On the fourth anniversary of Russia’s full-scale invasion, Carnegie experts discuss the war’s impacts and what might come next.

- +1

Eric Ciaramella, Aaron David Miller, Alexandra Prokopenko, …

Source: Getty

Every year, flooding imposes large human and economic costs around the world. These damages are increasing. Land use practices can intensify the dangers, and many people lack insurance and struggle to recover from floods.

Every year, flooding imposes large human and economic costs around the world. These damages are increasing. Land use practices can intensify the dangers, and many people lack insurance and struggle to recover from floods. This paper surveys the responses of eight countries to these challenges in order to identify and assess the trade-offs inherent in managing flood risk. We hope this comparative discussion will be helpful to policymakers seeking to better protect citizens and commerce from harm.

From a residential property owner’s perspective, the ideal flood risk management strategy would do three things: keep them safe from flooding (other than that caused by the most extraordinary disaster), include affordable flood insurance to make them whole following a disaster, and facilitate daily use and transactions related to their home or business. No national strategy we have studied includes all of these elements. We believe, however, that the efforts of national governments that are trying to cost-effectively manage flood risks while protecting lives and livelihoods provide valuable lessons.

We have identified three distinct challenges that flood risk management poses:

There are trade-offs in each of these challenges. As we outline below, however, there are a few aspects of an ideal flood management system that are most likely to enable people to enjoy safe and prosperous futures. We summarize these here as six recommendations and note which countries provide examples of best practices.

In the next section, we summarize flood risk management approaches in each of the surveyed countries. We then discuss the lessons learned from each, showing how they embody the challenges and opportunities we identify.

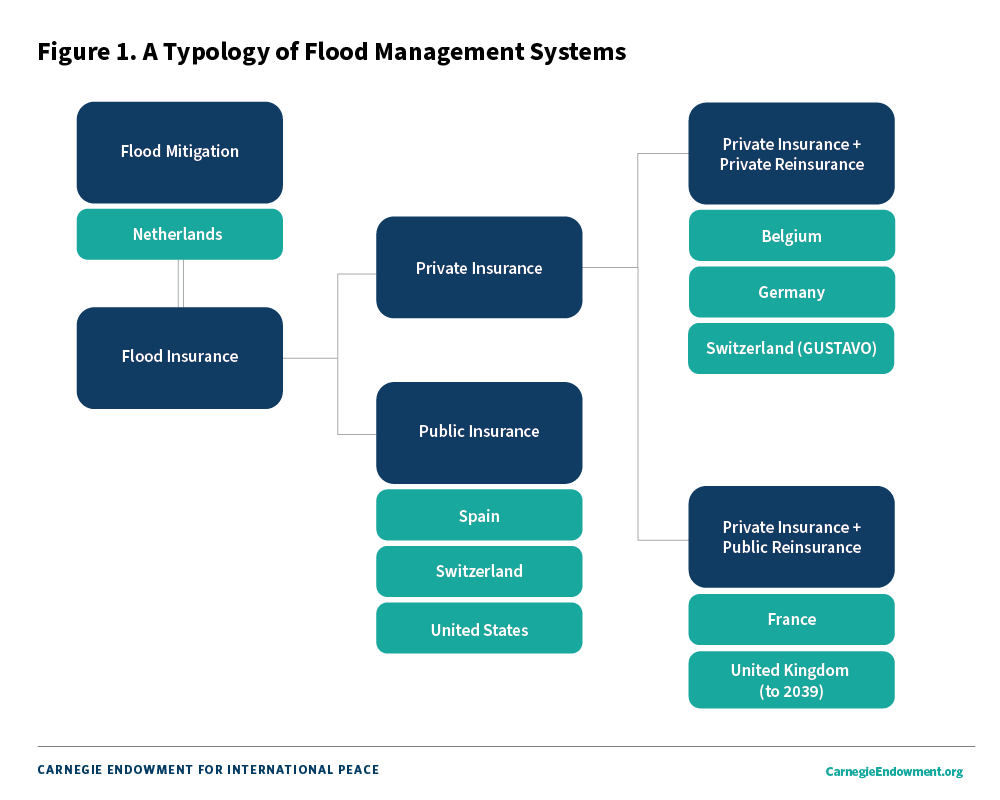

This piece describes flood management in Belgium, France, Germany, the Netherlands, Spain Switzerland, the United Kingdom, and the United States. (Italy and Portugal were also considered, but they do not yet have significant flood risk management systems in place.) Each of these countries approaches flood risk reduction, insurance provision, and disaster recovery differently (see figure 1).

