This publication is a product of Carnegie China. For more work by Carnegie China, click here.

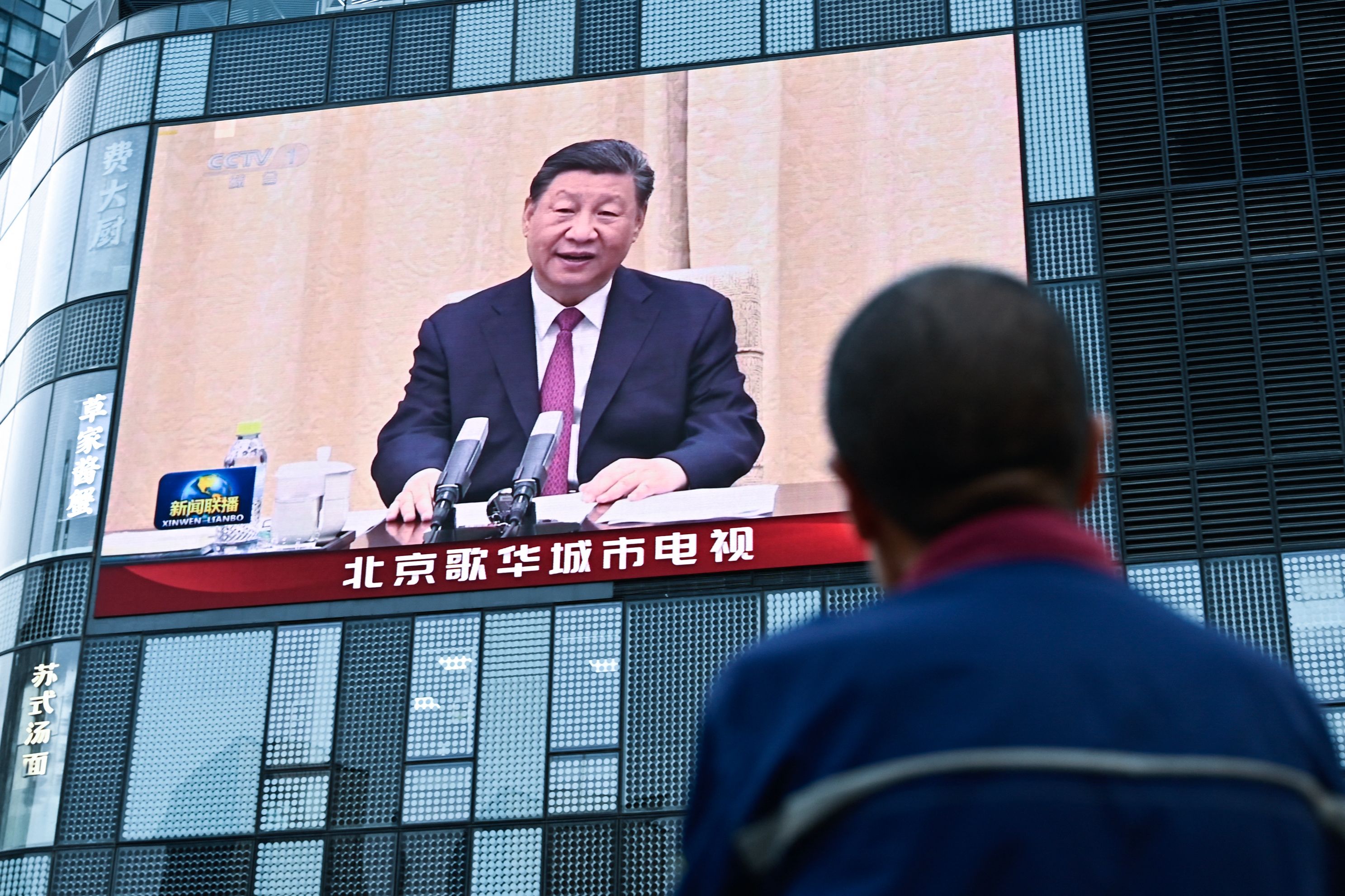

On Monday, February 17, Chinese President Xi Jinping set off a frisson of economic excitement by speaking at a high-level symposium of private sector entrepreneurs. The first meeting of its kind since 2018, it was attended by some of the leading lights of China’s technology and emerging sectors, with notable names including Huawei’s Ren Zhengfei, BYD’s Wang Chuanfu, Will Semiconductor’s Yu Renrong, Unitree Robotics’ Wang Xingxing, and Xiaomi’s Lei Jun.

Xi’s speech was widely seen as a much-needed confidence-booster for a beleaguered private sector suffering from weak domestic demand, rapidly falling profits, and global trade tensions. Xinhua’sheadline article that day was “Xi urges healthy, high-quality development of private sector,” and according to a People’s Dailyarticle the next day, “observers said the participation of private enterprises from both traditional and emerging sectors showed the continuous emphasis China’s top leadership places on the role of the manufacturing industry in the Chinese economy.” The article then went on to cite Liu Yonghao, founder of New Hope Group, as saying, “Inspired by the top leadership’s remarks, our company will capitalize on favorable policies and make efforts to propel further growth amid complex challenges.”

