Kenji Kushida

Source: Getty

Japan’s Aging Society as a Technological Opportunity

Japan’s extreme demographics are shaping the country’s innovation trajectory.

Summary

- Japan’s extreme demographic aging and shrinking is an economic and societal challenge, but also a technological opportunity for global leadership.

- Technological trajectories of worker automation and worker skill augmentation within Japan are already being shaped by the country’s demographics.

- Software, robotics, and other technology deployments are transforming the nature of work in a wide range of sectors in Japan’s economy, and across types of work such as blue-collar, white-collar, agriculture, manufacturing, and services.

- Specific ways in which Japan’s demographics shape technological trajectories include market opportunities, acute labor shortages, and favorable political and regulatory dynamics.

- The private sector is driving technology deployments in industrial sectors hit hard by Japan’s aging population, ranging from construction and transportation to medical care and finance, with strong government support in each of the domains.

- Demographically driven technological trajectories play to Japan’s strengths in implementing, deploying, and improving technologies rather than generating breakthrough innovations.

- Japan’s demographically driven technological trajectory can be an important platform for international technology cooperation, fitting with the top U.S.-Japanese political leadership agreements on fostering strong innovation and technology collaboration ties.

- Japan’s start-up ecosystem, often in partnership with large incumbent firms, will be critical in deploying new technologies by defining new markets and providing new offerings.

- An effective analysis goes beyond broad demographic numbers to delve into specific pain points of particular segments of society to better capture their situations and roles in shaping market opportunities that drive technological adoption.

- This introductory paper: (1) defines key analytical concepts; (2) surveys some of Japan’s key demographic shifts; and (3) highlights cases from agriculture, construction, transportation, healthcare, eldercare, land, and housing ownership.

Introduction

Japan’s rapidly aging and shrinking population presents major challenges to the country’s economic growth and societal well-being. Fewer working-age people must support a ballooning retired population. Healthcare costs are spiraling, and a broad array of social issues are being triggered by large elderly populations and a graying workforce. Depopulation in rural areas is accelerating, leaving high concentrations of aging residents who need more services while the number of providers of such services plummets. These challenges are not unique to Japan, but the scale and speed at which they are affecting the country are extreme; Japan is a harbinger of dynamics that will hit elsewhere.1

Japan’s demographic challenges also offer technological opportunities for the country to become a leader, and for international technology collaborations. As a wealthy society unwilling (for now, at least) to embrace major immigration to ameliorate labor shortages, depopulation, and an aging workforce, Japan’s demographic realities have galvanized a wide range of corporate efforts, supported both directly and indirectly by the government, to aggressively develop and deploy technological solutions to address deep challenges.

This paper is not a naïve and simplistic suggestion that robots can take care of the elderly and thereby solve Japan’s demographically driven challenges.2 Rather, Japan’s demographic realities are accelerating specific technological trajectories that are transforming the fundamental nature of work.

Japan’s demographically driven technological trajectories cluster around two contrasting paradigms: automation of work and augmentation of worker skills. Automation is typically framed in most global discussions as removing workers from tasks and jobs, which can risk eliminating far more jobs than job seekers, but in Japan’s case, automation is more an answer to labor shortages; there are no longer sufficient people to perform needed work. Augmentation is about enhancing the capabilities of people, whether through increasing efficiency or upskilling—allowing workers without specialized skills to perform specialized tasks.

Artificial intelligence (AI)-driven software technologies, coupled with hardware, human assistive robotics, and automated systems of all manner, are being developed and implemented across all types of work: white collar, blue collar, agriculture, manufacturing, and services. They are also being aggressively adopted across major industrial sectors, ranging from construction, finance, and transportation to agribusiness, eldercare, and public sector services.

The demographically driven technological trajectories are shaped by acute needs that exert themselves through market forces. Labor shortages change the industrial cost-benefit calculations of hiring people versus developing automation and skill-augmentation solutions.

Specific mechanisms in which Japan’s demographics shape technological trajectories include: (1) market opportunities of an unprecedented scale to serve the needs of a rapidly aging society; (2) acute labor shortages exacerbated by Japan’s low political willingness to embrace massive numbers of foreign workers, especially with its COVID-19 pandemic response of essentially closing national borders; and (3) favorable political and regulatory dynamics for pursuing the development and diffusion of new technologies and solutions.

In many cases, the basic technologies related to AI, software, and robotics are already available in some form, but have not been developed and commercialized to the point of widespread deployment. In short, many of the technologies are in an implementation, deployment, and optimization phase, where iterative improvements are critical, rather than at a radical innovation breakthrough phase. This plays to Japan’s historical strengths of deploying and improving technologies rather than generating breakthrough innovations.3

By deploying technologies to address societal challenges that arise from its extreme demographics, Japan is poised to be a leader in global markets. In numerous information technology-related markets since the mid-1980s, Japan found itself “leading without followers” by pursuing technological trajectories that isolated its domestic market, leading to ever-increasing domestic sophistication that became progressively decoupled from global markets.4 Most of these markets, ranging from proprietary computers to pre-broadband data networking, and hardware offerings such as minidiscs and a sophisticated mobile telephony and internet industry, were eventually disrupted. Silicon Valley companies in the U.S. computer, software, and semiconductor industries were responsible for much of the disruption. In contrast to this experience of “leading without followers,” technological development and deployment to cope with demographic change is an area where Japanese firms can become leaders with followers.

Japan’s rapidly maturing start-up ecosystem will play a critical role, often in partnership with large established firms. Start-ups often have expertise in automation-related technologies, especially software, while large established firms have deep financial resources and broad reach to deploy solutions and services.

Demographically driven technological trajectories are also a promising area for international technology collaborations. Notable business collaborations between Japanese firms and Silicon Valley are emerging as an important area of U.S.-Japan technology cooperation—an issue identified as critical by the political leadership in the overall U.S.-Japan relationship, but which often lacks specific details about what is happening on the ground.5

In policy discussions of market opportunities and technologies, it is critical to identify specific pain points of particular segments of society. Generalized discussions of large-scale trends can capture the big-picture challenges, but the visualization of concrete possibilities requires delving deeper.

For example, while it is useful to know that approximately 30 percent of Japan’s population was over age sixty-five in 2021, it is far more illuminating to understand the demographic status of households, since those are often the relevant units for life as experienced by people themselves. In 2019, 50 percent of all households had one or more members over sixty-five, and in 2020, 22 percent of women and 15 percent of men over age sixty-five were living alone. With these numbers projected to grow rapidly over the next decade, the broad range of needs becomes apparent in areas including healthcare, mobility, communications, and emotional well-being.

When broken down into specifics, the degree of aging in Japan is astonishing: the average age of farmers (whose primary occupation was farming, as opposed to part-time farmers) was 69.5 in 2021, the average age of taxi drivers was sixty in 2019, and truck drivers’ ages averaged forty-eight in 2020. Some piecemeal, stopgap measures are extreme, such as raising the maximum age limit for taxi drivers to eighty.6

Spiraling healthcare costs of an aging population are often mentioned, but beyond that, Japan must also confront a society in which cognitive impairments are almost unimaginably widespread. The government estimates that by 2030, between 20 percent to 22 percent of the population over age sixty-five will suffer from dementia.7 Given the high proportion of elderly people, this amounts to approximately one in fourteen to sixteen people in the entire country. Japan currently enjoys extremely high-levels of literacy and education, but the rapid growth in the proportion of people with cognitive impairment could dramatically change the contours of society. Redesigning major portions of societal infrastructure may be necessary in aspects ranging from mobility to communications, nutrition provision, and monitoring the elderly who live alone or in households comprised only of elderly members. Technology can play a critical role in these adjustments, although humans will certainly be involved in numerous steps along the way.

This paper provides an overview of several areas in which Japan’s technological trajectories are shaped by its extreme demographics.

Part one provides conceptual tools: the idea of technological trajectories; conceptions of technology diffusion; paradigms of human-replacement automation and human-skill augmentation; and private-sector-driven dynamics of technology cooperation and competition.

Part two offers a granular view of Japan’s demographic changes, focused on the deep needs and market opportunities created by each dimension.

Part three delves into specific cases of how the technological trajectories are progressing, along a matrix of specific cases of automation and augmentation, in a variety of sectors, including construction, agriculture, transportation, finance, and others.

Conceptual Tools

Technological Trajectories

Technological progress often follows specific trajectories—numerous actors exerting effort and deploying resources to pursue certain technological opportunities rather than others.8 These trajectories can differ across countries and profoundly affect the progress and diffusion of technologies.9

For example, in the 1970s and 1980s, Japanese firms burst into global markets by spearheading technological trajectories of lean production and precision manufacturing. Japanese firms became extremely competitive in sectors such as automobiles, semiconductors, and factory automation robotics. Their success displaced competitors around the world, including many firms in Silicon Valley in the electronic components and semiconductor industries.10

Then, in the late 1980s and 1990s, a new wave of Silicon Valley firms pioneered new technological trajectories, providing functionality through software, utilizing outsourced manufacturing, and creating de facto standards—a move to create value in ways that did not rely on electromechanical hardware manufacturing capabilities.11 This new technological trajectory commodified much of the hardware that Japanese firms excelled at producing, driving many Japanese companies out of global prominence in these areas.

In the 1990s and 2000s, the information technology (IT) trajectories pursued in Japan often ended with the country running in the same direction as much of the world, sometimes surpassing other countries in developments along those trajectories, but then experiencing a situation of “leading without followers” when the world abruptly shifted to a different trajectory—broadband internet, digital audio/video technologies, and cell phones, for example.12

Mechanisms of Technology Diffusion

The trajectory of technological development throughout history has not been driven simply by market opportunities or needs, but also by political and social factors.13

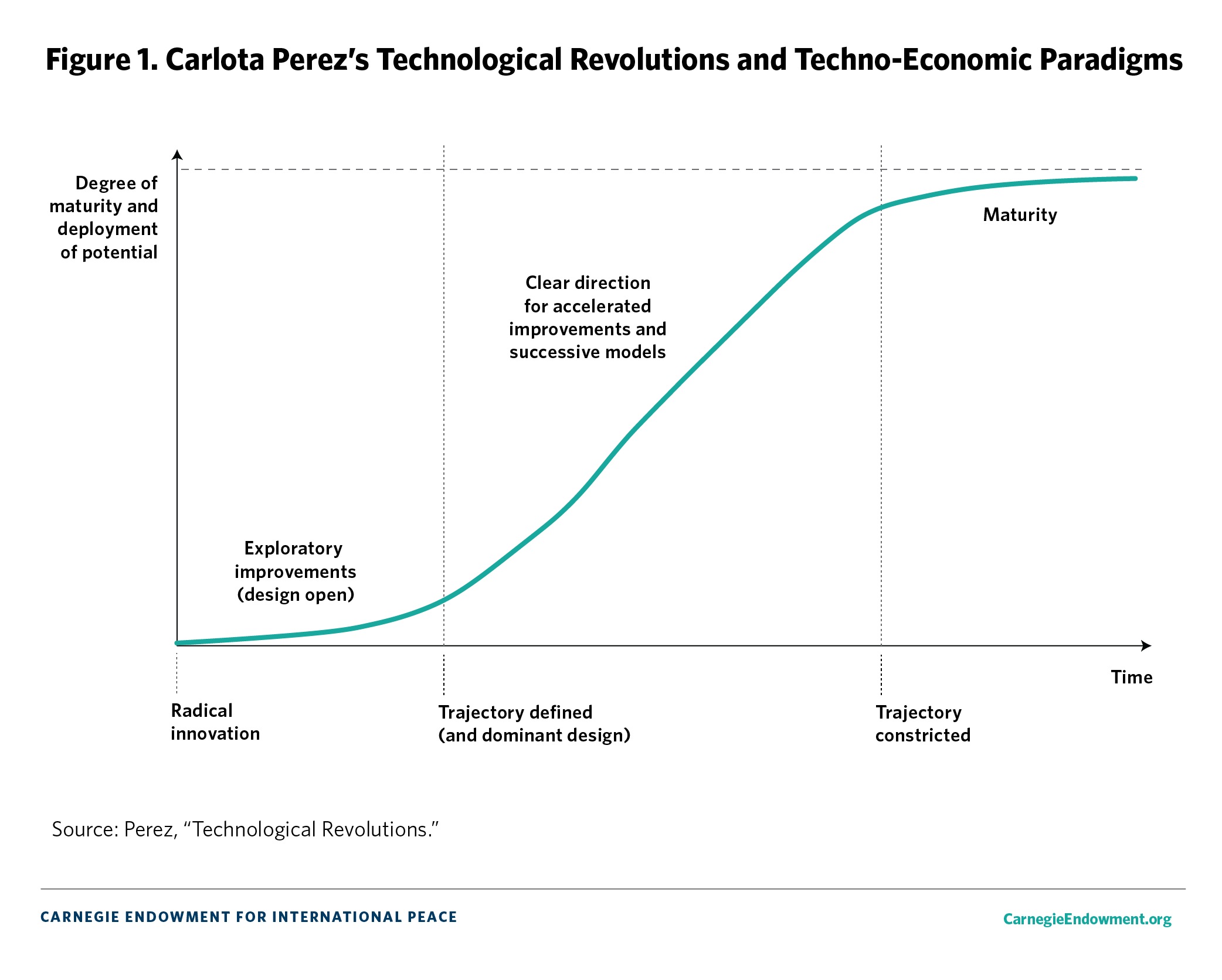

In a sweeping analysis of major technological paradigm shifts throughout modern history, Carlota Perez creates a framework highly useful for capturing the dynamics of technology innovation and diffusion. She differentiates between invention, which is in the realm of science and technological discovery, and innovation, which is the commercial introduction of new products. The process of turning inventions into innovation is shaped by the context, with factors such as relative prices, regulatory and institutional aspects, perceived market potential (which in turn depends on what markets are already accepted), the choice set of alternative technologies, and other societal features.

