Michael Pettis

{

"authors": [

"Michael Pettis"

],

"type": "commentary",

"blog": "China Financial Markets",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace"

],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "",

"programs": [],

"projects": [],

"regions": [

"China"

],

"topics": [

"Economy"

]

}

Source: Getty

China’s Rebalancing Timetable

A simple model can help illustrate the problems that China will face over the coming decade.

We often read in the press rather alarming stories about the rise of an ugly and belligerent nationalism in China, but while these stories are certainly very real, after the November 13 bombings in Paris I was struck by a very different kind of Chinese behavior. A lot of young people that I know in Beijing – high school and college students, young professionals, musicians, etc. – were horrified by the violence that occurred in Paris and very eager to express a real sympathy for Parisians, which they did in the ways that young people express themselves today, via smart phones, social media, and all the other things that wouldn’t have occurred to me. I saw an awful lot of these expressions of sympathy and while these are no more than small gestures, of course, they are personal, not official. As someone who loves Paris I was very happy to see lines of solidarity immediately stretch out to include so many young Beijingers, most of whom have never even been to France.

To turn to more mundane topics, last week I received an email from Jorge Guajardo, the former Mexican ambassador to China, with whom I regularly exchange emails in which we discuss the political and economic challenges associated with China’s economic adjustment, along with any insights that his knowledge of Mexican history might provide. While the differences between China and Mexico are obvious, too few of the analysts trying to understand the political economy of China’s adjustment seem to know much about Mexico, or indeed about other developing countries that have undergone similar experiences and whose histories can provide a useful framework with which to understand China.

It is far more common for example to look at the US and Japan for external references and comparisons, even though these two countries have social and political institutions that are far less like those of China than many, if not most, other developing countries. The differences in wealth alone are quantitatively so great that they also become qualitative hurdles. The US, after all, has 7.2 times the per capita GDP of China, according to the IMF, and American households earn around 11 times the per capita income of Chinese households. Japan has 4.8 times the per capita GDP of China and Japanese households nearly 6 times the per capita income. Mexico, on the other hand, has only 1.4 times China’s per capital GDP and less than 2 times the per capita household income.

By the way one of the ways of expressing Chinese rebalancing is to think of it as a closing of the gap between the difference in per capita GDP and per capita household income. In his email Guajardo asked me for details on Chinese consumption levels in order to understand China’s progress on rebalancing demand within its economy, and in my response I referred to this release in October from China’s National Bureau of Statistics:

Based on the integrated household survey, in the first three quarters of 2015, the national per capita disposable income was 16,367 yuan, a nominal growth of 9.2 percent year-on-year or a real increase of 7.7 percent after deducting price factors, which was 0.1 percentage point higher than that in the first half of the year.

I am not sure how comparable the two numbers are, but with real GDP growing at 6.9% and nominal GDP at 6.2%, it seems that disposable household income is growing 0.8 percentage points faster in real terms and 3.0 percentage points faster nominally (I am assuming population growth is more or less flat as the household income numbers are per capita). I don’t know how to reconcile these two numbers, but the gap between the growth in household income and growth in GDP, which is at the heart of rebalancing, is clearly reversing. After decades in which GDP growth sharply outpaced the growth in household income – and, with it, consumption growth – we must see this reversal, so that the growth in household income exceeds GDP growth by enough that the consumption share of GDP can return to healthy levels.

But the gap is not narrowing quickly enough to rebalance the economy by the end of President Xi’s term in 2023. There are different ways to measure the household income share of GDP and I have no strong arguments in favor of one way or another, but, according to the Economist Intelligence Unit, “Chinese Disposable Personal Income as a Percent of GDP” bottomed out in 2011 at 41.5% and is now rising, reaching 44.0% in 2014. According to the World Bank the “Share of household disposable income and labor (wages) in GDP” bottomed out in 2011 at 60% but in their June 2015 China Economic Update their data only runs to 2012. I am not sure why these numbers are so different.

If we assume that disposable household income is currently half of GDP, eight years of real GDP growth of 6.9% and real disposable household income growth of 7.7% will only raise the household income share of GDP to 53.1% in 2023, a little more than 3 percentage points higher and still below its 21st Century average and leaving China as dependent as ever on investment and the current account surplus. At this rate it would take 25 years for disposable household income to raise by 10 percentage points of GDP, which I would argue is the absolute minimum consistent with real rebalancing.

Even if the gap were to narrow twice as quickly as it is currently narrowing (i.e. if the growth in household income exceed the growth in GDP by 1.6 percentage points) it could easily take 10-15 years for China to adjust sufficiently that its economy can return to sustainable growth. Unless there are far more radical policies implemented to speed up the growth in the household income and consumption shares of GDP, in other words, (and this basically means stepping up the transfer of wealth from the state sector to the household sector), at the current rate we are not going to see sufficient rebalancing for at least 10-15 years.

