Implementing Phase 2 of Trump’s plan for the territory only makes sense if all in Phase 1 is implemented.

Yezid Sayigh

Source: Getty

The United States is losing the race for secure supply chains of clean energy. But a new framework could help the United States achieve technological leadership and geopolitical advantage in an interconnected world.

The following paper is in support of the Carnegie Endowment for International Peace’s U.S. Foreign Policy for Clean Energy Taskforce, a nonpartisan working group seeking to bolster U.S. clean industrial goals with cooperative decarbonization abroad.

U.S. foreign policy must be refocused for the United States to regain geopolitical advantage. Countries establish geopolitical advantage when they create exploitable choke points, eliminate adversaries’ sources of leverage, and cultivate wide networks of allies with a range of capabilities. In geopolitical competition, the key is to establish economic, political, and military freedom of maneuver, while supporting the autonomy and strength of one’s allies.1

Technological leadership and manufacturing capacity lies at the heart of geopolitical competition today. However, the United States is losing the race for future energy technologies with secure supply chains and the diplomatic contest for goodwill in emerging markets and developing economies. China has made strategic investments in energy and infrastructure throughout the Global South, building up strong diplomatic and commercial relations.

Emerging markets and developing economies want access to the best technologies and a pathway to genuine development. That pathway increasingly involves building manufacturing and processing value-added for clean energy technologies at home. Countries will not accept the perpetuation of extractive relationships with the world’s largest states.

The United States therefore needs an international strategy to build clean energy supply chains while creating diplomatic support in these countries. It should recognize that it cannot build secure energy supply chains on its own because the knowledge, infrastructure, and materials needed for producing the technologies are distributed across countries. Reshoring cannot fundamentally change this fact. Instead, the United States can work with allies and partners to make strategic investments in other countries that reduce China’s geopolitical leverage and increase supply chain resilience.

To regain geopolitical advantage, the United States and its partners need a new framework. This paper recommends the following:

The battle to build clean energy supply chains is about leadership in the technologies and supply chains of the future. Geopolitical advantage will accrue to countries that create prosperity by investing in the technologies of the future, scale supply chains to reduce dependence on adversaries, and establish broad networks of supportive allies and partners.

Today, China is seizing geopolitical advantage in three ways. First, its control over clean energy and critical minerals supply chains means that it can threaten the United States and its allies with retaliatory export controls on gallium, germanium, graphite, and rare earths. Second, its foreign financing has built up goodwill all over the developing world. Third, China’s story as a developing country that became a leading technological power is an inspiration and magnetic force. At the 2024 G20 summit in Brazil, Chinese President Xi Jinping articulated Beijing’s vision for common development via “inclusive economic globalization.”3 China is offering the countries in the Global South “new technologies, new industries and new business forms” that promise “digital, smart and green development.” The United States cannot ignore these arguments as mere rhetoric because they are backed by the example of China itself, which is powerful throughout the developing world.

At the same time, developing countries are not naive: they know there is a quid pro quo with China. China makes investments in other countries to create access for its firms and generate demand for its exports. Nonetheless, it is easy to conclude that the technology pathways that China offers are cheaper and more likely to fuel development than continued dependence on coal, oil, and natural gas.4

The United States cannot afford to cede the technologies of the future to China. To rebuild geopolitical advantage, the United States can and must lead an international coalition for technology leadership. It should compete selectively and strategically while remaining engaged in building and securing clean energy supply chains—even if only to reduce China’s leverage and undercut China’s advantages. In doing so, it can build on successful domestic and international policy by both previous administrations.

The first task is to build up the U.S. industrial base with strong industrial policy. Bipartisan actions by both the first Donald Trump administration and the Joe Biden administration bolstered American workers while positioning the United States in the supply chains of the future. President Trump sounded the alarm on critical minerals dependency and outlined a federal strategy.5 Bipartisan action under Trump created new foreign policy tools, such as the International Development Finance Corporation (DFC), and reinvigorated old ones, like the Export-Import Bank (EXIM). Under Biden, Congress passed the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law, and the CHIPS and Science Act, each of which are contributing to rebuilding the U.S. manufacturing and industrial base.

But the United States cannot do it alone—it needs to advance its industrial strategy with support from a broad coalition committed to technological competition.6 Such a coalition must be international because the knowledge, infrastructure, and materials needed to produce world-leading energy technologies are distributed across the globe. This infrastructure and knowledge can only be developed and transferred to the United States over decades. Close allies like Japan, South Korea, and the European Union (EU) have much of this expertise and are willing to support. But collaboration is necessary to secure real, lasting American capacity in novel technology areas.

Further, the difficulty of building supply chains means that friendshoring is necessary. Many of the critical minerals and components America needs to rebuild its industrial base will come from other countries. The vast majority of critical minerals must be friendshored. Even the nuclear production network, in which the United States plays a key role, is highly international.7 To secure necessary materials and products, the United States must conduct strategic diplomacy to build supply chains that work around Chinese and Russian bottlenecks.