In Perez’s framework, innovation trajectories are shaped by a tacit agreement among various actors about the uses to which technologies are put. Immediately after each radical innovation, the potential uses of the technology are wide open, with a wide range of actors engaged in exploratory improvements. Once a dominant design emerges, actors implicitly agree on a clear direction for accelerated improvement, bringing an era of optimization and maturation of the technology (see Figure 1).

Regulatory structures and government policies have actively shaped the directions of technological development, as well as influenced the patterns of diffusion. For example, steam power brought the Industrial Revolution to factories, but massive infrastructure projects, such as railways and the major canals linking bodies of water, had government support.14 In a more recent example drawn from the Cold War context, the U.S. Federal-Aid Highway Act of 1956, which called for the construction of a nationwide highway system, led to a shift in the technological trajectories of U.S. transportation away from railroads to trucks and gasoline-powered vehicles, since the United States rapidly constructed a network of toll-free highways particularly suited for automobiles and trucks. In Japan, however, the government’s efforts to build effective railways in highly concentrated urban areas, and the decision to impose relatively expensive highway tolls, led to sustained investments in railway technology, providing Japan with some of the world’s most sophisticated high-speed rail and urban trains and subways.

The sets of technological developments and deployments in Japan to cope with its extreme demographic challenges can be called a demographically driven technological trajectory, since they involve a wide range of corporate and government actors focused on transforming the nature of work to enable an economically viable society while coping with extreme demographics.

National/Local Contexts Shaping Corporate Strategies and Technological Choices

Although governments and policy can broadly shape them, technological trajectories are directly driven by companies. Company behavior is often embedded in national and local environments, which enable certain types of strategies rather than others in particular places. Even in an era of global multinational corporations, many companies remain relatively embedded in their countries of origin, where corporate headquarters or primary operations are located.15

For example, Toyota’s just-in-time production (also known as lean production) was developed in response to a lack of physical space in factories in Japan. These constraints led the company to develop the practice of holding minimal inventories while relying on frequent deliveries by suppliers; the practice then enabled Toyota to attain higher levels of flexibility and enjoy opportunities for continual quality improvement and cost-cutting. The “kaizen” paradigm of empowering shop floor workers to provide feedback to product engineers and production process improvement teams was facilitated by long-term employment arrangements and company-based unions that tightly bound the futures of both blue-collar and white-collar workers to their company’s long-term fortunes. This long-term employment practice was in turn a product of Japan’s early postwar baby-boom era when the country enjoyed large cohorts of young workers with far smaller cohorts of older workers and retirees—the arrangement of long-term employment stability in exchange for lower wages during a worker’s early years and rising wages with seniority was attractive to workers, while companies that had suffered from workforce attrition also benefited from the ability to lock in workforces.

Silicon Valley firms’ focus on software, the shift away from manufacturing to higher-end value in semiconductor chip design, and the transformation of production to cross-national production networks was in part a response to the strength of Japanese corporations in manufacturing. The oil shocks in the early 1970s that drove numerous firms into insolvency and mass layoffs broke the norms of long-term employment at large U.S. corporations and drove the white-collar skilled workforce toward great labor mobility. This high labor mobility aided in transforming U.S. industry; companies such as IBM and Intel began shedding large proportions of their workers to transform their business models. The Silicon Valley start-up ecosystem was boosted by the ability of new companies to attract workers who would willingly leave any firm with sinking fortunes in favor of employment in a new company on the rise.16

Japanese firms, embedded in the Japanese political-economic context, were unable and unwilling to adjust rapidly by suddenly shedding workers and shifting directions. As Japanese firms confronted new competitive realities from the 1990s onward with Silicon Valley companies leading the way by creating value in new ways, Japan’s social protections built around stable large-firm employment constrained adjustment strategies. Unable to quickly divest themselves of large proportions of their workers, Japanese companies had to slowly downsize their workforces through early retirement programs and age-based attrition, while limiting new hiring. They were also unwilling to take on large numbers of people with new skills rooted in software since they were overloaded with workers from the previous technological era.

Japan’s extreme demographic dynamics of an aging and shrinking population, while depopulating rural areas, are shaping Japanese firms’ corporate strategies to pursue demographically driven technological trajectories. On the one hand, Japanese firms of all sizes have higher numbers of older workers whose skills must be augmented and productivity increased if the firms are to remain competitive, especially since companies are unable and unwilling to rapidly jettison large numbers of workers. On the other hand, many jobs and occupations fail to attract younger people, especially work entailing long, grueling hours with low pay in either blue- or white-collar positions.

Automation vs. Augmentation: Paradigms of AI vs. IA

Since the early development of artificial intelligence (AI) as a set of research initiatives in the late 1960s, two distinct paradigms have emerged. The research efforts collectively labeled “artificial intelligence” were focused on replicating human capabilities to replace humans through automation. In contrast, efforts that fell under the label of “human-computer interaction (HCI)” were about augmenting human capabilities. While researchers in the HCI camp recognized that AI could eventually replace humans, they valued and prioritized symbiosis between humans and machines. This distinct contrast in notions of the future and philosophy about the place of humans remains a feature of AI development to the present day.17

This paper makes the distinction between AI as human-replacing automation, and intelligence augmentation (IA) as embracing the notion of enhancing human capabilities—also often referred to as “human-in-the-loop.” The distinction is useful in discussing demographically driven technological trajectories of transforming work, since some workers and occupations are being replaced due to AI, while others are being augmented in one form or another through IA. Commercial deployments of both types of systems are often simply labeled “artificial intelligence,” which obscures the very different nature of the work being transformed and its relation to workers.

Making this distinction captures the different political, economic, and societal dynamics surrounding the transformation of work: for example, fully autonomous AI systems in areas such as construction may be further in the future, but construction equipment with IA systems already enables relatively unskilled workers to perform tasks that previously required years of experience and skill acquisition. In other areas, such as transportation, in which rural bus routes are disappearing due to a lack of drivers, fully automated minibus transit along predetermined routes seems the only solution, galvanizing national and local governments and a variety of large corporate efforts in collaboration with start-ups. Without the AI/IA distinction, discussions can become unproductively confusing.

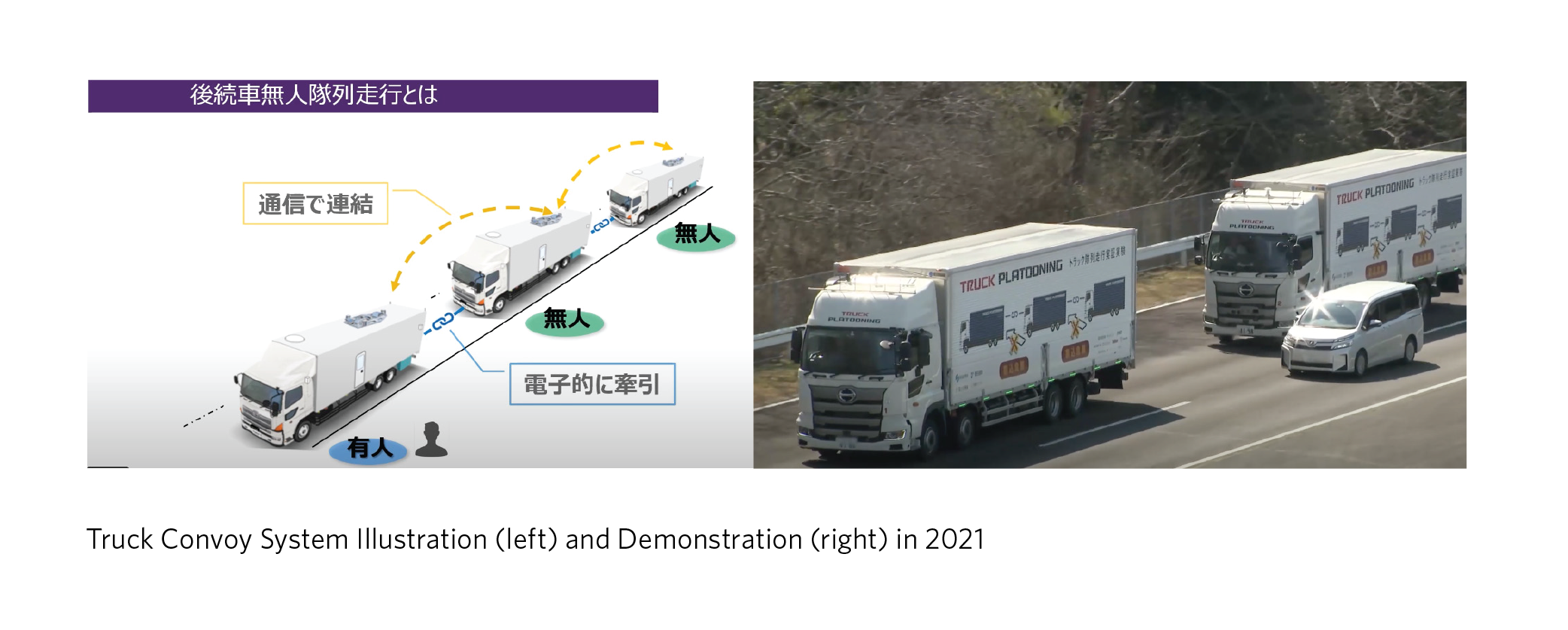

Moreover, the technological requirements for fully automating activities can be far higher than amplifying human activities. Some forms of IA such as truck convoys in which the front truck is driven by a person, while two or three trucks follow closely behind without a driver but linked through sensors and software, are not fully autonomous. In allowing a single driver to do the work of three, it does replace drivers, but categorizing it as AI because it uses digital tools to replace humans, and because it uses some degree of autonomous driving capabilities for the followers in the convoy, is also misleading. The technology for IA in many areas is far closer to commercial deployment than fully autonomous AI, further strengthening the case to make the analytical differentiation despite both reducing the number and skill requirement of humans needed to perform tasks.

Industry Dynamics Driving Cross-Border Technology Collaboration and Competition

Technology cooperation and collaboration across countries—particularly between close allies such as the United States and Japan—are increasingly important policy topics amid escalating U.S.-China tensions and technological competition. However, these national-level policy discussions often miss the importance of private-sector competition at the firm level, where much of the actual cooperation and collaboration in technology occurs. National economies are shaped by corporations, and corporations are directly responsible for employing labor and providing capital and services. They are responsible for adopting business models that utilize technologies, and they make decisions about which technologies to develop, which technologies to deploy, how to create businesses based on them, and what local and international partnerships to pursue to achieve their goals.

Firms compete intensely with one another in domestic and global arenas, and firms, not technologies, are the winners and losers in competition; the best technologies by no means ensure that the firms developing or deploying them will emerge as winners.18 What happens to the wealth created by successful firms, as well as the labor force of unsuccessful firms, depends largely on national political bargains and regulatory structures.19 Each country’s domestic political arrangements influence the areas in which firms compete—marketcraft, or how markets are designed.20

Cross-border technology cooperation and competition are often a function of corporate strategies within each country, which are in turn shaped by each nation’s rules and regulations governing the design of markets in which firms compete.

Japan: From “Leading Without Followers” to Leading With Followers

Japan is a world leader in its demographic trajectory of aging. However, it is followed by numerous advanced industrialized countries with falling birth rates and extending lifespans. Japan’s Asian neighbors, China and particularly South Korea, face precipitously falling birth rates. Technologies developed or deployed within Japan to solve domestic, local demographic challenges hold the potential to be applicable elsewhere.

The pattern of deep societal problems in Japan leading to solutions potentially applicable elsewhere is an important dynamic of innovation in Japan given its recent history of “leading without followers” in IT industries. Japan has experienced leading without followers in a broad range of fields.21 Examples include the country’s internet-connected, advanced mobile industry that predated smartphones by a decade; pre-broadband network infrastructure known as ISDN; data communications standards and equipment called ATM that were disrupted by the current internet protocols TCP/IP; consumer electronics such as recordable minidiscs; and, in computing, sophisticated word processor/printer combinations that were advanced beyond personal computers (PCs), but lacked open platforms for software. This dynamic of “leading without followers” is often referred to within Japan as “Galapagos syndrome,” in which geographic isolation led to a proprietary trajectory of evolution. Even more problematic for Japan was the disruption of these “Galapagos” industries by Silicon Valley’s smartphones and their app ecosystem; DSL broadband networks; innovation based on the internet as a global, open platform; PCs whose modular architectures and Windows operating system moved value away from proprietary systems; and the U.S. software industry writ large.

This time, there is reason to believe that solutions for demographic change can be expanded outside Japan, opening the possibility that Japan will be a leader with followers.

Japan Is More Open and Global Than Often Understood, But Not to Immigration

The final conceptual building block is the reality that Japan’s economy is far more open than many international observers realize. Beginning in the late 1990s, formerly protected sectors ranging from finance to telecommunications and pharmaceuticals opened dramatically.22 Software and IT platforms are now overwhelmingly provided by U.S. global platform companies Amazon, Google, and Microsoft. The opportunity to capture value from Japan’s demographic shifts is not limited to Japanese firms; non-Japanese firms can gather data and provide solutions within Japan, which may then be applied in other international markets.

Supporting the notion that Japan is surprisingly open to non-Japanese firms, in 2022, Japan’s Digital Agency selected Amazon Web Services (AWS), Google Cloud, Oracle, and Microsoft to provide its “government cloud” services to replace the proprietary decentralized systems operated by central and local governments.23 Legacy systems built by companies such as NTT Data, NEC, and Fujitsu were proprietary and unable to share data across government organizations and localities, hindering the government’s efforts in digital transformation.

