These principles aim to codify core responsible practices and establish a common universal platform of high-level guidelines necessary to build trust that a nuclear energy resurgence can deliver its intended benefits.

Ariel (Eli) Levite, Toby Dalton

Source: Getty

Evaluating the potential of today’s putative nuclear renaissance requires a critical look at what has changed, what hasn’t, and what would be required to avoid the pitfalls that turned prior periods of nuclear boom to bust.

A recent flurry of activity around nuclear energy—driven by an upsurge of interest and incipient investment from technology companies anxious to find enough power for AI—points toward a potential renaissance, both in the United States and around the world. We’ve been here before, of course: nuclear power has experienced similar periods of optimism since its inception in the 1950s. However, especially in the United States, such hopes have been repeatedly crushed under the weight of construction delays and cost overruns, as well as persistent, inherent problems such as safety concerns, long-lived toxic waste, and environmental damages. Evaluating the potential of today’s putative nuclear renaissance thus requires a critical look at what has changed, what hasn’t, and what would be required to avoid the pitfalls that turned prior periods of nuclear boom to bust.

Traditional, large nuclear plants of the type recently completed in Georgia and under construction in many countries around the world can put significant baseload electricity on power grids over long periods of time.1 Yet such projects, especially in the West, are incredibly risky from a financial perspective; utility owner operators have become averse to making huge capital bets and asking their rate payers to assume the costs for projects that could fail. In contrast, new nuclear technologies offer the promise of smaller, modular, more versatile, safer, and cheaper applications, potentially also with a lower environmental footprint. Can these ideas be turned into reality and deployed at scale to provide affordable, safe, and reliable energy without increasing financial, environmental, or security risks?

As governments and industries evaluate this question, what emerges is a need for clearer understanding of what responsible use of nuclear technology entails and the roles that various stakeholders must take to ensure it.

Nuclear is increasingly presented as a viable, abundant, “clean” complement to renewables like solar and wind, which lack the always-on generation capability provided by nuclear power, and natural gas, which is relatively cheap and currently plentiful. Popular support for nuclear power in the United States has been trending upward for the past decade, with over half of Americans now favoring expanded use.2 Traditional utilities remain interested in large-scale nuclear power to meet growing energy demand from many sectors, provided these can become far more affordable to build.

One of the main drivers of the current renaissance is the interest and potential purchasing power of major technology companies. These companies need power—and lots of it—for energy-hungry data centers that are the beating heart of AI. Even if the anticipated demand does not fully materialize due to efficiency gains from next-generation chips and improved AI models, these companies will still need far more power than they consume today. They are attracted to new nuclear reactor designs on the drawing board, which promise improved safety, versatility in size, application, and deployment locations, and the potential to be a stable power source for decades. Among these, small modular reactors (SMR) and Advanced Modular Reactors (AMRs) may also be more affordable by virtue of plans to standardize and industrialize their production. Many of the components ideally could be assembled in a factory and then quickly deployed to sites, in contrast to the huge civil works requirements for traditional nuclear plants. The consequent economies of scale should decrease costs over time.

Nuclear power currently enjoys uncommon bipartisan political support. In 2024, the Joe Biden administration committed $900 million to spur “safe and responsible” deployment of SMRs to meet the growing demand for “clean, reliable, and affordable” power.3 Driven by interest and investment from technology companies, the Donald Trump administration appears set to double down, signaling that developing innovative technologies and selling them worldwide will be an integral part of U.S. energy strategy going forward. This is now motivated less by climate considerations (as during the Biden administration) and more to reinvigorate the U.S. industrial base, stimulate domestic innovation and employment, and prevail in the global technology and security competition with Russia and China. The U.S. secretary of energy described this in a secretarial order issued almost immediately after his Senate confirmation.4

“The long-awaited American nuclear renaissance must launch during President Trump’s administration. As global energy demand continues to grow, America must lead the commercialization of affordable and abundant nuclear energy. As such, the Department will work diligently and creatively to enable the rapid deployment and export of next-generation nuclear technology.” (emphasis added)

