With the blocking of Starlink terminals and restriction of access to Telegram, Russian troops in Ukraine have suffered a double technological blow. But neither service is irreplaceable.

Maria Kolomychenko

Source: Getty

The United States battery industry has fallen dangerously behind the global leaders. The main thrust of the U.S. policy response to the battery crisis must be the urgent commercialization of next-generation technologies where the United States can actually enjoy a competitive advantage.

The United States battery industry has fallen dangerously behind the global leaders. A cornerstone of the modern economy, batteries are essential and ubiquitous across consumer electronics such as cellphones, military equipment such as drones, and clean energy products such as electric vehicles (EVs) and power grid storage installations.

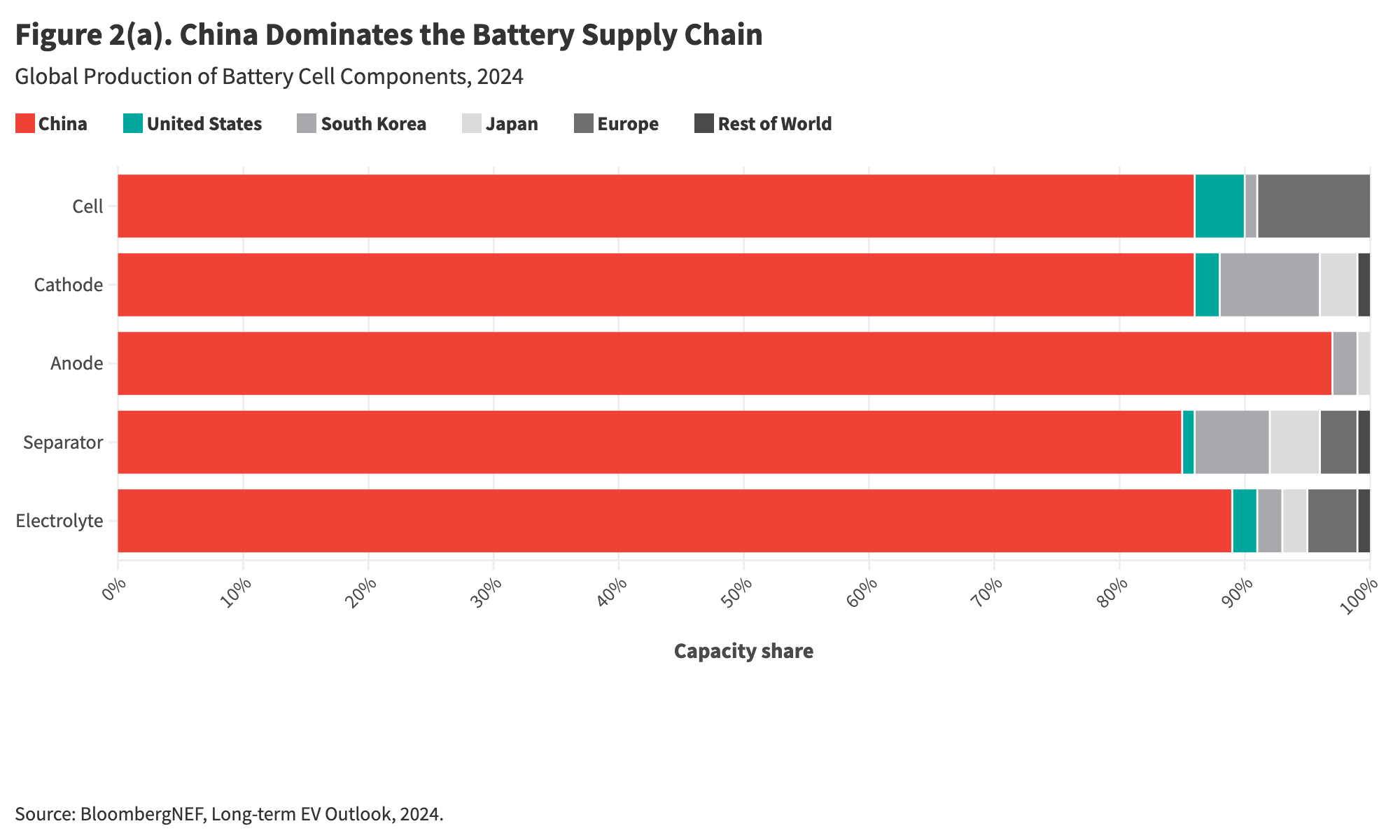

Over the past decade, China has come to dominate this critical industry. Across every stage of the value chain for current-generation lithium-ion battery technologies, from mineral extraction and processing to battery manufacturing, China’s share of the global market is 70–90 percent.1 Japan and South Korea, once world leaders in battery technology and production, now hold minority market shares, and the United States is in a distant fourth place. As a result, the United States almost entirely relies on Asian imports for the batteries widely used today.