Banks are increasingly turning to U.S. IT providers such as Microsoft to replace their legacy core banking IT systems. Since 2021, numerous local banks have announced their adoption of Microsoft Azure to replace their core banking IT system.24

More recent U.S. start-ups such as Docusign, Dropbox, Evernote, and, from the early 2010s, Salesforce, have been widely adopted by leading Japanese corporations.

Major parts of Japan’s start-up ecosystem are built on top of AWS and Google Cloud, which enable rapid scaling up and winding down of services as start-ups’ offerings grow rapidly or transform suddenly. AWS and Google both run start-up accelerators in Japan.

An increasing proportion of Japan’s major industrial firms have greater sales and activity abroad than ever before. Companies such as Mitsubishi Heavy Industries, Daikin, Komatsu, Tokio Marine, as well as Toyota, Honda, Subaru, and Nissan, have greater sales abroad than within Japan.25 With the globalization of production, these firms have moved beyond manufacturing within Japan and exporting to establish international offices often managed by local nationals, who are increasingly part of the firms’ executive teams.

The backdrop to this internationalization of Japanese companies is Japan’s political choice to avoid large-scale immigration or opening its borders to foreign worker inflows at a scale sufficient to address the labor shortage. While new worker visa programs are facilitating substantial and significant inflows of blue-collar workers in areas such as restaurants, nursing, construction, and over a dozen other sectors, the government’s projections for labor shortages in the short, medium, and long term far exceed the new inflows.

Japan’s Demographic Challenges: Economic, Political, and Social Issues

The degree of Japan’s demographic challenges is extreme, with the population rapidly shrinking and aging, and an increasing number of older adults living alone or in multigenerational households.

Big Picture: Population Aging and Shrinking

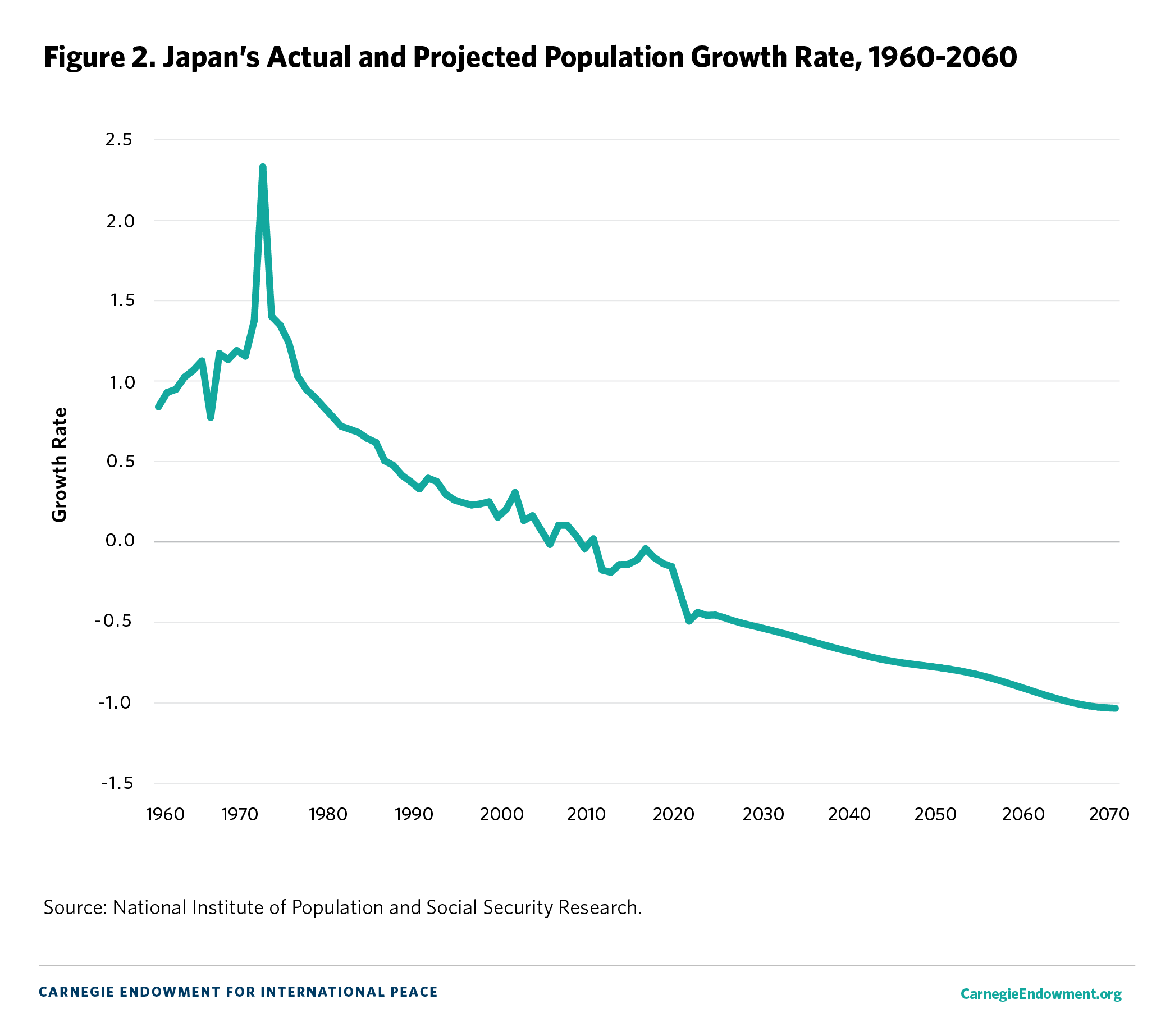

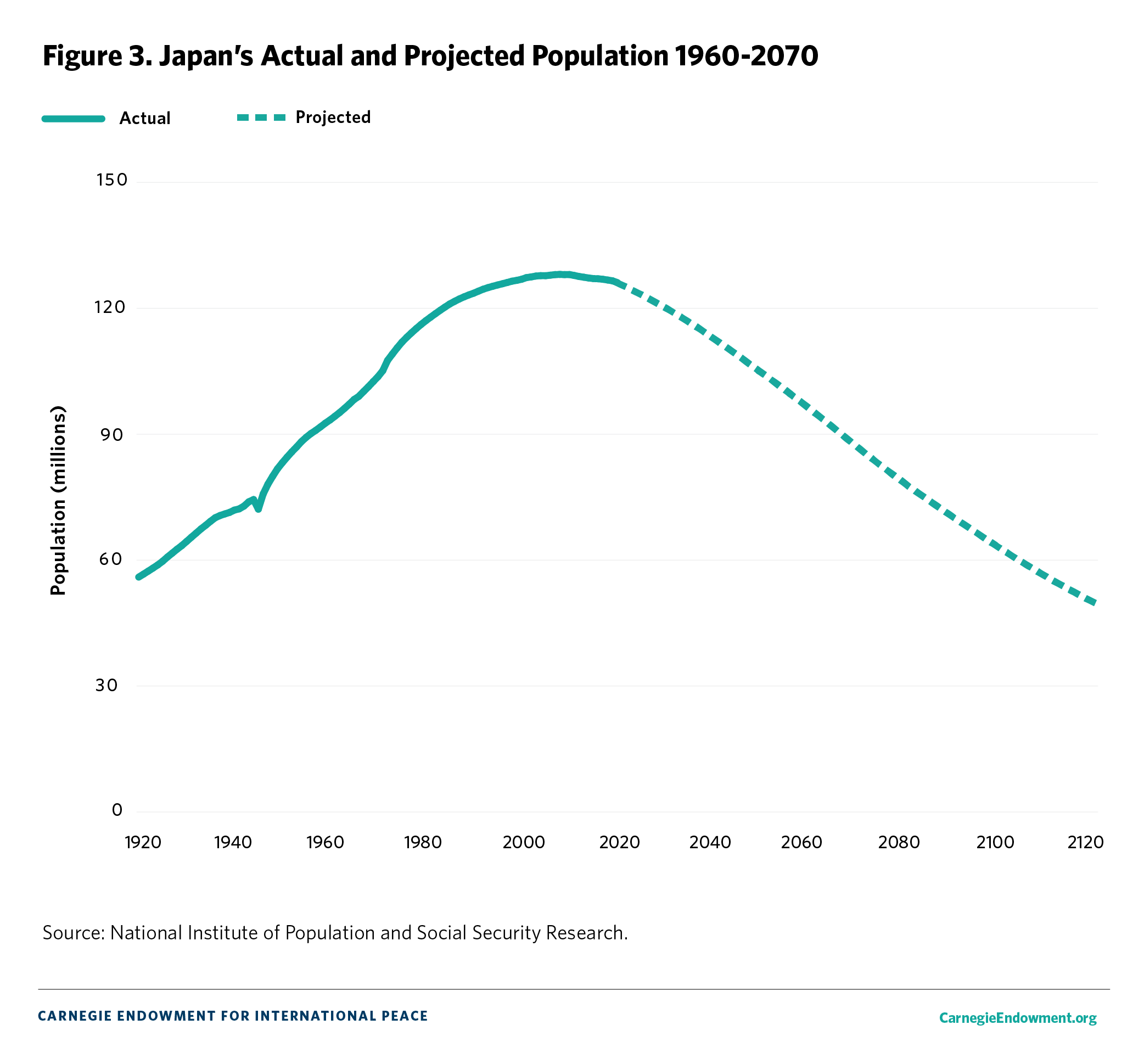

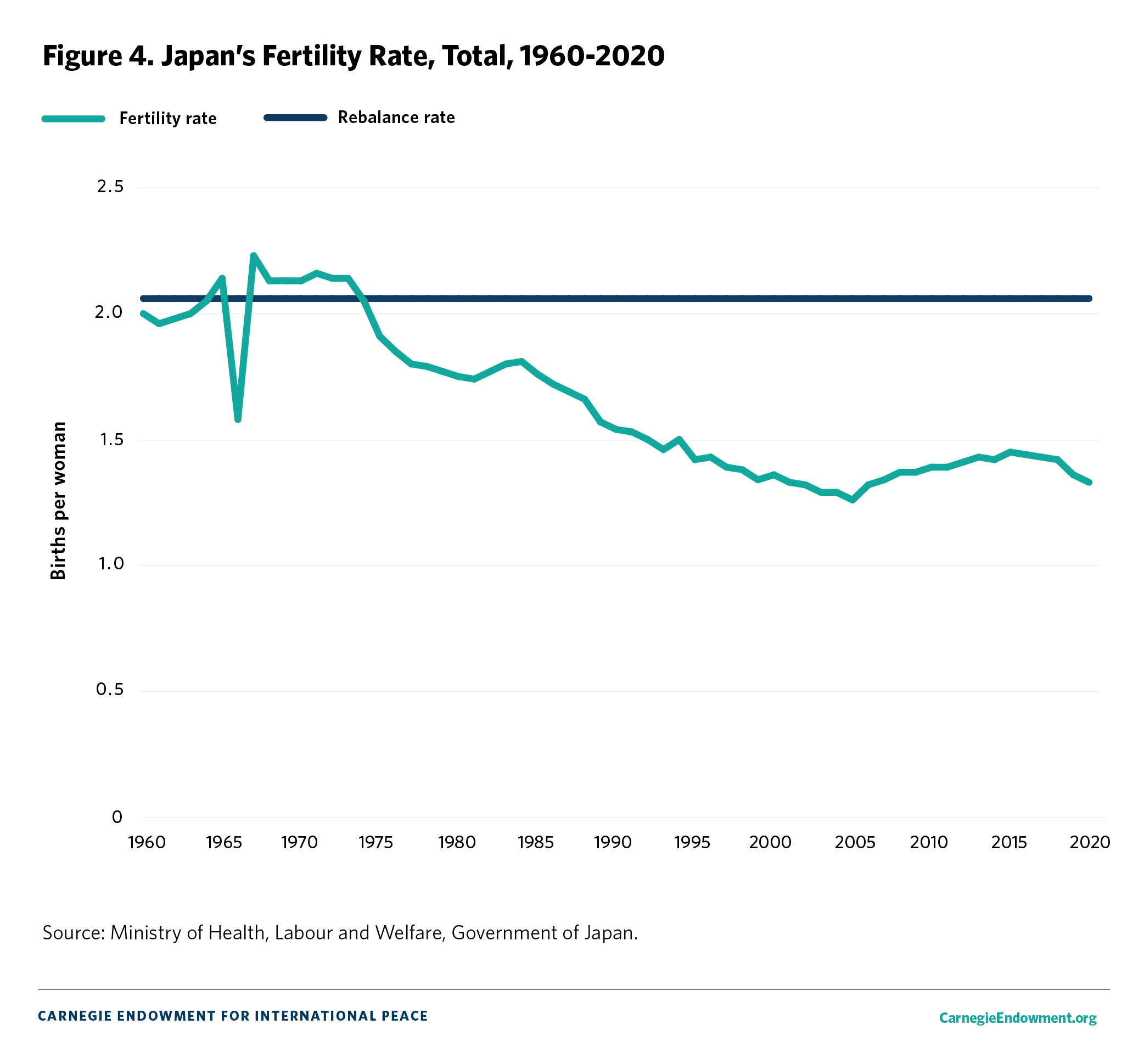

Japan’s population growth declined sharply after 1970, peaking at 128 million in 2010. Between 2015 and 2021, Japan lost more than 1.5 million people, and declining birth rates are accelerating the population decline (see Figures 2 and 3).26 No other advanced industrialized nation has experienced a population shrinkage of this magnitude—yet.

