In a volatile Middle East, the Omani port of Duqm offers stability, neutrality, and opportunity. Could this hidden port become the ultimate safe harbor for global trade?

Giorgio Cafiero, Samuel Ramani

{

"authors": [

"Safa Joudeh"

],

"type": "commentary",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [

"China Local/Global: Middle East and North Africa",

"China and the World"

],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [

"China Local/Global"

],

"regions": [

"Middle East",

"East Asia",

"China",

"Egypt"

],

"topics": [

"Trade",

"Economy"

]

}

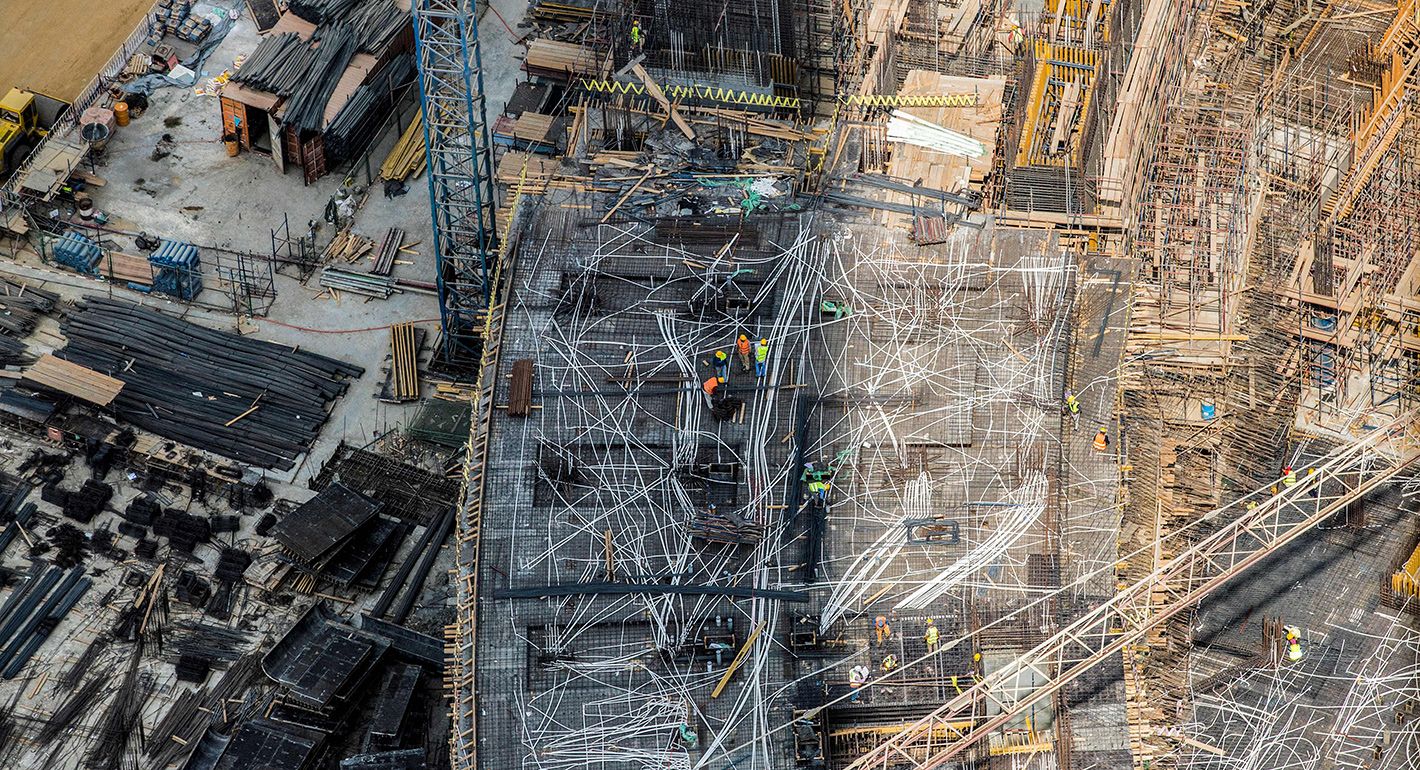

Source: Getty

Both Egyptian and Chinese state actors, planners, developers, and businesses have played an active role in transmitting and translating policies toward local industrial zones. But Egyptian policymakers need to step up proactive industrial policies and regulations for local industry to harness global linkages.

