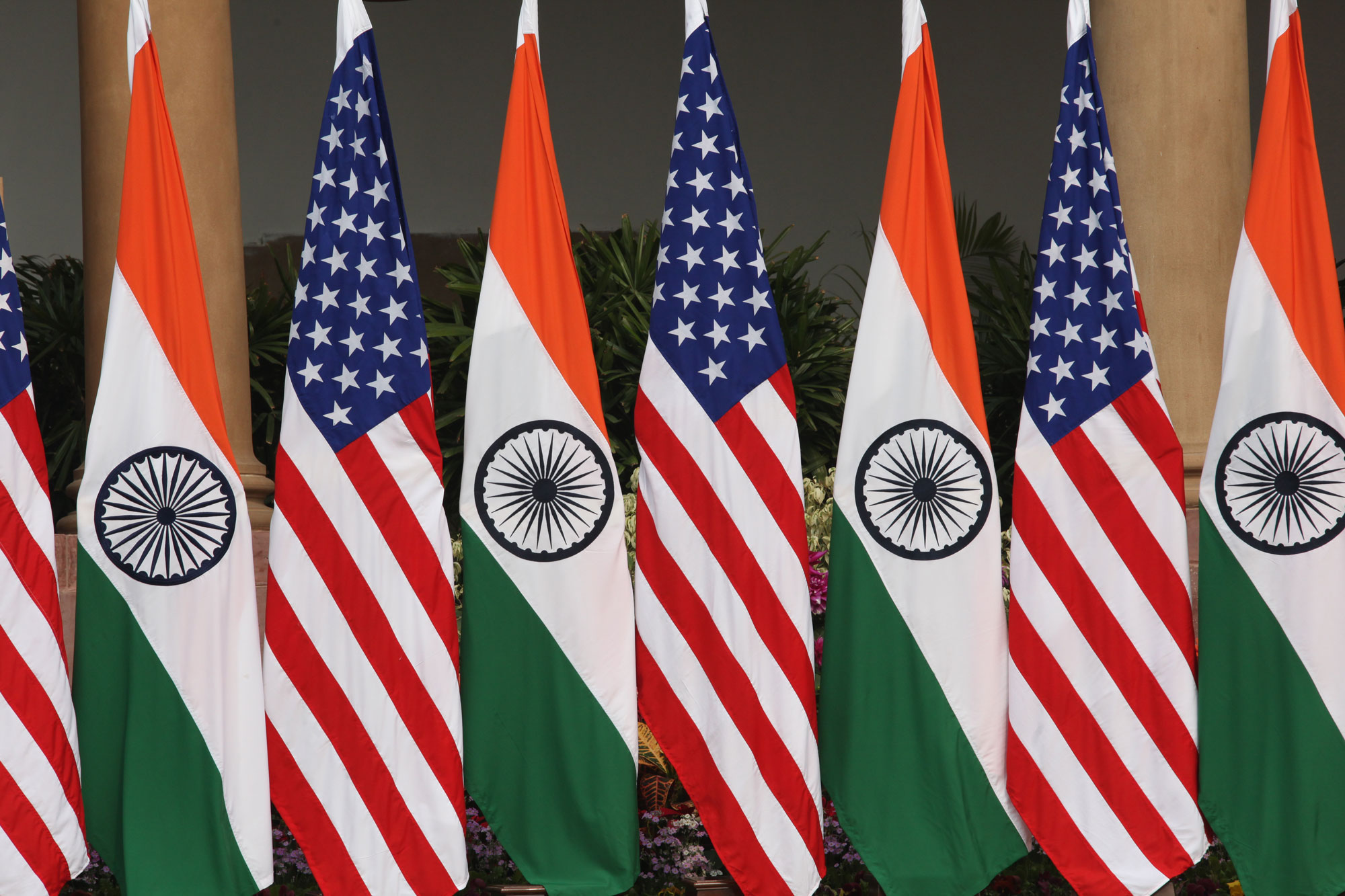

On March 10, 2023, U.S. Commerce Secretary Gina Raimondo and Indian Minister of Commerce and Industry Piyush Goyal inked a memorandum of understanding on establishing a semiconductor supply chain and innovation partnership. It was the latest in a flurry of bilateral initiatives signed between the United States and India regarding high-technology cooperation. For instance, in January 2023, the ambitious Initiative on Critical and Emerging Technologies (iCET) also singled out semiconductors as one of the areas for cooperation between the countries.

