The EU lacks leadership and strategic planning in the South Caucasus, while the United States is leading the charge. To secure its geopolitical interests, Brussels must invest in new connectivity for the region.

Zaur Shiriyev

{

"authors": [

"Zainab Usman"

],

"type": "commentary",

"centerAffiliationAll": "",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [

"Climate, Geopolitics, and Security",

"Climate Change"

],

"englishNewsletterAll": "",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "",

"programs": [

"Sustainability, Climate, and Geopolitics",

"Africa"

],

"projects": [],

"regions": [

"North Africa",

"Egypt",

"Southern, Eastern, and Western Africa",

"North America"

],

"topics": [

"Economy",

"Climate Change"

]

}

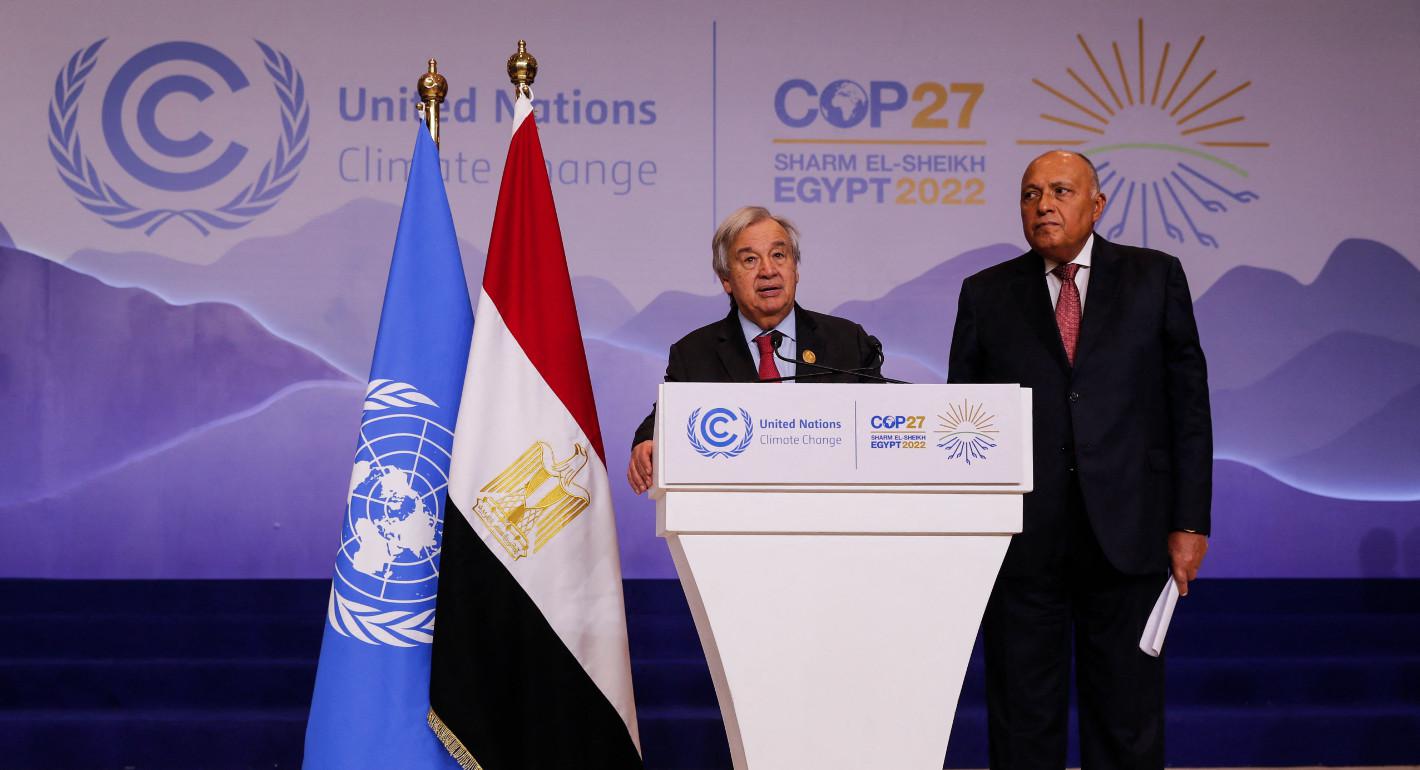

Source: Getty

The agreement on a new loss and damage fund is one of the summit’s bright spots, but more needs to be done to deliver the trillions of dollars needed to finance the low-carbon transition.

