Yukon Huang, Isaac B. Kardon, Matt Sheehan

{

"authors": [

"Yukon Huang"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"East Asia",

"China"

],

"topics": [

"Economy",

"Trade"

]

}

Source: Getty

What the West Gets Wrong About China’s Economy

Conventional wisdom about China’s economic problems, such as debt, growth, and trade, can often be wrong due to the lack of an appropriate framework for analysis.

Source: Foreign Affairs

Few countries command as much attention as China. That is not surprising. Its remarkable economic rise is shaking the world’s geopolitical balance even as it raises questions about the universality of market-led capitalism and democratic norms. In turn, China has become a lightning rod for all manner of anxiety. The White House has blamed China for the United States’ huge trade deficits, for example, even though there is no direct causal relationship between such deficits and China’s surpluses. In fact, there are several things about China that U.S. analysts get wrong.

It isn’t hard to understand why. For the general public, there are difficulties in drawing appropriate conclusions about a country that is so big and regionally diverse in the distribution of its natural resources and commercial activities. And sentiments are almost always clouded by differences in ideology, values, and culture.

For scholars, meanwhile, conflicting views stem from the lack of an agreed framework for analyzing China’s economy. Decades ago, in the heyday of the Soviet Union, universities taught courses on centrally planned or “transitional” economies as an academic discipline. With the demise of the former Soviet Union, this body of analysis faded away. Today, China is studied as a developing economy, yet it is not one. The close links between its financial, fiscal, trade, and social welfare systems make it a different animal entirely.

Given the lack of an appropriate framework for analyzing China, predictions of its future have varied wildly. Among the many popular beliefs are that China’s high debt levels will inevitably lead to financial crisis (yet its debt as a share of GDP places it around the middle of major economies); that corruption has negative consequences for China’s growth (yet deepening corruption has facilitated rather than impeded growth); that it is impossible for U.S. firms to compete with China because its wages are so low (yet China’s wages have increased fivefold since the mid-1990s); and that American companies invest a lot in China, which is a drain on jobs in the United States (yet less than two percent of America’s foreign investment over the past decade actually went to China).

If the analysis is off, then it is likely that Western policy responses are as well.

Why China’s Debt Is Different

For many years, annual Pew and Gallup polls have reported that most Americans see China as the leading global economic power. Europeans, for the most part, share this view. Those in the rest of the world, however, correctly identify the United States as the world’s top economic power. Perception is important; politicians are greatly influenced by where they sit and the sentiments of their constituents.

Why is there such a dichotomy between the views of developed and developing countries? The answer comes from the preoccupation of the United States and Europe with their huge trade deficits with China as a sign of economic weakness. Overall, the rest of the world generates trade surpluses with China, and many countries realize that economic power comes more from the strength of a nation’s economic institutions and the depth of its human capital than from trade alone.

For the more ideologically inclined, China’s economic ascendancy threatens the tenets of Western political liberalism—grounded in free markets, democracy, and the sanctity of human rights. These concerns often surface as a debate about the roles of the state versus the market, or the priority to be accorded to individual liberties versus collective action. The relative positions of the United States and China have become caricatures, although they may have more in common than many realize in terms of the problems that need to be addressed.

In the West, the debate about the market versus the state took on more urgency after the 2007-08 financial crisis, when major Western economies stumbled badly as China continued steadily apace. Critics of the Chinese model found China to blame for the West’s woes. They warned of its unbalanced growth (as measured by its extremely low share of personal consumption relative to the size of its economy and high outward investment), which would make it harder for the United States and Europe to recover. In the long run, the imbalance would even harm China itself. Thus, under U.S. President Barack Obama and now President Donald Trump, Washington has been urging Beijing to boost consumption if China wants to achieve high-income status—to escape the so-called middle-income trap.

Although “balanced” sounds good and “unbalanced” bad, those perceptions are misguided. Unbalanced growth is an inevitable but unintended consequence of a largely successful long-term development process. A decline in consumption as a share of GDP and a commensurate increase in investment actually comes from the movement of migrant workers from labor-intensive rural activities to more capital-intensive industrial jobs in cities. In the process, the share of consumption to GDP automatically declines even though consumption per person or household increases. In labor-surplus countries like China, farmers consume most of what they produce; thus, the share of consumption relative to agriculture output is high. When the farmer moves to an urban-based industrial job, such as assembling computers, he is paid a wage that is several multiples of what he was previously earning in agriculture; thus, his personal consumption increases considerably. But labor costs (and thus personal consumption) as a share of the value of an industrial product is relatively small compared with the costs of the components and the factory. Thus, the steady transfer of labor from agriculture to industry leads to a decline in the share of consumption to GDP but an increase in consumption per worker. Unbalanced growth has thus led to a rise in household living standards and China becoming a major manufacturing and trading power—much as it once did for Japan and South Korea and, a century before that, in the United States.