The good news is that after years of development, far superior battery technologies could reach commercial markets in the coming decade—and the race to scale them up remains wide open. Next-generation batteries represent a fundamentally new architecture compared with today’s lithium-ion batteries, leaving behind liquid components for a solid-state architecture and eliminating graphite, a material over which China has a chokehold on production. U.S. companies and research institutions have made strides toward commercializing next-generation batteries with dramatically better performance. These batteries have expanded energy storage, quicker charging rates, and radical safety improvements. Yet competition is intense, with U.S. rivals in Asia investing heavily in innovation. Washington will have to act with force and speed to recover from its disastrous start in the global battery competition and leapfrog China’s lead.

Even as it acknowledges the opportunities in next-generation batteries, the United States must be realistic about its slim odds of competing in today’s technology. Over the last two years, U.S. federal incentives for the battery supply chain have surged, but more than 90 percent of the funding spree has supported current generation, lithium-ion batteries. China’s lead in lithium-ion technology is such that the United States will struggle to ever pull even. To be sure, it is prudent to secure the supply of limited quantities of today’s batteries—whether through domestic production or imports from trusted partner countries—to reduce national security risks if China were to cut off battery exports. And there’s value in having a base of American workers and firms with experience manufacturing batteries.

Yet the main thrust of the U.S. policy response to the battery crisis must be the urgent commercialization of next-generation technologies where the United States can actually enjoy a competitive advantage. Doing so will be a tall order, but it is achievable at reasonable cost. The United States should redouble funding for research and development (R&D), target incentives and public financing for demonstrating and scaling up commercial production of next-generation batteries, and use public procurement to create protected markets for innovative technologies to gain a market foothold.