However, there were no specific projects singled out for semiconductor collaboration in the factsheet about the iCET released by the White House, unlike the other high-technology areas dealt with in the initiative, such as space, defense innovation, and technology cooperation. For instance, regarding space, there was a mention of cooperating on India’s Gaganyaan program and working together on NASA’s Commercial Lunar Payload Services program. Similarly, for defense innovation, there was talk about cooperation on jet engines and even a mention of General Electric’s jet engines possibly being jointly produced with Indian entities. When it came to semiconductors, the terminology employed was thought-provoking. The factsheet welcomed the creation of a task force by the U.S.-based Semiconductor Industry Association and the India Electronics and Semiconductor Association to develop a “readiness assessment” regarding near-term industry opportunities.

Calling the task force a “readiness assessment” might have come across as disparaging to some in India’s semiconductor ecosystem. The name implied that India’s attempts and policies to integrate itself into global semiconductor supply chains merit a closer look and require further scrutiny. However, it is an inescapable fact that India’s capabilities in large-scale semiconductor manufacturing are almost nonexistent, something that needs to be acknowledged and addressed. Perhaps just as well and timely is the phenomenon of friendshoring, which will have a critical role to play in augmenting India’s hardware capabilities.

The case for semiconductor manufacturing in India

For decades, India maintained a relentless focus on software-related know-how. In the process, India created an impressive roster of digital technologies that it deployed in the fields of digital payments, e-commerce, and digital identities software—it is now seeking to share these technologies with interested groups overseas. However, software products operate in a different manner as compared to hardware technologies such as semiconductors. Software companies have fewer entry barriers and can pivot to new opportunities relatively easily because of their digital nature. Indian companies have, by and large, not been able to crack the hardware puzzle. As a result, India remains a huge net importer of hardware technology.

However, while India’s digital public infrastructure journey has been lauded for its manifold societal benefits, its overall impact on creating manufacturing jobs is questionable when it comes to providing direct benefits or plugging leakages in the welfare disbursement system. While there might be multiplier effects toward creating employment opportunities in the health-care, payments, and e-commerce sectors, this is not the same as creating openings in the manufacturing sector. Semiconductor manufacturing in particular is critical for India. However, besides the usual reasons cited for encouraging manufacturing—such as the creation of jobs and the advancement of electronics supply chains—another compelling rationale is the irreplaceable role that the know-how learned through manufacturing plays in the long run. A robust manufacturing base ensures that the knowledge gained from “learning by doing” is transferred to domestic firms as well. The argument goes that a thriving manufacturing base, when not corroded by daft policymaking, only begets more manufacturing. Therefore, India’s ability to integrate itself into global semiconductor supply chains will be critical to any ensuing success in creating more advanced hardware.