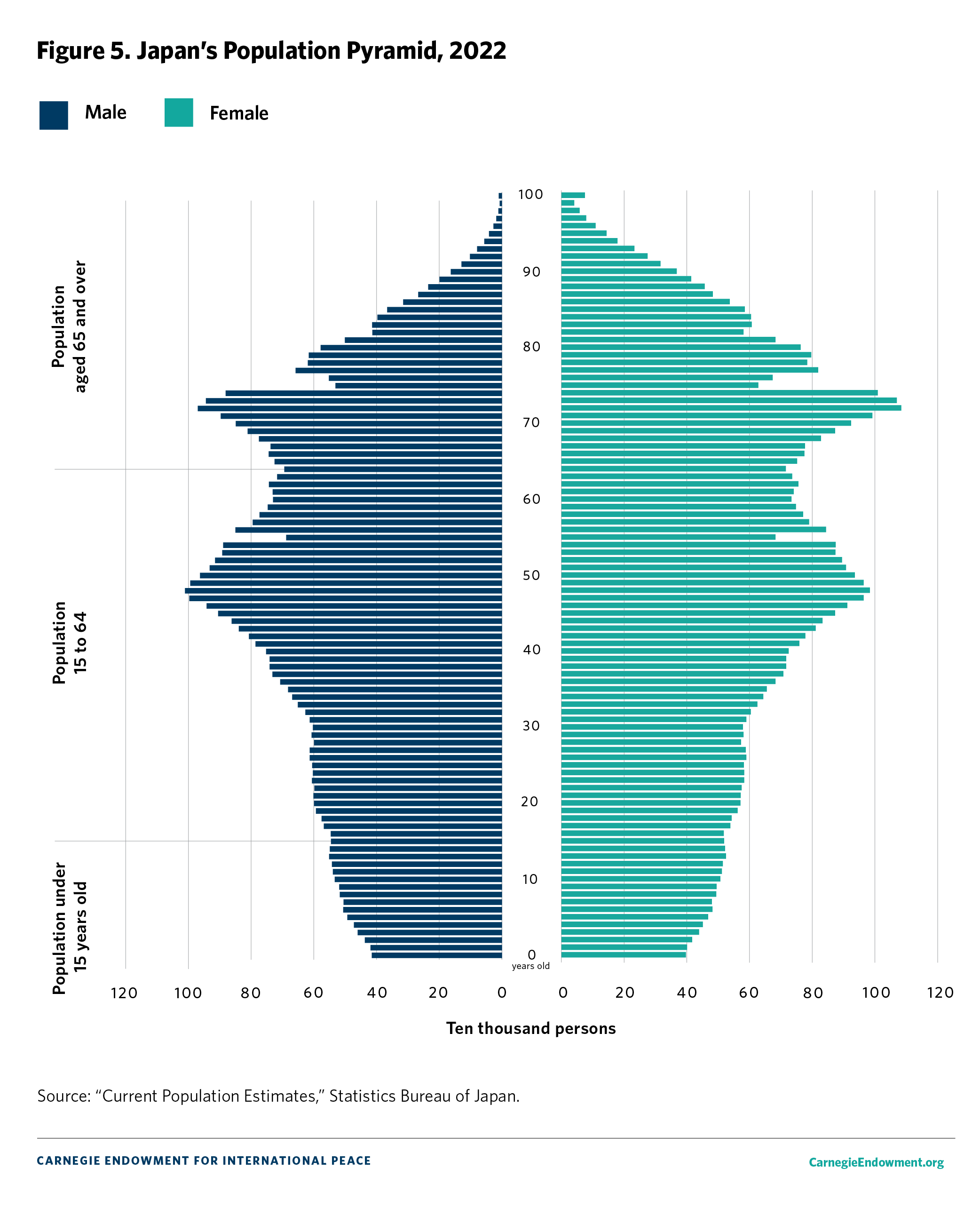

In addition to shrinking, Japan’s population is aging, with almost 30 percent of the population over age sixty-five in 2021. The government projects this number to grow to over 35 percent by 2040.27 Japan’s population pyramid is inverted, with a markedly smaller base of younger people supporting a larger older population (see Figure 5).

The aging population strains the tax base, as a high proportion of retirees must be supported by a decreasing number of workers. Healthcare costs are projected to spiral upward, given the higher costs associated with elderly populations.

A Closer Look: Aging Households, Elderly Living Alone

Yet, aggregate population age distributions only tell part of the story. For example, there can be significantly different needs for households in which the entire household is older, households in which one or two older adults are part of a household consisting of multiple generations, and those which consist of older adults living alone. In Japan, the number of each of these types of households is growing rapidly.

Currently available data does not distinguish between households with one or more senior members in multigenerational households and households in which the entire household of more than one person are older adults. However, the sum of these two—the number of households with one or more members over age sixty-five—accounted for 49.4 percent of all households in 2019, or 25.6 million households,28 roughly the same number of total households, regardless of age, as in Italy in 2021.29

Put simply, approximately half of Japanese households have at least one elderly member—the number of such households is equivalent to the entire population of Australia.

Multigenerational households with one or more senior residents are likely to face a variety of needs for home eldercare. Family members taking care of older adults are usually not eldercare professionals and lack training; thus, they have significant information needs about caring for seniors, as well as the need to support the physical movement of seniors, which can cause a variety of injuries to family caregivers without training. The desire or need to pursue employment while taking care of older members of the household also leads to the need for workplace arrangements that enable this situation.

Government data details the dramatic rise in the number of older adults (defined as sixty-five and older) living alone. In 2020, 22 percent of women over sixty-five and 15 percent of men over sixty-five were living alone, an increase from 11 percent (women) and 4 percent (men) in 1980, and 16 percent (women) and 6 percent (men) in 1995. The government projects that by 2040, 25 percent of women and 21 percent of men over sixty-five will be living alone.30 This is around 5.4 million women and 3.6 million men over age sixty-five living alone—roughly equivalent to the current population of Austria (see Table 1).31

| Table 1: Proportion of Men and Women Age Sixty-Five and Above Living Alone in Japan | ||

| Year | Men Age 65+ Living Alone | Women Age 65+ Living Alone |

| 1980 | 4% | 11% |

| 1995 | 6% | 16% |

| 2020 | 15% | 22% |

Source: “令和4年版高齢者社会白書”[White Paper on Aging Society (Reiwa 4 Edition)], Cabinet Office, Government of Japan, accessed May 3, 2024, https://www8.cao.go.jp/kourei/whitepaper/w-2022/zenbun/pdf/1s1s_03.pdf. | ||

This population distribution will create a wide range of needs for healthcare, communications with family or relatives, and logistics management of home care, physicians, and assistance in daily life, including mobility within the home and around in the community, as well as entertainment and pastimes for mental and emotional well-being.

Rural Extremes of Aging

The aging of Japan is more acute in predominantly rural prefectures. The data for the proportion of the population above sixty-five by prefecture shows that, in 2022, Akita Prefecture and Kochi Prefecture had the highest populations of senior citizens, at 38.6 percent and 36.1 percent, respectively, followed by Yamaguchi Prefecture (352 percent), Tokushima Prefecture (35.0 percent), and Aomori Prefecture (34.8 percent). In comparison, Tokyo was 22.8 percent and Osaka 27.7 percent.32 The Cabinet Office’s estimate for 2045 is that the proportion of residents over age sixty-five will reach 50.1 percent in Akita Prefecture and 46.8 percent in Aomori Prefecture, while Tokyo and Osaka’s proportions rise to 30 percent and 36 percent, respectively (see Table 2).

| Table 2: Prefectures with the Highest Proportion of Senior Citizens, 2021 and 2045 Estimates | ||

| 2022 (%) | 2045 Estimate by MIC | |

| Akita | 38.6 | 50.1 |

| Aomori | 34.8 | 46.8 |

| Kochi | 36.1 | 42.7 |

| Yamaguchi | 35.2 | 39.7 |

| Tokushima | 35.0 | 39.7 |

| Tokyo | 22.8 | 30.7 |

| Osaka | 27.7 | 36.2 |

Source: “令和5年版高齢者社会白書”[White Paper on Aging Society (Reiwa 5 Edition)], Cabinet Office, Government of Japan, accessed May 4, 2024, https://www8.cao.go.jp/kourei/whitepaper/w-2023/zenbun/pdf/1s1s_04.pdf. | ||

The scale and magnitude of Japan’s aging, especially when considered at a household and regional level, are truly extreme.

Tokyo’s Massive Elderly Population and Depopulation of Rural Areas

Over the past couple decades, Japan’s primary cities of Tokyo, Osaka, and Nagoya were growing, but almost everywhere else shrank. As of 2022, roughly half of Japan’s population lived in these three metropolitan areas, and approximately 30 percent of the nation resided in the broader Tokyo area.

On the one hand, the scale of urban Tokyo in comparison to other major cities around the world shows how large it is. As the population ages, the sheer number and proportion of elderly residents will create a substantial range of needs for urban eldercare.

| Table 3: Urban Population in 2018 | |

| City | Millions |

| Tokyo | 34 |

| Osaka | 19 |

| Delhi | 30 |

| Shanghai | 27 |

| New York (including Newark) | 19 |

| Paris | 11 |

Source: “World Urbanization Prospects 2018,” United Nations Department of Economic and Social Affairs, accessed April 23, 2024, https://population.un.org/wup/. | |

On the other hand, rural Japan’s population decline is driving younger rural Japanese to move to urban areas in search of better jobs and healthcare, further accelerating rural depopulation. The Japanese government keeps track of home registration addresses of its residents, and in 2022, the Tokyo metropolitan region, including adjacent prefectures of Kanagawa, Saitama, and Chiba, marked the twenty-seventh consecutive year of Japanese nationals moving into the region from other parts of the country—a trend that was briefly interrupted by the economic bubble bursting in 1990 and the global financial crisis of 2008 that triggered a sharp recession in Japan, but which has continued before and since.33

In 2023, a government research institute predicted that Akita Prefecture, whose population has been shrinking the most rapidly among Japanese prefectures, would lose approximately 42 percent of its population by 2050. Its population was 960,000 in 2020, but it was predicted to fall to 560,000 by 2050. Following Akita, the populations of neighboring northern prefectures of Aomori and Iwate were predicted to fall by 39 percent and 35 percent, respectively, by 2050.34 With 40 percent to 50 percent of the population of these areas predicted to be over age sixty-five, the rural eldercare challenges are almost beyond a simple extrapolation of current eldercare solutions and facilities.

Immigration Not a Solution

Political dynamics within Japan have not led to large-scale immigration policies or an attempt to aggressively increase the number of foreign workers at a level necessary to ameliorate labor shortages. A new set of foreign worker programs enacted in April 2019 enables approximately 340,000 blue-collar workers to enter fourteen sectors in Japan, including nursing, restaurants, retail, construction, and others.35 A separate trainee program brought around 480,000 people to Japan between 2013 and 2017. Cabinet Office estimates place the current worker shortages at around 1.2 million people in sectors such as agriculture, construction, hotels, and restaurants.36 However, these efforts are insufficient to fill the gap of millions of workers projected to meet labor needs; one estimate from a survey by a consulting firm and Chuo University puts the number at 6.4 million workers by 2030.37

After the COVID-19 global pandemic hit in the spring of 2020, Japan essentially closed its borders to all incoming non-Japanese citizens that fall. This not only suddenly decreased the inflow of non-Japanese workers, but also had a chilling effect on training programs outside Japan for specialized positions such as nursing and eldercare. While the government resumed foreign worker programs as the pandemic subsided in 2022 and 2023, entailing the removal of most border restrictions, the numbers remain far below the population replacement rate or the gaps in worker needs.38

Spiraling Healthcare Costs

Healthcare costs are also estimated to spiral upward given Japan’s universal healthcare scheme. Healthcare costs for people over sixty-five are four times that of people under sixty-five, so as the sheer number of elderly people increases, costs increase far faster. Medical costs as a proportion of gross domestic product (GDP) surged from around 5 percent in the 2000s to 8.18 percent in 2021.39

The need to reduce government expenditures in the context of massive fiscal deficits also creates political tailwinds for regulatory structures and government policies to accelerate the deployment of labor-force-augmenting technologies.

Automation and Augmentation Across Sectors

The rapidly decreasing availability of skilled labor, and the geographic mismatch between labor needs and potential labor supply, are driving a trajectory of technological development and deployment in which Japan leads the world.

The following cases are paradigmatic examples of the dynamics underway in sectors including construction, agriculture, transportation and trucking, healthcare, eldercare, and land.