All of the assessed countries but one emphasize risk transfer—moving risk from an exposed party to an insurer holding a pool of differentiated risk—over lowering flood risk. The exception is the Netherlands. About 60 percent of this low-lying country is vulnerable to storm surges or riverine overflow. Because flood risk is present throughout the country, and therefore hard to insure against, the Netherlands’ approach to flood risk management is preventative. Floodplains have been expanded to give rivers more room to flow. Building codes mandate that populous areas be protected from floods with a 0.01 percent chance of happening in a given year. By 2050, primary flood defenses must offer protection from floods with as little as a 0.001 percent chance of occurring.

The downside of the Netherlands’ approach to flood risk management is that its reduction in the likelihood of most flooding reduces public concern about the issue and limits demand for private insurance. Dutch citizens believe that the damages caused by widespread flooding would financially overwhelm any private insurer. Insurers do not generally sell flood insurance because flooding would be a low-probability, high-impact event that could wipe out their reserves. The government has historically prioritized post-disaster aid over establishing a private insurance market.

This model was tested in 2021, when floods devastated the province of Limburg at a cost approaching €1.8 billion ($2.0 billion). The government paid out flood relief to individuals and companies, but also made clear that it considered the flooding an insurable risk because much of it was rainfall-caused. The government has warned that in the future, post-disaster relief will not be given for events that could have been prevented or insured against.

The case of the Netherlands shows that even a place that invests in lowering risk needs risk transfer.

Across Europe and the United States, we find three kinds of institutional design for flood insurance. In three countries (Belgium, Germany, and some parts of Switzerland), flood insurance is sold by private insurers who are reinsured by private reinsurers. (Reinsurance is insurance for insurers.) In two countries (France and the United Kingdom), flood insurance is provided by the private market, but private insurers are reinsured by the government in some way. In Spain, most of Switzerland, and the United States, flood insurance is provided by a government insurer that is either reinsured by the private market (the United States) or another public entity (Spain and Switzerland). See figure 2 for a breakdown of responsibilities.

Taking reinsurance into account is crucial to understanding what the ultimate breakdown of insurance costs is between the public and private sectors. Countries with private insurance but public reinsurance have stronger implicit guarantees behind insurance providers. This can incentivize unsafe consumer behavior, such as living in flood plains, but may also reduce the overall costs borne by the state by requiring less ad hoc disaster aid and creating the conditions for broader insurance coverage. Countries with private insurance and private reinsurance may have more difficulty ensuring access to insurance across geographies and be compelled to make post-disaster outlays to compensate for the inadequacy of insurance coverage. But their governments also bear lower burdens of responsibility to maintain reinsurance coverage, a pressure that can lead to indebtedness as a consequence of persistent disaster losses.

The public-private distinctions outlined in figures 1 and 2 reflect whether the state has decided it has an active role in managing flood risk—through risk transfer, lowering risk, and disaster recovery—or whether it sees itself as merely a facilitator of private insurance markets. Countries with sophisticated flood management systems, like Belgium, can have primarily private insurance markets in which the availability of risk transfer is required by regulation but not by the government actively providing insurance. Countries with government-centered risk management systems can display backwardness on flood risk management, as happens in France’s river basins, or decently refined risk-lowering strategies, which are present in Switzerland.

Beneath these public or private distinctions are different approaches voters and policymakers have taken to determining what principles should guide how responsibility for risk is apportioned. At one end are systems like those of France and Spain that follow a “solidarity” principle, in which there is group responsibility for risk transfer and disaster recovery. At the other end is Germany, where each person is mostly responsible for his or her own risk. The countries in between strike varying degrees of balance between individual and group responsibility by imposing rules about insurance requirements and risk reduction measures at different levels of government.

Risk transfer in Belgium, Germany, and the GUSTAVO cantons of Switzerland (the acronym comes from the first letter of each included canton’s name) is done through a private insurance, private reinsurance model. There are differences between these systems (whether flood insurance is optional or compulsory and whether pricing is risk-adjusted or flat-fee), but all lean toward emphasizing an individual’s responsibility for risk transfer and disaster recovery. All non-individual disaster recovery, like post-disaster aid, is ad hoc.