The Production Linked Incentive (PLI) scheme, which was introduced by the Indian government in February 2021 with an initial outlay of 1.97 lakh crores Indian rupees (approximately $24 billion), may be a good starting point. The purpose of the PLI scheme is to spur domestic manufacturing as well as create global champions in manufacturing. And the PLI scheme for mobile handsets has shown encouraging signs so far—India’s mobile phone exports have doubled to $5.5 billion in just one year, and initial data for 2023 shows that smartphone exports have already crossed $2 billion. Given this, the original equipment manufacturers (OEMs), which currently only assemble these products in India, may eventually think about also manufacturing them in India. The reasons for this line of thought are not hard to fathom. India’s domestic market for the larger electronics industry is currently valued at $118 billion. As this figure rises over the years, the market case for foreign companies to shift base to India, both to serve its domestic market as well as to drive exports, will become more compelling. As a result, the OEMs may eventually require their component/chip suppliers to relocate closer to their manufacturing base. This is because large-scale electronics manufacturing operations will be more convenient to sustain with an established semiconductor fabrication ecosystem in the country. Furthermore, given how the semiconductor content in electronic items is constantly increasing, India may find itself requiring more semiconductors in the future. Since this would have serious implications for India’s import costs for semiconductors, there is a strong market rationale for having a semiconductor fabrication facility (commonly known as a “fab”) in India.

What has changed now?

The question among prospective investors is: why should they seriously consider India for semiconductor manufacturing? More specifically, what has changed on the ground? After all, India had previously unveiled semiconductor policies—once in 2007 and then in 2013. When India announced a semiconductor policy in March 2007, it was, at the time, considered a major step toward attracting semiconductor companies to build their manufacturing facilities in India. However, semiconductor manufacturing never quite took off in the country due to various reasons. For one, the financial incentives provided by the Indian government were inadequate. In 2007, it had committed only 20 percent of the capital expenditure for units located inside special economic zones and 25 percent for units located outside. Given that India’s domestic consumption of electronic exports at the time was pegged at around $28 billion only, the cost-benefit ratio for semiconductor firms got skewed. Another reason was the delay in policy rollout, which, according to senior executives from leading semiconductor firms, prevented India from securing investments.

It took India another eight years to formulate a dedicated and holistic semiconductor policy, in December 2021, notwithstanding another unsuccessful attempt to kick-start the creation of a semiconductor manufacturing ecosystem in 2013. Below is a brief analysis of the 2021 policy. The success of a policy for semiconductors can be gauged by whether it gets the right mix of the following items.

Business climate

Despite the impressive strides made by India in improving its Ease of Doing Business ranking, the perception that there are significant bottlenecks to conducting business operations in India persists. A large part of this may be because the last avatar of a policy on semiconductors was introduced almost ten years ago. Therefore, most stakeholders’ perceptions of the semiconductor ecosystem may be a bit dated. Accordingly, more work will have to be done to change that perception.

A good start to improve the perception of India’s business climate would be to streamline the structure of the Indian Semiconductor Mission (ISM). The ISM is the nodal agency that is entrusted with ensuring that India emerges as a hub for global electronics manufacturing and design. It is also the primary interface for many people who wish to invest in the country’s semiconductor space. Therefore, it is a microcosm of how businesses deal with India’s regulatory framework. The ISM is housed as an “independent business division” within the Digital India Corporation (DIC). Even though the DIC is a nonprofit company, its chairmanship is held by the union cabinet minister for electronics and IT, which means that the ISM is eventually accountable to the Ministry of Electronics and Information Technology (MeitY). Given the scope of the ISM’s objective, a few options could be explored to streamline its structure.

First, it could be designated as a truly independent nodal agency, with its own budget and the flexibility to decide its agenda and make swift hiring decisions. As a measure of accountability, it could be required to table an annual report to the Indian Parliament instead of the MeitY. Reporting to the MeitY means competing with the other issues that the ministry is seized with at any given point in time, be it the pending data protection bill, intermediary liability guidelines, or other pieces of legislation. Also, by reporting directly to Parliament, the ISM could become less susceptible to any pressure that may be exerted on a nodal agency by the line ministry to which it reports. Theoretically, vested groups may also find it considerably harder to sway decisionmaking in Parliament as opposed to a ministry.

