pettis

- Axis of Resistance or Suicide?Commentary

As Iran defends its interests in the region and its regime’s survival, it may push Hezbollah into the abyss.

Michael Young