Belgium’s regulatory structure puts the onus for risk transfer on the individual, but creates a strong supporting framework to make risk transfer accessible and affordable. Disaster recovery is balanced between individuals and the government.

Belgian law requires flood and other disaster insurance to be bundled with fire insurance, which is in turn required by most banks for mortgages (of ten to thirty years). Each property insurer has an assigned upper limit for how much risk exposure they can bear. This is to facilitate primary property insurers’ ability to buy reinsurance, because reinsurers price according to the level of risk in an insurer’s portfolio.

Insurers are able to adjust premiums according to property risk up to a maximum rate set by the government. If an insurer is unable to insure a property for the maximum rate or less, they can pass the property’s policy on to the nationwide natural catastrophe pool, Canara. Canara functions similarly to an American FAIR Plan. All residential property insurers contribute to the pool in proportion to their market share, and premiums and losses are shared in the same way. Buildings built in high-risk areas post-2008 are not covered by the maximum rate, so insurers can set premiums for such structures at their discretion. Such buildings are also not entitled to bundled flood insurance in the same way as other structures (meaning insurers can choose to refuse to offer flood coverage), and their occupants do not receive disaster aid in the event of damages.

When a disaster’s damages exceed €280 million ($318 million), the federal government will intervene to make policyholders whole and prevent insurer insolvency. In Flanders, victims of particularly rare or intense disasters (causing damages greater than €30 million or $34 million, very low-probability disasters, or disasters with an intensity that exceeds a certain threshold) can receive relief from the Flemish Disaster Fund. The payout is contingent on the victim’s municipality having applied to be included within a declared disaster-affected area and has a €500 ($567) deductible. Wallonia caps an individual insurer’s annual damages at €320 million ($363 million). This was tested in 2021, when flooding caused over €2.5 billion ($2.8 billion) in damages in the region. Wallonia and Assuralia, Belgium’s insurance association, negotiated an agreement to have insurers pay €590 million ($669 million) in insurance claims while the region paid the balance using a five-year, interest-free loan from insurers.

Flood risk mitigation is cooperatively handled by the federal government and the governments of the Belgian regions. The regions set regulations for preventing rainwater flooding, build flood control structures, and define flood control areas. Wallonia additionally makes flood risk maps available to local authorities and has a structure for “river contracts” by which some local authorities agree to aggressively manage flood risk.

In 2024, flooding caused Germany €2 billion in insured damage in a single month. In 2021, flooding was responsible for $40 billion in losses, the majority of which were not insured. Flood risk management is mostly an individual responsibility in Germany. There is no national flood insurance or loss-reduction scheme, in spite of periodic attempts to create one. Flood insurance is an add-on to fire insurance. It has only a 40 percent take-up rate. Many homeowners wrongly assume that they have flood coverage. Pricing is roughly risk-based, with a four-tier flood hazard zoning system, ZÜRS, used to gauge the insurability of a property and set premiums.

Insurers in Germany face an adverse selection problem: Most people who buy flood insurance will be those whose properties are riskiest to insure. To compensate for this and the absence of cross-subsidization because of low uptake, insurers price flood insurance expensively but not granularly. This creates further disincentives to acquiring insurance for people facing lower risks, even though some states have said that they will not pay disaster relief to people who could have purchased insurance.

Switzerland’s approach to flood risk management, which we expand on later in this piece, incorporates risk reduction into risk transfer. Risk reduction is often an individual responsibility, but the government provides a range of support, including technical advice, to facilitate it.

In Switzerland’s GUSTAVO cantons, which account for 20 percent of the real estate market, disaster insurance is bundled with fire insurance and both are provided by private insurers. Four of these cantons require disaster insurance, while three do not. In all seven, disaster insurance is required for a mortgage. The federal government sets the prices insurers can charge across the seven cantons, and insurers are obliged to meet coverage standards set by a 1993 law. Pricing varies between cantons but not within them, making it roughly risk-based. A ₣1.0 billion ($1.2 billion) joint fund exists to compensate insurers for excessive losses.

