Summary

South Korea lies on the fault line of the U.S.-China divide. This report focuses on three key aspects of this geopolitical situation. First, it explores how the Republic of Korea (ROK), also known as South Korea, can make key contributions as a “critical technology wingman” of the United States and the potential benefits of such an arrangement for both sides. Second, it delves into how America’s Asian allies are coping with the growing dilemma of wishing to reduce their dependence on the Chinese market but being unable or unwilling to decouple from China due to its immense economic potential even as these U.S. partners seek to strengthen their security and defense ties with the United States. Third, the report examines how the United States and the ROK can forge and sustain a robust technology alliance in a way that acknowledges the leading role that the private sector will play in making more resilient and secure supply chains.

When the second Donald Trump administration comes into office in January 2025, one of the most important strategies it must lay out is a comprehensive high-tech policy that includes unparalleled cooperation with capable allies amid intensified U.S.-China competition. But operationalizing such a policy is going to be increasingly difficult given that every U.S. treaty ally, and the United States itself, has enormous economic linkages with China. As Trump regains the White House, he is likely to stress why he thinks that China is ripping off the United States with trade deficits and that rich American allies (like South Korea) are supposedly reluctant to help cover shared defense costs. Arguably, one way to pursue Trump’s vision of a stout, self-interested U.S. posture on the world stage would be to harness the power of economically developed, technologically advanced, and militarily capable allies—such as South Korea, Japan, and Australia in the Western Pacific—as part of a regional coalition.

Major U.S. allies in the Indo-Pacific face a host of critical security threats such as North Korea’s growing nuclear arsenal, China’s increasingly aggressive posture, renewed defense cooperation between Russia and North Korea (such as the signing of a bilateral defense agreement in June 2024 and North Korean troops being sent to fight alongside Russian forces in Ukraine), and the possibility of a major crisis or conflict in the Taiwan Strait. And on top of such security risks, South Korea, Japan, Taiwan, and other U.S. allies now are contending with equally salient economic and technology security challenges that has placed leading South Korean tech firms such as Samsung, Hyundai, SK Hynix, and LG at the forefront of building more resilient supply chains and beefing up technological cooperation with the United States.

As China’s own high-tech capabilities grow in response to more stringent U.S. export controls and tariffs, South Korea must confront a China that is the world’s number two economic superpower, Asia’s most powerful military, and (increasingly) a technological innovator to be reckoned with. While siding with the United States on critical technologies leaves South Korea open to Chinese political pressure and industrial espionage against South Korean government entities and major firms, the ROK would only have marginal leverage against China without a security, economic, and technological alliance with the United States.

As the United States and the ROK prepare to celebrate the seventy-fifth anniversary of their security and defense alliance in 2025, forging a durable technology alliance is going to become an increasingly critical element of their cooperation. How this technology alliance evolves will depend on a range of factors such as the outcome of the 2024 U.S. presidential election; the trajectory of U.S.-China strategic competition; and a host of technological factors including the pace of innovation in sectors like artificial intelligence (AI), quantum computing, unmanned and autonomous weapons systems, nuclear fusion, and new materials. And while an enormous power gap will continue to exist between South Korea and the United States, the ROK has emerged as one of Washington’s most important niche technology partners.