The UN’s twenty-seventh Conference of Parties at the sunny resort town of Sharm El-Sheikh, Egypt, was branded as the “implementation COP.” This was the climate summit that would finally fulfill previous financial pledges for investing in renewable energy, building infrastructure to withstand extreme weather events, responding to climate disasters, and funding other such aspects of climate action. The summit’s Egyptian presidency also framed the meeting as an “Africa COP,” to emphasize that implementation is most relevant to Africa (and other parts of the Global South, such as Pakistan) that are extremely vulnerable to global warming, despite contributing little to the greenhouse gases driving climate change. But upon the meeting’s conclusion, some bright spots emerged, even though more needs to be done to meet goals of implementation.

In the weeks leading to the summit, the widening chasm between the financial resources needed to address the climate crisis in low- and middle-income countries (LMICs) and the actual delivery was conspicuous. To limit global warming to 1.5 degrees Celsius, estimates say annual clean-energy investment needs to triple by 2030, exceeding $4 trillion, while adaptation in developing countries will cost up to $340 billion a year. Yet the Annex II countries legally obliged to give climate finance under the terms of the UN climate convention have made smaller contributions to the internationally agreed target of $100 billion per year. In 2020, the United States, Canada, Australia, and the UK paid far below their internationally agreed targets than their shares of historical emissions, while Germany, France, Japan and the Netherlands each gave billions of dollars more than their obligations.

More of the public finance promised is trickling in at COP27, but it remains far below what is expected. President Joe Biden announced that the United States will aim to provide $11 billion annually by 2024 and $150 million to support adaptation initiatives, including in Africa. The latter will likely encompass the President’s Emergency Plan for Adaptation and Resilience in Africa, comprised of early warning systems and includes $24 million to help farmers access insurance, $10 million to support the launch of the Cairo Center for Learning and Excellence in Adaptation and Resilience, and $25 million for the African Union’s African Adaptation Initiative, among others. Across the Atlantic, Germany is leading a G7 initiative that will support disaster risk management in vulnerable countries. The contributions to this fund so far include 170 million euros from Germany, 20 million euros from France, 10 million euros from Ireland, and 7 million euros from Canada.

This lack of forthcoming finances—from Annex II countries whether due to lethargy or competing domestic priorities—does not bode well for other climate funds. The loss and damage funding, which finally made it onto this year’s COP agenda after years of advocacy by LMICs, is meant to provide compensation for climate disasters caused by wealthy countries’ greenhouse gas emissions. It is an additive, not a substitute, to the $100 billion agreed upon at COP15 in Copenhagen in 2009. How to quantify loss and damage, where to house the funds, how to disburse them, and who pays this compensation (should China and India count, even though they are large emitters but not Annex II countries?) are all serious questions being debated.

On the private-sector front, the story is slightly more upbeat with the promise of trillions of dollars in capital markets waiting to be unlocked with the right mechanisms. But even promising developments have hit roadblocks. For example, the Glasgow Financial Alliance for Net Zero promised at COP26 to mobilize more than $130 trillion of assets from investment banks, hedge funds, private equity firms, and others toward climate action. But it now faces an uncertain future after the alliance dropped its link to the UN-backed Race to Zero, which it had earlier showcased as a mark of its rigorous standards. Besides, the global energy crisis exacerbated by the war in Ukraine has reinforced the unwillingness of several financiers to immediately halt investments in fossil fuels, and thus meet the net-zero requirement of the coalition.