Reflecting these realities, the United States has launched a wide range of initiatives for international industrial policy and supply chain coordination. The Minerals Security Partnership coordinates critical mineral supply chains with allies including Australia, Canada, Japan, and European partners to reduce dependence on China. The Indo-Pacific Economic Framework (IPEF) works with Asian partners on supply chains, clean energy, infrastructure, and trade standards. The U.S.-EU Trade and Technology Council aligns industrial policies, technology standards, and supply chain resilience between the United States and the EU. The Americas Partnership for Economic Prosperity promotes supply chain integration and economic cooperation across the Americas. These initiatives have overlapping goals and memberships but operate somewhat independently. There must be better coordination among these various partnerships, and the new U.S. administration has the opportunity to consolidate them under a more unified strategic framework.

To achieve this and other strategic goals, this report proposes to simultaneously broaden and focus the Partnership for Global Infrastructure and Investment (PGI). Launched in 2022, the PGI coordinates infrastructure investment among G7 partners and pledged to mobilize $600 billion for clean energy and supply chain projects in developing countries. It should be broadened by serving as an umbrella to bring together the foreign policy tools created during the first Trump administration and the Biden administration into a coherent U.S. interagency process. And it should be focused on meeting specific supply chain targets. On this proposal, the PGI should begin by setting targets that prioritize supply chain segments according to their importance to the net-zero economy and the current share of expected demand that the United States and its partners could produce.

The United States should then set up a collaborative process for project development with its partners. Projects should be assigned to individual countries to lead. For projects the United States leads, it should use the Energy Security Compacts process as proposed by Katie Auth and Todd Moss to shepherd the projects through the interagency process. Successful projects would be supported by three sets of interlinked activities: support for industrial policy in the project’s host country, financial support from a variety of national and international funds, and demand-side support through market creation policies such as clubs, tariffs, and joint procurement.

By integrating prioritization, project development, finance, and joint industrial policies, the PGI can be rebuilt into the organizational and strategic framework the United States and its allies need to compete with China. By extending support and guaranteeing the promise of value-added production in emerging markets and developing economies, the partnership can secure diplomatic support while reducing dependence on adversaries’ supply chains. As such, it will increase the autonomy of the United States and its allies, thereby helping it regain geopolitical advantage.

China conceives of international politics as a struggle primarily structured by scientific and technological competition.8 Leading great powers need large populations and healthy economic growth. Manufacturing-led industrialization and scientific and technological advancement are the key drivers of economic growth. As Tanner Greer and Nancy Yu put it, “The central task of the Chinese state is to build an industrial and scientific system capable of pushing humanity to new technological frontiers.”9 China’s industrial policy has been focused on this since 1986 when it launched the 863 Program—the first of several bids for leadership in science and technology.10 The Made in China 2025 program, which seeks to make China a world leader in ten strategic sectors, is the latest and most powerful iteration of this strategy.11

China’s success provides a model for industrial development that other countries are keen to follow. At the 2024 G20 summit, Xi’s message was that China’s example proves that developing countries can turn “blueprints into reality.”12 Beijing’s Belt and Road Initiative and the Global Development Initiative provide the finance necessary to draw countries in. Although the Belt and Road Initiative has radically reduced in size over the past five years, China continues to conduct strategic outbound foreign direct investment (FDI) in key technology areas and make plans to build infrastructure for regional integration in Latin America and Africa.13

In the past five years, Chinese investment abroad has become more focused on strategic technology sectors. Outbound FDI is now used to open markets for Chinese exports. In Brazil, for example, the Chinese company BYD purchased Ford’s old vehicle plant to assemble and sell vehicles to Brazil’s growing middle class.14 Meanwhile, Goldwind took over GE’s wind turbine factory to fuel Brazil’s renewable energy build-out.15 However, Chinese companies are not necessarily transferring value-added manufacturing. Value-added refers to the value that is created when raw materials, parts, and components are transformed into finished products. Chinese investments often correspond to the last stage of assembly. E-bus assembly by Chinese companies in Kenya, for example, is very low value-added.16 Chinese investment does not necessarily create a strong basis for economic development through manufacturing, but it does bring jobs and infrastructure. This helps to legitimate Chinese imports of high-quality, affordable consumer goods.

China can also directly help countries reduce their foreign currency liabilities through electrification. Building out renewables reduces dependence on foreign oil and gas imports by creating a new source of domestic energy production. The economics and geopolitical advantages of solar are already transforming global energy demand in the Global South. Pakistan is installing record numbers of cheap Chinese solar panels—as much as 17 gigawatts in the first nine months of 2024.17 For context, this made Pakistan third, between the United States and Brazil, on the global installation list. Türkiye doubled its solar installations in 2024, and India increased its own by 180 percent.18 Saudi Arabia does not publish solar installation numbers, but it imported 9.7 gigawatts of solar panels from China through the first seven months of 2024. The Middle East is now the fast-growing region for renewables outside of China.19 This is indicative of a major shift, and a challenge to U.S. oil and gas exports.