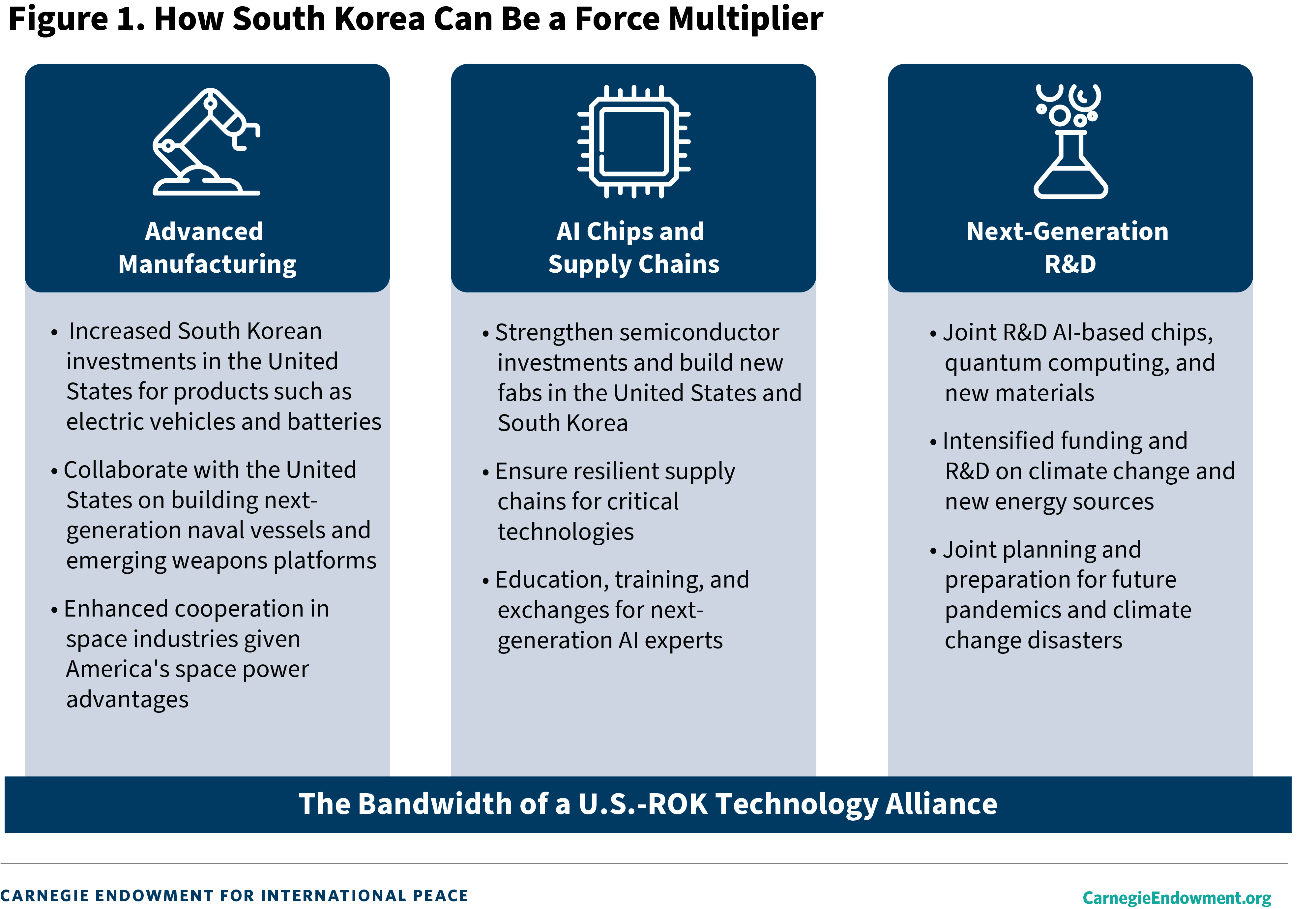

South Korea today is a world leader in advanced manufacturing including in fields like shipbuilding, semiconductors, automobiles, and consumer electronics. The United States can, obviously, continue to maintain its global superpower posture without South Korea. But the ROK is making and will continue to make vital contributions to U.S. economic and national security as a force multiplier (see figure 1). In an age when national power differentials are measured at subatomic levels, how the United States and South Korea can maximize opportunities for key technological cooperation through governmental, commercial, and educational partnerships will become increasingly vital. It is nearly impossible to imagine today that major South Korean conglomerates—such as Samsung, Hyundai Motors, Hanwha, and LG, among others—would invest tens of billions of dollars in the United States. The 1953 mutual defense treaty and the presence of 28,500 U.S. troops in South Korea remains the backbone of the U.S.-ROK alliance.1 But in a world where economic and technological security are becoming just as important, if not more so, than traditional security and defense, South Korea’s vital technologies and advanced manufacturing capabilities mean that it can play a much more important role in an expanded alliance well into the 2030s and beyond.