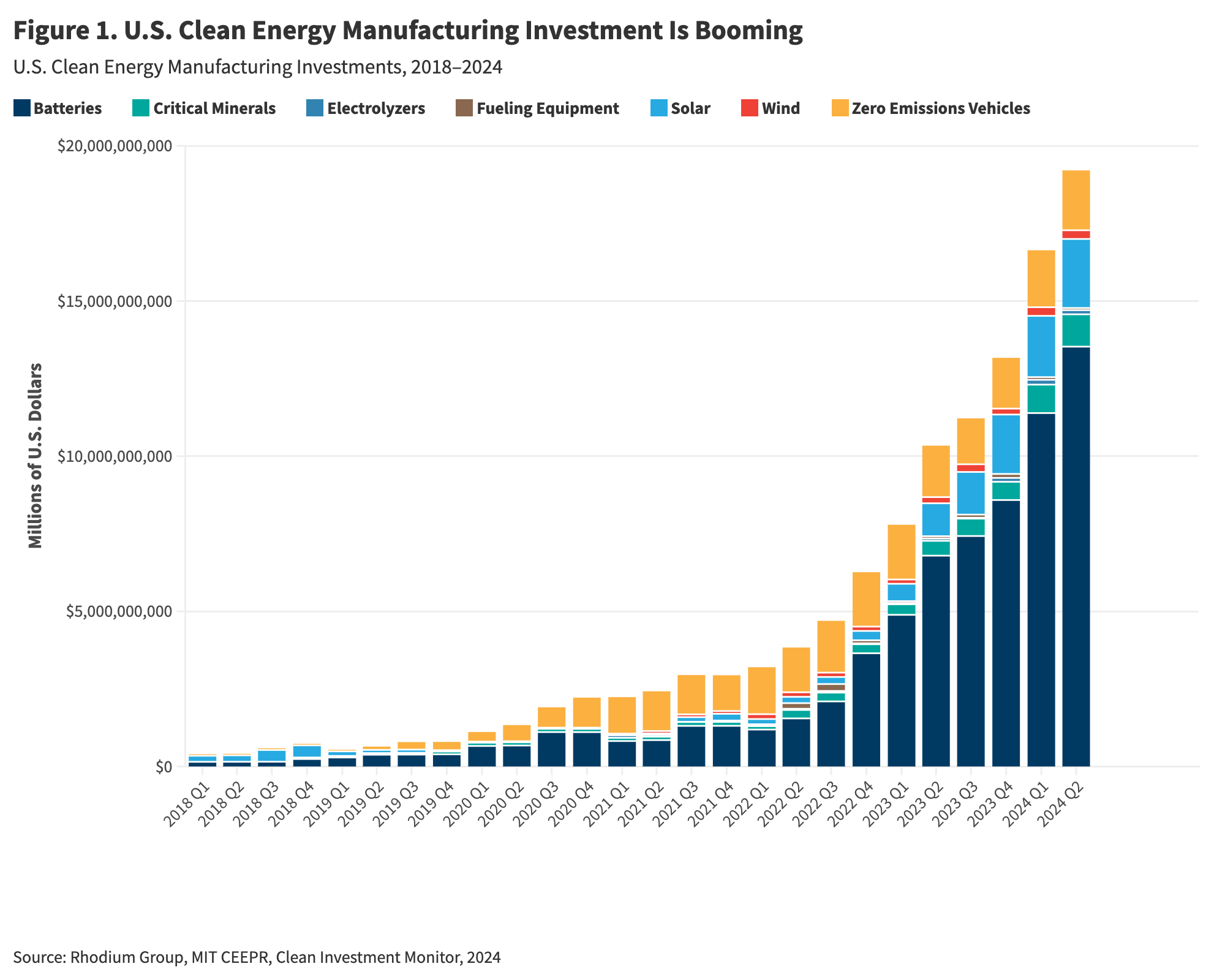

The dire state of the battery race might seem surprising, given that the United States has recently made historic investments in its battery industry. Over the past two years, U.S. investments in batteries and critical minerals refining have grown at least threefold, with battery manufacturing investments totaling $40.9 billion from Q2 2023 through Q2 2024 (see figure 1).2 This is largely thanks to government policies and incentives, notably the manufacturing and investment tax credits in the Inflation Reduction Act.3 The United States is enjoying a battery boom. Given this progress, why can’t it expect to close the competitiveness gap with China?

Simply put, China’s lead in existing lithium-ion battery production is too large. After decades of Chinese investment in lithium-ion supremacy, even today’s U.S. surge, which is almost exclusively focused on manufacturing current lithium-ion technology, hasn’t stopped China’s widening lead on cost and economies of scale. Beginning in 2001, Beijing made electric vehicles (EVs) and their batteries a priority in its Five Year Plan, motivated by its realization that China would struggle to catch up to the United States and Japan when it came to innovation in internal combustion engine technology.4 By the end of the 2000s, the Chinese government was providing major support for the firms making EV batteries, including tax breaks, cheap land, and public procurement. Researchers at the Center for Strategic and International Studies calculated that Chinese government support for the battery and EV sector totaled $230 billion from 2009 to 2023.5 China dominates the manufacturing of every component of battery cells as well as the upstream supply chain (see figure 2a). Chinese firms not only refine most of the world’s battery minerals at home but also have extensive interests in mines abroad. For instance, more than 90 percent of Africa’s supply of lithium this decade will be produced by entities at least partly owned by Chinese firms.6

And China plans to keep stepping up production. The International Energy Agency projects that “Chinese dominance of the cathode and anode active material manufacturing capacity will not see any significant reduction by 2030; it doesn’t see the US winning more than 15% of the lithium-ion market by 2030, even if all announced projects materialize.”7