China has become a global power, but there is too little debate about how this has happened and what it means. Many argue that China exports its developmental model and imposes it on other countries. But Chinese players also extend their influence by working through local actors and institutions while adapting and assimilating local and traditional forms, norms, and practices.

With a generous multiyear grant from the Ford Foundation, Carnegie has launched an innovative body of research on Chinese engagement strategies in seven regions of the world—Africa, Central Asia, Latin America, the Middle East and North Africa, the Pacific, South Asia, and Southeast Asia. Through a mix of research and strategic convening, this project explores these complex dynamics, including the ways Chinese firms are adapting to local labor laws in Latin America, Chinese banks and funds are exploring traditional Islamic financial and credit products in Southeast Asia and the Middle East, and Chinese actors are helping local workers upgrade their skills in Central Asia. These adaptive Chinese strategies that accommodate and work within local realities are largely ignored by Western policymakers.

Ultimately, the project aims to significantly broaden understanding and debate about China’s role in the world and to generate innovative policy ideas. These could enable local players to better channel Chinese energies to support their societies and economies; provide lessons for Western engagement around the world, especially in developing countries; help China’s own policy community learn from the diversity of Chinese experiences; and potentially reduce frictions.

Evan A. Feigenbaum

Vice President for Studies, Carnegie Endowment for International Peace

China’s overseas industrial parks have developed rapidly under the Belt and Road Initiative (BRI), emerging as a significant platform for economic cooperation between China and BRI partner governments over the past decade. As of 2018, at least 123 new and previously built overseas parks had come under the BRI’s umbrella across Asia, Europe, and Africa, with additional parks being planned and implemented in the subsequent years. Under the banner of mutual benefit, these parks aim to facilitate the flow of Chinese outbound investments to host locations while supporting the industrial development needs of host countries.

As the potential for further BRI-linked initiatives grows, there is a need to examine how the Chinese industrial park model exported through the BRI is realized in practice. Specifically, it’s essential to evaluate the adaptive capacity of Chinese-built industrial parks in terms of their ability to align with and boost nationally rooted development agendas in host locations, particularly for governments seeking to capitalize on China’s substantial offshoring manufacturing capacity within the context of the BRI.

This paper summarizes the findings of two years of empirically grounded research in the Chinese-built Suez Economic and Trade Cooperation Zone (SETCZone) in Egypt, conducted to understand the SETCZone’s adaptive and developmental capacity. The research reveals mixed results and provides useful insights. The SETCZone’s sectoral planning aligns with the domestic industrial base in Suez, appearing to prioritize domestic strategic coupling with a complementary local supplier base. However, the zone’s institutional framework falls short of incorporating the proactive industrial policies and regulations necessary for local industry to harness global linkages. As a result, while the zone has successfully expanded Chinese outward foreign direct investment, it has not fully leveraged the presence of Chinese firms to develop backward linkages or to generate opportunities for industrial upgrading and diversification in Egypt.

Both Egyptian and Chinese state actors, planners, developers, and businesses have played an active role in transmitting and translating zone-based policies. However, while theoretically, these relationship networks between global and national actors shape policy dynamics around shared objectives, power distribution plays a crucial role in determining policy outcomes. Uneven market relations in which these actors are embedded constrain domestic political institutions and limit the policy space available to domestic actors.

