Yukon Huang, Isaac B. Kardon, Matt Sheehan

{

"authors": [

"Yukon Huang"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie China"

],

"collections": [],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie China",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"North America",

"United States",

"East Asia",

"China"

],

"topics": [

"Economy",

"Trade",

"Foreign Policy"

]

}

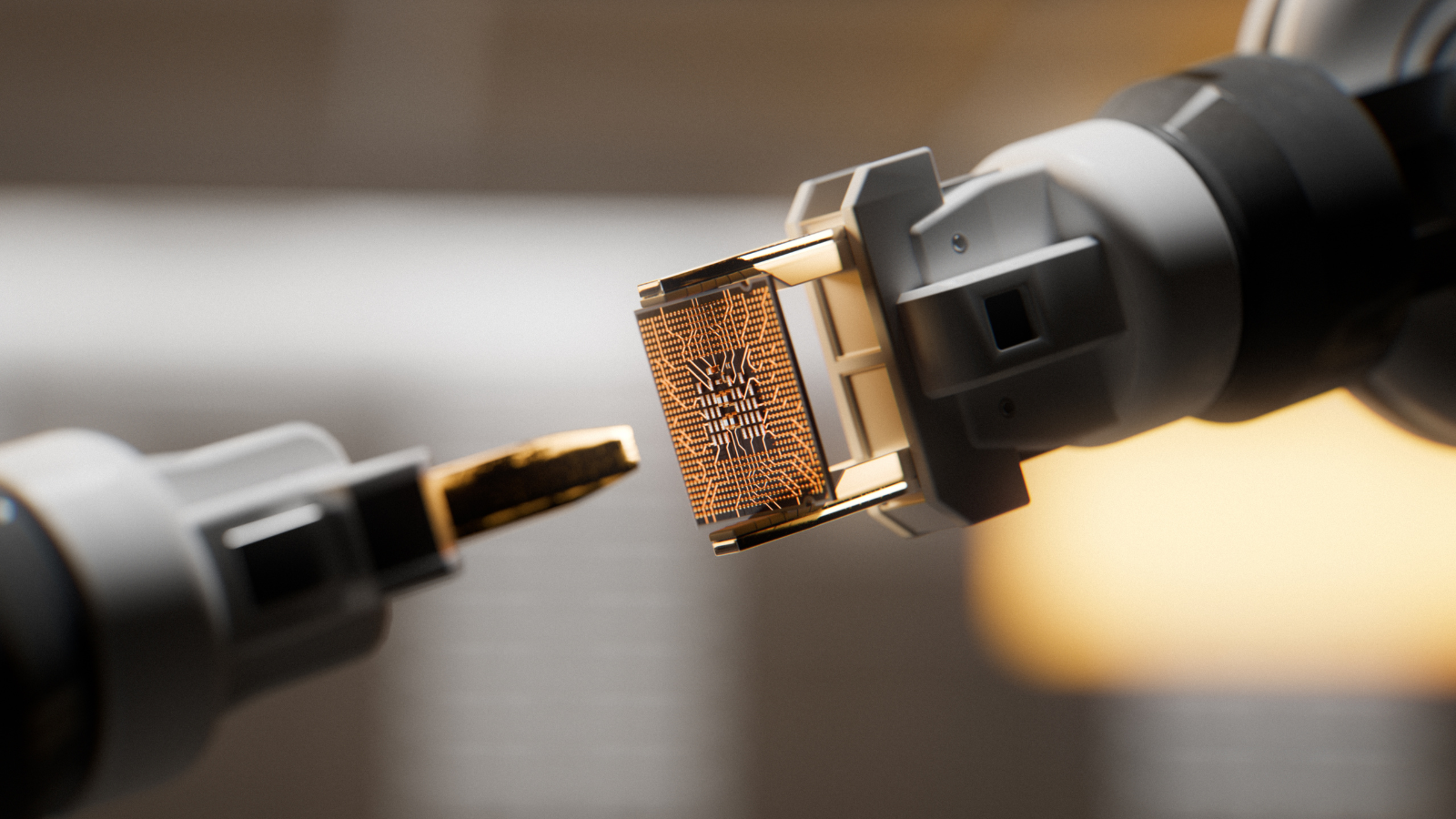

Source: Getty

China’s Foreign Investment Law and US-China Trade Friction

Questions remain about how committed the Chinese Communist Party (CCP) is to continue “reform and opening” even as Xi seeks to advance CCP control in every sector.