—U.S. Secretary of Energy Chris Wright, February 5, 2025

The biggest names in tech are becoming nuclear stakeholders both as future customers and developers, not merely as off-takers of the power. For example, Microsoft’s deal in late 2024 to buy power from a restarted reactor at Three Mile Island allowed it to lock in over 800 megawatts of electricity for its planned AI infrastructure.5 Google has agreed to purchase energy from a fleet of SMRs being developed by the start-up Kairos Power; the first of these is supposed to be operating by 2030.6 OpenAI’s Sam Altman is heavily invested in (and CEO of) Oklo, which is currently working to build a small-scale reactor that could eventually power AI data centers.7 And in the largest commercial deployment deal to date, Amazon is working with a company called X-energy to bring more than 5 gigawatts of new SMR projects online across the United States by 2039.8

Private capital firms are evaluating SMRs as potentially marketable investments, albeit cautiously. While technology firms have invested billions in startups—often spurred by government grants or tax credits—venture capital and private equity firms have been slower to commit funding without a proven technology and “order book” for new builds.9 In the past, the eye-watering start-up costs and uncertain payoff of large-scale nuclear projects have scared off private investors. Nuclear plants were typically constructed by utilities which could draw on public funds to finance construction costs; regulated energy markets ensured that costs could be recouped over time.10 Ultimately, massive government subsidies likely would be needed to achieve the scale of growth inherent in the U.S. commitment to triple nuclear capacity by 2050.

So, the table is set. Innovators are creating promising technologies, technology companies need power and have deep pockets, financiers are circling cautiously, and the government is supportive. Is this sufficient for a renaissance?

Notwithstanding the optimism, nuclear power is still far from risk free and at least a decade away from large-scale deployment even if everything goes to plan. Many governments and industries are hedging their bets, looking at their available options for near-term power and investing in fusion technology as a potential alternative in the medium- to longer-run. Billions more will still need to be invested even as new nuclear systems compete against readily available alternatives that are less risky (and initially, at least, much more affordable) such as oil and gas, as well as renewables like solar and wind combined with large-scale storage.