The findings of this research indicate that political ownership and policy space are critical factors in the ability to advance domestically rooted development policies, particularly those that contribute to domestic capacity building. Effectively enlarging policy space and increasing host state economic activism requires further action at both the domestic Egyptian and Chinese levels to overcome challenges arising from interstate power imbalances, which limit the host country’s ability to shape its own development policies.

The SETCZone was launched in 2008 as a component of the Africa Economic and Trade Cooperation Zone (ETCZone) program, an early pilot industrial zone program which has since been incorporated into plans for connectivity and cooperation under the BRI. During the time of its launch China was rapidly expanding its involvement with African countries under the banner of win-win partnerships. In a period of just two decades beginning in the early 2000s, the stock of Chinese investments in Africa increased by more than 60 times and is likely to continue growing due to a surge in private investments and the establishment of new industrial parks and economic zones in the region.

The launch of the Africa ETCZone program during this time aimed to facilitate the transfer of China’s excess industrial capacity offshore, helping to expand existing markets following decades of attracting foreign direct investment (FDI) to support domestic industrialization. Under its broader “Go Global” agenda, China’s Ministry of Commerce launched proposals for the development of nineteen ETCZones worldwide, six of which were planned for Africa. These zones were intended to serve as cornerstones for expanding China-Africa investment and trade cooperation while enabling the transfer of China’s industrial capacity offshore as local Chinese industries moved to higher value-added production.

A key theme of the Africa ETCZone program was the complementarity of Chinese investments to African needs and priorities, given the variation in economic structures across partner countries and the sectoral diversification of Chinese overseas investments. Accordingly, while some African ETCZones host resource-driven investments (For example, oil in Nigeria and copper in Zambia), others specialize in the industrial production of consumer and investment goods. Though the majority of China’s investments are concentrated in the energy and construction sectors—ETCZone investments reflect an increasing emphasis on growing the share of investments in manufacturing and services—with nearly all of the zones hosting manufacturing facilities.

Egypt’s SETCZone is one of China’s earliest overseas industrial zone experiments in Africa under the ETCZone program, established in partnership with the Egyptian government to enhance Chinese-Egyptian economic cooperation and to meet the objectives of both the Egyptian and Chinese governments. Its establishment coincided with the announcement of Egypt’s first Special Economic Zone in 2002, an initiative aimed at supporting export-oriented manufacturing and growth in Suez by building production capacity in low-skilled, labor-intensive industry sectors to gradually promote industrialization.

Since 2013, Beijing has been focused on developing the SETCZone as a platform for promoting the BRI, announcing a long-planned extension of the original 1.34 square kilometers area and new investment deals worth over $3 billion. The SETCZone has since become a BRI flagship project in the Middle East and North Africa region. At the same time, China’s ambitions in the Suez have dovetailed with plans for the economic regeneration of the Suez Canal Axis under Egypt’s “Vision 2030,” the Egyptian government’s strategy for generating economic growth launched in 2016.

Between 2017 and 2022, Chinese investment in Egypt increased by 317 percent. One of the main pillars of Chinese-Egyptian economic cooperation is the enhancement of manufacturing production, with Chinese investment in Egypt largely concentrated in industrial projects, which constitute a 55 percent share of all investments, while construction accounts for 20 percent, and services 12 percent. The SETCZone plays a key role within this cooperation framework, supporting Chinese enterprises in search of investments and market share while attracting mobile capital with the aim of building up industries and labor capacity in Egypt. Now operating at full capacity, it is touted by Chinese officials as a model of solidarity, cooperation, and mutual benefit, making it a valuable case study on the capacity of Chinese industrial parks to adapt to domestic needs and contexts.

There is no single policy framework for the implementation of ETCZones. Instead, the governance and institutional frameworks of individual ETCZone’s are negotiated with host governments to fulfil the requirements of investors on the one hand, while aiming to meet the needs of domestic stakeholders on the other. Nonetheless, a common feature of overseas ETCZones in Africa is that they are financed, developed, and operated by Chinese industrial zone developers and operators. This model prioritizes heavy capital expenditure by the Chinese regional state-owned enterprises (SOEs) backed by extensive support from the central Chinese government. Across ETCZone programs, the limited role of host partners in providing capital appears to have granted Chinese interests monopoly over planning, management, and investment promotion in these zones.