But does China have 10-15 years? The maximum adjustment period, as I’ve long argued, is largely a function of the country’s debt dynamics. Beijing can keep growth high enough that unemployment is held to acceptable levels only as long as debt can grow fast enough both to

- Roll over the large and growing amount of debt whose principle and interest cannot be serviced from earnings generated by whatever project the debt funded, and

- Fund the required amount of additional investment or consumption to generate enough economic activity to keep unemployment from rising.

In order to answer the question of how much time China has I thought it would be useful to work out a simple model for the growth in debt to see how plausible it is to assume that China has another 10-15 years in which to manage the adjustment without implementing far more dramatic transfers of resources, either to pay down debt or to raise household wealth. The model shows pretty clearly that China does not have that much time unless we make extremely implausible assumptions about the country’s debt capacity and, just as importantly, about market perceptions about this debt capacity.

The model shows that even making fairly optimistic assumptions and accepting the lower end of debt estimates, debt cannot stabilize unless growth slows very sharply. If growth does slow sharply enough—to an average of 3% over the next five years – and if at the same time the financial sector is reformed so rapidly that within five years China’s economy is able to grow with no increase in debt (so that China actually begins to deleverage), debt can remain within a 200-220% of GDP range.

But if financial sector reforms fail to result in a sharp improvement in the efficiency of lending, and if Beijing does not permit the economy to slow rapidly, it will be almost impossible to keep debt from rising significantly. Even assuming that higher debt levels do not generate financial distress costs that depress economic growth further (an assumption with which I strongly disagree), there is a real question about whether China can continue another five years without sharply adjusting its growth model during this time.

Making debt sustainable

The model must start with current debt levels, and then project both the growth in debt and the growth in GDP. Although there is a lot of concern about the quality of the data, we do have enough information at least to establish the minimum debt levels. As of the third quarter of 2015, total social financing (TSF), often used as the best proxy for total direct or indirect obligations of the Chinese government and banking system (although it excludes a number of relevant debt categories), had grown by around 12% year on year to RMB 135 trillion, which is equal to about 208% of China’s GDP.

Because of the provincial bond swaps completed this year, in which TSF debt was converted into non-TSF debt, debt actually grew by at least one percentage point faster than the growth in TSF, so with nominal GDP during that same period growing by 6.2%, to say that debt is growing twice as fast as nominal GDP is probably conservative. If we make the heroic assumption that debt-servicing capacity is growing in line with nominal GDP, we can assume, very conservatively, that debt is growing a little more than twice as fast as debt-servicing capacity.

Of course debt growing faster than debt-servicing capacity is unsustainable, so we will set as our first financial sector target the point at which the two grow in line with each other. Once China can reach this point, we will assume that it has resolved its adjustment and that any further increase in debt is sustainable and no longer causes uncertainty about the allocation of debt-servicing costs, and with it financial distress costs, to rise.

This is also a fairly heroic assumption. All the historical evidence – even more so for developing countries – suggests when an economy is perceived as being excessively leveraged, there is significant downward pressure on growth and increasing financial fragility until the economy begins systematically to deleverage. Deleveraging usually occurs either because the government has implemented policies that explicitly assign losses to sectors of the economy that are able to absorb these losses without creating financial distress conditions, or because creditors are forced into explicit or implicit debt forgiveness (for example through debt restructuring). We will assume however that deleveraging isn’t necessary, and that it is enough merely to keep the debt-to-GDP ratio stable.

For our model we are going to propose an average growth rate for a ten-year period, and we will assume that during this period, nominal GDP growth drops by a constant amount every year to reach this average growth rate. Nominal GDP growth will decline in a straight line from 6.2%, in other words. We will also assume that at first debt will grow just over twice as fast as GDP, as it is doing today, but this ratio will decline in a straight line until, at the end of ten years, debt is growing at the same speed as nominal GDP, so that the debt-to-GDP ratio is stable.

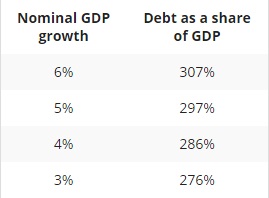

That is all it takes. If the total amount of debt today is equal to 208% of GDP, the total amount of debt as a share of GDP in ten years in our model will be wholly a function of the GDP growth rate. Here are the numbers:

If Beijing tries to maintain high growth rates of around 6%, unless there is a dramatic and disruptive change in the financial system it is unlikely to be able to do so without seeing debt grow at the end of ten years to 274% of GDP, something that no country under relevant circumstances has accomplished. Even if Beijing sharply reduces growth, to 3% on average (if household income grows at 5%, as China rebalances, household income will rise from 50% to 61% of GDP), debt must still reach nearly 251% of GDP without disrupting the economy.