China also depends on oil imports, and its decarbonization push must be understood in this context. China’s commitment to reducing oil imports can be seen in its wind, solar, electric vehicle, and batteries strategies, but also in its latest domestic green policy moves. China is now rapidly building hydrogen, sustainable aviation fuel, and clean shipping fuel technology pathways.20 Although it is still building coal-fired power plants, it is preparing to decarbonize aviation and shipping because those sectors rely on refined petroleum products. As China’s refineries import and process less oil, China will have not just less gasoline but also less bunker fuel (marine fuel) and kerosene (jet fuel), meaning that it needs to decarbonize across sectors to maintain balance. Moreover, these policy moves are now positioning China to lead in sustainable aviation and clean shipping technologies.

U.S. protectionism will play into China’s hands.21 Simply deciding that green energy is bad for America will backfire. Solar power is cheaper than oil and gas in developing countries.22 Other countries will be happy to use Chinese solar panels to reduce oil and gas demand and drive development. But the United States needs many of those countries in its geopolitical coalition. Instead of abandoning technological and political leadership, the United States can support those countries’ development hopes while weakening China’s hold on clean energy supply chains.

During the Cold War, the United States led a coalition of free countries in the pursuit of prosperity and progress. It did so by offering a common vision and building collective institutions with other nations. A similar vision and institution-building project is needed today. To lead, the United States will need followers. But in today’s international system, followers have another compelling option from China.

How can the United States regain geopolitical advantage? In geopolitical competition, maintaining freedom of maneuver for oneself and one’s allies is a crucial part of preserving economic and military security.23 Countries can gain geopolitical advantage by creating exploitable choke points, eliminating adversaries’ sources of leverage, and cultivating wide networks of allies with a range of capabilities.

This section outlines three overarching elements for a strategy to rebuild American geopolitical advantage. To do so, the United States will need to combine strategic overseas investment that reduces dependence on China with broader efforts to articulate public principles that other states can support.

China’s control over key critical minerals and clean energy components can only be addressed by building supply chains overseas. It is in the United States’ geopolitical interest to actively build manufacturing, mining, and value-added processing throughout the world. In a complex global order, strategic independence means maximizing your options while minimizing others’ ability to pressure you. Actively building ex-China supply chains creates options and weakens China’s advantage. This will have the added benefit of creating valuable investment in other countries, which will build goodwill throughout the world to counter Chinese influence.

To enhance freedom of maneuver, the United States should strategically construct networks of allies capable of producing both clean energy minerals and clean energy technologies. De facto sovereignty, understood as genuine autonomy, requires minimizing potential leverage points for adversaries while developing diverse tools to apply counterpressure. Given future uncertainties, developing varied capabilities and pressure points enables diplomatic and geopolitical flexibility. Diplomatic initiatives to expand resource and manufacturing capabilities among partner nations serve to diminish the leverage of geopolitical competitors.

The most severe supply constraints typically manifest in upstream segments of supply chains, with critical minerals and processing emerging as persistent bottlenecks. This upstream leverage is amplified by extended development time frames—mining projects in advanced economies require minimum five-year permitting periods, averaging 15.7 years from discovery to production. Similar extended timelines apply to developing manufacturing ecosystems and executing technology transfer strategies. A necessary complement to permitting reform in the United States is supporting the development of mines in partner countries. By supporting project development in other countries, the United States can shorten these timelines and alter the landscape of geopolitical power.

Another avenue for reducing dependency is to cultivate competitors to China. This can be productively done in complex technologies that will be difficult for the United States to produce at competitive costs. In these areas, the United States could support developing countries with the profile necessary to compete with global prices. For example, investment in burgeoning solar industries in India, Malaysia, and Vietnam could help produce low-cost competitors to China’s solar supply chain. This would diversify production while reducing China’s global market share. Further, Vietnam has a strong electronics manufacturing base that could cut into Chinese dominance throughout the region. Smart moves designed to undercut China’s industrial base will be needed to complement investments in U.S. manufacturing.

How can the United States build a strong block of allies and partners and regain its geopolitical position? As Robert O’Brien, national security advisor in Trump’s first administration has argued, America first does not mean America alone.24 But coordinating allies into a coherent block is a difficult task that will require the public articulation of principles.

A critical principle the United States should emphasize is that the international economy is not zero-sum, but that countries can benefit by forging collaborative value chains that advance innovative technologies.25 Structured competition can and will benefit all states. However, America First policies could drive a wedge between the United States and its allies and create a zero-sum mentality. Trump has promised more tariffs; the strategy appears to be to use tariffs as the basis for a series of quid pro quos.26 This will immediately alienate allies and make the task of rebuilding a coherent block more difficult. To minimize the damage, it will be important for the administration to publicly articulate the purpose of any tariffs and be prepared to adjust in response to policy changes.

Nonetheless, Trump’s policies are informed by a broader set of principles that other countries could agree to and that institutions could be built around. The administration could outline its vision around the following principles:

Level playing field: Improve the prospects for American workers by ensuring that all countries play by the same rules.