Construction

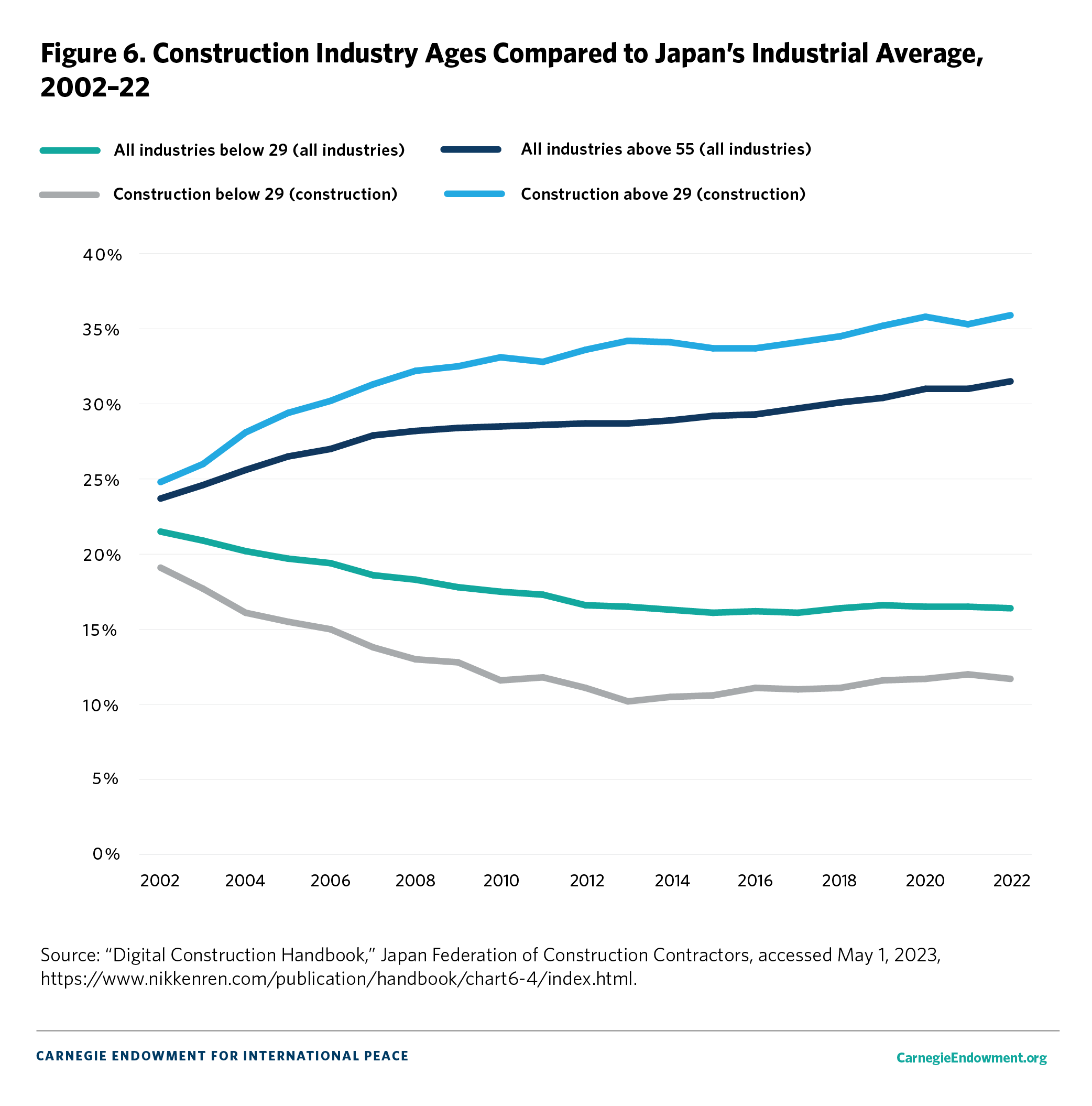

Compared to Japanese industry overall, the construction industry confronts the steepest rise in aging of its workforce. The proportion of workers above age fifty-five was 36 percent in 2022, rising from 25 percent in 2002. Over the same time span, the proportion of workers below age twenty-nine decreased from 19 percent to slightly less than 12 percent.

Upskilling with IT-Enhanced Heavy Machinery

In the construction industry, the average age of operators of equipment such as bulldozers and excavators is dramatically rising. Labor shortages that led to delays in construction projects motivated the leading construction equipment manufacturer Komatsu to pioneer several deployments of IT-enabled equipment.40 The focus was on worker augmentation—enabling low-skilled workers to perform tasks that previously required experienced operators.

From 2013, Komatsu introduced a line of “ICT (Information and Communications Technology) Construction Equipment” that enabled worker upskilling. Carving precise angles in hillsides using excavators, for example, previously required up to a decade of experience. With the operator sitting facing the slope without a side view, and multiple joints in an excavator arm and bucket, the seemingly straightforward act of carving a hillside at a precise angle was fraught with high skill requirements. The ICT excavator, introduced in 2014, uses sensors embedded in numerous places on the equipment to assist the operator in making a dig. The operator simply positions the bucket at the beginning point of the dig and pushes the “semi-auto” mode button on the console. The digger proceeds to dig according to the prescribed angle on its own.

This operation is not fully automated; the operator must position the bucket in the desired location before commencing the cut. The operator must also identify the presence of large rocks or debris that may affect the dig. However, these tasks are more easily performed by humans than is development and deployment of AI algorithms to identify such obstacles. Therefore, the ICT excavator is not aimed at fully automating the operation—it was deployed to close the skill gap between available operators and the skills needed to perform advanced tasks.

Similarly, ICT bulldozers, introduced in 2013, embedded the skill necessary to create flat surfaces into the machine itself. Traditionally, an operator needed years of experience to make manual and constant adjustments to the bulldozer blade, since the weight load and resistance of dirt increases as more dirt is pushed forward. With the “ICT Bulldozer,” the computer-controlled blade adjusts itself, requiring only that the operator move the bulldozer; surfaces end up flatter than most experienced professionals can achieve.

Komatsu sells equipment throughout the world, marketing systems developed to solve problems within Japan—an example that highlights the dynamic of a Japanese company solving domestic problems, while simultaneously gaining global success as a leader in the technologies it develops.

Automating Construction Site Material Haulage, Partnerships with Silicon Valley

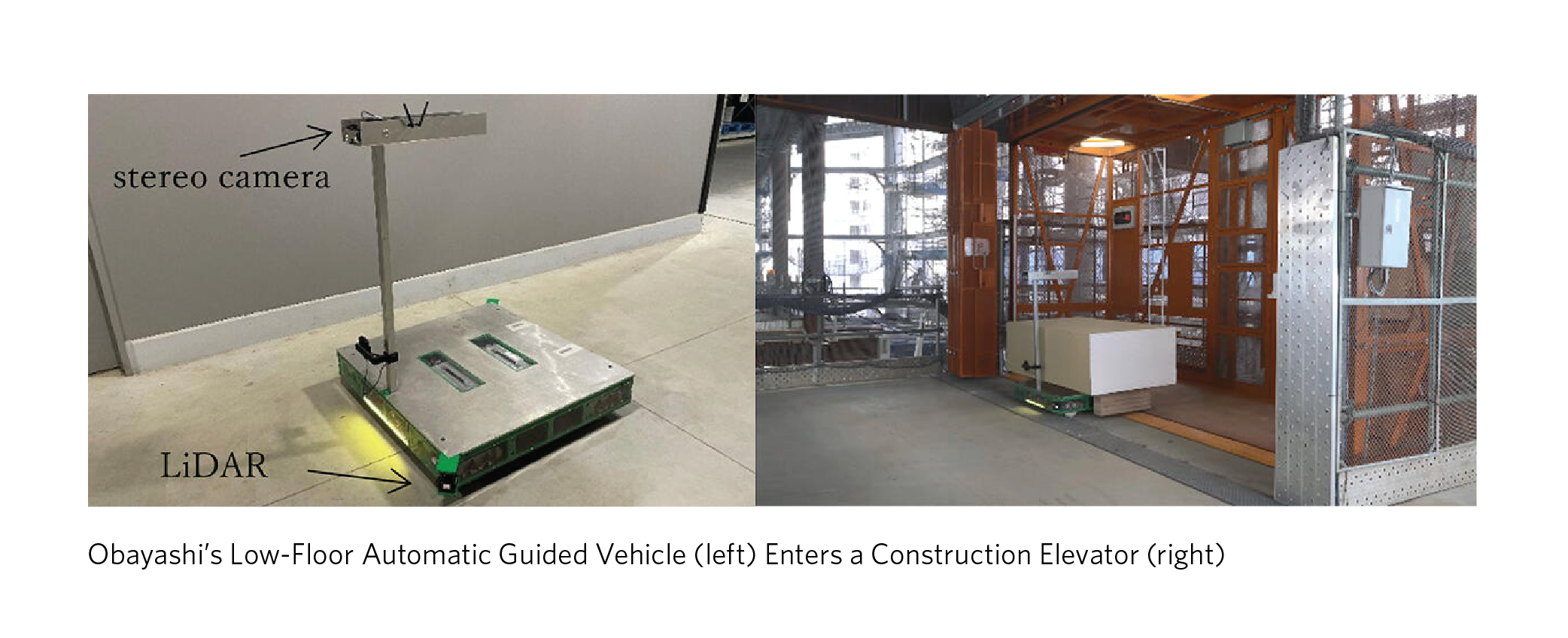

Obayashi, one of Japan’s major construction companies, in cooperation with SRI, a Silicon Valley research institute with extensive experience in AI software, co-developed autonomous hauling vehicles for construction sites.

Moving heavy construction materials in sites such as high-rise buildings traditionally required one person on each corner, with a manually pushed or electronically controlled trolley to move the material. The overall labor shortage, and higher likelihood of workers sustaining injuries as they grow older, were key motivations for Obayashi’s development of autonomous hauling vehicles—machines that can carry various materials around the construction site.

Autonomous hauling robots are already common in manufacturing plants or massive warehouses such as those of Amazon. However, construction sites are far more treacherous environments than the carefully controlled indoor factories and warehouses—floor plans can change overnight, wireless communications coverage can be spotty, and temporary obstacles can appear at any time. The technical challenge in developing autonomous hauling robots was much greater.

SRI, originally Stanford Research Institute, but spun out of Stanford University in the 1970s, has historically specialized in varieties of AI. The voice assistant Siri was originally developed at SRI before spinning out and being acquired by Apple.

Obayashi partnered with SRI to create autonomous hauling robots for construction sites, with Obayashi providing the hauling robot, and SRI contributing the AI and sensors. The resulting autonomous hauling robot not only eliminated the need for workers to accompany it, but could also take the elevator by itself with just an elevator operator. It turns out that a bottleneck on construction sites is the slow-moving construction elevator, designed to carry both people and material. Morning traffic jams, as workers head to their respective floors of a high-rise construction site, are exacerbated by the need to also transport bulky construction material; bottlenecks can last more than an hour as workers wait for transportation to their work floor. The autonomous hauling robot can move construction material overnight, eliminating bottlenecks and contributing to higher worker efficiency.

Construction Partnerships with Silicon Valley: Drones Making 3D Maps and Autonomous Dump Trucks

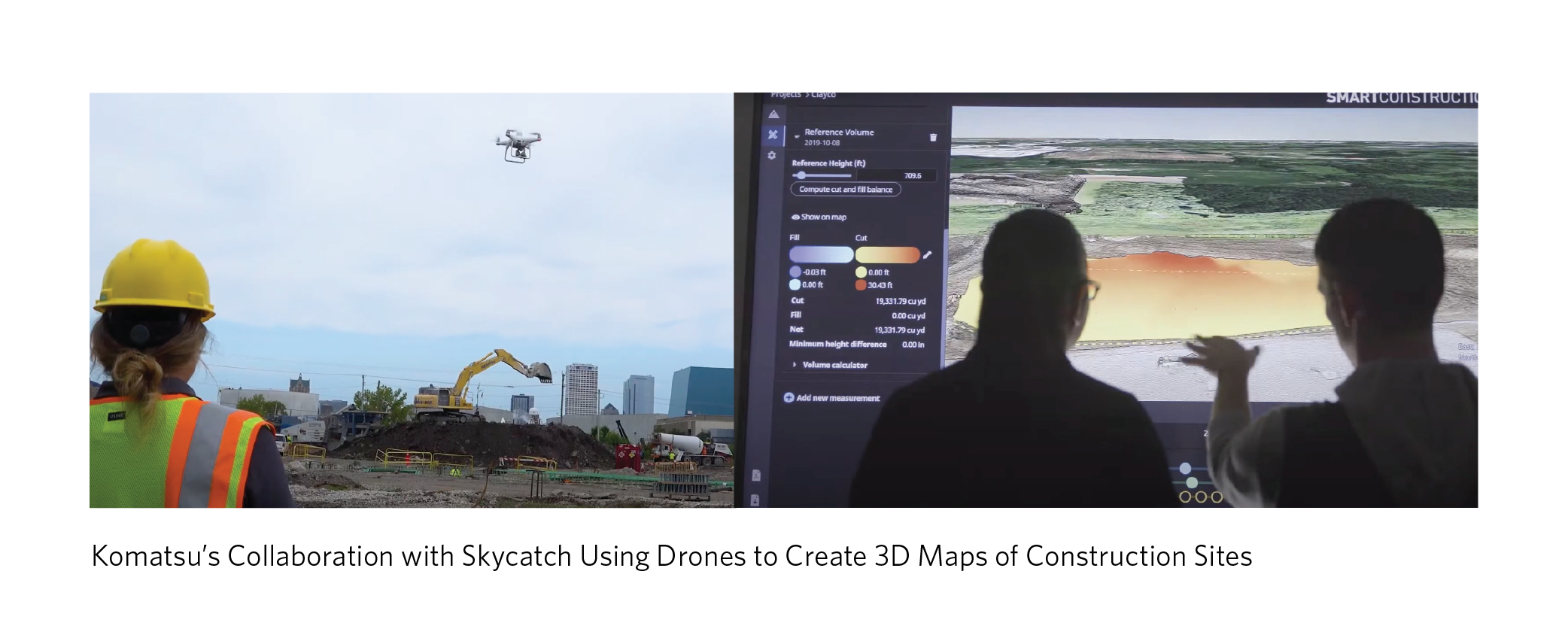

Partnerships with Silicon Valley have been prominent for Japanese construction-related firms. The combination of labor shortages facing Japanese firms, their global reach, the strengths in software of Silicon Valley firms, and the relatively low levels of regulation in construction or mining sites created market opportunities for collaboration.