Public reinsurance systems move varying degrees of responsibility for managing flood risk and disaster recovery from individuals to the state. This is done to the greatest extent in France, which epitomizes the solidarity principle (but has individual responsibility components). In the United Kingdom, public reinsurance is a means to temporarily make private insurance more available and affordable while property owners are pushed to adjust to the realities of a changing climate. In both countries, the downside of the public backstop is that the pressure on insurers to price premiums according to risk diminishes, because the government, with its diversified base of policyholders, is offering reinsurance and cross-subsidization.

France coordinates disaster mitigation, insurance, and relief through a program called Cat Nat. Cat Nat has two pillars: solidarity and responsibility. In France, property insurance compulsorily includes disaster insurance. Solidarity requires all policyholders to pay a 20 percent surcharge on their property insurance premiums. The surcharges fund disaster reinsurance, prevention, and relief. When a disaster is declared, policyholders in the affected area file claims with their insurers, who are compensated for their payouts by Caisse Centrale de Réassurance (CCR), the state-backed reinsurer, or by a private reinsurance company. Most insurers are reinsured by CCR, which compensates them for from 50 percent of their losses to 100 percent above an annually-set threshold. Insurers can also transfer their disaster coverage premiums to CCR and have CCR take over responsibility for paying out those claims.

The second pillar, responsibility, functions at individual and governmental levels. It means that there is a compulsory property insurance deductible, €380 ($431), for residential property, and that victims without insurance are not eligible for government disaster aid. At the municipal level, communities that adopt Risk Prevention Plans (RPPs) can decrease their deductibles. RPPs and Action Programs for Flood Prevention (PAPIs), which are efforts to manage risk within a river basin, are both partially funded by the disaster prevention fund. Similarly to how aid works at the individual level, insurers can refuse to insure properties that do not follow a municipality’s RPP.

In spite of these measures, Cat Nat has been criticized for not doing enough to incentivize risk reduction or protect the poor. Local leaders know that even if they make poor zoning decisions, the costs of disasters experienced by vulnerable areas will be covered through the program. One study found that low-income homeowners and tenants are overexposed to flood risks by 5.5 percent and 8 percent, respectively, compared to the mean. For all income deciles outside the top 10 percent, premiums account for a higher share of income than for the top 10 percent, making the program weakly regressive.

From 1982 to 2014, floods accounted for 62 percent of disasters declared in France. From 1982 to 2016, annual natural disaster claims averaged €1.2 billion ($1.4 billion). From 2016 to 2022, they more than doubled to €2.5 billion ($2.8 billion). These costs have stretched Cat Nat thin. The surcharge on premiums was only 12 percent from 2000 to 2025, and CCR has run a deficit every year since 2016—showing the fiscal problems that can come with avoiding risk-adjusted pricing or not enforcing risk-lowering measures.

The United Kingdom’s flood reinsurance scheme, Flood Re, is a temporary program meant to keep insurance affordable for homeowners (in homes built before 2009) in high-risk areas for flooding. Many mortgage lenders require flood insurance for flood-prone properties. Right now, Flood Re keeps prices lower than they would be otherwise in an effort to keep homeowners on flood insurance and to incentivize flood protection measures. When Flood Re phases out in 2039, insurers will be expected to sell insurance based only on the risk a property faces. The program is funded by a fee paid by insurers that generates £135 million ($179 million) in annual revenue. Insurers are reimbursed by Flood Re for claims made by a flood insurance policyholder and can also pass on policies to Flood Re at a fixed price that is based on the insured property’s tax bracket. Such policies have an excess (like a deductible, except it does not affect premiums) of £250 ($332).

In fiscal year 2023, Flood Re made a pre-tax profit of £24 million ($32 million). That was 74 percent lower than the previous year, because a record-breaking 288,567 properties entered the program following severe storms. Effective April 2025, three changes will be made to Flood Re’s structure: Its liability limit will be increased to £3.2 billion (from £2.1 billion), which is about $4.3 billion; its fee collection will be increased to £160 million ($213 million), and its annual loss limit will be increased from £100 million to £250 million ($333 million).

Early evidence (Flood Re was introduced in 2016) suggests that Flood Re creates moral hazard. The Bank of England found that before 2016, flood-prone properties’ values were declining. Since 2016, they have increased by an average of more than £4,000 ($5,300). Using Flood Re to build homeowner resilience by 2039 is a growing priority for the government. To send clear risk signals, Flood Re has proposed introducing certificates attached to properties that would tell buyers the property’s flood risk (which was recently updated by the United Kingdom’s Environment Agency for hazards including surface flooding). To promote adaptation, Flood Re’s Build Back Better initiative allows homeowners to use their insurance payouts to install up to £10,000 ($13,300) of flood protection measures for their homes. About 70 percent of the private insurance market in the United Kingdom has followed suit and created similar rules.