Beyond so-called unbalanced growth, world financial markets have also been fixated on China’s surging debt-to-GDP ratio and a property bubble. Experts such as the former IMF chief economist Kenneth Rogoff and agencies such as the Bank for International Settlements (BIS) and Moody’s have warned that all economies that have incurred comparable increases in debt have experienced a financial crisis and that there is no reason why China should be any different.

Yet China is, in fact, different—not because it is immune to financial pressures, but because of the structure of its economic system. The more optimistic observers point out that most of China’s debt is public rather than private, sourced domestically rather than externally, and that household balance sheets are typically strong. But neither the optimists nor the pessimists recognize that, a decade ago, China did not have a significant private property market. Once that market was created, credit surged into establishing market-based values for land—whose value was previously hidden in a socialist system. The fivefold increase in property prices over the past decade is the consequence.

The question now is whether current asset prices are sustainable. If they are not, a debt crisis is plausible. On that score, housing inventory has declined in recent years and affordability has improved. Many analysts have compared China’s housing prices with other major cities to get a sense of whether they are too high. But usually such comparisons are with much richer cities such as Hong Kong, Singapore, and Tokyo. Few realized that compared to India, prices in China’s megacities are actually much lower.

China’s financial situation does warrant serious attention, but it is not in crisis the way some observers suggest. Although China’s largely state-owned banking system has been too lax in its lending practices, the excessive pressure for credit expansion comes from local governments, which do not have the authority to raise revenue needed to fund the social and infrastructure services to support a rapidly growing economy. They have survived only because they have been able to borrow from state-owned banks to finance these expenditures. Thus, China’s debt problem is not so much a sign of typical banking problems but rather the consequence of a weak fiscal system.

Trading Up

For many China observers, worsening social tensions are the real risk to the country. Over the past several decades, income inequality has increased more rapidly in China than in any other major economy, environmental degradation has become a source of social protests, and worsening corruption is perceived as hampering growth and destabilizing the system.

Efforts to aid the poorer interior regions and to revamp social programs are beginning to moderate income disparities. The government is also starting to address environmental concerns because the rise of a more concerned middle class has made doing so a political imperative. But addressing corruption has revealed a potential conflict between political and economic objectives. Chinese President Xi Jinping sees arresting corruption as critical to preserving the legitimacy of the Communist Party, whereas economists, be they Chinese or Western, see dealing with it as essential to maintaining rapid growth. But these goals are not compatible.

Corruption is said to impede growth in developing economies because it dampens investment, both public and private. But China is different because the state controls all the major resources such as land, finance, and the right to operate commercial activities. Since privatization of those resources is not politically realistic, corruption allows for the transfer of use rights of these assets to private interests through formal or informal contractual arrangements with party and local officials. Such an arrangement encourages investment in infrastructure and industrial expansion in support of growth, with both sides sharing the gains. It is the major reason China has done so well economically even though it has lacked strong institutions and the rule of law.

Yet as China’s economy becomes more services-oriented and complex and public dissatisfaction with the inequities of rent-seeking behavior intensifies, sustaining growth may require getting the party out of its dominant role in controlling access to resources and economic opportunities.

Beyond national and international investment, international trade is another concern. Many Americans share the sentiments of Trump and his key advisers that America’s huge trade deficits are closely linked with China’s large trade surpluses. Yet the reality is that there is no direct causal relationship between the two.

As a former chairman of the Council of Economic Advisors, the Harvard professor Martin Feldstein, has written, “every student of economics knows or should know that the current account balance of each country is determined within its own borders and not by its trading partners.” Basic accounting principles tell us that the United States’ overall trade deficit is the result of a shortage in national savings relative to spending due to excessive government budget deficits and households consuming beyond their means. The countries that show up as being the source of the offsetting trade surpluses are coincidental.

How can this be explained intuitively to the non-economist? A close look at historical trends provides an answer. America’s trade deficit became significant around the late 1990s and only began to moderate around 2007. But China’s trade surpluses with the United States were not significant until 2004-05. How could China be responsible for America’s trade deficits when America’s huge deficits emerged long before China’s huge surpluses?

