This essay is part of a series of articles, edited by Stewart Patrick, emerging from the Carnegie Working Group on Reimagining Global Economic Governance.

As the world emerges from four decades of a dominant neoliberal narrative, there are opportunities to reposition the public sector in an economy that works for all, and to put the world on a more sustainable growth path for people and the planet. Making this transition, however, will require an enabling international environment for steady national progress, which should include a new commitment to global public investment (GPI).

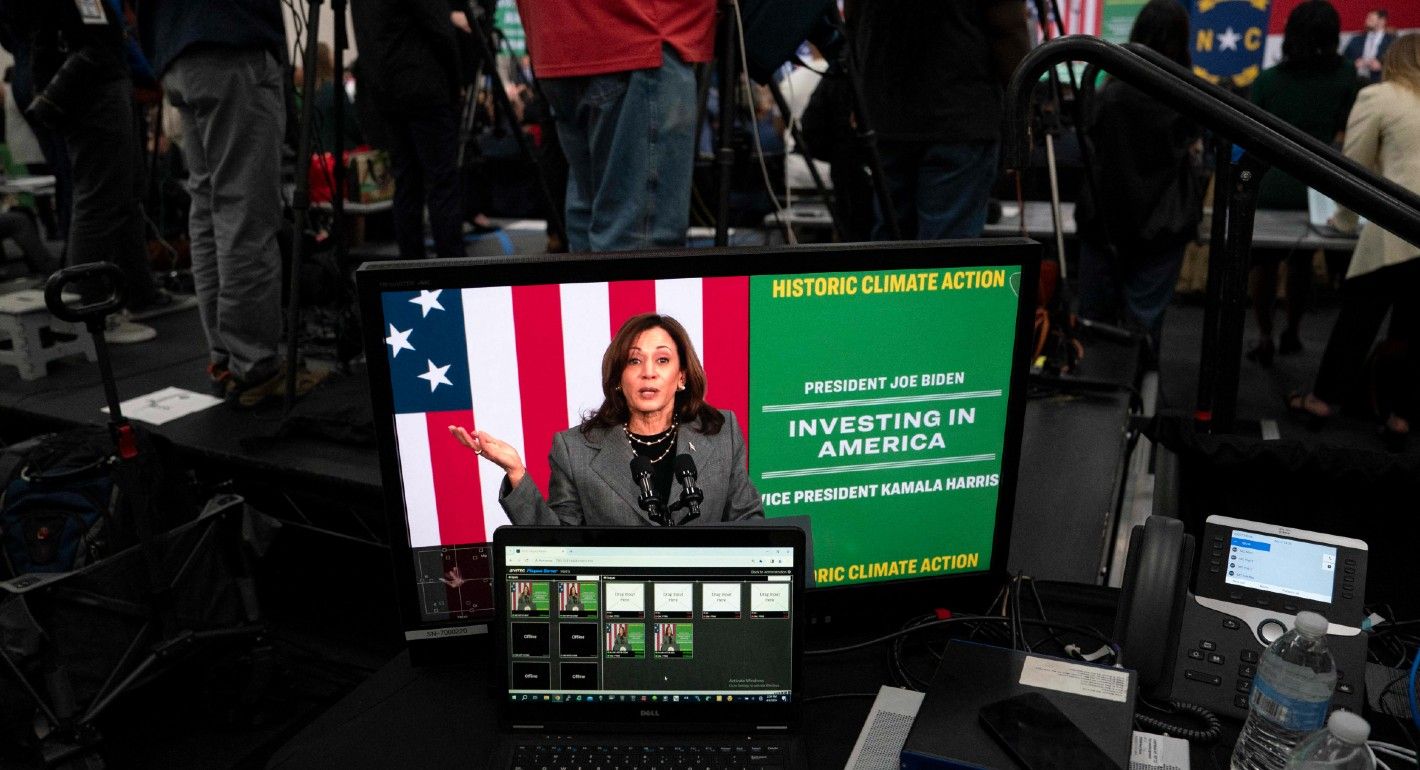

The West’s newfound faith in “industrial policy” offers great opportunities to pursue heterodox growth strategies in many countries. In the past, industrial policy often was disparaged as the fruitless task of “picking winners”—intervening in the market economy to privilege particular projects, firms, and sectors over others. In its modern incarnation, most impressively exemplified by the largescale public investments of U.S. President Joe Biden, it is more likely to focus on enhancing the productivity of the economy as a whole, with particular regard to ensuring the appropriate supply of public goods and services and reducing economic disparities. At its best, it focuses on structural, transformational change, rather than narrower approaches such as export processing zones, which produce goods intended to pay off loans with foreign exchange but have weak backward linkages to the real economy. Given the climate crisis, industrial policy in the twenty-first century must also be “green.” That is, it needs to support the shift to a low-carbon economy, while avoiding “green colonialism,” which sees the green transition as simply a new extractive opportunity.