National development: Enable countries to create strong industrial strategies that will rebuild their industrial bases.

Productivism: Ensure that strategic investments improve the overall global economy, rather than creating subsidy races.

Building as leverage: Focus investments in areas of geopolitical priority to reduce dependence on adversaries and undercut adversaries’ strengths.

The U.S.-Mexico-Canada Agreement (USMCA) negotiations and outcome suggest that the first Trump administration aimed to create a level playing field for American workers. Labor and environmental standards were a cornerstone of the agreement, and there were a number of local content requirements. In addition, the USCMA included a “labor value content” rule stipulating that 40 percent of the value-added take place in high-wage factories.27

We can add to this the idea that all countries, including the United States, should be able to pursue national development strategies. As a senator, Secretary of State Marco Rubio cosponsored legislation for America’s own national development strategy, but other countries must be given the same opportunity.28 This will mean realigning international norms and institutions to make space for strategic action.

To ensure that such strategies are globally beneficial, countries must adhere to a principle of productivism. Investments must increase productivity and competitiveness, not simply subsidize goods or encourage dumping.

Finally, as this report argues, building supply chains for critical materials and technologies is key to creating leverage and reducing the risks of Chinese control over them, with the added benefit of reducing China’s strength. However, these supply chains are highly specialized and subject to bottlenecks because critical materials and technologies are produced in specific places where knowledge and infrastructure has accumulated. This means that they are difficult to reproduce. Therefore, the United States cannot reroute or diversify supply chains by fiat; it will need to take deliberate action and investment.

These four principles collectively outline a pragmatic alternative to either pure free trade or pure protectionism. They provide a basis for managing nationalism and competition, constructively channeling industrial policy and strategic trade policy through clear principles and institutions. A new international economic framework emerges that balances national autonomy with global cooperation. Countries can retain their autonomy and pursue the promise of national development by using industrial and trade policy to advance their national interests. Nonetheless, this need not spill over into unrestrained zero-sum competition. Instead, economic nationalism and strategic competition can be oriented to productivist ends that enhance welfare for all, while reducing dangerous dependencies in critical supply chains.

Institutionalizing these principles will require significant reforms to existing international economic institutions and norms. Already, the rules and principles of international order are in flux. To regain leadership, the United States needs to help reconstruct a new set of rules. The key challenge for the United States will be creating institutional mechanisms that can distinguish productive industrial policies from destructive ones, while building the international cooperation needed to develop new supply chain capabilities in strategically important locations. This suggests a need for new forms of international coordination focused on infrastructure development, knowledge sharing, and capability building rather than just market access and trade rules.

It is in the United States’ national interest to invest in international cooperation and collaboration by embedding these principles in bilateral and multilateral agreements. It can begin by pushing for statements in support of national development and a level-playing field in international forums like the G7 and G20—ensuring that all states have the policy space to pursue national goals. But it will also need to do more detailed work to articulate the economic policy basis of productivism and establish clear rules for the trading order in a world of industrial policy.

To regain geopolitical advantage, the United States and its partners will have to offer something of both material and symbolic value: real investments that offer the promise of economic progress. China’s overseas investment has slowed in recent years, but Chinese projects continue to produce geopolitical value. If the United States and its partners are going to compete geopolitically, they need a focused and strategic approach to overseas investment.

The Biden administration piloted such an approach through the PGI, which it launched through the G7. The PGI was an innovative effort to bring together allies and the private sector to drive investment in economic corridors and clean energy supply chains. However, the PGI delivered only one signature project, the Lobito Corridor, in which the U.S. government invested $4 billion.29 The PGI never coalesced into the kind of ambitious strategic program that the United States and its partners need to rebuild geopolitical advantage throughout the world.

Instead, a new strategic approach should focus on value-added manufacturing. The more countries can produce the raw materials and components for high-value goods domestically, the more economic benefit they can get from the process. Japan, South Korea, China, and their imitators all developed by moving up the value chain, domesticating more high-value components in key sectors.30 The good news is that creating value-added in partner countries will be the natural outcome of smart American investments abroad that support U.S. national interests. Many countries have the potential to develop comparative advantages in clean energy manufacturing, critical minerals production, and chemical processes. Identifying the highest priority countries for the United States to engage with and supporting industrial policy in the right technology areas will create alternative sources of supply and generate goodwill in other countries. This will in turn help rebuild the United States’ geopolitical advantage.

This work must combine two kinds of international policy efforts:

U.S. foreign industrial policy can be seen in how it has leveraged existing diplomatic, financial, and trade mechanisms to strengthen global clean energy supply chains. It has focused on directing financing to nations that can support U.S. industrial development goals, such as diversifying battery supply chains. For instance, the DFC made equity investments in Techmet to support nickel and cobalt mining facility in Piaui, Brazil, and supported the construction of a new First Solar factory in India.31

U.S. joint industrial policy can be seen in the proliferation of partnerships—such as the PGI and the Mineral Security Partnership—designed to coordinate investment in clean energy supply chains. It can also be seen in the failed Global Arrangement on Sustainable Steel and Aluminum, a proposed climate club between the United States and the EU.32 Joint industrial policy could also be pursued by harmonizing tariffs or coordinating subsidies.