The confusion comes from having China as the final assembly point for parts produced by other Asian countries. In the 1990s, America’s bilateral trade deficits were concentrated among the more developed East Asian economies. The share of U.S. manufacturing imports from Asia has not changed over time, but the bulk of it shifted to China after the country became the last stop in the regional production network in the early 2000s.

Conventional wisdom also suggests that too much of America’s foreign direct investment (FDI) is going to China, resulting in job loss and declining competitiveness. Yet despite the United States and China being the world’s two largest economies, only about one or two percent of U.S. foreign direct investment has gone to China over the past decade. Going the other way, only three or four percent of China’s outward investment has been directed to America.

The existence of tax havens means that the real numbers are likely higher, but consider the EU, which is comparable to the U.S. in economic size. Over the past decade, annual flows of European FDI to and from China have been roughly two to three times those of the United States although they began at around the same levels a decade ago. The difference is that the European Union’s manufacturing strengths are more complementary to China’s needs than the United States’. The EU’s top exports to China are dominated by machinery and automobiles as well as high-end consumer goods. These products require FDI flows to support market penetration and servicing.

In comparison, the top categories of U.S. exports to China over the past decade include oilseeds and grains and recyclable waste (scrap metal and discarded paper), which do not lead to FDI. The third type is largely Boeing aerospace products, but Boeing has refrained from opening operations in China until recently, whereas its European competitor, Airbus, has had manufacturing centers in China since 2008.

Regarding outward investments, Europe is again more attractive because China and Europe are more complementary in their respective industrial structures than China and the United States. In addition, the EU is a much easier market for China to penetrate because it offers a greater choice of partners that are less preoccupied with security concerns. If one EU country restricts access to its market, a Chinese company can still enter through a different member country to gain access to the greater EU market. Although partnerships with individual U.S. states are possible, overarching federal policy is disadvantageous for Chinese investors relative to the more open environment that the EU offers.

Promoting more FDI in both directions would benefit both the United States and China. But the Trump administration may resist any agreement that would encourage American firms to invest more abroad. Moving forward on the bilateral investment treaty that has been under negotiation for years, however, should be high on the agenda even if it is not politically expedient.

No Zero-Sum Game

In assessing China’s economy, the puzzle is not whether one should be positive or negative. Rather, it is coming up with a framework that leads to a better understanding of China’s reality. For now, more often than not, the China debate reflects a misreading of the role of the state in influencing economic decision-making in China. The Western concept of an economy is based on competition among firms in open and free markets. Unique to China, local governments are also part of the competitive economic environment. Beijing sets the broad parameters and policies are calibrated in ways that defy traditional thinking. Competition in China is not just the result of pressures generated by markets and firms but can also come from local government entities. Not incorporating these factors into the analysis leads to a misunderstanding of what has been happening in China.

It is good for the world if China is stable and progressing well economically. Such progress is best supported if the country’s economic and financial problems are accurately assessed and addressed. Misunderstanding the nature of its debt problem, for example, by not recognizing that it is as much a fiscal problem as a banking issue, contributes to misguided efforts. China has one of the most restrictive regimes regarding foreign investment in services. Liberalizing access would cater to the United States’ strengths as well as spur the competition and knowledge exchange needed for China to become more innovative. Thus, the debate should be less about punitive tariffs and more about negotiating a bilateral investment treaty. Moreover, rather than worrying about China’s unbalanced growth model, the focus should be on persuading China to grant its rural-to-urban migrant workers full access to the social and economic services accorded to established urban residents. Doing so is justified for reasons of equity, but it would also spur growth in personal consumption and help moderate China’s trade surpluses, thus easing global trade tensions. Finally, at the geopolitical level, economic differences between nations can and do raise concerns, but ultimately their resolution does not have to be a zero-sum game.

About the Author

Senior Fellow, Asia Program

Huang is a senior fellow in the Carnegie Asia Program where his research focuses on China’s economy and its regional and global impact.

- Three Takeaways From the Biden-Xi MeetingCommentary

- Europe Narrowly Navigates De-risking Between Washington and BeijingCommentary

Yukon Huang, Genevieve Slosberg

Recent Work

More Work from Carnegie Endowment for International Peace

- The Other Global Crisis Stemming From the Strait of Hormuz’s BlockageCommentary

Even if the Iran war stops, restarting production and transport for fertilizers and their components could take weeks—at a crucial moment for planting.