One great advantage of this model over most others is that it makes very explicit the relationship between credit growth and GDP growth, so that it is impossible accidentally to posit scenarios in which debt is implicitly assumed to decline inconsistently with GDP growth acceleration. Debt levels in this model are specifically associated with different GDP growth levels, so that this model allows us to acknowledge that a country can safely service and refinance higher debt levels if it is believed to have greater growth potential.

It is clear from the model, however, that without a major change or disruption in policymaking, current debt dynamics will be hard to sustain, even with assumptions underlying the logic that are very conservative. What the model tells us is that if GDP growth declines in an orderly way – which assumes that there will be no unexpected shocks or disruptions – and if Beijing is able to reform the financial system and improve the relationship between credit growth and nominal GDP growth so that the two are sustainable at the end of ten years, there is almost no scenario under which debt does not rise sharply, in many cases perhaps out of control.

Many analysts argue that total debt in China in fact exceeds TSF, and believe that the true debt level is closer to 250% of GDP, and perhaps even more if we include the substantial number of corporate receivables that have surged in recent years. If this were true, and for those who want to make the appropriate adjustments, increasing the initial amount of debt by 42 percentage points, to 250% of GDP, would cause an increase in the final debt numbers ranging from 51 percentage points of GDP for growth rates of 3% to 54 percentage points for growth rates of 6%.

Tweaking the model

A more serious criticism is that Beijing has been trying to reduce the credit intensivity of growth at least since Wen Jiabao’s famous “Four Uns” speech of March, 2007, but has failed to do so. Credit is growing more slowly than it has in the past but not because the financial system has become more efficient but simply because debt levels have become too high, causing regulators to force down the growth in credit without seriously improving the efficiency of the financial sector. The result is that lower credit growth simply means lower GDP growth.

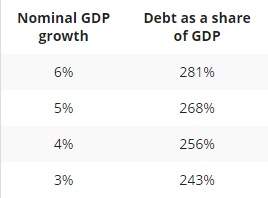

It is difficult to model the many ways credit intensivity of growth can change, but if we simply assume that there is no improvement except as growth slows, so that the ratio between credit growth and GDP growth stays constant, the table below shows debt levels at the end of ten years at different GDP growth rates:

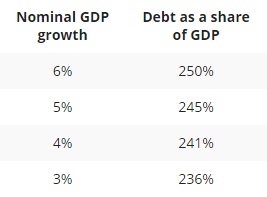

On the other hand if we make assumptions that are far more favorable, if less plausible, and propose that nominal GDP will grow at 3-6% on average for the next ten years, but that the relationship between the growth in credit and GDP growth will improve much more dramatically than in our first set of scenarios, it is still hard to work out a good scenario. Let us propose that at the end of ten years, instead of debt growing at the same pace as GDP, as in our first set of scenarios, the efficiency of the financial sector will have improved to such an extent that it can generate up to 6% GDP growth without any increase in debt at all. We will also assume that to get there does not require a financial crisis or any debt forgiveness, and that the financial sector gets there smoothly.

This would be a remarkable achievement, and probably unprecedented in history, and it would be just barely enough to solve China’s debt problem. Here is the table that lists the debt-to-GDP ratio as a function of GDP growth:

It is in my opinion almost impossible that China would be able to improve its financial efficiency so dramatically without a significant slowdown in growth, but at least mechanically it is clear that if China were able to do so while maintaining nominal growth rates on average of 5-6%, by the end of ten years China’s debt to GDP ratio would be largely unchanged, although this would only happen after having risen to 235% during the first five years.

This set of scenarios probably represents the absolute upper limit of optimism for anyone who hopes that China can adjust smoothly and non-disruptively over a ten-year period without a dramatic change in policy, most importantly a process of wealth transfer in which as much as 2-4% of GDP is transferred from the state sector to ordinary households every year for many years. Under these scenarios debt stabilizes at a sustainable level at the end of the ten-year period, and growth rates remain reasonably high, but it is important to specify the assumptions to make clear just how difficult and unlikely this set of scenarios is likely to be:

- We are assuming that TSF captures the total relevant amount of debt.

- We are assuming that the growth in debt-servicing capacity is on average equal to the growth in nominal GDP.

- We are assuming that the financial system will adjust smoothly and without friction.