A new strategic approach to building clean energy supply chains can learn from the successes and failures of these efforts. To strengthen U.S. geopolitical advantage, such an approach must diversify the supply of critical technologies and materials while providing support to other nations. Such efforts need to combine foreign industrial policy tools and collaborative experiments in joint industrial policy.

A comprehensive, strategic approach to strengthening clean energy supply chains overseas can build on the work of the Clean Energy Supply Chain Collaborative and the PGI and proposals such as that for Energy Security Compacts.33 Such an approach should have five core elements:

These elements provide a framework for organizing all the foreign policy tools and international partnerships discussed in this report. This work should be coordinated through a more institutionalized iteration of the PGI. The Minerals Security Partnership is perhaps a better model, as it had regular meetings with international partners that aimed to create an active project pipeline, while spurring joint investments in the best projects.

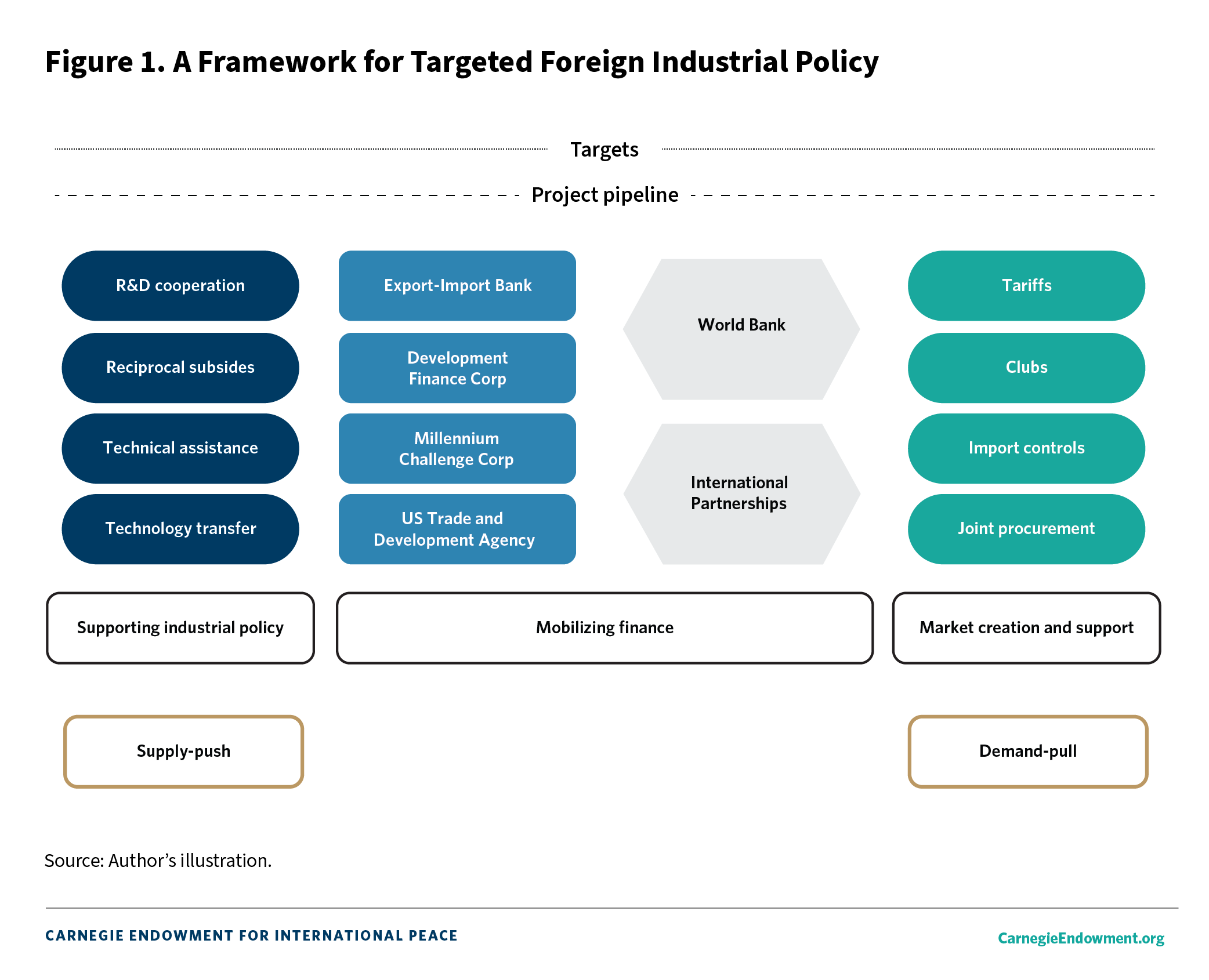

The proposed framework is about process and strategy. It is designed to streamline and unify a variety of U.S. government efforts and ongoing international initiatives into a coordinated effort. Through the framework, the United States and its partners could first identify and rank supply chain priorities based on two key criteria: their significance to the zero-emission economy and current production capacity outside of China. This would yield a clear list of production targets that would inform investment priorities. They could then seek to identify projects throughout the world that would help to achieve the production capacity laid out in the targets.