Second, and perhaps more importantly, given the mandate of the ISM to propel the semiconductor ecosystem—something that will inevitably touch upon matters related to energy, airport connectivity, customs duties, water supply, and so on—it may be worth considering whether it should be structured as an interagency organization. For instance, to implement the CHIPS and Science Act in the United States, the CHIPS Program Office (CPO) was created to implement a sizeable portion of the $52 billion funding allocated under the act. To effectuate this, the CPO will work closely with the Office of the Secretary of Commerce and other agencies, including the CHIPS Implementation Steering Council, the Departments of Defense, State, Energy, and Homeland Security, the Office of the Director of National Intelligence, the National Science Foundation, and the Office of the U.S. Trade Representative. This reflects a whole-of-government approach that may be needed in India as well.

Ease of trade

Trade policy can also affect the degree of innovation that takes place within a country by (1) raising awareness about foreign advances in technology, (2) creating competition among both domestic and foreign businesses, (3) allowing nations to focus on their strengths, (4) creating the wealth necessary to invest in high-tech industries, and (5) allowing a country to make use of the economies of scale. Regarding friendshoring, it should be noted that countries such as Vietnam are a part of regional trade arrangements, including the Regional Comprehensive Economic Partnership. Consequentially, if semiconductor companies based out of China were to diversify, they would be unlikely to face major changes to the tariff scheme applicable to their components if they were moved to Vietnam. This is because there is likely to be more uniformity among countries that are part of the same regional trade arrangement. Therefore, India’s trade policy stance also bears relevance. While the impressive numbers ratcheted up by India’s PLI scheme for mobile phones bear mention here, it has been pointed out by trade groups that the counterfactual scenario—how many more products would have been exported had an even more liberal trade regime been in place—has not been given sufficient consideration.

Moreover, India’s reconsideration in 2022 of its moratorium on imposing customs duties on items covered under the World Trade Organization (WTO)’s 1998 declaration may also work against it. India has maintained the moratorium since 1998 and was expected to continue until 2025. However, the country has been keen to renegotiate the terms of the WTO’s declaration; it feels that it is currently unable to impose tariffs on electronic transmissions. It ended up maintaining the moratorium, but the conversation continues. Interestingly, the WTO’s Information Technology Agreement-2 (ITA-2), an expansion agreement for ITA-1, which India signed in 1997, also contains provisions that provide for no customs duties on electronic transmissions. India has hesitated to sign the ITA-2, given its discouraging experience with ITA-1. If India ever lifts the moratorium on imposing customs duties covered by the 1998 declaration, it would be a confirmation that signing the ITA-2 will not be entertained by the country. Yet, at the same time, the Semiconductor Industry Association feels that the ITA and the ITA-2 are two of the most meaningful and commercially successful agreements because they have contributed to lowering consumer prices and the cost of trade. India’s reluctance to sign the ITA-2 may therefore impact investor sentiment among Semiconductor Industry Association members, as many semiconductor companies have stated that they will only do business with ITA member countries.

Supplier ecosystem

Semiconductor manufacturing and chip design operations typically work best in clusters, which are supplier ecosystems capable of providing all raw materials, components, and machinery. During the late 1980s, the fabrication and design parts of the semiconductor development process underwent a gradual decoupling, a trend that was anticipated and leveraged by Taiwan Semiconductor Manufacturing Company (TSMC) to great success. Despite this, a strong linkage between the design and fabrication processes is still critical. A good case study of how technological superiority cannot replace a supportive, fabless design ecosystem is Chartered Semiconductor Manufacturing (CSM), a Singaporean company established in 1987—the same year as TSMC. It was part of the Singapore Technologies Group, a government enterprise. Believed to have more advanced manufacturing processes than even TSMC, in the 1990s, CSM had a client roster that included Microsoft, Qualcomm, and Broadcom. Eventually, however, it fell by the wayside, owing to client demands to follow the manufacturing blueprints of TSMC, which leveraged its connection to a burgeoning ecosystem of fabless design firms in Taiwan. Singapore, on the other hand, lacked a comparative sustainable mass of fabless design firms. The lack of a linkage to such firms prevented CSM from iterating its fabrication process in accordance with the latest chip design processes. In 2009, Temasek Holdings, Singapore’s state-owned investment company, sold its entire stake in CSM to GlobalFoundries. Clearly, the financial wherewithal of Temasek Holdings was not enough to support a company that lacked a critical mass of an ecosystem of fabless design firms around it.