The foreign press also highlighted the meeting’s significance. For example, Reuters reported:

President Xi Jinping held a rare meeting on Monday with some of the biggest names in China’s technology sector, urging them to ‘show their talent’ and be confident in the power of China’s model and market. The tightly choreographed pro-business rally, a turnaround in Beijing’s approach to its tech giants from a regulatory clampdown four years ago, reflected policymakers’ concern about a slowdown in growth and efforts by the United States to limit China’s technological development.

The rest of official China was quick to show its support as well. The National Development and Reform Commission announced that it planned to “increase support” for private sector businesses and would “make contributions to major national strategies, enhance security capacities in key areas, and participate in large-scale equipment upgrades and consumer goods trade-in programs.”

But while official China lauded the importance of the meeting, the responses of analysts, businesses, and the market were more mixed. Some analysts posited that because this meeting represents public acknowledgment of a major shift in Beijing’s attitude toward the private sector, it augurs well for the performance of the Chinese economy. Other analysts were skeptical. The Shanghai Stock Exchange Composite rallied strongly in the days prior to the meeting—largely because of excitement over DeepSeek’s artificial intelligence capabilities and possible implications for Chinese productivity growth—and traded up slightly the day of the meeting, but then dropped nearly 1 percent the following day. It reversed most of that decline, however, during the next two days.

The different perspectives on this meeting reflect, not surprisingly, the various understandings of the underlying problem facing China’s private sector. If the problem is mainly one of low confidence, then strong, confidence-building gestures may be enough to make a difference. If, however, the problem is primarily a structural one of weak domestic demand, then these gestures may have a positive impact in the short term but it won’t be sustainable and will quickly fade if fiscal expansion isn’t redirected toward the demand side.

While most investors seem to favor the structural argument, some investors, along with much of the Chinese press, appear to favor the confidence argument. According to the latter view, due to the COVID-19 pandemic and the collapse in housing prices, Chinese households have lost confidence in their futures and in the value of their homes and have thus cut back on spending. In turn, this reduction in spending has undermined private businesses that relied on domestic demand to support their production, causing them to cut back on wages and employment and thereby further decreasing household confidence and consumer spending.

This self-reinforcing effect was exacerbated in the property market. As potential homebuyers became increasingly worried about the declining value of their savings (at its peak, as much as 60-–70 percent of Chinese household savings consisted of the equity in their homes), they pulled back from investing in the real estate market. Their retreat from home buying put further downward pressure on property prices, and this resulted in yet another self-reinforcing feedback loop in which lower property prices reduced demand for new apartments, which in turn led to further price declines.

The proposed solution, in this case, is for Beijing and local governments to take steps to revive household and business confidence. And, indeed, this is what Beijing has been trying to do for much of the past one to two years. There have been almost weekly announcements on new efforts to shore up housing prices and consumer spending, along with daily articles in the Chinese press about surges in spending on winter sports, movie attendance, specialty restaurants, museum tours, or any other sector in which consumer spending is growing faster than the national average.

Yet none of these efforts has had much impact, probably because programs to support housing prices and to subsidize consumer spending have been far too small. Still, the response so far has been to double down on confidence-boosting measures in the hope of breaking through and setting off a virtuous circle of rising household confidence leading to higher consumption and a resurgence of home buying—a circle that would ultimately boost domestic businesses and strengthen confidence further.

But while low confidence is certainly among the causes of China’s economic malaise, much, if not most, of the causality may be structural. Those who support this view believe the real problem is the decline in both household spending and home buying—two inevitable consequences of a growth model overreliant for many years on increasingly nonproductive investment funded by high savings. So, in other words, the problem is low consumption.

If this second view is correct, the implications for growth over the rest of the year are more pessimistic. Low confidence may make matters worse, but it is itself a rational consequence of the late stages of an unsustainable growth model; far from being the cause of low consumption, the decline in business and household confidence is the consequence of structurally low consumption. For example, low consumption in Japan was blamed on a fall in confidence set off by the bursting of the real estate bubble in 1990, but the country’s weak consumption growth continued long after the property collapse had bottomed out and began to reverse.

The right kind of pep talks may indeed create short-term boosts to confidence, which in turn can create short-term boosts to household consumption and spur businesses to eagerly respond. However, the structural view of the decline in consumption growth implies that without a transformation of the growth model toward a higher household share of GDP—which inevitably requires either explicit or implicit transfers from businesses or governments, showing why it is so difficult to pull off)—confidence-boosting pep talks won’t create sustainable increases in domestic demand.

Before they change their minds about Chinese growth prospects in 2025, most analysts will be watching to see if there is a transformation in Chinese fiscal policy, with more fiscal expansion directed toward the demand side of the economy rather than to the supply side. If that happens, then meetings like the one over which Xi presided on February 17 may indeed help, but if it doesn’t, these meetings are unlikely to cause much more than a surge in hopeful articles in the Chinese and foreign press.