After that, the partners could implement a coordinated approach to project development among participating nations. Specific countries could be assigned to spearhead each project in the pipeline. For U.S.-led initiatives, projects could follow the Energy Security Compact methodology proposed by Auth and Moss to navigate the interagency process. Projects moving forward could receive comprehensive support through three interconnected sets of activities: assistance for the host country’s industrial development plans, funding from diverse national and multinational sources, and initiatives to strengthen market demand, including trade agreements, tariff arrangements, and collaborative purchasing strategies.

By bringing together strategic planning, project execution, financial backing, and coordinated industrial policies, the enhanced PGI would provide the United States and its allies with the organizational structure and strategic framework needed to effectively rival China’s influence in the clean energy economy.

Critical minerals provide a good example to illustrate and further elaborate the framework. To focus this work, explicit targets identifying priority metals and production stages would be needed. Support for domestic industrial policy in other jurisdictions would help create and accelerate new mines. To get those mines to a final investment decision, significant capital would have to be mobilized. But that capital probably would not be mobilized without efforts to create markets for ex-China production through coordinated efforts by the United States and its partners.

The framework is built on the insight that clean energy technologies require both supply-push and demand-pull instruments working in tandem. Supply-push mechanisms help develop new technologies, improve existing ones, and scale production. These include research funding, tax credits for manufacturing, and support for demonstration projects. Demand-pull instruments create reliable markets for new technologies. They include procurement programs, deployment mandates, and standards. When coordinated, these approaches create a virtuous cycle: demand signals encourage private investment in manufacturing and deployment, while supply supports reduce costs and improve performance, making the technologies more attractive to buyers.

These concepts are usually applied to domestic industrial policy. Our framework applies them to the international sphere, where foreign and joint industrial policy can be integrated to support the development of international supply chains. The United States is already using technical assistance, its financing arms, and tariffs to support clean energy technology. The framework illustrates how these levers can be combined with collaborative efforts to develop joint industrial policy abroad.

Take critical minerals again. The United States does not have the reserves or expertise to quickly scale domestic critical minerals supply chains on its own. The critical minerals sourcing requirements in the IRA’s 30D electric vehicle consumer credit and 45X advanced manufacturing credits, which cover 10 percent of critical minerals production costs, have helped to friendshore and reshore some production.34 But a lot of work remains. Both supply-push and demand-pull policies are needed. Supply-push policies are needed to make new mines and processing techniques competitive with China-dominated production. Demand-pull policies are needed to create the market and price certainty needed to justify large-scale investments in new mining and processing capacity. Without clear signals that future demand will be strong and sustained, investors are hesitant to make long-term, capital-intensive commitments.

The Minerals Security Partnership, which emerged out of G7 initiatives to build critical minerals supply chain, provides an excellent example with important lessons. The partnership aims to catalyze public and private investment in responsible critical mineral supply chains globally. Members meet regularly to assess needs and create a project pipeline. The goal is to collectively accelerate and fund critical minerals projects with high environmental and labor standards, as well as share best practices for policy. While this concept is sound from a governance perspective, it has not solved the core problems in critical minerals markets. A more ambitious funding mechanism that can create price certainty is necessary. Traditionally, the United States has played that catalytic role, but cost-sharing arrangements, such as that embodied in the World Bank, could be employed here.35 The United States and its partners should learn from and expand the Minerals Security Partnership process to all clean energy supply chains.

The rest of this paper outlines the five elements of the framework and provides specific recommendations for U.S. foreign policy.

Clear, quantitative targets are needed to focus the efforts of the United States and its partners. These targets should identify supply chains for prioritization and specific segments for focused action balancing a variety of energy security goals.

The Carnegie Endowment for International Peace’s U.S. Foreign Policy for Clean Energy Taskforce has done two pieces of work that serve as inputs into target-setting. First, the technical analysis provides an assessment of the progress that has been made in building de-risked supply chains for critical clean technologies. This work identifies priority areas for strategic investment. Second, the supply chain resilience framework helps to differentiate between technologies, identifying some as high priority based on a variety of economic, national security, and geopolitical measures. (Please see the project hub for all supporting analysis and papers.)

The results and approaches from these papers should be combined to determine specific ex-China pathway targets in priority investment areas. According to the taskforce’s analysis, all countries outside China are currently expected to produce 25 percent of solar modules and 10 percent of the wafers needed in a net-zero scenario.36 In addition, all countries besides China are slated to manufacture 50 percent of their own batteries but only 17 percent of the upstream materials. The supply chain resilience framework suggests solar should be lower priority for the United States and its partners, which should collectively aim to manufacture 30 percent of expected demand for all segments. Following this logic, the United States and its partners should slightly bolster module manufacturing but really focus on building up wafer capacity outside of China. The framework suggests that batteries, since they are more integral to the economy and defense applications, should be subject to a 65 percent ex-China target. Ambitious targets are also needed for nuclear and geothermal to provide countries with cheap, de-risked baseload power.