However, for a long time, India has occupied a position in semiconductor supply chains where a contrasting phenomenon is at play. It is widely recognized as home to 20 percent of the global workforce that designs chips, with foreign corporations owning the intellectual property (IP) underlying the chip designs. This phenomenon of India-based research and development (R&D) labs creating IP for a global marketplace is pervasive throughout the larger Indian economy as well. A recent estimate puts the approximate percentage of patents generated by the R&D centers of India’s multinational corporations (MNCs) between 55–60 percent of the total patents granted by the Indian patent registry.

However, this presence of R&D labs, including those of some premier chip design firms, has not been accompanied by any commercial chip fabrication activity being conducted in India because most R&D, while undertaken in such labs in India, was not deployed in the country due to a perceived lack of a vast domestic market for the products that use such R&D. Instead, the R&D labs set up by MNCs are driven by India’s adequate supply of quality scientists and engineers and low wages. In other words, the presence of chip design firms in India is not primarily motivated by an objective to exploit any commercial opportunities or market prospects. The lack of what is perceived as a robust market opportunity has been the persistent reason for other MNCs’ decisions to limit their presence to R&D activity, most of which is repatriated back to their home countries. Furthermore, the jury is still out on whether the recent success of the PLI scheme for mobile handsets will sustain over the coming years and lead to any change in this trend. All in all, the crucial linkage required between chip design and fabrication firms is missing in India on account of suboptimal manufacturing. Additionally, semiconductor supply chains are incredibly complex—even chipmakers face considerable opacity in determining which products their chips might end up in. Due to this, tracing any locally manufactured chips to any final products used in India would be a very challenging, albeit not impossible, task.

Supply chains are notoriously “sticky” and will not simply relocate on account of more subsidies being offered, subsidies that could be withdrawn at a moment’s notice. What is needed is a larger cluster that can support manufacturing and sustain long-term operations. It should be noted that even if manufacturing were to onshore to India, the transfer of technology will be key to India’s emergence as a long-term manufacturing hub. In this regard, India’s semiconductor policy also requires applicants to own or possess production-grade, licensed technologies. Whether companies will commit to bringing these technologies will also hinge upon an agglomeration of multiple factors, such as business climate, domestic market, export potential, infrastructure, and talent.

Talent

India’s plan to train 85,000 engineers as part of its Chips to Startup (C2S) scheme is noteworthy and could play a role in scaling semiconductor workforce development in the country. However, it would be worth noting the following while training talent or the workforce.

- Making students industry-ready: While India does have the theoretical base required to impart semiconductor training to most students and professionals, what is needed is to make the graduates industry-ready and “connect them with prospective employers.”

- Imparting practical knowledge: Even the engineering schools that do focus on disciplines related to semiconductors, such as microelectronics, chemical engineering, and electronic engineering, are seen as lacking the academic rigor to prepare students with the necessary practical problem-solving skills.

- Leveraging existing massive open online courses (MOOCs): The government of India has come out with a MOOC platform called SWAYAM (Study Webs of Active-Learning for Young Aspiring Minds), which is available for free and has a bevy of video lectures, reading materials, and online forums for enabling discussion on topics taught on the platform. It has various courses on semiconductor devices taught by faculty from renowned Indian universities, including the Indian Institute of Science, Bengaluru, and the Indian Institutes of Technology in Kharagpur and Hyderabad.