Source: Diplomat

On March 15, China’s National People’s Congress passed a new foreign investment law, designed to ease restrictions on foreign firms’ operations in the country. Because the law explicitly addresses some major U.S. concerns, including the practice of forced technology transfers, many have interpreted the new legal framework as a peace offering to Washington amidst talks to end the ongoing trade war.

At the same time, however, a trade deal seems far away. U.S. officials have confirmed that a tentative end-of-the-month goal for a summit between U.S. President Donald Trump and Chinese President Xi Jinping is off the table. And more broadly, questions remain about how committed the Chinese Communist Party is to continue “reform and opening” even as Xi seeks to advance CCP control in every sector.

To understand the foreign investment law and the prospects for further reform in the context of the U.S.-China trade war, The Diplomat spoke to Yukon Huang, a senior fellow with the Asia Program at the Carnegie Endowment for International Peace. Huang, who formerly served as the World Bank’s country director for China, is an expert on China’s economy and the author of the 2017 book, Cracking the China Conundrum: Why Conventional Economic Wisdom Is Wrong.

What do you make of the recent passage of China’s foreign investment law? How much of an impact will this have on the business environment for foreign firms?

Beijing fast-tracked approval of the foreign investment law in response to pressures to reach an agreement with the U.S. on a trade deal. Many compromises were struck to bring this law to fruition so quickly. The result is that Beijing revived a 2015 draft that had 170 articles and turned it into a version with around 40, of which many are a single sentence each. The foreign business community has expressed concern about the law being too vague and lacking implementation details. However, expecting all their concerns to be handled adequately in one law was unrealistic.

One should see the law as a statement of intentions that are broadly responsive to the foreign business community. Specifically, that foreign firms should not be forced to transfer their technology to Chinese firms; protection of intellectual property should be strengthened; procurement of goods should not discriminate against foreign firms; and foreign investment should be encouraged subject to security reviews.

Many commentators have stressed that the devil is in the details. The law, for example, does not define the nature of the security reviews but consider that the comparable U.S. security review process (CFIUS) for foreign investment has been routinely criticized for its cumbersome and opaque nature, even though it has been around since 1988. On a more encouraging note, foreign business associations have commented favorably that a clause was inserted at the last minute promising that agencies would protect the confidential information provided by foreign businesses and that violators would be punished. Realistically, it will take years if not decades to adjust China’s existing regulations and processes at both the national and local levels to conform with the new law.

Behaviors will not change overnight and actions contrary to the spirit of the new law will continue but hopefully less frequently. Easily overlooked is that China has been making progress on these issues, albeit too slowly for the foreign business community. China’s ranking on the World Bank’s ease of doing business improved to 46 in 2018 compared with 78 in 2017. AmCham in China’s survey indicated that 96 percent of its U.S. firms in 2017 felt that IPR enforcement in China had improved over the past five years compared with 86 percent in 2014. Hopefully this new law will speed up the reform process.

To what extent should we see the law as motivated by the U.S.-China trade war, and a desire to undermine the external criticisms being leveled at the Chinese economic system?

Beijing sees the new law as a convenient way to deal with the broad range of issues that the White House raised in its March 2017 “Omnibus Report on Significant Trade Deficits” and a subsequent report in March 2018 on alleged Section 301 violations of the U.S. 1974 Trade Act. Those documents highlighted specific problems as well as provided sweeping assertions about China’s trade and investment practices, such as discriminatory treatment of foreign enterprises and theft of intellectual property.

Many of these accusations would be hard to validate in a legal sense but the message was clear, that China’s trade and investment policies are “unfair.” The new law is an attempt to reaffirm that China’s trade practices are or would be brought in line with globally acceptable norms. The new law is about intentions but what matters to foreign businesses are actions. The predicament is that the two sides are dealing with a range of structural issues that cannot be resolved in a single law or even in the likely forthcoming trade agreement between the U.S. and China. Both sides need to work towards developing a more rules-based institutional approach.

Xi Jinping has increased Communist Party control over every sphere in China, including the economy. Still, state officials constantly promise that China will continue to deepen its “reform and opening” process. How much political will is there for further economic opening?