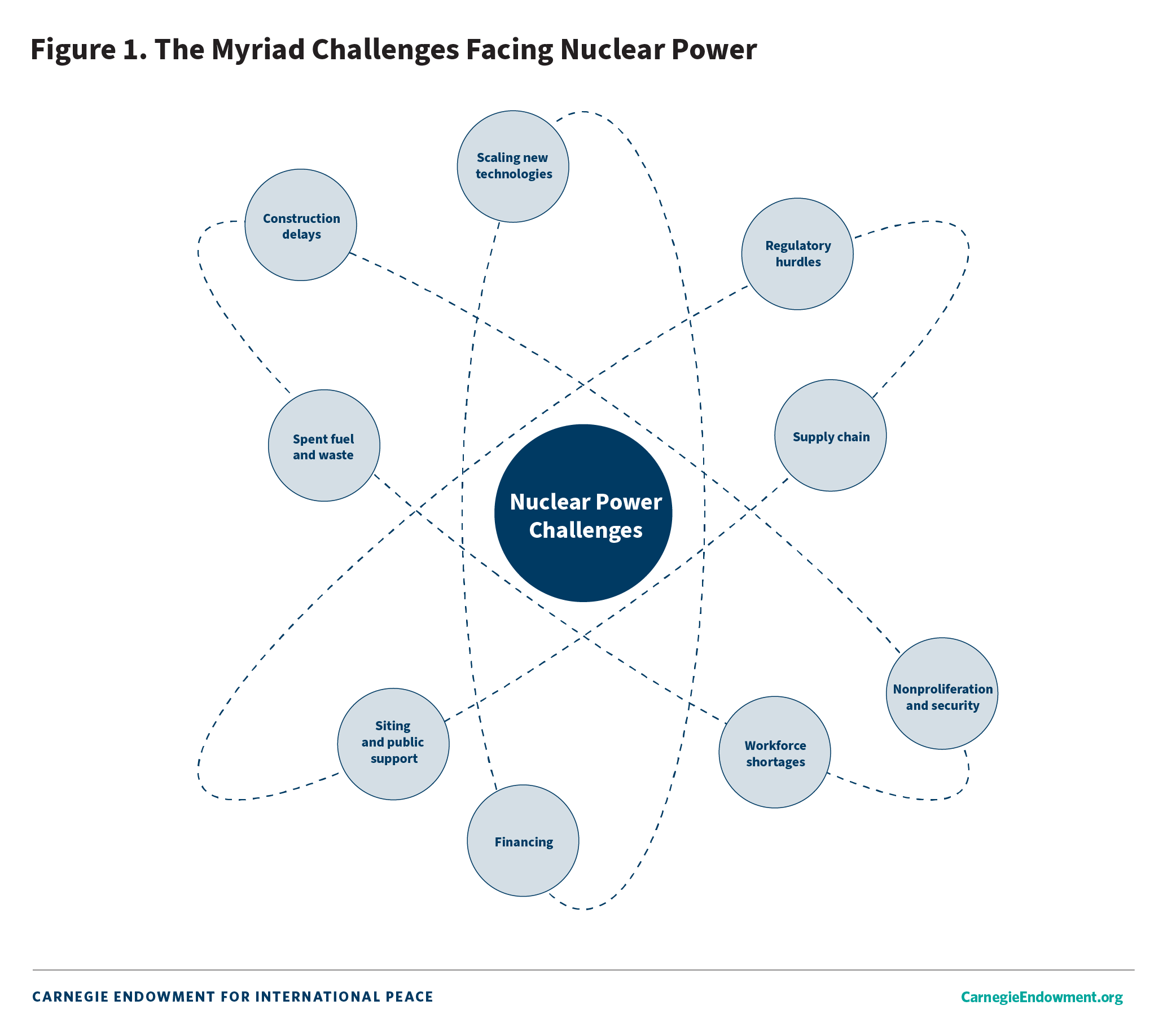

Myriad challenges that have troubled nuclear power in the past have not been (and will not be) miraculously resolved by new nuclear technologies. As examples:

All these factors must be considered and addressed for nuclear power to grow. Any one of them could prove a renaissance killer.

Technology providers tend to be focused on being first—and they are certainly energizing the current conversation—but investments in nuclear technology connote multigenerational commitments that transcend sovereign boundaries and business cycles. The Silicon Valley model of “move fast and break things” to shake up an industry is not a good fit for a power source for which misuse, a mistake, or even a natural disaster anywhere in the world could sink the entire industry. Should there be any doubt, consider how incidents at Three Mile Island, Chernobyl, and Fukushima are seared into collective memories.

Recent experience has been cautionary at best. The last project completed in the United States—Plant Vogtle in Georgia—was seven years late and $17 billion over budget.11 A project in South Carolina was abandoned in 2017 after more than $9 billion was sunk into it.12 In the early 1980s, a Washington State utility financed the construction of multiple nuclear plants with bonds; the project was later abandoned, causing the utility to default on $2.25 billion in bonds.13 In 2023, NuScale Power, a nuclear startup, announced it was canceling plans to build six small reactors in Idaho.14 The project, which had received significant federal support and was meant to demonstrate the technology, had already advanced far through the regulatory process. But NuScale struggled with rising costs and was unable to sign up enough customers to buy its power.