- We are assuming that there are no financial distress costs, so that as debt rises, it does not put downward pressure on GDP growth.

- Finally, and this is a fairly complex assumption, we are assuming that if there is unrecognized bad debt in the banking system that is being rolled over regularly, the interest cost is effectively zero. If the amount of bad debt in the system is low, we can safely ignore this assumption, but if say 20% of the loans consist of unrecognized bad debt, this will increase the growth rate of debt by perhaps 1-2 percentage points annually.

Obviously this set of scenarios – in which GDP grows on average at rates between 3% and 6% for ten years while credit efficiency is improved so dramatically that in 5-6 years China begins to deleverage and by the end of the period these growth rates can be maintained with no growth in credit – is theoretically possible, but just as obviously it is highly implausible, and I cannot think of any country in history that has achieved such a turnaround in its financial sector without having first experienced a brutal financial crisis. No matter how I work the numbers it just seems to me very obvious that unless it sharply speeds up the process of transferring wealth to the household sector so that consumption can grow much more quickly, China simply does not have ten years in which to manage a non-disruptive adjustment unless we are willing to make assumptions so heroic that even El Cid would blanche.

Varying the adjustment period

If we do the same exercise using the same assumptions we used in our very fist set of scenarios, but allow for a longer adjustment period, say fifteen years, we get the following results:

These numbers are clearly too high and show that there is no point in trying to develop scenarios in which China adjusts more slowly over a longer period of time. The argument that the more carefully and slowly Beijing manages the adjustment process, most especially the reform of the financial sector, the less likely it is to be disruptive, can only be true if we assume that there is no limit to Beijing’s ability to raise debt credibly.

If instead we go in the other direction and assume that Beijing adjusts more aggressively, and if we do the same exercise using the same assumptions but this time posit a seven-year adjustment period, we get the following three sets of results. The first set assumes that at the end of the 7-year period debt is growing at the same rate as nominal GDP:

The second set assumes that at the end of the 7-year period the nominal growth in debt is zero:

In this scenario debt rises to roughly 225% of GDP during the first four years before declining. And finally the third set of scenarios assumes that there is no improvement in the credit intensity of growth:

For the sake of completion, I will make the same set of assumptions and assume that Beijing moves even more aggressively, and in the first set of scenarios gets the growth in credit to keep pace with the growth in nominal GDP within five years, and in the second set of scenarios gets credit the growth in credit to drop to zero within five years. Here is the relationship between credit growth and GDP growth:

Once again in the second set of scenarios, in which the improvement in the financial sector is so dramatic that within a few years China begins to deleverage and in five years GDP is able to grow with no growth at all in credit, debt rises to 27-19% of GDP in the first three years before declining.

I can keep going but the conclusions are pretty clear.

- Credit growth in China is too high as are current debt levels, and the sooner Beijing gets credit growth under control, the better. This latter statement in itself is not controversial of course, but my simple debt model shows just how urgent it is for Beijing to get credit growth under control. It clearly does not have ten years or even seven years. It might have five years, but only if the markets – Chinese investors, businesses, and savers, both wealthy and middle class – are convinced that it is moving in the right direction.

- There is no obvious level at which debt levels for any country are too high, but China is already at the very high end among developing countries, and of course the more debt rises relative to GDP, the greater the risk of some kind of debt-related disruption.

- If you ask most economists why “too much debt” is bad, they will tell you that it is because the higher the level of debt, the greater the risk of a debt crisis. Unfortunately this very unsophisticated answer turns the discussion about debt into a discussion about why China will or will not have a debt crisis at current or future projected debt levels.

It also means, unfortunately, that for those who believe (and I include myself in this group) that the structure of Chinese financial markets and Beijing’s high credibility give it protection from the risk of debt crisis – so that a debt crisis is unlikely except at very much higher debt levels – there is little to worry about. In fact the real cost of excessive debt levels is what finance specialists call “financial distress” costs, and I have explained elsewhere how debt can become excessive. China is already experiencing financial distress costs and as debt rises, these costs will make it harder and harder for China to achieve target growth rates except at the expense of even more debt, so that rising debt automatically means lower growth than otherwise.

There is so much evidence supporting the view that high debt levels in an economy reduce that economy’s growth that it is surprising how few economists understand the urgency of getting credit growth under control. In the past whenever growth has slowed sharply in an overly indebted economy, economists blame the inadequacy of reforms and the cowardice of policymakers, but if slower growth has happened in every single case of excessive debt, it is absurd to blame the pusillanimity of policymakers. We are already seeing how rising debt levels have caused Chinese growth to drop below projections year after year, and already economists are shifting the blame from their ineffective models to the incompetence of Beijing’s economic stewardship. And as debt continues to grow, the economy will continue to slow, and economists will continue to blame Beijing’s incompetence.