Noah Gordon, Lucy Corthell

- Resetting Cyber Relations with the United StatesArticle

For years, the United States anchored global cyber diplomacy. As Washington rethinks its leadership role, the launch of the UN’s Cyber Global Mechanism may test how allies adjust their engagement.

Patryk Pawlak, Chris Painter

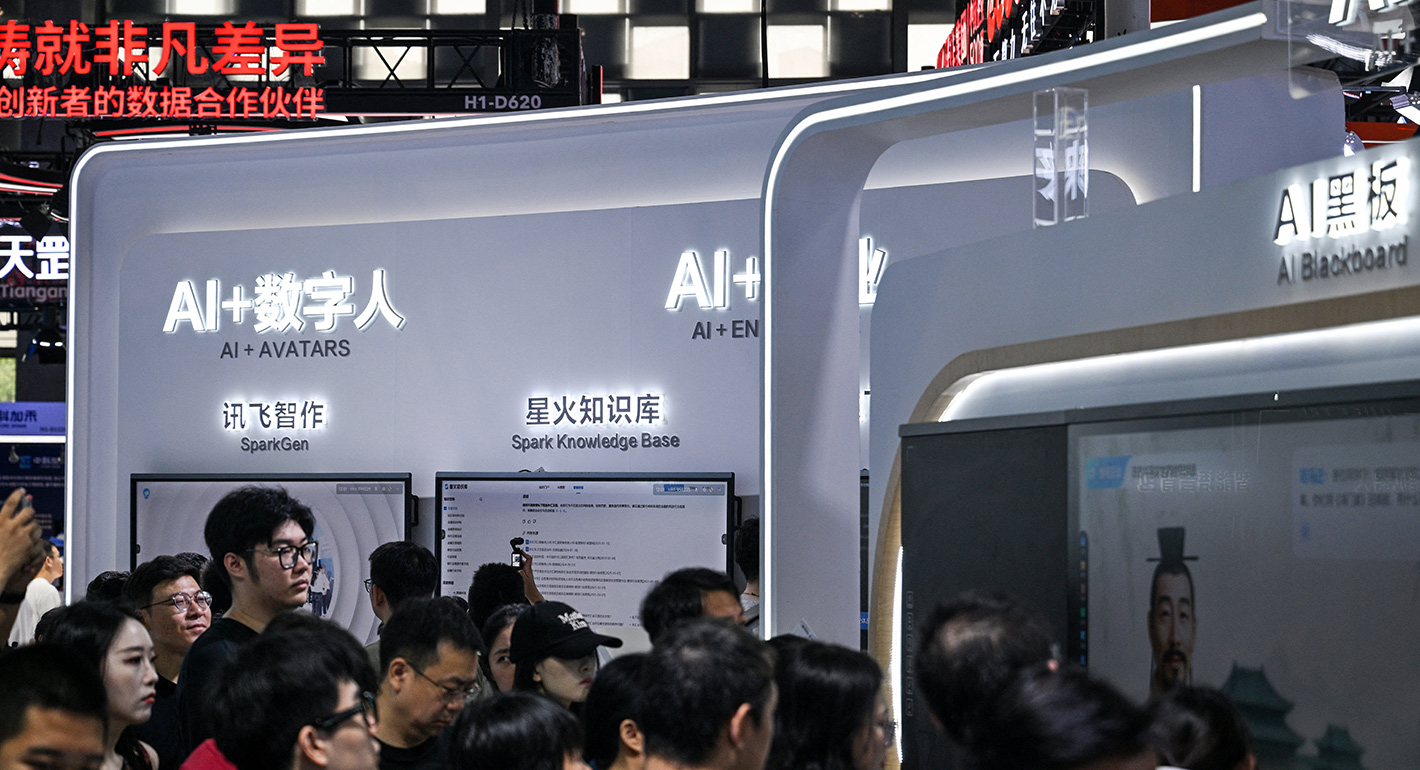

- China’s AI-Empowered Censorship: Strengths and LimitationsArticle

Censorship in China spans the public and private domains and is now enabled by powerful AI systems.

Nathan Law

- Why Are China and Russia Not Rushing to Help Iran?Commentary

Most of Moscow’s military resources are tied up in Ukraine, while Beijing’s foreign policy prioritizes economic ties and avoids direct conflict.

Alexander Gabuev, Temur Umarov

- Georgia’s Fall From U.S. Favor Heralds South Caucasus RealignmentCommentary

With the White House only interested in economic dealmaking, Georgia finds itself eclipsed by what Armenia and Azerbaijan can offer.

Bashir Kitachaev