At the community level, Flood Re is complemented by efforts to bulk up flood defenses. The Environment Agency works with local councils to create and implement flood risk management plans (FRMPs) for each of the country’s major river basins. These are intended to protect residents of each basin from major flood events, and to facilitate investments in resilience such as the Bridgwater Tidal Barrier, which is supposed to protect thousands of homes in the low-lying Somerset Levels and Moors from flooding. The government decides how to spend, and which projects to spend on, by considering the populations and economies at risk, as well as the return on each investment in a flood mitigation measure.

There are three countries with truly public flood insurance: Spain, most of Switzerland, and the United States. In these places, flooding is the costliest category of disaster and incentives to reduce damages are, at a social level, high. But they take different approaches to promoting risk reduction, risk transfer, and relief, as well as widely varying attitudes toward the question of responsibility.

Spain’s two-tier disaster insurance system, like France’s, relies on the solidarity principle. The private market insures events such as frosts and storms, while floods, earthquakes, and tsunamis are included in extraordinary risk insurance, which is a compulsory part of property insurance. Different insurance lines have different surcharges applied to them. These are transferred monthly to the state-backed Consorcio de Compensación de Seguros (CCS). When there is a disaster claim, CCS pays for the policyholder’s losses—making it an insurer, not a reinsurer. Because of the solidarity principle, premiums are not risk-based.

Surcharges have been lowered twice in the past twenty years as both policies in force and compensation claims have quadrupled since the 1990s. CCS has never had to make use of its guarantee from the central government. But circumstances may be changing. From 1987 to 2022, floods accounted for 70 percent of insured disaster losses. That total is likely to have increased since 2024, when flooding in Valencia caused $4.2 billion of insured damage and $6.8 billion of uninsured losses. A consequence of the floods has been a pause in mortgage approvals pending lenders receiving updated information about properties’ risk profiles and damages.

In nineteen of Switzerland’s twenty-six cantons, flood insurance is provided by a public cantonal insurer (KGV) in a bundle with fire insurance. KGVs insure around ₣2.0 trillion ($2.5 trillion) worth of property, 70–80 percent of Switzerland’s total real estate market, with comprehensive (including full reconstruction value), compulsory insurance. The KGVs have their own reinsurer, an inter-cantonal fund capitalized at ₣1.2 billion ($1.5 billion). Of this amount, ₣950 million ($1.16 billion) is risk-carrying. The fund offers relief if a KGV’s losses exceed a fifty-year-return annual loss. Within a canton, all policyholders pay the same rate, but pricing differs between cantons. This is because each canton is thought to have a consistent risk profile. So there is solidarity between insureds as well as among insurers.

In addition to providing insurance, the KGVs also fund risk prevention, with ₣240 million ($294 million) annually dedicated to funding fire brigades and around ₣80 million ($98 million) to building improvements for fire and flood prevention. These enable the KGVs to support property-level risk reduction measures. One of the KGVs’ advantages is that alongside insurance, risk prevention and land use are recognized as components of their mission.

Flood insurance in the United States is provided by the National Flood Insurance Program (NFIP), a program run by FEMA. NFIP was created as part of a comprehensive flood management program in which communities, to be eligible for flood insurance, had to commit to making certain floodplain management and land use decisions. Flood insurance is sold as an optional add-on to property insurance. Historically, premiums involved extensive cross-subsidization, with people in high-risk areas not paying enough relative to the cost of their claims. Premiums are now set based on a property’s granular level of flood risk, in an example of risk-based pricing. If an individual takes measures to reduce their flood risk, their premiums can decrease.

When a disaster occurs, the disbursement of aid is also coordinated by FEMA. Once the president declares a disaster, people in the affected area are eligible for aid such as rental assistance, reconstruction assistance, and municipal funding. In areas categorized by FEMA as flood zones—where there is a 1 percent annual chance of flooding above a certain threshold—homeowners must have flood insurance to receive government-backed loans and aid, including mortgages. In many cases, however, this requirement is not well enforced.