For example, construction equipment firm Komatsu partnered with Silicon Valley drone platform company Skycatch to create three-dimensional (3D) maps of construction sites throughout Japan. The use of drones dramatically reduced the time and labor intensity needed for taking measurements in outdoor construction sites; numerous workers using tripod-mounted measurement devices requiring weeks to take measurements were replaced by a twenty-minute procedure of launching a drone, a tactic that could be performed frequently. Komatsu met Skycatch in late 2014 through the Silicon Valley-based venture capital company it had invested in, and by 2016 the partnership was deployed commercially. By mid-2021, over 26,000 construction sites around the world, including sites in Germany, had used this technology.41

Construction firm Obayashi partnered with SafeAI, a Silicon Valley start-up that outfits existing construction vehicles with sensors and various equipment that enables autonomous operation. The partnership began in 2020 with proof-of-concept trials using Caterpillar equipment in Santa Clara, California, in the mountains above Silicon Valley in November 2021. In 2022, Obayashi and SafeAI performed a demonstration in Japan, with 150 industry and government participants.

Obayashi set up an investment and research lab in Silicon Valley—the Silicon Valley Ventures & Laboratory—in 2017. It invested in venture capital firms specializing in construction technology such as San Francisco-based Brick and Mortar Ventures and Boston-based Building Ventures. Obayashi held a start-up pitch competition and demonstration project called the Obayashi Challenge in 2017. This was a useful mechanism for them to meet start-ups working on construction-related technologies, although SafeAI was introduced through a venture capitalist in which Obayashi invested.

Japanese Government Support for IT Deployment in Construction

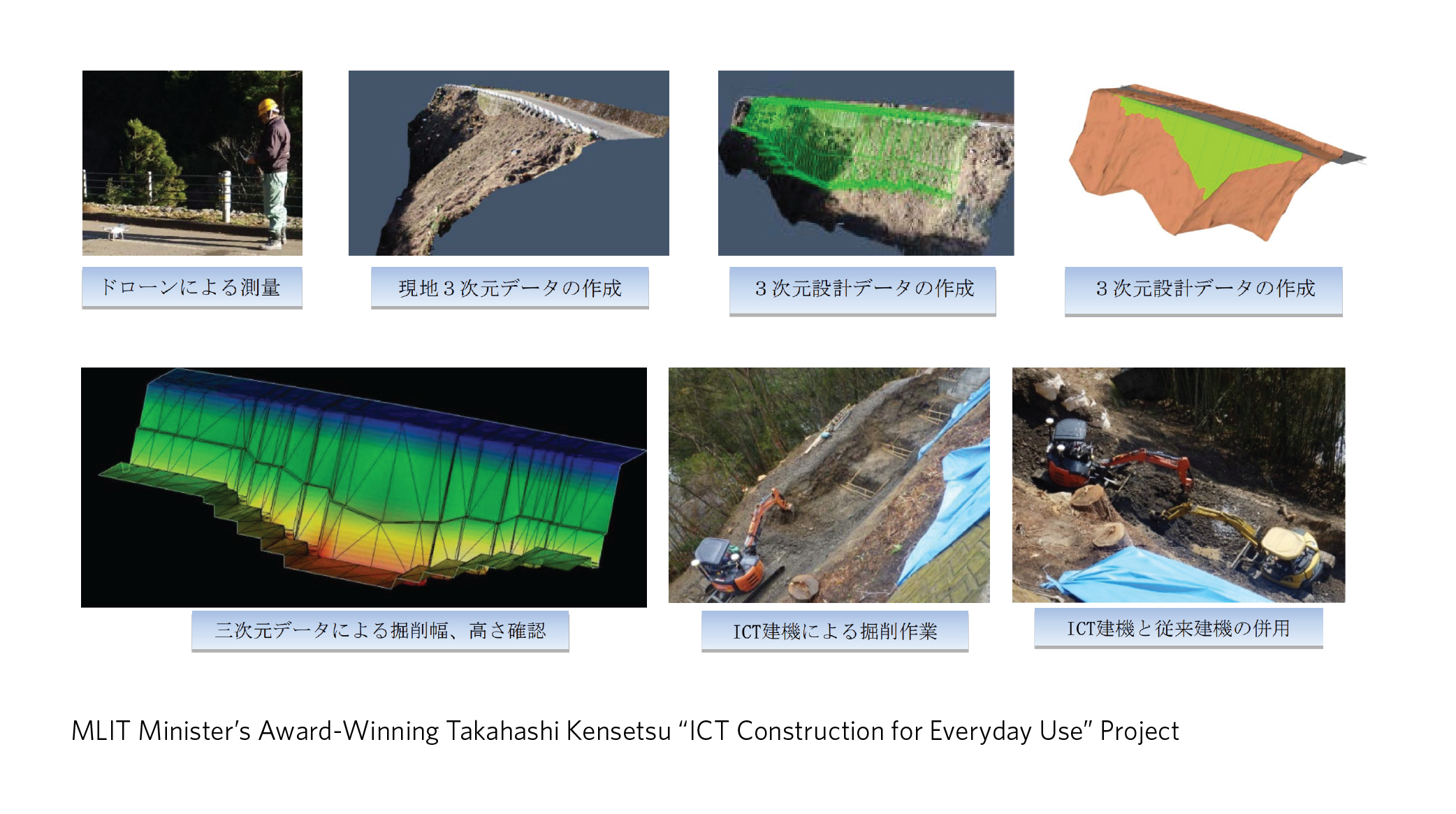

Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) fully supports efforts by the construction industry to deploy IT for increased productivity and enhanced workflows.

In 2016, MLIT announced an initiative called “i-construction” to facilitate the use of technologies such as sensors, network connections (the Internet of Things, IoT), and AI to increase productivity. The explicit motivation for the initiative, as listed in the opening of the document, is the shrinking and aging of the workforce that creates a pressing need for increasing worker productivity. The initiative calls for the use of information technologies in planning and construction, optimization of logistics and processes, and elimination of obstacles in construction processes. Driven by MLIT, an “i-construction consortium” was established, with 1,193 firms, sixty-four government entities, and thirty-seven expert members as of November 2022, organized into three working groups: technology development and deployment; 3D data generation and trade; and overseas standards.42

The annual MLIT Minister’s Award, along with several other awards, recognizes exemplary projects. The 2022 award, as an example, went to Takahashi Kensetsu, a company in Shikoku, for its project to widen a road on a steep cliff. The road was the only access for a small hamlet, and severe cracking had caused safety concerns. Drones were used to survey the steep cliff below the road, reducing the original twelve days required to perform the survey by five days while increasing the safety of workers. A detailed 3D model of the terrain shortened the time usually used to rework the construction designs and make decisions about where to place drainage pipes and other infrastructure, cutting several more days from the process.43

Agriculture: Extreme Demographic Shift and Need to Transform Work

Japan’s farming population is aging and shrinking to an astonishing degree. The farming population decreased sharply, from 2.05 million in 2010 to 1.23 million in 2022. The average age of farmers—individuals for whom farming was their primary occupation—was sixty-seven in 2015, rising to an estimated 68.4 in 2022.

Especially given that Japan’s food self-sufficiency as measured by caloric intake is 40 percent, and that high-end agricultural products are finding lucrative markets in China and other parts of Asia, the government and private sector are moving to transform the nature of farm work. While corporate farming has increased, the noncontiguous small agricultural plots common to Japan’s mountainous topography hinder large-scale farming that uses massive equipment—the northern island of Hokkaido is an exception.

In recent years, the age distribution within this shrinking population has risen acutely. In 2022, 70 percent of farmers were above age sixty-five, up from 61 percent in 2010. This compares to an estimated 34 percent in the United States and 9 percent in Germany of farmers over age sixty-five.44 A further break down of statistical proportions shows that farmers in Japan above age seventy-five comprised 33 percent of the total in 2022, up from 29 percent in 2010. It is difficult to imagine a more extreme aging segment of population engaged in economic activity.

| Table 4: Age of Primary Farmers in Japan, 2015–21 | ||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Average Age of Farmers | 67.1 | 66.8 | 66.6 | 66.6 | 66.8 | 67.8 | 67.9 | 68.4 |

Source: “令和4年度 食料・農業・農村の動向” [Reiwa 4th Year Trends in Food, Agriculture, and Rural Areas], White Paper, Ministry of Agriculture, Forestry and Fisheries, Government of Japan, 2023, https://www.maff.go.jp/j/wpaper/w_maff/r4/pdf/zentaiban.pdf. | ||||||||

| Table 5: Total Farming Population and Distribution of Ages, 2010-2022 | |||||

| 2010 | 2015 | 2020 | 2021 | 2022 | |

| Total Farming Population (thousands) | 2,054 | 1,757 | 1,363 | 1,302 | 1,226 |

| Distribution of Ages (percent of total) | |||||

| Above 75 | 29.0% | 31.3% | 31.7% | 31.5% | 32.9% |

| 65–74 | 32.5% | 33.6% | 37.9% | 38.0% | 37.3% |

| 50–64 | 28.2% | 25.2% | 19.6% | 19.1% | 18.4% |

| 15–49 | 10.4% | 9.9% | 10.8% | 11.4% | 11.4% |

Source: “令和4年度 食料・農業・農村の動向” [Reiwa 4th Year Trends in Food, Agriculture, and Rural Areas], White Paper, Ministry of Agriculture, Forestry and Fisheries, Government of Japan, 2023, https://www.maff.go.jp/j/wpaper/w_maff/r4/pdf/zentaiban.pdf. | |||||

Corporations have increased their presence in Japan’s farming, but do not compose the majority of farming value or area. The proportion of land cultivated by corporations increased from just below 10 percent in 2010 to 24.9 percent in 2022. Unsurprisingly, corporate farms had larger plots than individuals, with higher sales.

Just over 10,000 people below age forty-nine became fulltime farmers for the first time in 2021, and of those, 51 percent came from other occupations and 21 percent were previously students.45

The amount of cultivated agricultural land in Japan has been decreasing, as shown in Table 6. The decline in farming population is contributing to an abandonment of fields.

| Table 6: Total Cultivated Agricultural Land in Japan, 2015–21 | |

| Year | Millions of Hectares |

| 2015 | 4.5 |

| 2016 | 4.47 |

| 2017 | 4.44 |

| 2018 | 4.42 |

| 2019 | 4.40 |

| 2020 | 4.37 |

| 2021 | 4.35 |

Source: “農地に関する統計” [Statistics on farmland], Ministry of Agriculture, Forestry and Fisheries, Government of Japan, accessed April 23, 2024, https://www.maff.go.jp/j/tokei/sihyo/data/10.html. | |

A surprising amount of Japan’s farmland is unregistered. According to data gathered by the Ministry of Agriculture, Forestry and Fisheries in 2016, about 930,000 hectares, or approximately 20 percent of the total farmland area in Japan, was either unregistered or thought to be unregistered. Out of this land, approximately 54,000 hectares is not being utilized.46

Several factors contribute to an increase in unregistered land. In some cases, family or relatives may have been unwilling to register the inheritance of farmland, for which they would need to pay high inheritance taxes. In other cases, no family or relatives existed to register the land. Since decentralized land registration records are kept in local government offices, family members or relatives may neglect checking these records to see whether the deceased members held parcels of agricultural land.

Skill Augmentation and Industry Convergence in Agriculture: Transforming Wet Rice Farming

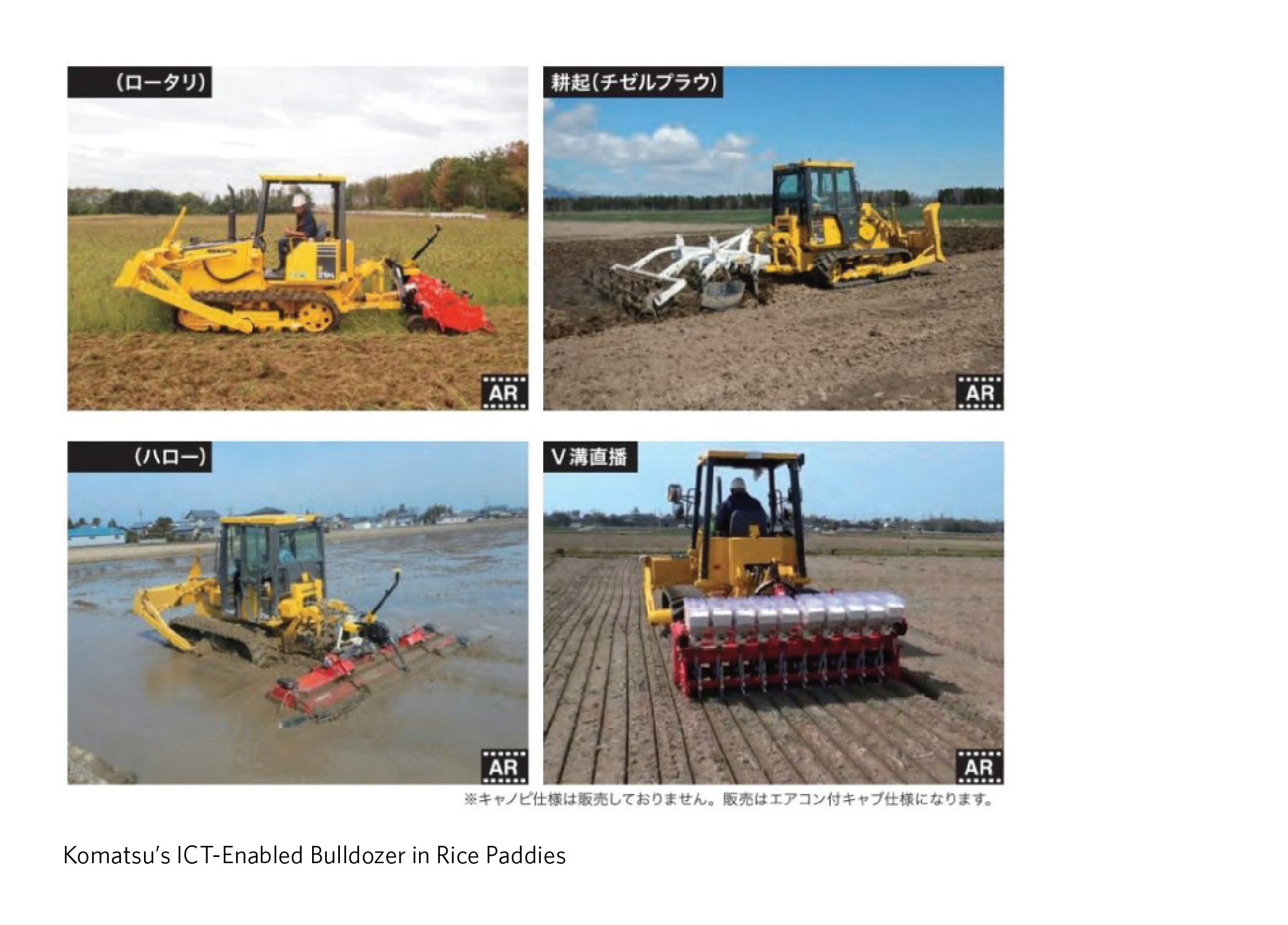

Komatsu has been undertaking efforts in agriculture to deal with the need to increase the productivity of agricultural workers, as well as to better utilize land—a surprising proportion of which is being abandoned.

