Cornelius Adebahr

{

"authors": [

"Cornelius Adebahr"

],

"type": "other",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie Europe"

],

"collections": [

"Iranian Proliferation"

],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Europe",

"programAffiliation": "",

"programs": [],

"projects": [],

"regions": [

"Middle East",

"Iran"

],

"topics": [

"Foreign Policy",

"Economy",

"Nuclear Policy"

]

}

Source: Getty

Implications of Tehran’s Look to the East Policy for EU-Iran Relations

As the United States puts pressure on Europe to cut down on its trade ties with Iran, Tehran has already set its sights eastward. To remain a player, the Europeans have to step up their game.

Source: Stiftung Wissenschaft und Politik

As the United States puts pressure on Europe to cut down on its trade ties with Iran, Tehran has already set its sights eastward. Whether nuclear technology from Russia, oil sales to India, or all sorts of produce from China—Iran is certainly keeping its business options open as the EU struggles to keep its comprehensive cooperation agenda alive. To remain a player, the Europeans have to step up their game both through economic resilience vis-à-vis US sanctions and through policy initiatives to resolve the simmering crisis.

Pragmatism or principle?

Lamenting Iran’s turn to the East has become fashionable in the wake of Washing-ton’s unilateral withdrawal from the nuclear deal and Europe’s difficulties in keeping its (economic) side of the bargain. Yet this is nothing new. Iran has refused to take sides since the 1979 revolution, as embodied in the latter’s phrase ‘neither East, nor West, but the Islamic Republic’.1 Moreover, it is not only Iran that is ‘turning East’, the world’s entire economic activity has shifted in that direction. Once America’s dominance reached its pinnacle in the mid-20thcentury, Asia—first and slowly, Japan, and then, very rapidly, China—has pulled the world’s economic centre of gravity to where it was 2000 years ago: Central Asia.2 This is particularly true for the energy sector.3 As a consequence, other Arab states around the Persian Gulf have also begun to intensify their business relations with Asia.4 At the same time, politics is of course at play, given that European businesses feel obliged to follow US sanctions against Iran. In fact, even before the current US president announced his country’s withdrawal from the groundbreaking 2015 Vienna agreement, resignation among businesspeople had already sunk in. Throughout the deal’s implementation period, existing US bans on financial transfers had hampered even lawful trade. With Washington announcing its decision to reimpose all its original sanctions by early November 2018, most multinational companies quit their business in Iran.5 Consequently, EU-Iran trade stalled in 2018 following a short-lived boom after the agreement was struck. At €18.4 billion, trade in goods stood more than 13% below the €21.0 billion level seen in 2017. This was a marked drop after two consecutive increases, doubling from €7.7 billion in 2015 to €13.7 billion in 2016 and growing again by another 50% in the following year.6 Moreover, in the face of Washington’s ‘maximum pressure’ campaign, the International Monetary Fund revised its earlier projections downward, expecting the Iranian economy to shrink by 3.9% in 2018 and 6.0% in 2019 year-on-year, respectively.7

Faced with the fading of the ‘promised’ European market, Iranians are understandably turning their trade eastward. Yet even this is not so easy, as the difficulties surrounding the development of the South Pars gas field have underlined in a highly symbolic way. The world’s largest natural gas field is shared between Iran and Qatar due to its geographic location at the centre of the Persian Gulf. While Doha has exploited the riches of what it calls North Dome for nearly 30 years, the Islamic Republic began production on its side only in 2002, its efforts continuously hampered by US and international sanctions.

Much hope had been placed in boosting the country’s emerging liquefied natural gas industry by enlisting French company Total together with Malaysian Petronas and Chinese CNPC for the further development of the gas field once sanctions were lifted in early 2016.8 However, Total felt compelled to cede its share to CNPC in the autumn of 2018 in anticipation of Washington reimposing its oil and gas sanctions—only for the Chinese state-owned company to back out a couple months later for fear of straining US-China trade talks through continued investment.9 Thus, what initially looked like the perfect embodiment of Iran being forced to turn eastward, now appears as a case of the country’s broader economic malaise, or at leastthe sanctions-induced part of it.

