Raluca Csernatoni, Sinan Ülgen

{

"authors": [

"Sinan Ülgen"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie Europe"

],

"collections": [

"Arab Awakening"

],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Europe",

"programAffiliation": "",

"programs": [],

"projects": [],

"regions": [

"Middle East",

"North Africa",

"Egypt"

],

"topics": [

"Economy"

]

}

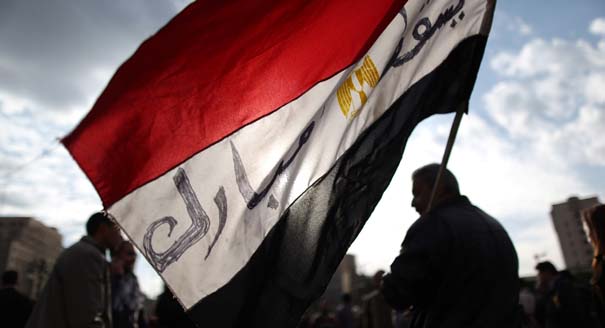

Source: Getty

Bring the Revolution to Arab Economies

While failure to reach a power-sharing agreement in Egypt will prolong political instability, economic inaction would be just as damaging to the consolidation of democratic rule.

Source: Globe and Mail

The showdown between Egypt’s Islamists and military rulers is a clear reminder of how difficult democratic transitions in the Arab world are likely to be. Failure to reach a power-sharing agreement will prolong political instability. But economic inaction would be just as damaging to the consolidation of democratic rule.

Emerging Arab leaders, from Islamists to reinvented former regime officials, are keenly aware of the need to improve their countries’ economic prospects. They know full well that their popularity can be sustained only if they are able to deliver growth, employment and higher living standards. This would be a difficult challenge under any circumstances – and is all the more daunting against the backdrop of the Arab Spring’s destabilization of economic systems across the Middle East and North Africa.

Even in countries like Tunisia and Egypt, where the transition to democracy is more advanced, political uncertainty has tended to plague economic achievements. In 2011, Tunisia’s economy shrank by 1.8 per cent – its first contraction since 1986. Unemployment reached 18 per cent, up five points from 2010. The Egyptian economy contracted by 0.8 per cent, and one million people lost their jobs. Egypt’s foreign-investment inflows have also dried up, falling from $6.4-billion (U.S.) in 2010 to a mere $500-million in 2011.These trends are affecting these countries’ fiscal balances. Egypt’s budget deficit reached 10 per cent of GDP, while its foreign-exchange reserves have fallen to $15-billion – barely enough to cover import bills for the next three months. In Tunisia, the budget deficit has widened sharply since the revolution, rising from 2.6 per cent of GDP in 2010 to 6 per cent in 2011.

This rapid economic deterioration, combined with the high political expectations, is creating a sense of urgency. Emerging political actors feel compelled to develop more detailed economic programs and to address growing material grievances. For example, whereas the Islamists had previously focused on political themes, the recent election campaigns saw a rhetorical shift to economic aspirations.

Overall, the emerging political players – particularly Islamist parties – have adopted a rather conciliatory tone regarding engagement with international actors. These parties’ economic programs are by and large pro-market, emphasizing the private sector’s role in driving growth and the need to attract foreign capital. The state is seen as a vehicle for ensuring social justice, and there are scant references to sharia principles.

Both in Tunisia and Egypt, for example, Islamist politicians have given assurances that the economically critical tourism sector will not be hindered by Islamic law. Their economic programs also foresee a role for international institutions in helping overcome challenges.

Indeed, whereas resistance to foreign intervention and assistance has been strong with respect to democratic reforms, new Arab leaders seem more receptive to the West on economic objectives. This is an unprecedented opportunity for international engagement with the new Arab leadership, which should incorporate short-, medium-, and long-term goals.

Short-term goals must have priority, because many Islamist parties are being pressed to produce positive results within a single electoral cycle. The new governments will face the immediate challenge of creating jobs, for which the only available recipe is investment in large-scale public-works projects.

The international community can help Arab governments with such initiatives in several ways: It can increase the amount of promised financial assistance. It can provide technical expertise on debt management. And it can help establish a secure and predictable legal and regulatory framework for public-private partnerships. International actors, jointly with Arab governments, can then help to market these opportunities.

Only a combination of these options would allow Arab economies to create jobs now, while avoiding the risks of destabilizing fiscal imbalances or a lack of financing for private-sector investment. The West, for its part, stands to gain in myriad ways. Even in the midst of a protracted currency crisis, foreign governments can surely sign on to an agenda that prioritizes transfers of know-how over cash infusions.

About the Author

Senior Fellow, Carnegie Europe

Sinan Ülgen is a senior fellow at Carnegie Europe in Brussels, where his research focuses on Turkish foreign policy, transatlantic relations, international trade, economic security, and digital policy.

- Can the EU Achieve Its Tech Ambitions?Q&A

- Can the EU Overcome Divisions on Defense?Q&A

Catherine Hoeffler, Sinan Ülgen

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

- The Other Global Crisis Stemming From the Strait of Hormuz’s BlockageCommentary

Even if the Iran war stops, restarting production and transport for fertilizers and their components could take weeks—at a crucial moment for planting.

Noah Gordon, Lucy Corthell

- Who Will Be Iran’s Next Supreme Leader?Commentary

If the succession process can be carried out as Khamenei intended, it will likely bring a hardliner into power.

Eric Lob

- Bombing Campaigns Do Not Bring About Democracy. Nor Does Regime Change Without a Plan.Commentary

Just look at Iraq in 1991.

Marwan Muasher

- Iran Is Pushing Its Neighbors Toward the United StatesCommentary

Tehran’s attacks are reshaping the security situation in the Middle East—and forcing the region’s clock to tick backward once again.

Amr Hamzawy

- The Gulf Monarchies Are Caught Between Iran’s Desperation and the U.S.’s RecklessnessCommentary

Only collective security can protect fragile economic models.

Andrew Leber