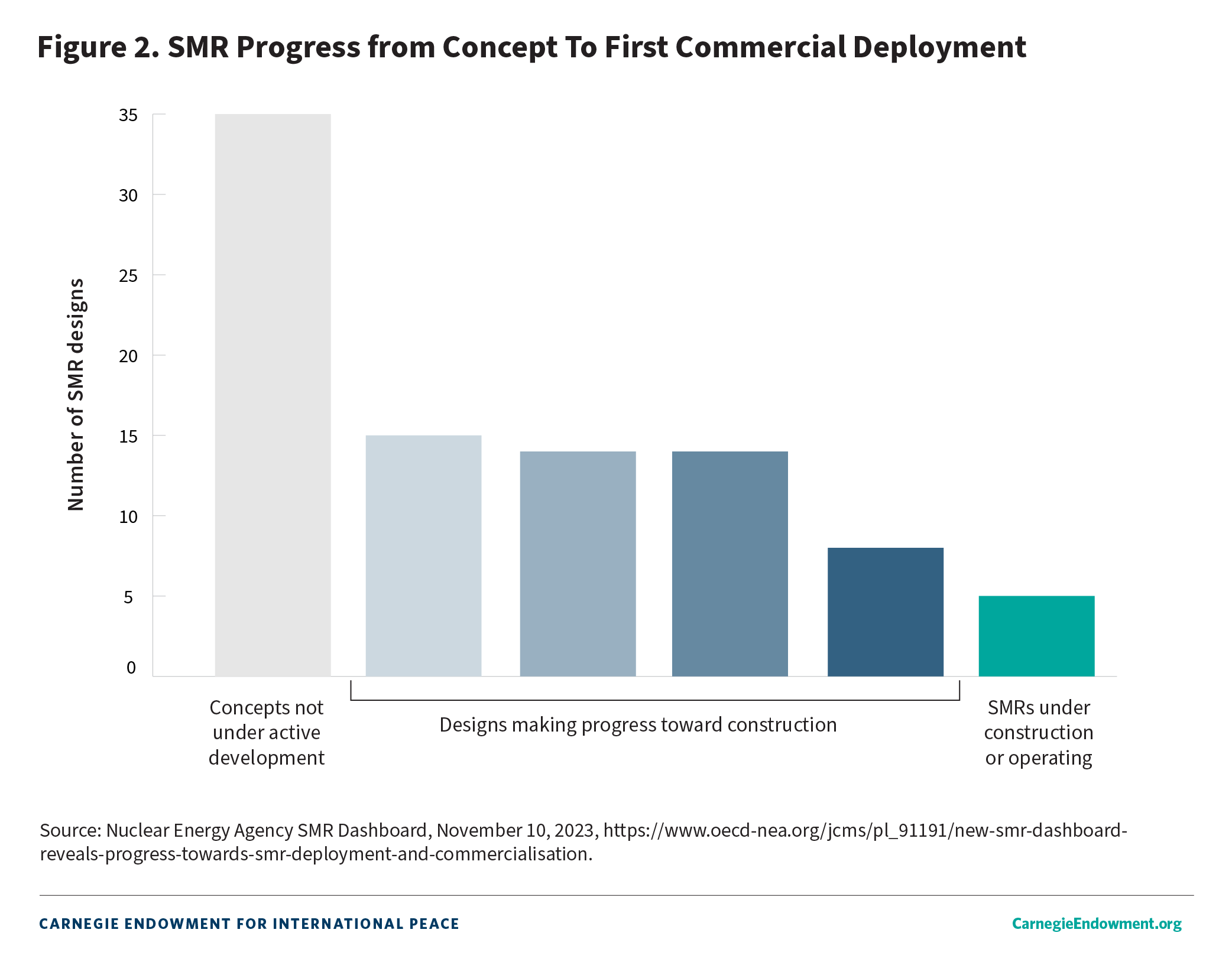

Even with the checkered history of large-scale projects and early setbacks for SMRs, the race is on worldwide. Upward of eighty designs are being developed, and more than fifty SMR projects are making progress toward construction worldwide, with five under construction or in operation.15

While it will be several years before large scale deployments occur—likely with the dozens of designs currently under development whittled down dramatically—some specific plans are emerging. For example, GE Hitachi (a U.S.–Japanese alliance) has developed an SMR with plans for deployment in Canada, Poland, Estonia, and the United States. In 2023, GE Hitachi announced that it had entered into an agreement with Ontario Power Generation to deploy four of its SMRs at an existing nuclear site in Canada, with the first to be built by late 2028.16 In addition, the Tennessee Valley Authority (TVA) is leading a coalition of utility and other partners, to compete for $800 million in grant funding for SMR development. If the grant is awarded, TVA plans to deploy the GE Hitachi design with commercial operation planned for 2033.17