In 2007, the contract to develop the SETCZone was awarded to Tianjin TEDA—a subsidiary of the Tianjin municipal government in China—who purchased 1.34 square kilometers from the Egyptian government. Initial investment in the SETCZone was thus made by Tianjin-TEDA using its own capital. Tianjin-TEDA established the Egypt-TEDA Investment Company, a country-based affiliate and joint venture tasked with establishing a joint Chinese-Egyptian industrial complex in the Suez Economic Zone. Chinese ownership accounted for 80 percent of Egypt-TEDA, effectively rendering the zone a Chinese-run project with a small participatory stake by Egyptian state actors (Author interview with Suleiman Ahmed, Investment Attraction Supervisor at Egypt-TEDA SETCZone Development Company, on 18 January 2018, Suez).

Developing the SETCZone’s business environment and governance relied on coordination among actors at various levels to design plans, rules, and regulations. Nonetheless, TEDA’s control of the zone’s strategic planning, constrained opportunities for domestic influence on policymaking. Early on, the SETCZone development strategies were provided by the TEDA and an initial masterplan was overseen by a committee of representatives from the central and regional Tianjin governments, including the Chinese Ministry of Foreign Trade and Economic Cooperation, the Chinese State Economic and Trade Commission, and the Tianjin Municipal Government. Industrial promotion is managed by a department based in Tianjin TEDA and exclusively targets Chinese firms. As a result, apart from three joint ventures between Chinese and Egyptian state-owned enterprises, all of the zone’s firms are Chinese invested.

On the Egyptian side, the Suez Economic Zone Authority’s Board of Directors (BOD) oversees the management of the SETCZone and enforces relevant regulations. The BOD includes high-level government officials representing ministries and governorates, as well as financial and legal experts. It oversees the development of the wider Suez Economic Zone in which the SETCZone is located, including designating developers and allocating land. The BOD is also tasked with handling matters related to approval, registration, licensing, and incorporation procedures for new projects among other investor services. Additionally, it creates a special customs and tax administration system to facilitate customs procedures. The BOD further manages incentives and can introduce its own regulations, including developing policies for investors.1

In the SETCZone itself, the BOD’s activities are primarily related to negotiating large deals and implementing SETCZone regulations and policies. These policies involve offering tailored facilities, incentives, and support services for business, and were designed to provide a secure environment and standardized management for Chinese enterprises to encourage export firms to relocate into the zone. In this way, the zone’s policy framework facilitates China’s centrally coordinated strategy of ‘Going Global in groups.’

The SETCZone policy framework includes the provision of major on-site facilities and infrastructure including utilities, connections, and roads, as well as energy provision and some off-site infrastructure and material assets such as privatized ports. The zone offers preferential regulatory and financial incentives for Chinese investors. Additionally, the zone provides low-cost production inputs like labor, land, energy, and transportation. The SETCZone also provides Chinese exporters with Egyptian Certificates of Origin. These certificates provide access to Egypt’s preferential trade agreements, guaranteeing the access of Chinese firms to markets in the United States, EU, Türkiye, and other MENA region markets, as well as twenty-nine African nations that have free trade agreements (FTA) with Egypt, free of custom duties and other non-tariff barriers.

The selective trade liberalization and investment facilitation measures implemented in the SETCZone thus renders the zone a key instrument in supporting China’s export policy and core interests in the region and beyond. However, while the SETCZone’s comprehensive facilities and favorable regulatory environment have succeeded in attracting Chinese investments, the absence of a guiding role by domestic institutions and government policy in driving the structural transformation agenda and cultivating sustained industrial development is a significant limitation. There is little government involvement in facilitating skills and technology transfers or promoting local capabilities—critical factors for successful industrialization and structural transformation. Moreover, neither the developer nor the Chinese Ministry of Commerce, which oversees the zone program, introduced interventions to connect the local economy with the zone through inter-firm linkages. As a result, there is a lack of backward linkages to domestic suppliers and minimal positive spillovers from Chinese firm activities, hindering the potential to drive initial industrialization within the domestic economy.