The eight flood risk management systems described above present tensions between risk reduction and insurance, subsidies and signaling, and public and private systems. In the United States, these tensions are often summarized as affordability (cheap insurance) versus availability (presence of insurance). This formulation neglects both the importance of risk reduction and the difficulty of capturing the full meanings of availability and affordability.

For example: Artificially suppressing the price of insurance through regulation can make insurance more affordable in the short term. This is done by tightly regulating rates and banning risk-based pricing in California and France, respectively. In the long run, these regulatory efforts may keep people in high-risk areas where they are vulnerable to great financial and personal losses. The rest of society often ends up subsidizing these costs. Similarly, public and compulsory systems help increase insurance availability by functionally enrolling all consumers in insurance plans. But they may increase risk exposure if they do not come with expectations that local governments make responsible decisions about zoning, land use, and flood mitigation.

As risk exposure and more intense disasters combine, flood risk management systems, both for reducing risks and transferring them by way of insurance, are bearing greater burdens. NFIP is $22.53 billion in debt, with $2 billion stemming from losses related to Hurricanes Helene and Milton. Some European insurance systems, even those that experience less adverse selection, are deteriorating. Spain’s CCS saw its surplus go from €571 million ($649 million) in fiscal year 2022 to €29.6 million ($33.6 million) in fiscal year 2023, part of a decade-long increase of 50 percent in natural disasters’ damage as a percentage of total damages. France’s CCR experienced a seventh straight year of losses, losing €80 million ($91 million) in fiscal year 2023. In the United Kingdom, Flood Re saw its profits go from £92 million ($122 million) to £23.8 million ($31.8 million) between 2023 and 2024, with 30 percent of all claims ever filed with Flood Re arriving in the twelve months leading up to March 2024.

These rising losses and shrinking surpluses demonstrate that no flood management model is perfectly suited to a world of greater hazards and predictably rising exposure. Reforms are needed. We believe that the strength of the U.S. system is its move to risk-based pricing and its inclusion of both individual and public responsibilities for risk reduction. The Netherlands and Switzerland show how to execute the latter part of this (the risk reduction component), more effectively, while Belgium, France, and Switzerland show how access to flood insurance can be expanded through bundling. The United Kingdom’s model, with its clear end-date, helps create a transition from subsidized flood insurance to risk-reflective flood insurance that does not leave consumers stranded, and France’s deficit-inducing model shows how not to approach affordability. As policymakers work to reform or create flood risk management systems, they should learn from these strengths and weaknesses.

Insurance is the essential mechanism for communicating how risky a given location is. If pricing is actuarially fair, meaning that the cost of an insurance premium and the expected long-term payouts of a policy balance out, a particular location’s higher risk should be matched by higher flood insurance costs in that same location. The change in price reflects the greater probability of losses associated with that location.

Making disaster insurance actuarially fair is uncommon. Many plans avoid actuarially fair pricing in two ways: by not pricing risk at all, or by pricing risk discretely rather than granularly or continuously. Not pricing risk at all is epitomized by the idea of solidarity, which charges all people in a given country with insurance coverage the same flat rate. Solidarity leads to cross-subsidization, when people in low-risk areas cover some of the costs that people in high-risk areas would otherwise face. This occurs, for example, in France and Spain, and can have negative fiscal consequences for the government if pricing for high-risk areas is too low or disasters become unmanageably expensive.

It is rare for governments to directly subsidize premiums by making payouts to consumers. But it is common for the disaster insurance regulatory structure to have the effect of distorting prices or producing cross-subsidization.

The benefit of not pricing risk is that people who might otherwise be unable to receive insurance because they live in high-risk areas have access to it. But it also mutes the incentive for people (or governments) in high-risk areas to change their behavior. They do not bear the true costs of their decisions and any risk-lowering requirements that exist may not be enforced. This can be true even when disasters occur repeatedly.

In France, as in the United States prior to the introduction of Risk Rating 2.0, properties that face repeated flooding do not see commensurate increases in their insurance premiums in spite of their clearly higher risk exposure. Measures to tie receiving insurance to investing in risk-reducing measures, like better land use planning, have been tried in the United States and France as well as Belgium, where the consequences for not abiding by risk-reduction measures are strict.