Initially, as part of its efforts in corporate social responsibility and to reward Ishikawa Prefecture, where Komatsu was founded and which is experiencing rapid aging and depopulation, the company began applying industrial thought processes to the problem of raising the incomes, and thereby the productivity, of farmers. A study of the cost structure of rice farming found that transplanting seedlings into water-drenched rice paddies was the costliest and most labor-intensive process. The reason for transplanting was that water-drenched paddies were not productive for raising rice from seeds; the seeds would not remain in neat rows, and were often eaten by birds, resulting in low and uneven yields. (The purpose of having rice paddies water-drenched in the first place is to keep out most types of weeds.)

Komatsu’s experiments showed that their industrial ICT-enabled bulldozers could make the surface of rice paddies almost completely flat—something not previously possible. The flat surface, with an angular groove cut into the paddy, meant that rice could be planted from seeds without production loss. The cost savings were approximately 40 percent. Taking bulldozers into rice paddies was an idea that the agricultural sector would not have instigated. Moreover, compared to small agricultural tractors, industrial bulldozers turned out to be lower in cost and more durable, with little skill necessary for operation, since the blade is automatically controlled.

The next step in this line of deployment is conversion of rice paddies into dry fields for a variety of other crops, depending on relative market prices. Flooded rice paddies need not remain rice paddies if they are maintained by bulldozers, and they can be converted to grow wheat, barley, buckwheat, potatoes, or other crops, depending on weather patterns and relative prices. This upends Japan’s traditional practice of maintaining wet rice farming fields without crop rotation.

Within Japan, the problem of unused and abandoned agricultural land is also a result of population aging and shrinking. With the use of bulldozers to maintain fields, farming tasks can be scaled up.

Finally, at the Nikkei Agritech Summit in 2018, the chairman of Komatsu announced that the company was taking the agricultural business into Indonesia—a very large country with many islands, crops, and small-scale farmland that includes flooded rice paddies.47 In 2019, Komatsu’s branch in Indonesia began testing and cultivating rise using the ICT bulldozers.48

Agritech Linkages to Silicon Valley

Japan’s agricultural machinery firm Kubota, which focuses on small- and medium-size equipment, is actively cultivating ties with Silicon Valley and California through agritech investments into start-ups. Kubota established the Kubota Innovation Center Silicon Valley in 2021 following the establishment of its overall innovation center in 2019.

In recent years, Kubota has grown more in overseas markets than in Japan. In 2022, its revenue from global markets was more than three times larger than domestic revenue, with ¥2.08 trillion from operations overseas in 120 countries, and ¥602 billion in Japan.49 In 2018, domestic revenue was ¥577 billion in the Japanese market, with ¥1.27 trillion from overseas, making it just over double the domestic market.50 In the first quarter of 2023, Kubota’s revenue in the United States grew 100 percent from the previous year.

As Kubota entered global markets, it sought to differentiate itself by investing in Silicon Valley agritech firms. It partnered with SVG Ventures, a venture capital firm based in Silicon Valley that also runs Thrive, a start-up acceleration program. With the help of SVG Ventures, Kubota invested in several Silicon Valley start-ups, not simply to obtain technologies and businesses for use in Japan, but to be an active player in California’s specialty crop industry. While global agricultural equipment firm John Deere focuses on large equipment at large scale, Kubota’s strategy is to focus on high-value specialty crops, a good fit in California.

One of Kubota’s investments is Advanced Farm Technologies, which makes robots to assist in harvesting fruit, with strawberries and apples as growth areas. Kubota also invested in Bloomfield Robotics, a company using digital imaging and artificial intelligence to monitor the health and performance of crops using cameras mounted on tractors and other farm equipment. By early 2023, Kubota had invested in five Silicon Valley–based agritech start-ups, and in September 2024, Kubota acquired Bloomfield Robotics outright—its first merger orchestrated by the Silicon Valley office.51

Government Support for ICT-Enabled Farming

The Japanese government is actively promoting the use of IT in farming. In 2019, the Ministry of Agriculture, Forestry and Fisheries established an Agriculture New Technology Field Implementation Promotion Program as an industry-university-government information exchange platform for smart agriculture. The Smart Agriculture Project within the program includes developing farmland infrastructure and IT-enabled agriculture, such as autonomous driving, data usage, and upskilling.

Annual reports that detail promising pilot projects indicate the government’s support of research and technology deployment to raise productivity and sustain Japan’s agricultural sector by transforming the nature of work. Since Japan’s dependency on food imports amounts to approximately 60 percent of caloric intake, the Japanese government also faces a food dimension to agriculture.

In a 2023 report, an overview of the Smart Agriculture Project directly states challenges facing Japan: the decreasing agricultural population (from 11 million in 1960 to 1.36 million in 2020) and an aging farming population.52 In the introduction, the report identifies the growing amount of land per farmer that needs to be maintained; the large amount of manual labor, such as for sorting produce, difficult and dangerous tasks not conducive to easy automation; and high-skill requirements for operating equipment, all of which raise barriers to entry of newcomers. The key issues identified as crucial to smart agriculture are: (1) automation of tasks, such as robotic tractors, and irrigation infrastructure operated by smartphones; (2) easy data and information sharing, such as location-based data coupled with sensor-generated data from fields allowing even inexperienced personnel to monitor and optimize agricultural processes; (3) use of data, such as from drones and satellite imaging, for generating and analyzing sensor-generated and weather data; and (4) use of AI tools in optimizing crop growth and forecasting diseases.

Sample projects from the 2023 Smart Agriculture Project report are below.

Transportation and Logistics

The aging of Japan’s commercial drivers means labor shortages in transportation and logistics industries, creating pressure to fully automate vehicles, enhance productivity of drivers through every possible means, and deploy robots to automate deliveries.

The average ages of bus, taxi, and commercial truck drivers in Japan in 2021 were 53.0, 60.7, and 48.6, respectively. As Table 7 below shows, drivers worked long hours with relatively low pay. An eight-hour workday for five days a week is 160 hours for four weeks; professional drivers logged between twenty and forty-nine hours more than this per month. The average salary in Japan in 2021 was ¥6.18 million (approximately $56,200 at the average 2021 exchange rate),53 while bus and truck drivers’ salaries were in the ¥4 million range, and those of taxi drivers below ¥3 million. The proportion of women in all three categories was 4 percent or lower.

| Table 7: Japan’s Commercial Transportation Workers, 2021 | |||

| Buses | Taxis | Trucks | |

| Total number of drivers and maintenance personnel | 130,000 (as of 2020) | 270,000 (as of 2020) | 850,000 |

| Average age | 53.0 | 60.7 | 48.6 |

| Proportion of women | 2.2% | 4.0% | 3.6% |

| Hours worked per month | 180 | 176 | 209 |

| Average annual income (average 2021 exchange rate USD) | ¥4,040K ($36,844) | ¥2,800K ($25,480) | ¥4,460K ($40,786) |

Source: “令和4年度国土交通白書“[White paper on land, infrastructure, transport and tourism in Japan (Reiwa 4th edition)], Ministry of Land, Infrastructure, Transport and Tourism, accessed May 4, 2024. | |||

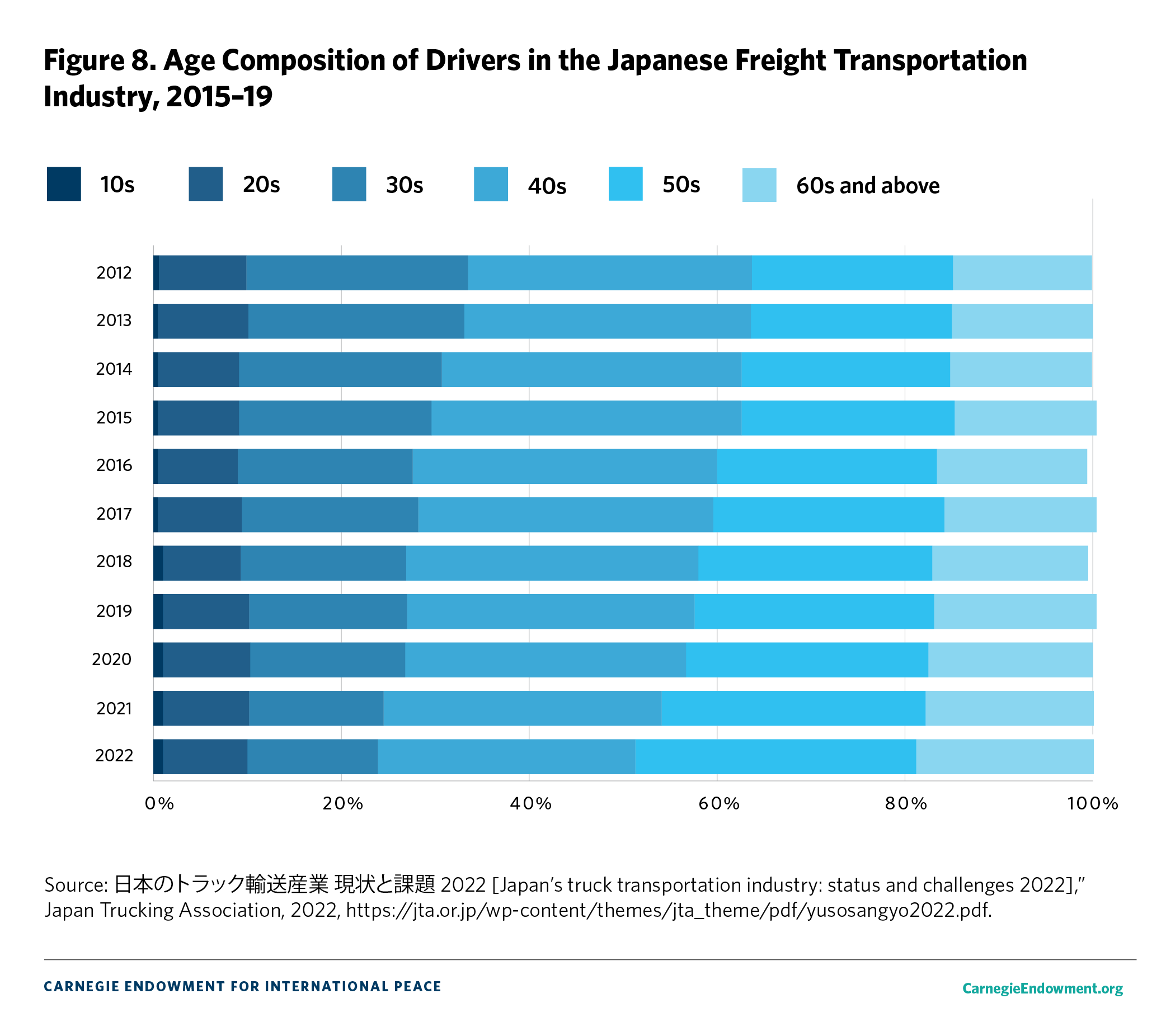

Especially in commercial trucking, the long, grueling hours, extended periods of time away from home, and low pay has made these occupations unattractive to younger workers. The proportion of drivers in their twenties fell below 20 percent after 2015, while the proportion of drivers in their fifties and sixties increased steadily, growing to over 40 percent.

Driver Augmentation: Truck Convoys and Self-Driving Expressway Lanes

Even before fully automated, driverless vehicles become a commercial reality, segments of the Japanese government have been actively engaged in supporting the technological augmentation of existing drivers through various means.

One method of driver augmentation is semiautomated truck convoys, in which one truck driven by a person is closely followed by one or more driverless trucks that are digitally tethered to the lead truck.

Multiple consortia of industry players, with the full support of the government, have been actively testing these technologies on public roads and expressways. Some tests involved non-Japanese firms as well.

In late 2018, Hino Motors, Isuzu Motors, Volvo Group’s UD Trucks, and Mitsubishi Fuso Truck and Bus, now a subsidiary of the Mercedes-Benz Group, began testing truck convoys outfitted with an array of sensors and software on expressways west of Tokyo. Toyota Tsusho, a trading company subsidiary of Toyota, coordinated the tests, with the full support of the Ministry of Economy, Trade and Industry (METI). Large 12-meter trucks were driven at 80 kilometers per hour in groups of four, making convoys 35 meters long. The 2018 “MLIT Transportation Policy White Paper” proposed a goal for perfection of the technology by 2020, with commercial deployment in 2022.54 Truck convoy technologies also promise lower fuel emissions since the trucks can closely follow the other trucks in the convoy.