The performance of the SETCZone is thus heavily influenced by Chinese control and asymmetrical power relations, which shape the type of development the zone fosters. The absence of an active role by domestic agents in shaping engagements with China significantly hampers the potential benefits of such collaborations, leaving the host economy unable to fully leverage the advantages of foreign investment. As a result, the strategies adopted by firms operating in these zones do not offer opportunities for technology transfer, industrial upgrading, and diversification, foreclosing the opportunity for the development of a competitive industrial sector in the host economy.

A firm-level analysis of a number of SETCZone firms across various heavy industry and light manufacturing sectors confirms this significant shortfall. The SETCZone hosts thirty-eight manufacturing enterprises operating in four priority sectors for investment attraction: heavy industry, electrical equipment, fiberglass, and textile. There are five megaprojects in the heavy industry, fiberglass, and electrical equipment sectors. The remaining companies operate in the light manufacturing textile sector. Despite the variety of businesses, a key feature that cuts across all sectors in the SETCZone is the vertical integration of Chinese value chains. Interviews with six SETCZone investment projects in the heavy industry, electrical equipment, fiberglass, and textiles sectors reveal zone-based firms systematically engage Chinese rather than domestic input suppliers in order to support the supply chains of firms based in China.

A variety of production strategies are adopted across the firms examined, as pressures in different industries push firms toward different production organization patterns and markets. Megaprojects act as upstream suppliers, leading chains that cut across more than one country and directing their product flow of component parts to regional markets in the Middle East and Africa. Jushi Egypt, for example, is a $58 million subsidiary of the world’s second largest fiberglass manufacturer and the largest fiberglass manufacturer in the Middle East. The majority of Jushi Egypt’s inputs are supplied by Chinese firms, including Chinese mineral mining companies based in Egypt. As an upstream supplier, Jushi’s annual output capacity of 200,000 tons is then exported to Europe and the Middle East to be used in the production of such end products such as turbine blades, yachts, and pipelines.2

While the majority of heavy industry firms are upstream suppliers, textile companies act as downstream suppliers (or final output generators) catering to local and regional markets. These companies import unfinished products, finish or assemble them and sell the final product directly to end users. Factories such as single-brand blanket manufacturer Linyi, carpet and blanket manufacturer Ya’ou, and scarf manufacturer Tianjin Egypt-Yashmagh Textile Co. import both unfinished products and most of the primary commodities used in assembly such as fabrics and yarn. In most cases, these companies have branched off parent firms in China and receive imports of input material from their lead firms.3

The latter example shows how SMEs in the light manufacturing sector have remained vertically integrated with their parent firms in China, supporting the supply chain of firms in the Chinese national economy by finishing or assembling products for local (or regional) distribution and consumption. The former example is illustrative of the tendency of Chinese firms in the heavy industry sector to also bypass domestic markets and internalize production operations, including in extractive sectors and raw material processing. Hence in both upstream and downstream production, Chinese domestic enterprises support the supply chains of firms in the Chinese national economy, allowing these firms to operate abroad while efficiently retaining complementary competencies in task-based production and sometimes marketing, logistics, and distribution in house.

The strategy of vertical integration is present across all firms assessed. This strategy allows Chinese firms to retain control of all stages of the labor-intensive manufacturing chains, rather than outsourcing operations to domestic firms while simultaneously reducing production costs by offshoring their subsidiaries. Meanwhile, the inclusion of domestic enterprises into the value-addition process is either limited or controlled, leaving minimal opportunity for the transfer of knowledge and technology to local firms. The zone’s policy framework reinforces this divide by preventing domestic firms from establishing strategically beneficial global connections and limiting the ability of national institutions to effectively intervene in their operations.