The problem with discrete risk-pricing is the information challenge it poses to consumers. “Bands” of flood risk create discontinuities between themselves that can lead consumers to believe that, of two adjacent areas, one is safe and one unsafe, and to insurers reflecting that perception in their pricing. But these discontinuities obscure the reality that risk, rather than jumping from one step to another, is a continuous distribution. There is no bright line between safe and unsafe. This is a major challenge in Germany, where a single flood risk “band” (one of the four ZÜRS described above) can contain multiple orders of magnitude of risk. In spite of reforms, this issue remains a challenge in the United States, where residents of identified flood zones face stricter safety and insurance standards than those outside of them, even if the properties may experience differences in risk as small as a tenth of a percent.

Reforms of flood management systems must be intentional about how they approach risk and its costs. Muting the price signal can make insurance cheaper, as in the United Kingdom. But it can also expose vulnerable people to disaster from which they might have other difficulties recovering, as we see in the United Kingdom’s flood-prone Somerset Levels and Moors.

An ideal flood insurance system should be actuarially fair, to communicate the risks of living in a given place. It should also be structured so as to incentivize disaster prevention, thereby reducing risk exposure. Recent reforms in the United States to NFIP, namely Risk Rating 2.0, suggest that the best way to do this is to combine risk-based pricing, so that cross-subsidization does not occur, with subsidies for lower-income people and some standard of compulsory disaster coverage. We turn to those two measures in the next section.

The financial resources to know about and afford insurance may be unequally distributed. To protect the whole of a population, optimized flood management systems should enable lower-income people to afford insurance, and ensure that awareness of insurance is high.

In many countries, flood insurance has been made affordable through muting risk signals, as in France and Spain. This is arguably (a) counterproductive, because it leaves consumers with less information than they should have; (b) regressive, because it tends to benefit the well-off; and (c) likely to create moral hazard, because people can choose to live in places where they know the government will bail them out—a problem that has been observed in the United Kingdom since the creation of Flood Re. The key to an effective system is likely found in separating the notion of risk from the idea of subsidization.

Rather than keeping prices low to make sure insurance is affordable, governments should prioritize acknowledging flood risks and making insurance actuarially fair. The United Kingdom, which has been updating flood maps and working to transparently communicate individual properties’ flood resilience, shows how this can be done. For those who cannot afford these risk-adjusted premiums, targeted, transparent subsidies may make sense—but not forever. Such subsidies will enable people who have historically lived in vulnerable areas to afford to continue living there. Once disasters occur, however, that substantially damage their properties, these subsidies should be re-targeted at supporting thoughtful relocation efforts. The subsidy should be neither invisible nor perpetual. Unfortunately, no country has yet put this principle into practice, though some U.S. states, like Kentucky, are spearheading relocation.

If insurance were simply actuarially fair, without subsidies, some people unable to afford insurance costs might forgo insurance altogether. This would create a greater burden for society in the case of a disaster. The government would be left picking up the tab for people who did not have the financial resources to recover from a shock and might be unable to relocate to a place where recovery would be possible.

A correlative of lower incomes is lower information about insurance’s benefits, costs, and function, particularly for disaster recovery. Governments have a range of options for overcoming this challenge. They can make flood insurance compulsory or bundle it in different ways. Compulsory insurance could be imposed either universally, as it is in France, or as a requirement to receive services such as a mortgage. Bundling could involve making it mandatory to sell all-peril insurance, as is the case in Belgium and Switzerland, rather than having flood insurance as an add-on, which can confuse consumers and limit uptake. Or, if the goal of insurance is to protect the contents of a property rather than the property itself, insurance could be bundled with an item at the point of sale.

Such requirements will ensure education is no bar to insurance access. They present the opportunity to offer people who might otherwise decide to put themselves in risky situations, like living in a river valley, the information to reconsider.

A necessary addendum to the equal access argument is that insurance does not have to be only indemnity insurance, which requires proof of damage for a policyholder to receive a payout. Parametric insurance, which ties insurance payouts to objective indicators of disaster intensity like water velocity; microinsurance, which is insurance in small amounts; and insurtech, which speeds insurance delivery, can improve insurance uptake by changing the parameters of what insurance is. Policymakers interested in protecting citizens from the costs of disasters and enabling equal access to that protection should create regulatory conditions that permit either experimentation with or deployment of these new kinds of insurance.