Particularly since the COVID-19 pandemic damaged economies around the world, causing debts to stack up in rich and poor countries alike, finance ministers have been looking to the international financial architecture to do much better at supporting green transitions and progressive policies to counter poverty and inequality. The success of green industrial strategies will require an international order that is conducive to these national approaches, ensuring that sufficient financing is available, that this financing is prioritized in an appropriate way, and that any conditions attached support national strategies rather than undermine them (as they often have done in the past). In short, a Global Green New Deal must complement many national-level Green New Deals, or only the world’s richest countries will be able to pursue progressive green policies.

The GPI approach is an ambitious new financing model to ensure that sufficient amounts of public money are available internationally to pay for common global needs, and that this money is spent effectively and accountably. Rather than the us-them, North-South, donor-recipient framing of “development aid,” the GPI approach suggests that all countries should contribute economically according to a fair-share formula, all countries can benefit according to their particular circumstances, and, crucially, all countries must have a fair say in prioritizing and accounting for global funding. In short—all contribute, all benefit, all decide.

The Role of GPI in Green Industrial Strategies

The GPI approach can bolster the push for a new era of green industrial strategies in at least four ways.

A Modern Narrative Centering “The Public”

The most prominent advocates of neoliberalism (most notably the United States’ former president Ronald Reagan and the UK’s former prime minister Margaret Thatcher) were by no means economists. What gave neoliberalism its political power was its accompanying narrative: The state is too powerful and intrusive, and its role in the economy must be limited as much as possible. The result was a skewed, disembedded approach to economics, favoring unfettered markets and capital over labor, which rewarded some but left most communities poorly served.

The success of a new era of green industrial strategy will depend as much on reclaiming the narrative as on devising the best technical economic, social, and environmental policies. The most important part of that narrative is recentering the concept of the public in economic, environmental, and social policies. The role of the state and the public sector must be reconceived as central to healthy economies and societies, acting not to the detriment of the private sector but as the necessary complement to it. State action—such as appropriate regulation and facilitation—and state inaction—such as permitting loopholes to be exploited or offering perverse incentives, as in the case of fossil fuel subsidies—will drive different types of private flows.

Much national-level campaigning over the past decades has sought to recenter the concept of the public good, for instance in pushing for corporate regulation and for fairer taxes to increase spending on public services and infrastructure. This battle cannot be waged simply at the national level, however. A new, post-neoliberal era will require similar steps at the international level, including the generation of unprecedented resources to solve the problems we face collectively as humans.

According to the prevailing narrative, strongly implied at the 3rd Financing for Development conference in Addis Ababa in 2015, the era of large-scale international public finance is coming to an end. The priority must instead be on mobilizing “trillions” of dollars from private finance and domestic sources. In fact, public money must remain at the heart of debates about delivering global on objectives—and particularly the United Nations Sustainable Development Goals (SDGs)—for two reasons. First, the actual supply of private money mobilized for development purposes has been a fraction of that anticipated. Second, private and public money are fundamentally different in their characteristics; the former is governed by an intrinsic profit motive, while the latter is more easily tailored to social objectives. Accordingly, public money cannot simply be replaced by other types of finance.

This last statement is obvious at the national level (the economist Mariana Mazzucato describes public money as a “first resort” rather than a last resort) and is just as true at the international level. The special characteristics of international public finance include its motivation (the public good rather than the need for profits), accountability processes (answering to international priorities, not just national politics), flexibility (it can, for instance, be countercyclical), concessionality, and expertise (knowledge and experience passed on by engagement with international entities). Its unique combination of these factors makes it appropriate for some types of tasks, such as humanitarian activities, certain elements of public interest research, and investments in poorer countries where financial returns may be low.

Public investment has been critical in most countries that have successfully industrialized, especially when broadly shared progress is considered as important as rapid growth. When there is limited market incentive for private companies to invest in areas of obvious public interest, public money can step in, boosting economic productivity and helping to lift the whole economy. The GPI approach applies the same argument internationally. These are reinforcing narratives.

Additional Finance Is Hard, but It Is Needed

Of course, building GPI to support green industrial strategies will require much more than a compelling narrative. It necessitates heavy investment. Unfortunately, many countries in the world are today in debt distress thanks to a constellation of crises, among them the COVID-19 pandemic, commodity price slumps, and economic fallout from the war in Ukraine. GPI can provide additional money to pay for the things we care about in our world.

Although estimates vary as to how much finance is required to respond to current crises and help prevent future ones, all agree that the scale of the global financial gap is enormous, and that the shortfall is measured in the trillions, not the billions.

In short, much more money needs to be available globally to support urgent progress. A large proportion needs to be highly concessional public finance. Even if additional grant funding from donors seems unlikely in the short term, it needs to be part of the longer-term vision, along with slower, lower-interest options for debt repayment.