The second element of a new approach is to build a pipeline of priority projects that can deliver on the targets. The proposal by Auth and Moss for Energy Security Compacts within the U.S. government is needed to organize the interagency process to create a project pipeline and mobilize the right tools.37 The proposed Energy Security Compacts aim to solve a critical problem in U.S. foreign investment: while the United States has strong tools for financing mature energy projects, it lacks mechanisms to develop early-stage projects into bankable investments, especially in developing and emerging markets.

Energy Security Compacts would establish a coordinated approach across nine U.S. agencies to identify, develop, and support energy projects through their full life cycle, from initial planning to final financing. The initiative would create project pipelines by combining early-stage project preparation support (through agencies such as USTDA) with policy reforms and institutional strengthening (through the Millennium Challenge Corporation, or MCC, and USAID), while ultimately channeling mature projects to agencies such as the DFC and EXIM for large-scale financing. This systematic approach would help transform promising energy opportunities into viable investment-ready projects, particularly in strategic partner countries where energy security aligns with U.S. national interests.

The initiative would serve as the United States’ process for supporting an invigorated PGI. To operationalize this plan, the PGI should be upgraded from an initiative housed within the State Department to a directorate of the national security advisor, which is well placed to coordinate the interagency process and the diplomatic effort among allies for Energy Security Compacts. A critical problem, however, is that the National Security Council team does not have direct access to the complex supply chain analysis and project evaluation teams that would be needed to make the PGI more strategic. A consolidated international industrial policy secretariat should be created within the National Security Council or an independent Energy Security Compacts Coordinators Office (as proposed by Auth and Moss).38

A critical piece of the framework is to support industrial policy in partner countries through technical assistance. The Clean Energy Supply Chain Collaborative initiated by Biden’s National Security Council began this work by sharing lessons learned from the IRA and explicitly encouraging countries to create their own green industrial policies. This is essential, but the United States and its partners should create a more systematic approach to supply-push policy. This is needed to develop and commercialize next-generation technologies in which the United States and its allies can compete.

The United States, through the Department of Energy, conducts a range of joint research and development projects, but they are often disconnected and unfocused. Embedding them within the PGI and tying them to specific sectoral targets would provide strategic direction and offer a sense of urgency to these existing collaborations.

There is potential to expand joint industrial policy by harmonizing subsidies within clubs. Harmonizing subsidies is when multiple countries coordinate to set common or similar subsidy levels in specific sectors. Reciprocal subsidies entail offering domestic subsidies to firms conducting projects in other jurisdictions. Critical minerals are an excellent candidate for reciprocal subsidies because they are noncompetitive. The United States needs to friendshore vast quantities of copper, nickel, zinc, and tin, so supporting mine development in other jurisdictions does not create competitors with U.S. firms, especially if they receive similar subsidies. Harmonized and reciprocal subsidies have another benefit: they enable market competition within the club while protecting against Chinese non-market practices. This is necessary to ensure that companies do not devolve into rent-seeking.

Facilitating technology transfer includes efforts to support the creation of indigenous technology ecosystems. For example, FDI could create shallow enclaves or positive spillovers in the receiving economy—depending on whether the country has a good strategy for taking advantage of projects. Efforts to create absorptive capacity for technologies by funding research institutes and subsidizing local production of high-value components could turn FDI recipients into technology players. The United States and its allies could support technology transfer in countries poised to build a solar industrial base that could compete with China, such as Vietnam.39 It is a matter of ensuring that countries understand the importance and potential of technology transfer through technical assistance and tying external support to plans for real transfer.

Specific sectoral initiatives that combine a few of the framework’s elements should also be integrated under the PGI. For nuclear power, there are multiple international initiatives that need to be brought together and aligned; the Sapporo 5 partnership and the FIRST Program to advance and accelerate small modular reactor (SMR) demonstration could be upgraded and focused in the PGI.40 These programs would then have the broader support of the prioritization and pipeline infrastructure set up by the PGI’s secretariat.

Industrial policy comprises various projects to build plants and other pieces of infrastructure. Those projects require financing. All large capital projects, whether for new or established technologies, would benefit from policies and coordinated efforts to mobilize finance. These projects would then produce the energy and materials needed for successful industrial policy and geopolitical advantage.

Aligning and empowering the DFC, EXIM, USAID, MCC, and USTDA are necessary to bolster U.S. foreign industrial policy. At present, these agencies can be used as strategic investment tools, but each of them has limits to their individual and collective impact. Each agency needs more flexibility, as detailed in our recommendations below, to enable the United States to rebuild geopolitical advantage.