- Increasing mobility between academic ecosystems: It is recommended that the Indian government’s Global Initiative of Academic Networks (GIAN) in higher education program be utilized more robustly for semiconductor workforce development. The GIAN program aims to “elevate India’s scientific and technological capacity” by creating engagement between Indian institutes of higher education and accomplished scientists, academicians, and entrepreneurs overseas. Usually, teaching a semester overseas may be seen as an expensive proposition by international faculty members since most faculty might have to forgo research and laboratory time at their home universities, not to mention the prospect of lower remuneration in India. However, the GIAN scheme has addressed these concerns. Currently, it provides an attractive remuneration of up to $12,000 for 20–28 hours of contact. Furthermore, the travel and stay of overseas faculty are to be arranged by the host institution. Therefore, given the manifold benefits, more awareness is needed regarding the GIAN scheme.

- Creating awareness: There is a need to promote the semiconductor industry and make it more popular among students. While it can offer promising remuneration, it is neglected by many candidates in favor of the software and IT industries. These industries are seen as requiring easily transferable skills suited to various software companies, which makes for easier lateral movement of employees.

Infrastructure

An equally, if not more, important question within the concern of infrastructure availability is that of land. Traditionally, land acquisition in India has been a time-consuming, not to mention costly, process. It is common to see most land acquisition efforts in India be mired in litigation. Accordingly, alternatives to land acquisition have become popular over the last few decades. One of these mechanisms is land pooling. This mechanism has also taken off in the state of Gujarat, which has witnessed a significant rise in the pooling of land under the Town Planning Scheme since 1985. This is noteworthy given that the Dholera Special Investment Region, developed through land pooling, has been singled out by some as the location that is best equipped with the infrastructure required to support a semiconductor fabrication facility in India.

Simply put, this is how land pooling works—the concerned urban authority approaches several landowners and, instead of requiring them to part with the legal title over their land, these landowners are presented with the offer of reassembling their land parcels into a new layout plan. If the landowners agree, the urban authorities can then pool these land parcels and develop new infrastructure in the same consolidated land parcel, which leads to a considerable increase in its overall value. In return, landowners see a substantial portion of their properties rise in value. In addition, the landowners are provided with land near their original property so as not to displace them from their locality. This increment in the value of the land is used to finance the development of infrastructure. Land pooling is cost-effective because the land is not purchased from the landowners by an urban authority. Instead, in return for their land, the landowners acquire an interest in the value of the redeveloped land parcel. This brings down costs significantly for the urban authorities. Therefore, in addition to being a more cooperative venture compared to the traditional land acquisition model, land pooling is also a self-financing mechanism.

Geopolitical stars align

It remains to be seen whether India might squander the opportunity provided by the offshoring of supply chains away from China and the interest in India’s new semiconductor policy. There is currently a groundswell of global sentiment when it comes to offshoring supply chains away from China, including those for semiconductors. On top of this, India is finally being considered as a serious contender for the diversification strategy of many electronics companies. This confluence of geopolitical tailwinds and the accompanying transitory but once-in-a-generation supply chain recalibration is unlikely to persist for long. India should therefore quickly recognize the value of this potential momentous shift in globalization.

In fact, although the visionary founder of TSMC, Morris Chang, has pronounced globalization to be dead—an observation that is largely in line with the prevailing sentiment that globalization will no longer continue to shape the international system as it did before—this finding has been contested by others. The reality is perhaps somewhere in between. It appears that while the underlying thread of globalization has somewhat unraveled, a new global consensus is in the offing as countries weave together a new understanding of what the new normal will be. For semiconductor supply chains, this will most likely mean a shift from offshoring to friendshoring through which supply chains will be designed for resilience and not necessarily efficiency, as evidenced by the new fabs being announced for Arizona in the United States, Germany, and Japan.