The Bill Gates–backed firm TerraPower is developing an SMR that it claims can be built affordably once economies of scale are realized.18 In March 2025, TerraPower announced a plan for the commercialization and deployment of its reactors in North America, the United Kingdom, the European Union, and more. TerraPower will need to account for differing legal requirements for such international deployments, and has teamed with KBR (formerly Kellogg, Brown, and Root) to help manage projects and reduce the risks of construction or other delays.19

Nuclear energy is fundamentally a different proposition than any other current power source in that it requires a much longer-term horizon and commensurate level of attention, commitment of resources, and adjudication of responsibility to achieve its potential. Assuming today’s nuclear enthusiasm survives the inevitable challenges it will face, and some of the innovative designs are indeed constructed and put into operation, sustaining nuclear power for the next half century and beyond requires a different perspective. All the relevant stakeholders must grasp the extraordinary responsibility they share in driving the significant expansion of this technology.

This responsibility includes factoring in such things as how local communities will be affected and how enriched uranium fuel and plutonium-bearing spent fuels—which could be used for weapons and, in the latter case, would be dangerous for millennia—will be protected, stored, and ultimately disposed of. These are but some of the full costs of nuclear power. Innovation alone will not address longer-lead and longer impact items—like workforce and supply chain challenges, gaining public support for new facilities, or building in appropriate security features during the design phase. Innovation will have to be balanced with an understanding of the need for very careful stewardship of the technology.

Governments may wield less influence amid rapid technological development, even with demand for subsidies. Regulatory agencies are also facing workforce shortages and calls to scale back public transparency processes, which place stress on both their licensing duties and their function as arbiters of public trust.20 Thus, responsible use of the technology could increasingly fall on a growing cast of industry players—which now includes highly influential technology companies. Motivating them to incorporate broad responsibility principles in their strategic planning will require convincing them that such principles align with their self-interests and belong in their business cases for nuclear power.

Nuclear energy is facing a moment of truth. New technologies are exciting, but they face intrinsic and persistent challenges that will be tempting for stakeholders to kick down the road or expect someone else to handle. Deferring attention to these long-term requirements would be a mistake. Chasing the next idea amid a rush to generate more power—without addressing the fundamental underlying challenges—could doom both individual and collective efforts. The coming decade may be the last chance to position nuclear as an anchor in an evolving energy mix. Success requires that all stakeholders—governments, regulators, owners and operators, financers, and vendors—have a clear understanding of what responsible use of nuclear technology entails and have clear priorities for avoiding the types of safety, security, or proliferation incidents that could doom an inherently globally interdependent enterprise.

Visiting Scholar, Nuclear Policy Program

John H. Pendleton serves as a visiting scholar in the Nuclear Policy Program. Prior to joining Carnegie, he served almost thirty-five years at the U.S. Government Accountability Office (GAO).

Senior Fellow, Nuclear Policy Program, Technology and International Affairs Program

Levite was the principal deputy director general for policy at the Israeli Atomic Energy Commission from 2002 to 2007.

Senior Fellow and Co-director, Nuclear Policy Program

Toby Dalton is a senior fellow and co-director of the Nuclear Policy Program at the Carnegie Endowment. An expert on nonproliferation and nuclear energy, his work addresses regional security challenges and the evolution of the global nuclear order.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

These principles aim to codify core responsible practices and establish a common universal platform of high-level guidelines necessary to build trust that a nuclear energy resurgence can deliver its intended benefits.

Ariel (Eli) Levite, Toby Dalton

Mutual suspicion between Moscow and Ankara is growing as Türkiye cozies up to Washington and NATO while reducing its dependence on Russian energy.

Ruslan Suleymanov

By attempting to avoid complex regulations around safety and transparency, the Trump administration may do more harm than good when building new nuclear reactors.

Christopher T. Hanson

Tehran’s most urgent task is to reduce the risk of further Israeli and U.S. airstrikes. Russia’s role as a deterrent in this respect is more multifaceted than simply supplying weapons, whose real impact will only become apparent many years from now.

Nikita Smagin

Russia and China account for the vast majority of planned new nuclear reactors. But the greatest leverage in the supply chain is not the reactor designs but rather the fuel they require.

Daniel Helmeci, Jonas Goldman