A lot can be accomplished by reauthorizing and bolstering existing tools. The United States could create a new finance authority that could spend money on overseas supply chains.41 In particular, an entity that could write contracts for difference to backstop critical minerals prices would be a game changer in this strategic sector. As much as $300 billion is needed to secure critical minerals markets.42

An invigorated PGI could provide an opportunity to garner catalytic support from allies and other partners. Only by working to coordinate strategic investment across the World Bank, sovereign wealth funds, pension funds, and private capital can the trillions needed to build supply chains be mobilized. A key lesson from the Biden administration’s de-risking initiatives and Europe’s financing push is that public capital is more likely to play the necessary strategic role than private capital.43 Private capital is limited in its ability to build clean energy supply chains because it is agnostic about ownership and strategic considerations. Therefore, private capital cannot fully or accurately value the projects viewed from the perspective of national or public interest.

Advait Arun has made several strong recommendations for expanding public finance, including creatively using the Treasury Department’s $40 billion Exchange Stabilization Fund, strategically using the International Monetary Fund’s Special Drawing Rights, and expanding multilateral development bank balance sheets.44 These and other initiatives are needed to expand the pool of organized public capital that is available to backstop and mobilize private capital.

The development of new technologies requires the creation of new markets that will secure demand for new products. Scaling technologies requires scaling markets that will create demand for the technologies. That demand drives deployment, which in turn lowers costs and makes the technology even more competitive. Clean energy technologies require strong demand-pull mechanisms because market forces alone often fail to drive sufficient adoption of emerging climate solutions. While early-stage research and development support (or the “technology push”) is crucial, history shows that new technologies rarely achieve widespread deployment without robust demand signals.46

If the United States and its partners want to support demand for ex-China products and materials and create an edge in technology areas such as batteries, geothermal energy, and nuclear energy, then they need to work together to ensure that there is demand for their materials and products. China has overcapacity and therefore the ability to pressure prices in solar, batteries, rare earth magnets for wind and electric vehicles, metals such as steel and copper, and critical minerals. This can be achieved by building and coordinating government procurement, industrial policy clubs, and tariffs.

The most ambitious version of these proposals is the creation of climate clubs—arrangements among countries that align domestic industrial policy and decarbonization pathways with demand-side guarantees like procurement, tariffs, and standards. For example, the proposed Global Arrangement on Sustainable Steel and Aluminum would have formed a U.S.-EU club to address both Chinese steel dumping and decarbonization challenges in the sectors. The goal was to align incentives for low-carbon production methods, creating carbon-based trade measures that would incentivize other countries to decarbonize their steel and aluminum production as well. De facto, this would have created an ex-China market, as China’s steel production heavily relies on metallurgical coal. Although negotiations for this club failed,47 the fundamental idea of creating geopolitical clubs that support industrial policy for decarbonization is a crucial piece of the net-zero future. Clubs could also be explored in critical minerals and nuclear technology to backstop ex-China supply.

Technological leadership lies at the heart of national prosperity and power today, but this leadership cannot exist in isolation. Every technological leader requires followers, and these followers—particularly swing countries in the Global South—have choices about whom to align with. These nations seek not just access to advanced technology but also viable paths toward development.

A fundamental reality shapes this dynamic: successful, cost-effective technologies invariably depend on global value chains, where expertise and production capacity are distributed across multiple countries. The concept of reshoring, while appealing, cannot override this basic economic truth. As a result, technological leadership inherently operates in international networks, making it fundamentally geopolitical in nature.

Success in this arena requires a three-pronged approach: reducing one’s own dependence on adversaries, helping allies decrease their dependencies, and strategically undermining adversaries’ strengths. For the United States to achieve these objectives, it should prioritize strategic overseas investments via institutions such as the DFC and EXIM. Work by the United States alone will be insufficient—an invigorated PGI supported by new principles of international order are needed if the United States and its allies are going to effectively compete with China. Success also requires a sophisticated combination of foreign policy and joint industrial policy, such as through newly created climate clubs. The latter is particularly crucial in strategic supply chains, such as those for critical minerals and clean steel. However, implementing joint industrial policy presents significant challenges, especially in an era of resurgent nationalism. It will take creativity, resolve, and imaginative leadership to succeed.

The key lies in intelligently combining foreign and joint industrial policy tools to align supply-push and demand-pull mechanisms across entire value chains for critical minerals and key technologies. The framework presented in this paper could help the United States achieve both technological leadership and geopolitical advantage in an interconnected world.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

Implementing Phase 2 of Trump’s plan for the territory only makes sense if all in Phase 1 is implemented.

Yezid Sayigh

Western negotiators often believe territory is just a bargaining chip when it comes to peace in Ukraine, but Putin is obsessed with empire-building.

Andrey Pertsev

When democracies and autocracies are seen as interchangeable targets, the language of democracy becomes hollow, and the incentives for democratic governance erode.

Sarah Yerkes, Amr Hamzawy

Unexpectedly, Trump’s America appears to have replaced Putin’s Russia’s as the world’s biggest disruptor.

Alexander Baunov

From Sudan to Ukraine, UAVs have upended warfighting tactics and become one of the most destructive weapons of conflict.

Jon Bateman, Steve Feldstein