Read Full Text

This article was originally published by Stiftung Wissenschaft und Politik.

Notes

1 For an assessment of Iran’s aspiration for equidistance from the early days of the nuclear negotiations see: Sanam Vakil, “Iran: Balancing East Against West”, in: The Washington Quarterly 29 (4), 2006, pp. 51-65.

2 The Chinese Century is Well Under Way, The Economist, 27 October 2018(accessed 2 September 2019). Previously analysed by Richard Dobbs, Jaana Remes, James Manyika, Charles Roxburgh, Sven Smit and Fabian Schaer, Urban World: Cities and the Rise of the Consuming class, McKinsey Global Institute, June 2012 (accessed 2 September 2019).

3 Ken Koyama, International Energy Market’s Gravity Center Shifting to Asia, The Institute of Energy Economics Japan,IEEJ Special Bulletin,30 May 2018 (accessed 2 September 2019).

4 Jun Dingand Qian Zhao, “The Diplomatic Strategy of GCC States: A Case Study of Saudi Arabia’s Recent Changing Diplomacy,” in; Asian Journal of Middle Eastern and Islamic Studies12(4), 2018, pp. 475-483.

5 Clifford Kraus, Trump Hit Iran With Oil Sanctions. So Far, They’re Working, New York Times, 19 September 2018 (accessed 2 September 2019); Ellen R. Wald, 10 Companies Leaving Iran As Trump's Sanctions Close In, Forbes, 6 June 2018 (accessed 2 September 2019).

6 European Commission, European Union, Trade in Goods with Iran, 19 March 2019 (accessed 2 September 2019).

7 IMF, Islamic Republic of Iran: Country Data, International Monetary Fund (accessed 2 September 2019); See also: IMF, World Economic Outlook, July 2019: Still Sluggish Global Growth, July 2019 (accessed 2 September 2019).

8 Iran: Total and NIOC Sign Contract for the Development of Phase 11 of the Giant South Pars Gas Field, Total Press Statement, 3 July 2017 (accessed 2 September 2019).

9 Chen Aizhu, CNPC Suspends Investment in Iran's South Pars After U.S. Pressure: Sources, Reuters, 12 December 2018 (accessed 2 September 2019).

About the Author

Former Nonresident Fellow, Carnegie Europe

Cornelius Adebahr was a nonresident fellow at Carnegie Europe. His research focuses on foreign and security policy, in particular regarding Iran and the Persian Gulf, on European and transatlantic affairs, and on citizens’ engagement.

- EU-Iran: Time to Revisit Assumptions and StrategizeCommentary

- Making an Inclusive EU Strategy on Iran a RealityResearch

Cornelius Adebahr, Barbara Mittelhammer

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

- Is a Conflict-Ending Solution Even Possible in Ukraine?Commentary

On the fourth anniversary of Russia’s full-scale invasion, Carnegie experts discuss the war’s impacts and what might come next.

- +1

Eric Ciaramella, Aaron David Miller, Alexandra Prokopenko, …

- Indian Americans Still Lean Left. Just Not as Reliably.Commentary

New data from the 2026 Indian American Attitudes Survey show that Democratic support has not fully rebounded from 2020.

- +1

Sumitra Badrinathan, Devesh Kapur, Andy Robaina, …

- Taking the Pulse: Can European Defense Survive the Death of FCAS?Commentary

France and Germany’s failure to agree on the Future Combat Air System (FCAS) raises questions about European defense. Amid industrial rivalries and competing strategic cultures, what does the future of European military industrial projects look like?

Rym Momtaz, ed.

- Can the Disparate Threads of Ukraine Peace Talks Be Woven Together?Commentary

Putin is stalling, waiting for a breakthrough on the front lines or a grand bargain in which Trump will give him something more than Ukraine in exchange for concessions on Ukraine. And if that doesn’t happen, the conflict could be expanded beyond Ukraine.