More promising are the developments around carbon trading, such as the launch of the African Carbon Markets Initiative. Created to increase the continent’s participation in voluntary carbon markets, the initiative aims to produce 300 million carbon credits annually on the continent by 2030, unlock $6 billion in revenue, and support the creation of 30 million jobs. Under the leadership of its newly elected president, Brazil joined the Democratic Republic of Congo and Indonesia—collectively home to more than half of the world’s remaining primary tropical forests—to form a rainforest protection alliance to monetize and protect these carbon sinks. U.S. climate envoy John Kerry also announced several initiatives supporting carbon trading, with congressional members promising more action on this front. Global carbon markets, worth $850 billion, could expand even faster.

The most notable financial packages were prepared outside COP27 and targeted to specific countries—a trend that’s gaining traction across the world. On Tuesday, Indonesia announced a $20 billion Just Energy Transition Plan (JETP) to support its phase-out of coal by 2030 and to reach net zero emissions by 2050. But the plan was actually unveiled thousands of miles away from Sharm in Bali, Indonesia, at the G20 summit. Like South Africa’s pioneering $8.5 billion JETP announced in Glasgow in 2021, Indonesia’s plan was negotiated with a number of Annex II countries co-led by the United States and Japan, and including Canada, Denmark, the European Union, France, Germany, Italy, Norway, and the United Kingdom. An $11 billion JETP for Vietnam is expected to be announced at the ASEAN-EU summit in December. Egypt is also working to secure $500 million from the United States, Germany, and the EU to finance its transition to clean energy, and Biden announced a plan to mobilize $2 billion in private investments for solar energy development in Angola.

These side deals hold a certain promise of gaining country ownership: they are based on clear objectives, co-designed with the country in question, based on the country’s own plans and resource endowments, are time bound, are potentially easier to track than aid money, and could give the country more agency than the donor-recipient power dynamic of aid money. Yet if such deals were to replace multilateral frameworks in the delivery of climate financing, it could be a devastating setback to global climate action—not least because smaller, poorer, and more vulnerable countries will not have the geopolitical muscle to negotiate their own JETPs.

Many of the LMICs left out of such side deals could be pulled even further into China’s orbit. After all, China—which typically avoids loud announcements at COP summits—is still the largest financier of energy projects in Africa. Chinese banks provided nearly $50 billion of energy investments to the continent between 2000 and 2020. Many of these projects are negotiated and agreed upon bilaterally, with the individual countries or through the triennial Forum on China-Africa Cooperation. With China already doing more on energy financing beyond the UN COP framework and Western countries inadvertently using a similarly playbook of negotiating side deals with middle-income countries, this development could constitute a serious setback for multilateralism.

By advancing an implementation goal for COP27, the Egyptian presidency succeeded in facilitating a more focused discussion on climate finance. But the actual delivery of pledges has left much to be desired. In many cases, public funding was in the low millions of dollars, instead of the billions expected and the trillions needed to finance a low-carbon transition. Although policy and regulatory innovations could unlock trillions of dollars in private capital, COP27’s wins were not ambitious enough to meet the scale of the challenge. The glacial progress in meeting financing targets will likely cause more frustration around the world, leading to more vociferous calls for climate reparations and potentially raising questions about COP’s ability to deliver results, as powerful countries increasingly negotiate side deals. While the amounts and mechanisms for mobilizing climate finance will continue to be debated at UN summits, those most vulnerable to warming will continue to struggle with the delay to combat the effects of a warming planet.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

The EU lacks leadership and strategic planning in the South Caucasus, while the United States is leading the charge. To secure its geopolitical interests, Brussels must invest in new connectivity for the region.

Zaur Shiriyev

An Armenia-Azerbaijan settlement may be the only realistic test case for making glossy promises a reality.

Garo Paylan

Supporters of democracy within and outside the continent should track these four patterns in the coming year.

Saskia Brechenmacher, Frances Z. Brown

Is Morocco’s migration policy protecting Sub-Saharan African migrants or managing them for political and security ends? This article unpacks the gaps, the risks, and the paths toward real rights-based integration.

Soufiane Elgoumri

Venezuelans deserve to participate in collective decisionmaking and determine their own futures.

Jennifer McCoy