- The great difficulty of reducing credit growth is that it will lead to higher unemployment as manufacturing capacity is closed down and less infrastructure built. The only way to prevent rising unemployment is by opening up or increasing other sources of demand that do not require even faster growth in credit.

Some of these other sources of demand, like a greater current account surplus or enough of a realignment of the financial sector towards productive investment, are too impractical or uncertain to rely on, and in the end the only certain alternative source of demand is domestic consumption. Domestic consumption, however, is constrained by the low household income share of GDP, as I explained in the opening section of this essay, and so Beijing must speed up the process as much as it can. Ultimately the only way it can do so is by transferring wealth from the state sector to the household sector, something it is trying to do and which is recognized in the Third Plenum reforms, but this is politically very tough.

I would argue that if China can engineer a process by which at least 2% of GDP is transferred directly or indirectly to the household sector every year (or is used to pay down debt), it can easily avoid a debt problem or many years of economic stagnation. If it doesn’t, however, it is hard to see how China can adjust quickly enough to avoid at the very least a “lost decade” or two of low growth.

- In every one of its economic policymaking choices, Beijing must ultimately choose between higher debt, higher unemployment, or higher transfers of wealth from the state sector to the household sector. Every single policy results in some combination of the three. The time frame within which this must be resolved is set by deb capacity limits, and as my model shows, Beijing probably has no more than five years, perhaps much less, within which to resolve the rebalancing if it wants to avoid a disruptive rebalancing.

What I like about the model I have described above is that it doesn’t allow analysts to hide their implicit assumptions about credit growth, GDP growth, and the relationship between the two. With this model an analyst can make any assumption he likes about the economy and about economic reforms, and from there make explicit assumptions about the consequent growth in debt and the growth in GDP, and see if these are at all consistent. It also makes clear that the real difference in opinion about sustainability will only show up in terms of medium- and long-term growth forecasts. It doesn’t tell us anything that China grows by 7% next year, for example. As long as China has sufficient debt capacity, the economy can grow at any rate Beijing chooses.

What matters is the associated growth in credit. If growth next year of 7% were achieved with 18% growth in credit, things would actually be getting worse, not better. On the other hand if China grew next year by 5%, with credit growing at “only” 8%, this would represent a significant improvement in China’s medium- and long-term growth prospects. This is something that a lot of economists seem to have real trouble in understanding. There is no “good” level of economic growth independent of the associated growth in credit.

Ultimately, and to repeat Conclusion 5 above, Beijing must continuously choose between a rising debt burden, rising unemployment, or rising transfers of wealth from the state sector. All of its policy options boil down to one or more of these three. So far it has mostly chosen the first, but this can only go on until the country reaches debt capacity limits.

This article was originally published on China Financial Markets.

About the Author

Nonresident Senior Fellow, Carnegie China

Michael Pettis is a nonresident senior fellow at the Carnegie Endowment for International Peace. An expert on China’s economy, Pettis is professor of finance at Peking University’s Guanghua School of Management, where he specializes in Chinese financial markets.

- What’s New about Involution?Commentary

- Using China’s Central Government Balance Sheet to “Clean up” Local Government Debt Is a Bad IdeaCommentary

Michael Pettis

Recent Work

More Work from China Financial Markets

- Beijing’s Three Options: Unemployment, Debt, or Wealth TransfersCommentary

China’s debt problems have emerged so much more rapidly and severely this year than in the past that a growing number of analysts believe that this may be the year that China’s economy breaks. There is no question that China will have a difficult adjustment, but it is likely to take the form of a long process rather than a sudden crisis.

Michael Pettis

- The Impact in China and Abroad of Slowing GrowthCommentary

China’s rebalancing can only occur in a limited number of ways, and each of these has a fairly predictable impact. The path Beijing chooses to follow will likely be based on political decision-making.

Michael Pettis

- What Does a “Good” Chinese Adjustment Look Like?Commentary

Instead of a hard landing or a soft landing, the Chinese economy faces two very different options, and these will be largely determined by the policies Beijing chooses over the next two years.

Michael Pettis

- The Four Stages of Chinese GrowthCommentary

The past two decades of Chinese growth have disproportionately benefited a small elite that has become increasingly entrenched; the next stage must focus on liberal reforms to build social capital more broadly.

Michael Pettis

- Is Loan Growth in China Slowing?Commentary

Ineffectual loan quotas have led Chinese banks to devise new, riskier lending mechanisms. This trend will continue as long as China maintains its loose monetary and credit policies.

Michael Pettis