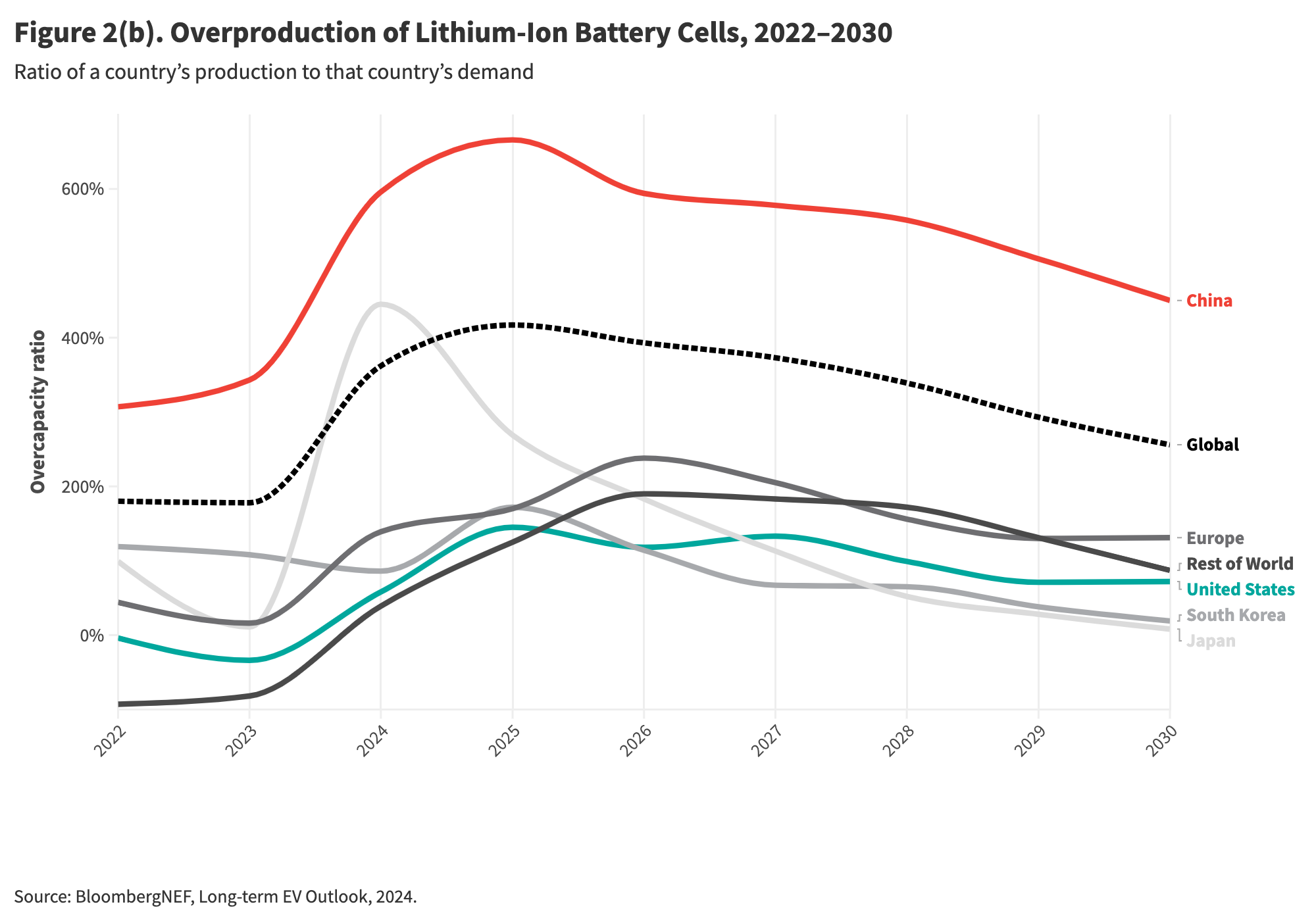

What’s more, China’s production capacity far outstrips the world’s demand, let alone its domestic demand; a subsidy-driven manufacturing and export model is driving global overcapacity of 400 percent (see figure 2b).

Admittedly, forecasts of future demand for clean energy products are always uncertain, and 2024 has brought a wave of consolidation and canceled investments to the Chinese battery sector.8 But it is clearly a massive challenge for U.S. factories and firms to compete with the scale of Chinese production, which are priced competitively in the protected U.S. market and are far more competitive than U.S.-produced batteries in markets around the world. In the wake of U.S. tariffs on Chinese EVs and battery minerals, China’s leadership decided at a crucial economic meeting on July 18, the Third Plenum, to double down on the manufacturing and export of batteries, EVs, and other low-carbon technologies.9 Any attempt by the United States to catch up with Chinese manufacturers of today’s lithium-ion batteries will require enormously expensive subsidies to produce a commodity product with slim margins, and China’s cost advantage is virtually insurmountable. Maintaining the political will to fund an indefinitely uncompetitive industry would be taxing.

Yet the United States cannot cede the field and yield economic sectors that are vital to prosperity. The largest use of batteries is for EVs, and the transition to EVs puts at risk the U.S. automotive industry, which makes a significant contribution to the entire U.S. economy. More than a million Americans work directly in motor vehicle and parts manufacturing, and the industry is at the core of U.S. metal-working capabilities.10 From California to Texas, batteries are also increasingly being used to store energy and make possible grids that rely on renewables.11 Batteries power the modern U.S. economy through portable electronics and a growing array of wearable devices. And batteries are critical to modern military operations, including powering combat troops’ equipment and marine and aerial equipment.

The task, then, is to prioritize the next generation of batteries.

The lithium-ion batteries mass-produced by China today are industrial marvels. The battery pack for an EV assembles thousands of tightly packed battery cells, each one comprising dozens of layers with precisely honed chemical compositions. Yet after more than three decades of improvements to commercial lithium-ion batteries, these devices are approaching the theoretical limits of their performance.

Next-generation batteries, defined in this paper as batteries that use lithium-metal anodes and enable solid-state architectures, could shatter those performance limits and eliminate the drawbacks of lithium-ion batteries, with revolutionary impacts across applications.

The advantages of next-generation batteries start with safety. Today’s lithium-ion batteries are based on a chemistry that is inherently flammable; when these batteries cross a temperature threshold, they can explode spectacularly through a process known as thermal runaway. Deadly fires from battery explosions have erupted on ocean tankers carrying EVs, and several incidents in South Korea, including fires that killed dozens at a battery plant and in an apartment building, have reduced the country’s demand for EVs.12 But next-generation batteries are inherently safe—they do not experience chain reaction thermal runaway because of their architecture. Dramatically improving battery safety could reduce risks from EVs and portable electronics, while also reducing fire shields that make today’s batteries heavier and undercut their performance.

More importantly, next-generation batteries could far surpass the limits of today’s batteries across key performance metrics, such as energy density by volume and weight, power density, charging speed, and durability. Each of these advantages brings revolutionary new capabilities. Next-generation batteries could unlock new generations of wearable electronics, extend the range and potency of drones, and enable vehicles that can drive more than 1,000 miles on a single charge and command five times the horsepower of EVs with today’s battery packs. There are also military advantages at stake: energy-dense batteries could power uncrewed submarines and enable combat troops in the field to power equipment such as night-vision goggles for longer periods and with lower weights.13

Achieving these new performance thresholds will require leaping beyond existing lithium-ion technology. Incremental approaches that modify existing lithium-ion technologies, such as enriching anodes with silicon, can deliver performance gains, though these batteries still suffer from drawbacks such as cell expansion that degrades reliability. Chinese firms may be best positioned to solve these technical challenges, building on their dominance of existing lithium-ion technology to become formidable competitors in these incrementally improved battery chemistries, and continuing to use their scale and experience to innovate in the manufacturing process. China is also moving swiftly ahead to dominate low-cost battery chemistries, such as sodium-ion batteries, which perform worse than lithium-ion batteries but can be far cheaper to produce and can enable low-cost, short-range EVs or grid-scale electricity storage.