Alexander Baunov

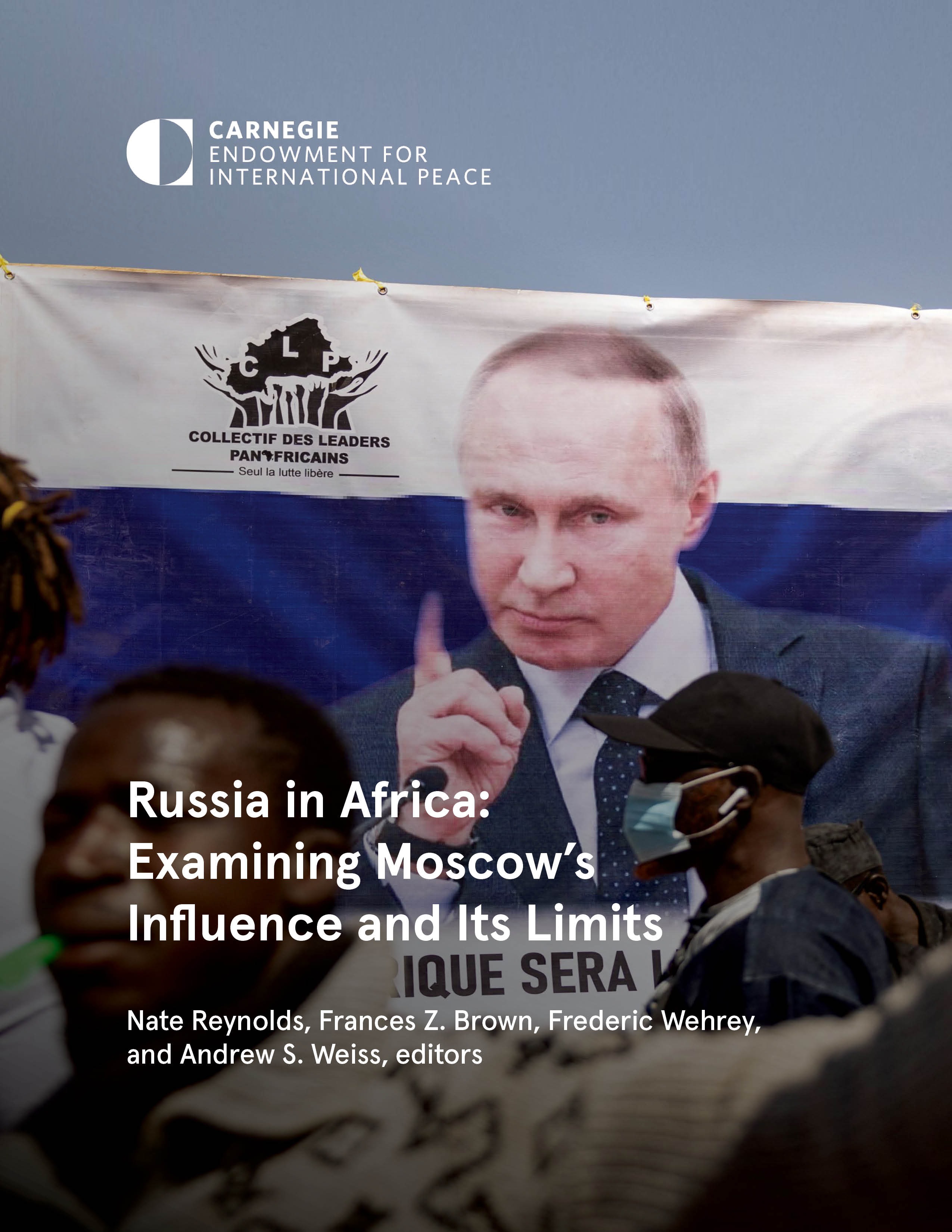

- Russia in Africa: Examining Moscow’s Influence and Its LimitsResearch

As Moscow looks for opportunities to build inroads on the continent, governments in West and Southern Africa are identifying new ways to promote their goals—and facing new risks.

- +1

Nate Reynolds, ed., Frances Z. Brown, ed., Frederic Wehrey, ed., …