For industrial zones to achieve dynamic and sustainable effects in their host economies, they must attract foreign investment, alongside establishing strategic connections between local and foreign firms to facilitate the transfer of knowledge and technology to domestic sectors. This was the rationale that guided the development of domestic Chinese Economic and Trade Cooperation Zones, the variant of Chinese investment regimes that the Chinese-Egyptian SETCZone was modelled after. By creating the conditions for the development of backward linkages to the local economy, Chinese zones served to shift the comparative advantage of regional economies from low to high value-added production, thus facilitating long-term structural change.

But contrary to the domestic Chinese industrial development model, the SETCZone has continued to function independently of its local setting, relying heavily on incentives to attract Chinese firms while remaining an enclosed space for the relocation of Chinese firms. Domestic Chinese suppliers remain the dominant or exclusive providers of component parts to offshoring firms based in the SETCZone, with little participation by Egyptian producers in the value-adding process. The SETCZone as such has supported the internationalization of Chinese capital while excluding the domestic industrial base from the gains of global production and trade. Although such investments may create jobs and potentially drive some economic growth, they will have limited ability to bring about significant structural transformation or enhance the host location’s role in the global division of labor.

The SETCZone’s limited integration into the domestic economy is due to a set of Chinese and host country conditions and determinants. Chiefly, the absence of political ownership and limited policy space have prevented local governments from asserting control, hindering the integration of domestically rooted development policies—especially those aimed at strengthening domestic capacity—into Chinese industrial zones. A large part of this has to do with the bigger picture of the zone program, its political economic objectives and institutional features, which inherently limit the role of domestic institutions and government policy in zone planning and industrial promotion.

Without incorporating the national visions of host governments into the build-up of Chinese zones, including efforts to channel investments into target sectors that foster strategically beneficial connections with local firms, and build industries within the same value chains, opportunities to promote industrialization are lost. Generating these opportunities requires strong domestic leadership, central government allocation of investments, and regulatory and legal frameworks that lay the foundation for sustained industrial upgrading, deepening, and development. Otherwise, Chinese investments risk reproducing the existing asymmetrical relationships and exclusions of the global political economy, facilitating the flow of capital and goods from Chinese regions to world markets without necessarily generating new opportunities for development in the host region.

Safa Joudeh

Safa Joudeh is a postdoctoral scholar at the Institute of Arab and Islamic Studies, University of Exeter. Her research, positioned at the intersection of critical policy studies, global political economy, and critical economic geography, explores the political economy of China’s port and maritime infrastructure projects under the Belt and Road Initiative (BRI). She focuses on the implications of Chinese infrastructure deployment and industrial capacity cooperation programs for host countries in the Middle East. Safa earned her PhD in Development Studies from SOAS University of London and currently serves as a teaching fellow in the Department of Politics and International Studies at SOAS.

In a volatile Middle East, the Omani port of Duqm offers stability, neutrality, and opportunity. Could this hidden port become the ultimate safe harbor for global trade?

Giorgio Cafiero, Samuel Ramani

Europe’s reaction to the war in Iran has been disunited and meek, a far cry from its previously leading role in diplomacy with Tehran. To avoid being condemned to the sidelines while escalation continues, Brussels needs to stand up for international law.

Pierre Vimont

South Korea’s rapid demographic transition previews governance challenges many advanced and middle-income economies will face. This paper argues that aging is not only a care issue but a structural governance challenge—reshaping welfare, productivity, and fiscal sustainability, and reorganizing responsibilities across the state, private sector, and society.

Darcie Draudt-Véjares

Two experts discuss how drone technology is shaping yet another conflict and what the United States can learn from Ukraine.

Steve Feldstein, Dara Massicot

Arguing that Chinese policy is hung on alliances—with imputations of obligation—misses the point.

Evan A. Feigenbaum