Upon assuming the leadership role, President Xi’s priority has been on foreign policy and political issues. Externally, this meant promoting the “China dream” — a vague but comprehensive notion built around the rejuvenation of the Chinese nation and its emergence as a global power. Closely associated with this vision is the Belt Road Initiative designed to solidify China’s position as the Middle Kingdom. Internally the focus has been on arresting corruption and strengthening the position of the Communist Party. Thus, the ambitious economic reform agenda that was detailed in the 2013 Third Plenum document was given less attention.

Part of the reason was a hesitancy to tackle structural issues during a prolonged economic slowdown when emerging financial risks were seen as more worrisome. Thus, officials were preoccupied with surging debt levels and putting in place a more flexible exchange rate system. That hesitancy meant neglecting the deteriorating performance of the state-owned enterprises [SOEs] in the aftermath of the global financial crisis. The government’s strategy to rely on diversifying SOE ownership but retaining a dominant state presence has not worked. There is not yet a political consensus on how to deal with the problem because the Party’s authority is closely connected to SOEs playing a major role in the economic system. Many officials also assume that a strong state presence is needed to promote a more innovative economy. Resolving these contradictions is the major reform challenge facing the leadership.

There are widely divergent opinions on the overall health of the Chinese economy. Assuming China continues largely along the same economic track — with minimal reforms, in other words — how do you see its long-term outlook?

Many observers see China’s economic slowdown as its “Achilles Heel.” China is now an upper-middle income country and in a few years will be classified as a high-income country. In that sense, one should have expected that growth rates would inevitably decline from its historical double-digit levels. Upper-middle income countries do not normally grow at even 7 to 8 percent annually. The decline is similar to the experience of other strong Asian performers decades ago, exemplified by Japan, South Korea, and Taiwan. China’s decline has been less precipitous than these examples and in many respects it has fared better.

However, there is a problem with the sustainability of its recent growth experience, which has been fueled by excessive credit expansion. The concern is more about the quality of China’s growth than the actual rate. China needs to rely more on increasing the productivity of its labor force and the efficiency of investment spending. For this to happen, Beijing must solve the problem of poorly performing SOEs and be more selective in its financing of infrastructure which has been distorted by a flawed urbanization process that has wasted resources. With such reforms, it can continue to grow in the 6-7 percent range for a far longer period than the other Asian success cases did at comparable per capita income levels.

What is the likelihood, in your mind, of a U.S.-China trade deal?

The chances are high that a deal will be struck. However, think of the outcome more as extending a temporary truce rather than providing a sustainable solution. The nature of the commitments being made are fine, but the challenge is about implementation and enforcement. Despite the best of intentions, there will continue to be violations and a realization that some issues have not been adequately addressed. Ultimately, both sides need to work toward a more enduring process to monitor actions and resolve disputes on an impartial basis. I continue to believe that a restructured WTO is the best option with the alternative being an investment treaty that is done in coordination with the EU. Such approaches would facilitate a more orderly process for state-to-state settlement of issues and provide a neutral option for international arbitration.

About the Author

Senior Fellow, Asia Program

Huang is a senior fellow in the Carnegie Asia Program where his research focuses on China’s economy and its regional and global impact.

- Three Takeaways From the Biden-Xi MeetingCommentary

- Europe Narrowly Navigates De-risking Between Washington and BeijingCommentary

Yukon Huang, Genevieve Slosberg

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

- India Signs the Pax Silica—A Counter to Pax Sinica?Commentary

On the last day of the India AI Impact Summit, India signed Pax Silica, a U.S.-led declaration seemingly focused on semiconductors. While India’s accession to the same was not entirely unforeseen, becoming a signatory nation this quickly was not on the cards either.

Konark Bhandari

- What We Know About Drone Use in the Iran WarCommentary

Two experts discuss how drone technology is shaping yet another conflict and what the United States can learn from Ukraine.

Steve Feldstein, Dara Massicot

- Beijing Doesn’t Think Like Washington—and the Iran Conflict Shows WhyCommentary

Arguing that Chinese policy is hung on alliances—with imputations of obligation—misses the point.

Evan A. Feigenbaum

- A China Financial Markets PostCommentary

Description of the post.

Michael Pettis

- Axis of Resistance or Suicide?Commentary

As Iran defends its interests in the region and its regime’s survival, it may push Hezbollah into the abyss.

Michael Young