But dramatic improvements across all performance metrics—enabling the most profitable and most compelling applications—can only be unlocked by eliminating a key component of today’s batteries: the graphite anodes that store positive ions and release them during discharge. Replacing these with lithium metal anodes would enable more energy-dense architectures and faster charging speeds. However, this change requires redesigning much of the rest of the battery cell to prevent degradation, such as by eliminating liquid electrolytes. Indeed, many have hailed solid-state batteries as a holy grail of battery technology development. It is no wonder, then, that the race is intensifying to develop and scale next-generation batteries. Here, the United States has critical advantages thanks to its world-leading innovation ecosystem, though China and other competitors aim to narrow the gap.

Next-generation batteries represent a critical battleground in the global competition to win market share in the battery industry. Over the past decade, the United States built an early technology lead through the R&D efforts of research institutions and venture-backed startups. Today, there are multiple publicly traded U.S. companies developing next-generation batteries; the only multibillion-dollar American firm of this kind, QuantumScape, has announced an industrial licensing and manufacturing deal with automaker Volkswagen Group.14

However, the global competition to be the first to bring next-generation batteries to market is heating up. The largest Chinese battery companies, including CATL and BYD, have joined together as part of a Chinese government-led consortium of companies and research institutions aiming to commercialize solid-state batteries.15 Elsewhere in Asia, Japanese automakers Toyota and Nissan are targeting solid-state battery production by 2028, and South Korean conglomerate Samsung aims to mass-produce next-generation batteries for premium vehicles by 2027.16

The reason for this fierce competition is that next-generation batteries could be the key to both seizing market share and turning a profit. Extreme Chinese overcapacity in producing today’s lithium-ion batteries means that the margins on today’s battery sales are slim or even negative.17 Next-generation batteries could come with premium pricing power. Because of their superior performance, they could power cellphones with energy-intensive artificial intelligence (AI) computing hardware or high-end EVs with increased acceleration and range, and they could unlock new market segments, such as more powerful and long-lived wearable devices. The companies and countries that achieve this performance first will be in pole position to rapidly capture a share of growing markets around the world.

Next-generation batteries could also bring important security benefits. Turning to batteries with lithium-metal anodes would eliminate one of the most concentrated Chinese supply chain advantages—the processing and production of graphite—defanging a potential security risk were China to cut off graphite supplies to the United States.

China recognizes it has a great deal to lose if it does not dominate this next round of battery innovation. As next-generation batteries reach commercial markets, China is forecasted to take only a minority share of their production by 2030, according to Benchmark Mineral Intelligence, which explains, “In a way, China sees solid-state batteries as a risk to their control over the lithium-ion battery industry.”18