The biggest theoretical challenge confronting governments is what balance to strike between responsibilities and privileges. In the United States, where insurance costs have grown and availability in some places has decreased, and in Europe, where many regimes enforce compulsory insurance access, there are some who believe that insurance is a right. There is arguably a human right to safe and decent housing. But supplementary measures—like insurance access—should be incumbent on meeting expectations of individuals and governments that involve lowering and preventing risk.

In our view, policymakers considering reform of their flood risk management systems need to turn contemporary debates over insurance access into more productive conversations about how to adapt to climate change without breaking the bank. A key way to do so will be making clear that property owners and local governments have responsibilities to lower physical risks to their properties if they expect to receive benefits that protect them from consequences. The initial concept for the NFIP sought to realize this vision, and the Netherlands, with its approach to risk prevention, shows how governments can achieve risk prevention while leaving risk transfer to private markets. Germany, which does not have a risk transfer framework to tie risk reduction measures to, shows the limits of taking a disjointed governmental approach to lowering risk.

At the individual level, a good example of this kind of contract would be requiring that holders of flood insurance policies invest in flood-proofing their homes. At the communal level, this might mean binding requirements not to build on floodplains if a community is to receive disaster aid. Countries like the United Kingdom, France, and the United States have begun to set such standards, but governments and insurers need to go further to view insurances, relief, and risk-reduction as three legs of a stool. Only in Switzerland, where the remit of insurers includes disaster prevention, is this idea taken seriously enough.

Policymakers considering reforms may want to consider what balance between responsibilities and privileges they are comfortable with when it comes to balancing the right to housing with the greater good. Arguably, society should not bear the costs of a few people’s short-sighted decisions, nor should policymakers enable people to put themselves at risk without adequate information and preparation.

Our recommendations are intended to provide a framework for flood insurance reform that accommodates the trade-offs that will need to be made to adapt to climate change and preserve some form of flood insurance access. Pricing of insurance premiums should be granularly risk-based so as to both communicate the true level of risk inherent in any given location and reduce moral hazard. Flood risk management should include measures aimed at lowering risk by keeping people out of unsafe areas and building to high standards, and these measures should be implemented in conjunction with insurance. When public insurance is offered, the duration should be limited, to avoid creating political incentives for keeping insurance prices artificially low. At the same time, access to flood insurance should be made as open as possible, either through mandatory disaster insurance or through bundling of disaster insurance with other insurance. In any case, flood insurance affordability should be secured through means-tested subsidies rather than through suppressing the price of premiums to keep insurance affordable.

Although our analysis of flood management systems has focused on the developed world, where most flood risk management has taken place, these guidelines are relevant to developing countries. Economic growth will pose countries in the developing world the same challenges now facing developed countries: insuring property without encouraging moral hazard, incentivizing lowering physical risks, and reducing both the economic and human costs of flooding. The developing world can make use of the developed world’s lessons and join them in designing flood management systems that strike the right balance of risk-signaling, access, and responsibilities to entitlements. There is no one perfect answer to flood risk. But our review suggests which measures make sense—and which should be avoided to save citizens and policymakers from fiscal pain, risky behavior, and loss of life and property.

Former Nonresident Scholar, Sustainability, Climate, and Geopolitics Program

Susan Crawford was a nonresident scholar in the Sustainability, Climate, and Geopolitics Program at the Carnegie Endowment for International Peace.

Daevan Mangalmurti

Research Assistant, Sustainability, Climate and Geopolitics Program

Daevan Mangalmurti is a research assistant in the Sustainability, Climate and Geopolitics Program.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

On the fourth anniversary of Russia’s full-scale invasion, Carnegie experts discuss the war’s impacts and what might come next.

Eric Ciaramella, Aaron David Miller, Alexandra Prokopenko, …

New data from the 2026 Indian American Attitudes Survey show that Democratic support has not fully rebounded from 2020.

Sumitra Badrinathan, Devesh Kapur, Andy Robaina, …

For climate-focused civil society in countries like Morocco, Algeria, and Tunisia to be most effective, organizations should work together to develop networks that extend their reach beyond their local area and connect across borders to share best practices and amplify each other’s work.

Sarah Yerkes

France and Germany’s failure to agree on the Future Combat Air System (FCAS) raises questions about European defense. Amid industrial rivalries and competing strategic cultures, what does the future of European military industrial projects look like?

Rym Momtaz, ed.

The speech addressed Iran but said little about Ukraine, China, Gaza, or other global sources of tension.

Aaron David Miller