By 2021, the project led by Toyota Tsusho, in collaboration with a start-up spun out of the University of Tokyo, Senshin Mobility (branded Advanced Smart Mobility in English),55 used Hino Motors vehicles and succeeded in testing convoys with driverless follower trucks.

In April 2023, the Japanese government announced that it would establish an expressway lane dedicated to self-driving vehicles beginning in 2024 on a 100-kilometer stretch of the Shin-Tomei Expressway, one of the transportation arteries linking Tokyo with Nagoya, Osaka, and western Japan.56

Self-Driving Buses as Solution to Driver Shortages

Self-driving vehicles are a focus in Silicon Valley, largely because of their potential profitability in transforming transportation on a global scale. In Japan, some of the most noteworthy efforts to create automated driving solutions are motivated by demographic challenges—the mobility needs of older adults and the shortage of bus drivers.

Odakyu, best known for operating trains and buses, but also a significant commercial/residential real estate developer and operator, partnered with Kanagawa Prefecture and Keio University to develop autonomously driven buses. SB Drive, a start-up, equipped buses from Hino Motors with sensors, such as GPS and millimeter wave radar. As part of Kanagawa Prefecture’s “Promotion of Robots in Society” initiative, Odakyu first tested the autonomous buses on Keio University’s Shonan Fujisawa Campus in June 2018.57

Three months later, Odakyu, in collaboration with Enoshima Electric Railway, an Odakyu group company, began testing the buses on public roads in the Enoshima area; Enoshima, an island connected to the mainland by bridge, is a popular tourist destination.58 In February 2019, around 700 residents took part in a test drive of the buses on 1.4 kilometers of residential streets in Tama City, a suburb of Tokyo, where Odakyu has a major presence.59 Tama City is well known as the site of Tama New Town, a major bedroom community built in the postwar rapid growth era and now one of the fastest aging areas in Tokyo.

Autonomous Taxis in Real-World Conditions

A partnership between Nissan and the Japanese internet company DeNA to develop a driverless taxi service led to Japan’s first field tests on public roads in March 2018. In 2017, DeNA and Nissan began developing a robo-vehicle rideshare service called Easy Ride. Much as in the popular rideshare apps Uber and Lyft, users can request rides by using the Easy Ride smartphone app; the vehicles that come to pick them up, however, are driverless. The service also allows users to inquire about local sightseeing destinations and to download available coupons through the mobile app. Operations are continuously monitored from a remote-control room.

DeNA and Nissan Motors have so far conducted two field tests. In the initial test, conducted in March 2018, 300 riders were picked up and driven around a 4.5-kilometer course in the Minato Mirai district of Yokohama.60 This was the first test in Japan of driverless vehicles on public roads with the participation of consumers.

Regulatory Support in Merging Industries: Cargo and Buses

The pathways from economic necessity or potential economic benefit to the creation of regulatory frameworks that enable industry and technology solutions to address problems are not automatic. Observers often note that, especially in the context of Japanese regulatory reform, vested interest groups successfully pressure political leaders to maintain bureaucratically driven restrictions on new services or new competitors, citing such pressure as a barrier to flexible economic adjustment amid new global competitive realities.61

For example, despite the aging of taxi drivers, and the scarcity of taxis in nonurban areas, services such as Uber and Lyft have been, in effect, shut out of Japan. Under current regulations, only licensed taxi operators are allowed to take passengers. Likewise, until 2017, passenger buses and cargo delivery vehicles were classified differently according to MLIT, and hybrid services in which buses could hold and deliver cargo were not permitted. A regulatory shift in 2017, however, enabled buses meeting certain criteria to carry over 350 kilograms of cargo. In the following two years, eight bus operators in six prefectures made use of this new regulatory environment.62

Even before the regulatory shift, Japan’s largest cargo operator, Yamato, had pioneered working with local bus companies in sparsely populated areas in Iwate and Miyazaki Prefectures, both facing significant depopulation. Citing the difficulty for bus operators to finance essential local operations in depopulated and aging communities, and the challenge of finding bus drivers and truck drivers in rural areas, Yamato proved that, with the removal of some seats, it could reliably help finance local bus operations by arranging cargo sharing in buses.63

After the regulatory shift of 2017, not only Yamato but also its competitor Sagawa Kyubin, and even the partially privatized postal operator Japan Post, joined in cargo sharing with local bus lines. The Japan Agricultural Cooperative, the powerful centralized entity handling everything from financing to logistics for much of Japan’s agriculture, also began utilizing space on express buses from regional areas to Tokyo to carry agricultural produce. In addition, Yamato has expanded into the use of refrigerated boxes on buses in Miyazaki to deliver freshly caught salmon to airports, from where they are sent to Hong Kong.64 These examples show that regulatory shifts in previously strictly regulated and segmented business areas are now actively enabling new corporate partnerships to pool resources for better use of limited labor forces, while also serving sparsely populated and rapidly aging areas.

Digitalization in Healthcare: Opening the Door to Transformation of Medical Care and Physician Labor Markets

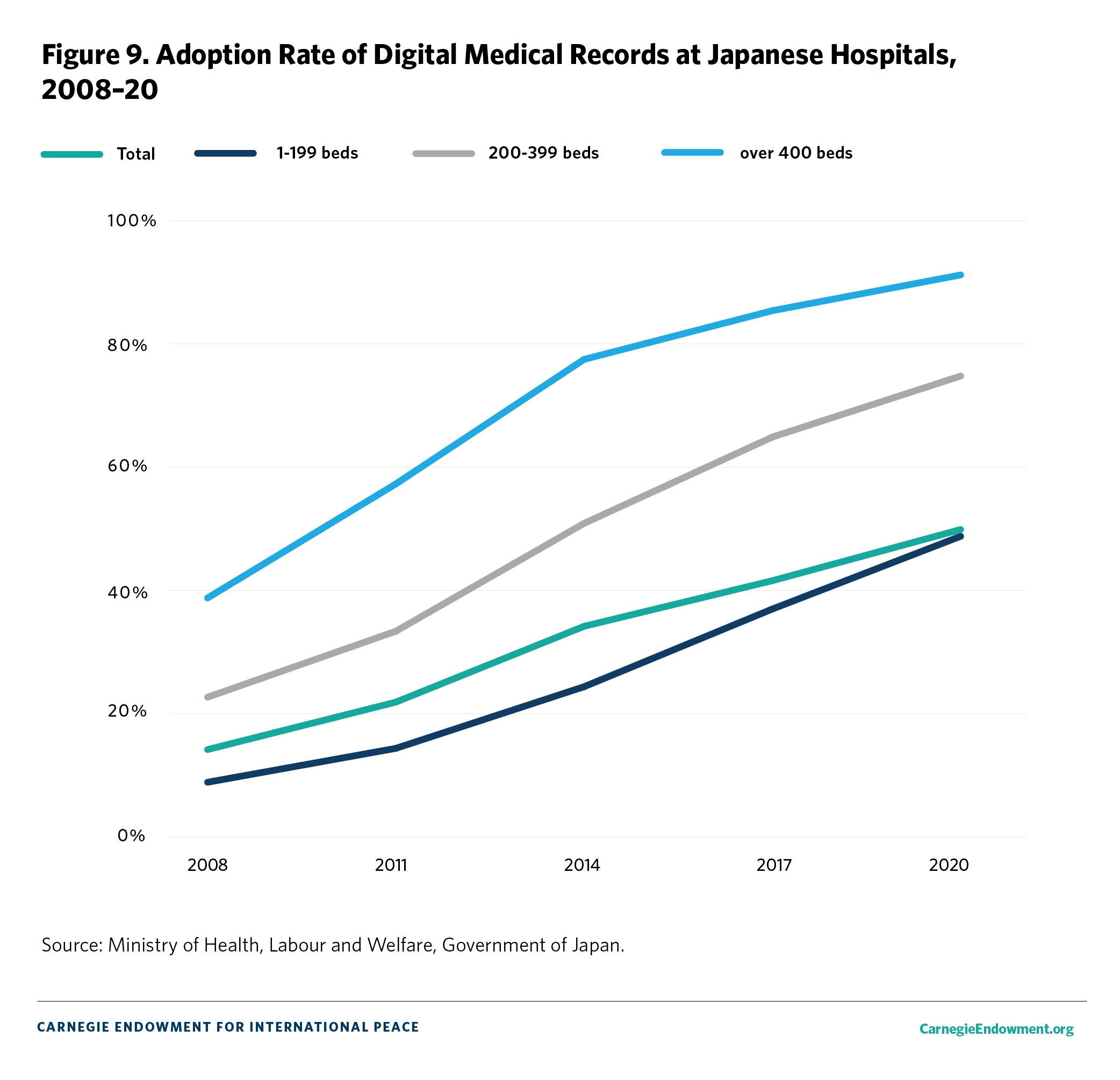

Adoption of IT in Japan’s healthcare system has been relatively slow, a pace often attributed to the large number of atomized small-scale clinics and hospitals. Such institutions exert political power through the Japan Medical Association, long recognized as one of Japan’s most powerful interest groups.

The diffusion of electronic health records has steadily expanded to roughly 50 percent, but online systems for reservations remained limited to 53 percent of all hospitals and clinics in 2020. Moreover, government estimates cited in a Nikkei news article showed 40 percent of the ¥40 trillion of Japan’s healthcare expenditures as labor costs.65 An internal breakdown of the digital health record adoption figures according to hospital size is revealing. As shown in Figure 9, while the adoption of digital records at large hospitals, with over 400 beds, rose rapidly from 20 percent in 2005 to 77.5 percent in 2014, adoption at hospitals with twenty to 199 beds rose from 4.8 percent to only 24.4 percent during the same period.

With the advent of global-scale cloud computing as a new, low-cost global infrastructure providing abundant computing resources at ever-lower prices, the cost of digitizing information is rapidly decreasing.66 This decrease has allowed several start-ups to offer digital patient record information to smaller clinics at low prices, enabling smaller hospitals and clinics to digitize patient records.

Once medical records are digitized, the path is open for offering a wide array of related services.

Medical Imaging and Remote Diagnosis: Transforming Both Diagnosis and Physician Labor Markets

One critical medical area where automation can have a large impact is cloud-based medical imaging services that share medical imaging data among hospitals and clinics, enabling remote diagnosis. The start-up Medical Network Systems (MNES) provides such a system, called Lookrec. Clinics and hospitals that contract with Lookrec upload patients’ medical images to a system built on a Google Cloud platform. Uploaded images are then used by medical doctors employed by MNES to make diagnoses.

Japan has one of the highest per capita installations of medical imaging hardware—MRIs, CT scan machines, etc.—but it faces an imbalance of having far more machines than radiology and pathology specialists who can make diagnoses. MNES founder Dr. Naoyuki Kitamura was motivated by one of his patients, a woman in her late thirties whom he diagnosed with late-stage, terminal pancreatic cancer. She had brought in an MRI that was scanned six months earlier but was marked as “no abnormality.” Upon research, however, Kitamura realized that the small, rural hospital where the patient had received the MRI and the diagnosis had no specialist, whereas Kitamura could easily identify the signs of developing cancer.67

Lookrec, given its cloud architecture and web-based front end, is low-cost, enabling medical institutions to easily share and maintain medical data, while also enabling patients to retrieve their own medical data. Because it is on a Google platform, Lookrec can be accessed anywhere, should people require overseas attention or treatment. Critically, services like MNES can address a mismatch between the workforce of doctors and the patients they need to serve. MNES employee physicians do not have to live near the patients they diagnose and are not constrained by hospital working hours. According to Kitamura, a significant cause of the shortage of diagnostic radiologists and pathologists is that female physicians tend to leave the field after marriage and childbirth—largely due to the extremely long and unpredictable working hours. Moreover, according to Kitamura, these female physicians with children tend to prefer living in urban areas so they can send their children to the best schools, making them even less likely to practice medicine in rural areas. When employed by MNES, however, working physician mothers have the job hours and locational flexibility that enables them to continue working.68

Healthcare and Eldercare Logistics Optimization

Japan’s demographic shift creates an acute need to coordinate logistics among caregivers. Kanamic Network provides an IT service that enables information sharing between municipalities, medical associations, hospitals, home care physicians, and collaboration between medical practitioners and nursing staff, eldercare givers, and care-plan managers through a task management system. Because coordination among all these actors is necessary for eldercare, Kanamic provides a centralized location for them to share information and coordinate services.

The service offered by Kanamic Network became highly popular, enabling the company to list on the small-market capitalization Mothers market in 2016, moving up to the first section of the Tokyo Stock Exchange in 2018; since then, its profits have been growing robustly. In September 2023, the company reported that its systems were being used in over 42,300 offices nationwide, by over 242,000 professionals, according to the Kanamic home page.69

Kanamic’s cloud service was developed through joint research with the University of Tokyo’s Institute of Gerontology. Kanamic has worked on projects for major customers, such as the Ministry of Health, Labour and Welfare, and the Ministry of Internal Affairs and Communications. The company has also provided consultation services for regional revitalization projects.70

Kanamic Network was founded by Minoru Yamamoto in 2000. Yamamoto was producing commercials for healthcare insurance when he developed an administrative system for more efficient home nursing care, building a network of medical and care workers. Yamamoto’s eldest son, Takuma Yamamoto, took over as CEO and president in 2005. Takuma began his career as a software engineer at Fujitsu in 2000, before eventually joining his mother and father at Kanamic.

Initially uninterested in joining his father’s company, he quickly saw the massive level of inefficiency in the industries and processes around eldercare. Incredible amounts of paper were consumed, requiring the use of “hanko” seals; eldercare home helpers were unable to go from one client to the next, instead returning to the office between each visit to complete paperwork. Takuma also saw care managers needing to log in and manually input data into multiple systems for various entities, such as eldercare facilities, clinics, pharmacies, insurance, and local government.