The U.S.-ROK Technology Alliance for the Long Haul

The purpose of this study is to assess how South Korea can forge a much stronger technology alliance with the United States amid growing pressures from all sides and challenging domestic socioeconomic conditions. The ROK has close security ties with Washington symbolized by the presence of the 28,500 personnel affiliated with United States Forces Korea (USFK). America plays a critical role in maintaining a combined warfare posture in South Korea with its ROK military counterparts. The USFK and the U.S. Seventh Air Force based at Osan Airbase in South Korea are also the only U.S. troops stationed in mainland Asia, and they bolster U.S. efforts at countering China’s growing military power throughout the Western Pacific. While South Korea focuses the lion’s share of its mission on deterring a nuclear-armed North Korea with a massive conventional military, the ROK forces are also mindful of China’s expanding anti-access/area denial capabilities (A2/AD) that would need to be countered in the event of a major war on the Korean Peninsula, Sino-Japanese conflict over the Senkaku Islands (which China also claims), or Chinese military actions to prevent reinforcement and related operations from United Nations Command (UNC) Rear that is based in Japan as part of the US Forces Japan (USFJ). In a major conflict or war on the Korean Peninsula, UNC Rear will play a crucial role in supporting U.S. and allied military operations on the peninsula including augmentation of U.S. troops as well as materials and supplies.

On the Fault Line of U.S.-China Strategic Competition

As Seoul navigates the fault line of U.S.-China competition, three factors will be at the forefront of its strategic calculus. The first is the key contributions South Korea can make as a technology partner of the United States. The second factor is how South Korea and other U.S. partners in Asia grapple with the challenge of reducing their economic dependence on China without decoupling from the Chinese market completely, while simultaneously bolstering defense ties with the United States. The third factor is the need for policies in Seoul and Washington that actively encourage a robust technology alliance with the United States, but at the same time ensuring that Korean companies are able to mitigate prolonged fallout from worsening U.S.-China tech wars.

For more than seven decades, the U.S.-ROK alliance has focused, (correctly) on meeting growing military threats from North Korea. More recently, China’s improving power projection capabilities throughout the Western Pacific have added a new layer to Seoul’s regional security landscape. On top of these two growing dangers, South Korea and the United States must now also contend with much closer military ties between Russia and North Korean since the outbreak of the full-scale Russia-Ukraine war in February 2022 and the signing of a new defense accord between Moscow and Pyongyang in June 2024. More recently, North Korea has sent thousands of troops to support Russia’s ongoing war of aggression against Ukraine.2 Together with Japan, the United States and South Korea confront a Northeast Asian geopolitical threat spectrum that is more dangerous than it has been since the outbreak of the Korean War in 1950. And according to an August 2024 article in the New York Times, U.S. President Joe Biden approved a new secret nuclear strategy called the “Nuclear Employment Guidance,” which is focused on a coordinated response to nuclear challenges from China, Russia, and North Korea.3 U.S. officials have said that China appears to be accelerating its strategic nuclear expansion, and the New York Times article found that the “Biden strategy sharpens that focus to reflect the Pentagon’s estimates that China’s nuclear force [will] expand to 1,000 by 2030 and 1,500 by 2035, roughly the numbers that the United States and Russia now deploy.”4

This is just one facet of the United States’ expanding strategic competition with China (and Russia) in addition to its efforts to address the growing threat posed by a nuclearized North Korea. But even as nuclear and military competition is a large component of the China challenge, an equally important race with far-reaching economic, military, societal, and technological ramifications is taking place simultaneously: the AI-driven rivalry between the United States and China as the superpowers compete for overarching technological supremacy. Multiple forces and factors are going to determine the long-term outcome of this epic, drawn-out contest between the United States and China, including how Washington and its allies will harness AI-driven capabilities with wide-ranging commercial and defense applications. The U.S.-China technology competition will continue well into the 2030s and beyond. An article by Ryan Fedasiuk specified five core technological areas to focus on, including “AI, autonomous systems, quantum computing, semiconductors, and the bioeconomy”—all areas that he points out were listed as the top five technological priorities in China’s Fourteenth Five-Year Plan.5 As Fedasiuk noted, “The five emerging technologies that form the axes of U.S.-China technology competition . . . offer opportunities not only for Seoul to solidify its security relationship with Washington, but also to achieve its long-term economic development objectives.”6

At the same time, while U.S. allies will continue to align with Washington on key technology issues, they are highly unlikely (as is the United States) to fundamentally decouple from China. How far America’s allies are willing to go to support U.S. policies including stringent export controls (toward China and Russia) will depend on the range and depth of opportunity costs that these partners’ governments and companies are able to absorb while managing increasingly complex ties with China. Even the United States cannot decouple itself totally from China given the enormous consequences such a move would have, quite apart from the virtual impossibility of stopping all trade and economic relations with China.