There is sufficient money available globally, but it is hard to access. The GPI approach is bold in refusing to accept excuses for lack of resolve in mobilizing it. Finding the money to back international objectives will not be easy, and it will take time as the dominant narrative shifts and policymakers search for technical fixes, but it has to be done. Major multilateral development banks and funds need to be replenished, bilateral spending must increase, and global taxation needs to take off.

By framing international spending by wealthier countries as “investment in our own interest” rather than “spending abroad,” the GPI approach shifts the possibilities for generating global public funds over the next decade.

Who Attaches the Conditions to Public Finance?

Though the quantity of money made available at the international level to support green industrial policy is vital, the way that money is used will be equally important. History and conventional international relations discourse suggest that those that provide the money will use it to bolster their own strategic interests and ideologies (economic and political) at least as much as globally agreed goals, let alone the interests of other countries. In the 1980s and 1990s, when the World Bank and International Monetary Fund—governed and financed mostly by Western nations—were at the height of their powers, they made access to their lending and grant-giving conditional, contingent on domestic policies in “recipient” countries that overrelied on the private sector, while undermining state capacity and accountability and taking little account of social effects.

The rhetoric in Washington and Brussels today is no longer underpinned by ideological assumptions of neoliberalism, yet achieving a global economic system that benefits everyone will require concrete shifts in the management of international public money. Industrial strategy in the United States, for example, could reinforce a broader global trend toward heterodox economic approaches, or it could be merely protectionism that will cause great damage to Global South economies. Which it will be depends to a large extent on who is in the room when specific policy decisions are made. Advocates of a more equitable global economic order cannot achieve their aims simply by winning policy arguments in conferences. They need to drive change in structures of global decision making, building greater voice for those who currently lack it.

Among the main objections to international financial institutions’ conditionalities is that they tend to treat countries of the Global South more harshly than other nations (although the bailout terms for certain European countries a decade ago were severe), and that they often are politically motivated prescriptions dressed in technical language. Put another way, governments in debt and in need of cash may be forced to accept conditions tailored to benefit the financial and political interests of the lender/donor.

Accordingly, any push for more national and international public investment must be accompanied by an equally strong campaign for better accountability for that money. This is the “all decide” element of the GPI proposal. By itself, of course, greater public investment will not erase global hierarchies; wealthy and more powerful countries will always exercise more sway. But better institutions, built according to GPI principles, have the potential to mitigate these asymmetries by increasing the voice of the poor and the marginalized and injecting more transparency into the terms of resource transfers.

The good news is that the evidence suggests that when recipient countries have more power over how external funds are spent, those funds are spent more effectively with better impacts for both people and planet.

Delivering Common Global Objectives

The final way that GPI can support effective national green industrial strategies is by improving delivery of global public goods and services. If the world begins, for instance, to deal with climate change successfully, improve global health security, manage the technological advances of artificial intelligence correctly, and protect the Earth’s biodiversity, the costs of delivering economic, social, and environmental progress at the national level will decline. Conversely, failure to address shared transnational problems through GPI will increase vulnerability and financial costs at the national level, as happened in the COVID-19 pandemic.

A Green World Economy Needs GPI

In sum, the GPI approach seeks to shift the narrative for the formulation of green industrial policy, increase the quantity of high-quality public money available to help implement those policies, empower recipient countries to better influence spending priorities for these monies both at home and globally, and provide global public goods that ease the burden on specific countries.

The pandemic has energized a revision of the simplistic anti-state rhetoric that has long been a staple of Western economists. The renewed confidence in the role of public money to support strong and green economies is welcome but must be backed with international concessional finance in addition to domestic resource mobilization.

A GPI package can kick-start green growth and poverty reduction in the sectors and countries that most need it. But rather than being pitched as “aid” to foreign countries, it should advance the priorities of the wealthiest nations as well. The global demand for green technologies, for example, should create more jobs in both North and South, if appropriately planned and regulated.

The world appears to be moving on from neoliberalism, but it is still hampered with an out-of-date approach to investing across borders. A wholesale shift in the quantity and representativeness of international public spending is required if green industrial policies are to be successful in nations across the world. A vision this bold will take time to achieve, as assumptions are overturned, budgets are redirected, and technical problems are overcome. The critical element is not to let today’s barriers—be they budgetary or political—constrain global ambition. Instead, as the world’s leaders respond to urgent crises, they must also build a new system of international public finance fit to deal with the crises and opportunities of the future.

Jonathan Glennie is a writer, researcher, campaigner, and consultant on sustainable development, inequality, and poverty. He recently co-founded a new think tank, Global Nation. His work looks in particular at the changing nature of international cooperation as dominant paradigms and global economic relationships evolve.

The author would like to thank Martha Bekele, Andrea Ordoñez, Luis Godoy, and Jean-Paul Adam for comments on this piece.