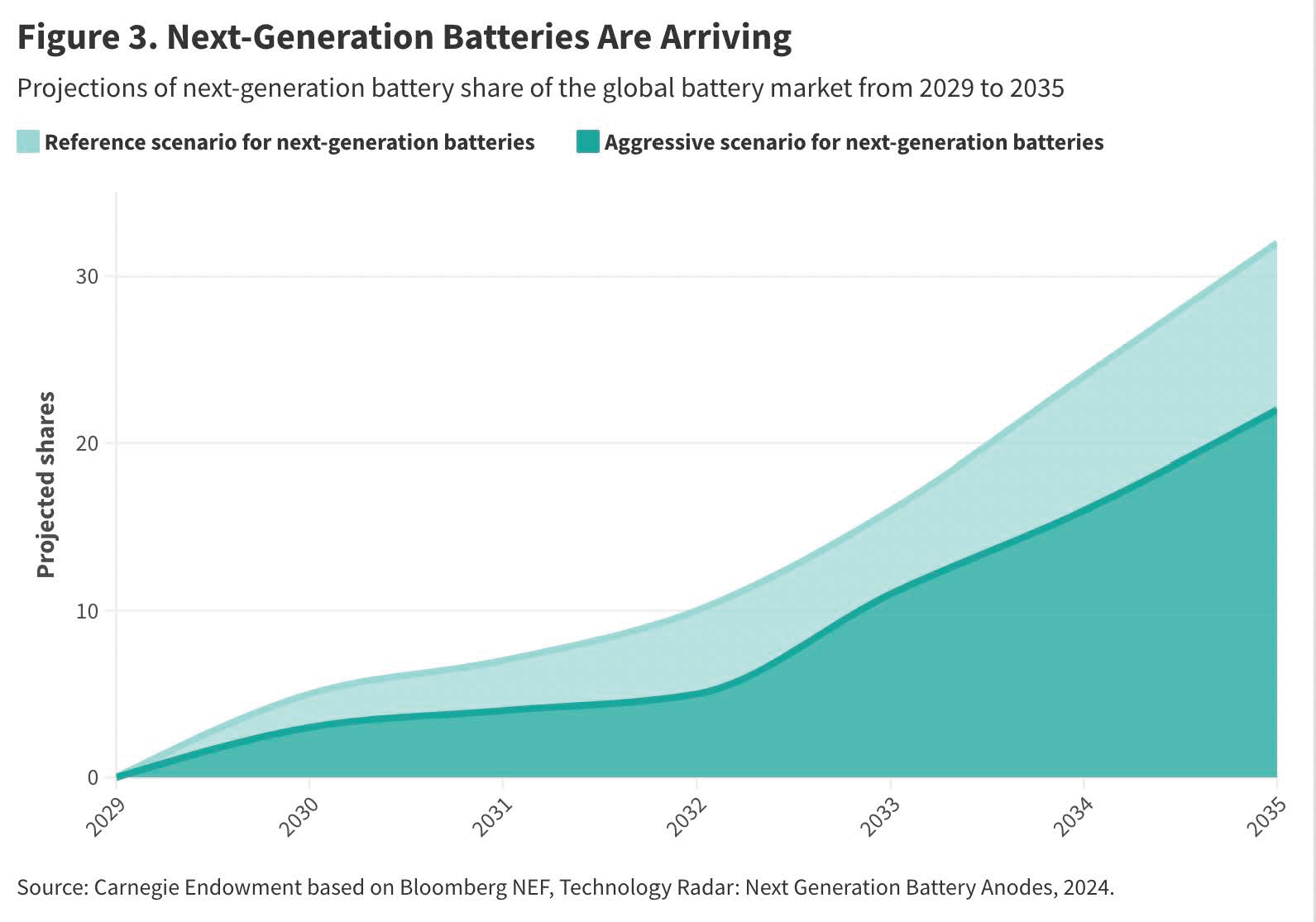

The coming years are critical in the race to commercialize high-performance, next-generation batteries. By 2035, Bloomberg forecasts that 20–30 percent of the global battery market could be served by disruptive next-generation batteries with lithium-metal anodes (see figure 3). But the proof points for commercial success—the first vehicles, consumer electronics, and military-grade equipment to use next-generation batteries—could emerge in the next twenty-four to thirty-six months.

The stakes are too high for the United States to fall behind.

Winning the race to dominate next-generation batteries will require a suite of policies targeted at scaling up emerging technologies. A critical insight is that incentives and market interventions required to cultivate next-generation batteries are very different from a policy framework tuned to increase production of today’s technology.19

Therefore, policymakers should avoid fighting yesterday’s war. As frustrating as it is that China has come to dominate the production of today’s lithium-ion battery technology through a mix of genuine innovation and manufacturing prowess as well as state-sponsored intellectual property theft and unfair trade and subsidy practices, it would be a mistake to try to beat China at its own game. Lavishing subsidies at a grand scale on domestic manufacturers to produce the same batteries that could otherwise be imported much more cheaply from China amounts to closing the barn door after the horse has bolted. U.S. producers will never catch up to the tremendous scale economies and experience that Chinese lithium-ion battery producers have achieved, and U.S. firms will remain woefully uncompetitive in global markets if they only produce today’s technology. To be sure, it would be wise for the United States to keep working to reduce its reliance on batteries (and refined minerals) produced in China by cultivating other suppliers such as Vietnam and India; the share of batteries imported from China reached 72 percent in 2023—50 percent would be more appropriate. But U.S. policymakers have to be realistic about what level of competitiveness they can achieve with tariffs on graphite and EVs like the ones the Biden administration introduced in May 2024.20

Unfortunately, the vast majority of current U.S. incentives for battery production, such as the Inflation Reduction Act (IRA) Section 45X tax credits, do not target next-generation batteries over existing technologies. As a result, these incentives are being used almost exclusively to support manufacturing facilities to produce lithium-ion batteries. In addition, a Carnegie analysis of the $24 billion in U.S. federal grants and loan guarantees through the Department of Energy over the last two years reveals that more than 90 percent of the funding has supported lithium-ion batteries, the current generation of technology. Some of the remaining funding has supported low-cost and low-density architectures that can be used to back up the power grid. And less than 1 percent of federal funding has supported next-generation solid-state batteries.

Given the extreme imbalance of U.S. government support for current-generation technology, U.S. firms seeking to harness government subsidies have looked to contract with leading Chinese producers of conventional batteries to build up domestic U.S. manufacturing capacity. Although it may be possible for the United States to benefit from Chinese expertise and foreign direct investment and protect intellectual property generated through these manufacturing partnerships, this should not be the only model for scaling up U.S. battery production. Indeed, there is no pathway to dethroning China’s dominance in the battery industry so long as U.S. producers depend on China for technology and manufacturing prowess. The only way to narrow, rather than entrench, China’s massive lead will be to invest decisively in next-generation batteries.