There is a notion being advanced that onshoring is destined for failure due to its supposed emphasis on self-sufficiency, subsidies, and local production. Friendshoring can address these concerns, especially that of self-sufficiency—if anything, friendshoring in semiconductor supply chains has primarily involved engaging with a wider range of partners as diversification rests at the heart of the strategy. Furthermore, the countries that are seen as candidates for friendshoring are not wholesale newcomers to the supply chains but are already part of them. Therefore, the play for friendshoring is best viewed as an exercise in gradual diversification and not as an abrupt shock to global supply chains in the form of a sudden decoupling from China. In any case, semiconductor supply chains were never truly globally distributed to begin with. Various parts of the supply chains—including chip design software, chip fabrication, assembly, testing, marking, packaging, and semiconductor manufacturing equipment—have always been concentrated in certain geographical regions.

Regarding subsidies, it should be noted that even China’s foray into semiconductor manufacturing was largely spurred by massive state-driven subsidies. The cumulative effect of state-provided subsidies in all sectors was even partly responsible for the onset of the U.S.-China trade war. And while no resolution to this trade war is in sight, there is now the added concern about how additional subsidies could skew global trading flows to the detriment of emerging economies. The reasoning goes that since friendshoring prioritizes trade with politically aligned countries—those that have an industrial base capable of filling in for China—other smaller, emerging economies will suffer in the form of lower trade flows, lesser financial investment, and reduced technology and knowledge transfers from the United States. While this argument has an intuitive appeal, it does not consider a scenario where continued offshoring predicated on massive subsidies from China will further hollow out the American industrial base and its resultant technological wherewithal and competitive trade position. In other words, if the United States continues to find its competitive advantage being eroded because of mammoth subsidies doled out in China—where subsidies operate less as short-term market incentives and more as long-term measures to fuel the larger economy—there will not be any technology left to share or transfer.

The concern that onshoring is doomed to fail on account of a focus on local production address only half the issue. While it is true that the American CHIPS and Science Act prioritizes the onshoring of production facilities back to the United States, these semiconductor production facilities are likely to take longer to realize profits, given higher production costs in the United States. Indeed, the commercial logic of the newly announced fabs is yet to be explained, with Chang conceding that it is likely to be a “wasteful, expensive exercise in futility.” However, what really needs to be thought through is how friendshoring can possibly make up for the anticipated loss of $300 billion in revenue that the Chinese market represents. By 2026, India is expected to have an $80 billion market for semiconductors. However, this will represent less than 10 percent of the global market, which is expected to reach $1 trillion in sales by 2030. Therefore, India and like-minded nations that seek to band together under a friendshoring initiative—be it the iCET, the Chip 4 Alliance (which India is currently not included in), or the EU-India and EU-U.S. Trade and Technology Councils—will have their task cut out for them.

A new beginning or more of the same?

There is an unmistakable sense of irony here—India’s newfound plans for integration into global semiconductor supply chains are driven by a decoupling between the world’s two largest economies and a considerably frayed incarnation of globalization. It took India a long time to consider a fresh policymaking approach toward encouraging hardware manufacturing; one can only hope that it does not take longer still to realize this vision.

India once invested in and envisioned ambitious space and nuclear research programs, conceived and executed by visionaries such as Homi Bhabha and Vikram Sarabhai. Decades of bureaucratic heavy-handedness, political inertia, and clampdowns on entrepreneurs under successive regimes followed. India is now presented with a fresh opportunity to correct the earlier misses and kick-start the manufacturing ecosystem. It might also be correct to say that the geopolitical stars have aligned to aid this opportunity. In a fractious world with fragmented supply chains, India finds itself at a crossroads—it can either undertake a serious attempt at nurturing hardware manufacturing or let yet another opportunity slip. Nations keen to partner with India and interested semiconductor companies will be observing what India does next. Moreover, the success of India’s semiconductor gamble may unleash a multiplier force of a cluster of Indian suppliers. In light of this, a lot is at stake for the business community in India, which will keenly be watching the government’s next move. However, should its ambitious semiconductor mission succeed, it is India itself that stands most to gain.