A wholesale shift in strategy to cultivate a U.S. industry developing and producing next-generation batteries will require three types of policies: (1) robust R&D funding, (2) funding to rapidly scale up new technology, and (3) protected markets for the early deployment of these new products.

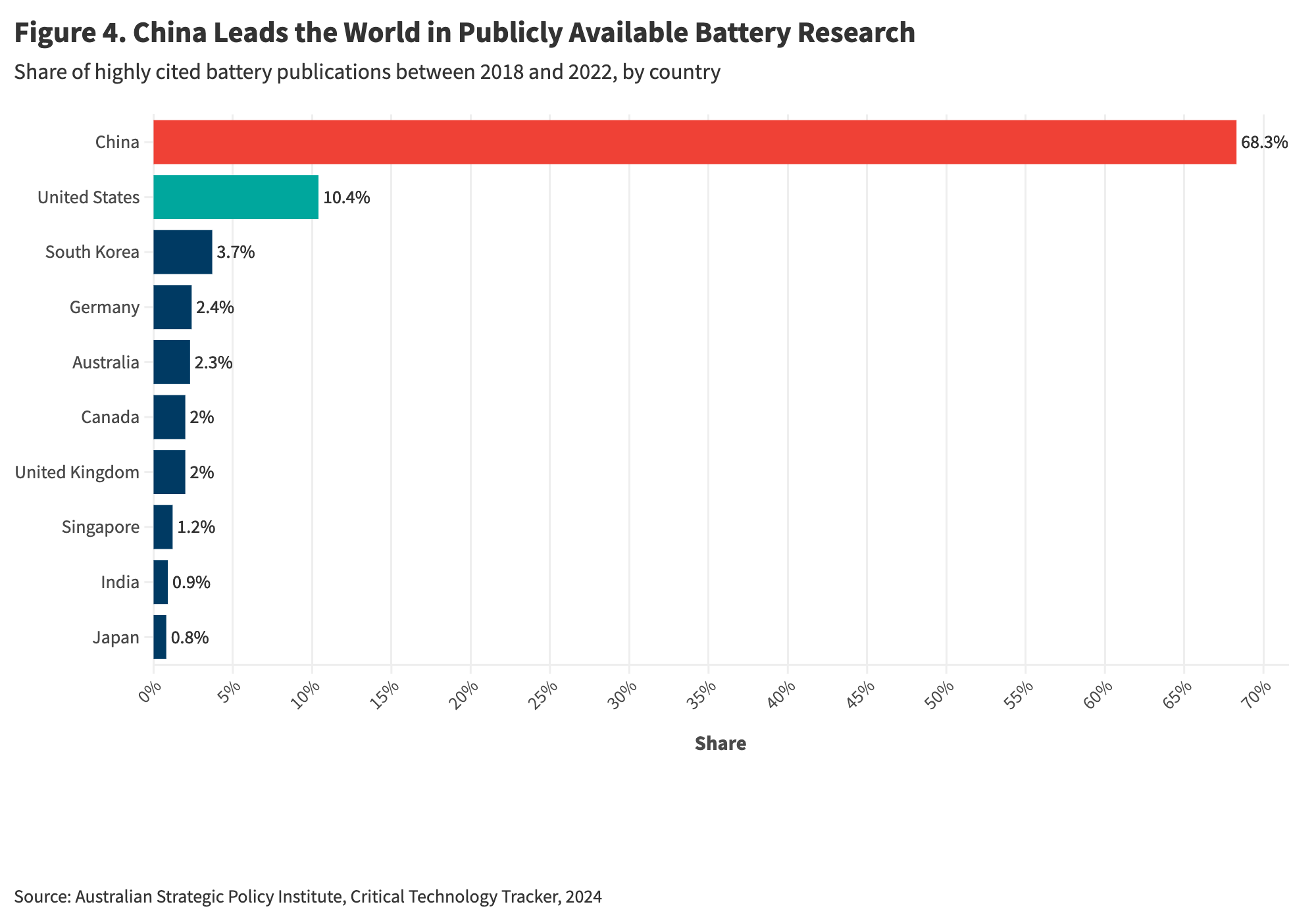

Pushing the technological frontier for battery performance and cost will require U.S. universities, research institutions, and National Laboratories to reestablish U.S. supremacy in battery technology. China has more than closed the gap in battery R&D—it has taken the lead (see figure 4). Thanks to aggressive Chinese R&D funding, 68 percent of highly cited technical papers on battery technology now come from Chinese research institutions, compared with just 10 percent from U.S. institutions.21

Although published scholarly work is widely available across borders, the know-how and centers of excellence generated to push the technological frontier confer competitive advantages to the countries that undertake cutting-edge R&D. Therefore, the U.S. Congress should urgently increase appropriations through the National Science Foundation (NSF), the Department of Energy, ARPA-E, the Department of Defense, and other funding sources for next-generation battery R&D. This would help fill the pipeline of pioneering research, including into battery technologies on the horizon that are so energy dense they could power long-distance aviation.22

The U.S. government should urgently increase funding dedicated to scaling up next-generation battery demonstrations and production. Today, there is a major gap between funds available for university research, such as from ARPA-E and NSF, and incentives for the mass production of mature lithium-ion battery technology, such as IRA tax credits and Loan Program Office manufacturing loans. The missing middle represents funds for scaling up production of next-generation battery technologies.

Companies at the forefront of developing solid-state batteries with lithium-metal anodes need tens of millions (in some cases hundreds of millions) of dollars in grants and low-cost loan financing to build pilot lines that iron out the kinks in their technologies. This funding is also essential for scaling up companies’ production now to at least a gigawatt-hour—enough to power 1,000 electric vehicles—and to hundreds of gigawatt-hours by the end of the decade. The Department of Energy has the latitude through its Loan Programs, Clean Demonstrations, and Manufacturing Offices to concentrate the support it offers toward next-generation battery manufacturing instead of only supporting existing technology manufacturing. The Department of Defense should also focus on cultivating new producers of next-generation batteries. And Congress should build on the IRA and Bipartisan Infrastructure Law by focusing new tax incentives on manufacturing for next-generation batteries, because today’s incentives will almost certainly be monopolized by producers of existing technologies.

It will be critical to create market opportunities for emerging U.S. producers of next-generation batteries to sell their products without fear of competing with low-cost, Chinese producers of existing lithium-ion batteries that can undercut new technologies. For next-generation batteries to gain initial scale and costs to fall, companies will need to ship initial volumes of product and build experience in serving customers and analyzing battery performance in the field. U.S. government procurement offers an excellent route to do just this.

The U.S. military should provide American firms with a dedicated market to power a small segment of military vehicles, drones, and other equipment with next-generation batteries, ensuring that existing lithium-ion technologies and Chinese suppliers are ineligible for these procurements. Similarly, these efforts could target other government purchasers of batteries, including the U.S. Postal Service truck fleet and the other twenty-eight government agencies that committed to ramping up procurement of EVs and bought nearly 10,000 of them in 2023.23 Shifting a fraction of those procurements to only target U.S.-produced next-generation batteries could create a critical beachhead market for companies to underwrite and finance new production lines and guarantee sales of a new technology that needs to get off the ground. Although the executive branch already has some leeway to develop these small procurements, Congress should explicitly authorize the U.S. federal government to prioritize next-generation U.S. battery technologies over existing ones.

As policymakers develop trade policy, they should ensure that U.S. competitors cannot take advantage of the country’s market to scale their next-generation battery designs by dumping or undercutting U.S. technologies through artificially depressed prices and government subsidies. Although in the long run, U.S. firms will need to build globally competitive next-generation batteries to truly realize the full market potential of these revolutionary technologies, the U.S. goal in the near term should be to tilt the playing field in favor of American next-generation battery commercialization and early sales. Failing this, China will dominate the next chapter of the global battery industry exactly as it has done to date.

The cost of these interventions is small—on the order of several billion or at most tens of billions of dollars—compared with the hundreds of billions needed to compete with the vast Chinese manufacturing complex for existing lithium-ion technologies. Leapfrogging China with U.S. innovation has the dual benefit of saving taxpayer resources and enabling a superior U.S. product that can compete effectively in global markets, particularly for premium applications. This is a strategy that plays to U.S. strengths and could reset the race for the batteries of the future, a race where America can actually hope to compete, rather than aspire to a distant second or third place. There is no time to waste.

Note: Sivaram would like to disclose that his father, Siva Sivaram, is CEO of QuantumScape Corporation, a U.S. battery firm. Varun Sivaram has no financial or other relationship to QuantumScape.

Correction: The author’s voluntary disclosure was added.

Correction: A calculation in the underlying data for figure 3 was revised. The aggressive scenario in 2035 was corrected from 54 percent to 32 percent, and the reference scenario was corrected from 32 percent to 22 percent.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

With the blocking of Starlink terminals and restriction of access to Telegram, Russian troops in Ukraine have suffered a double technological blow. But neither service is irreplaceable.

Maria Kolomychenko

A new Carnegie survey of Indian Americans examines shifting vote preferences, growing political ambivalence, and rising concerns about discrimination amid U.S. policy changes and geopolitical uncertainty.

Milan Vaishnav, Sumitra Badrinathan, Devesh Kapur, …

Integrating AI into the workplace will increase job insecurity, fundamentally reshaping labor markets. To anticipate and manage this transition, the EU must build public trust, provide training infrastructures, and establish social protections.

Amanda Coakley

In this moment of geopolitical fluidity, Türkiye and Iraq have been drawn to each other. Economic and security agreements can help solidify the relationship.

Derya Göçer, Meliha Altunışık

It’s dangerous to dismiss Washington’s shambolic diplomacy out of hand.

Eric Ciaramella