One would think that U.S.-China trade ties are likely to have dipped significantly since the advent of intensifying trade and technology competition over the past decade, but U.S. goods and services trade with China in 2022 totaled $758.4 billion, with U.S. exports accounting for $195.5 billion and imports from China totaling $562.9 billion.7 According to Statista, while there have been fluctuations in the U.S.-China trade volume due to such factors as COVID-19 disruptions, U.S. export controls, and tariffs, U.S.-China trade in 2014, for example, was some $592 billion and rose to some $658 billion in 2018.8 It is the most expansive bilateral trading relationship in the world. Thus, even as the United States and its allies engage in protracted strategic competition with China, especially in the high-tech arena, the data underscores the sheer magnitude and depth of America’s and its allies’ trade with China. As a result, a tech and trade war between the United States and its allies and China cannot help but be costly with immense political repercussions. Trump has said that he would impose a 60 percent tariff on Chinese imports if reelected that would not only drastically slow down the Chinese economy but also have ramifications for every major American ally in Asia.9 Even the ultra-libertarian CATO Institute wrote in July 2024 that, if Trump were to go through with his threats to impose a 60 percent tariff on all goods from China and a 10 percent tariff on all goods from other countries, in what Trump called a “ring around the country,” that Trump should “should call it a ring around consumers because the tariffs will raise prices, limit choices, harm productivity, and act as a tax on importing businesses.”10

What Does a Technology Alliance Entail?

Edlyn Levine of America’s Frontier Fund characterized a technology alliance in June 2023 as the convergence of economic interests and common values. Levine noted that U.S. partners such as South Korea, Japan, and the Netherlands were essential to helping maintain a “lead in technology because if we don’t lead in technology, we will not be able to lead in values.”11 In short, a technology partnership doesn’t just entail enhanced R&D collaboration and more resilient supply chains (as important as these aspects are) but needs a “super glue” that includes common values and interests in maintaining a rules-based international order. The United States and its key allies are all churning out their own versions of industrial policies to spur R&D in critical emerging technologies. While the jury remains out on how effective U.S. and other major economies’ industrial policies will be in triggering a genuine AI revolution, David Rotman wrote in January 2023 in MIT Technology Review:

One reason for renewed optimism is that today’s technologies, especially artificial intelligence, robotics, genomic medicine, and advanced computation, provide vast opportunities to improve our lives, especially in areas like education, health care, and other services. If the government, at the national and local level, can find ways to help turn that innovation into prosperity across the economy, then we will truly have begun to rewrite the prevailing political narrative.12

Presidential summits are often full of symbolic gestures, but Biden’s hosting of South Korean President Yoon Seok Yeol for a state visit in April 2023 was different. While the ROK and the United States began to stress the importance of technology cooperation starting in the 2010s, the April 2023 joint statement offered the most extensive vision of technological cooperation between the two countries to date. As the two leaders marked the seventieth anniversary of the U.S.-ROK alliance, they “affirmed the need to make bold investments to build clean energy economies and to build and strengthen mutually beneficial supply chain ecosystems for our critical technologies.”13 The statement also emphasized:

They [Biden and Yoon] also noted cooperation on . . . AI, biotechnology, medical products using AI, and biomanufacturing. They reaffirmed the importance of deepening cooperation between our foreign investment screening and export control authorities, recognizing the necessity to take appropriate measures to ensure national security, while maintaining resilient global semiconductor supply chains and keeping up with rapid technological advancement. The two Presidents welcomed the signing of a joint statement on U.S.-ROK cooperation in quantum information science and technology, and they called for efforts to conclude a U.S.-ROK Reciprocal Defense Procurement Agreement to strengthen cooperation in the global defense industry.14

Beyond these key areas, Biden and Yoon also stressed the importance of collaborating closely on cybersecurity, deepening space cooperation, and working jointly against space weaponization. The two leaders also called for “strengthening U.S.-ROK commercial space cooperation and welcomed the United States’ recent clarification of its export control policies on satellites and satellite components, which provides a foundation for expanded bilateral commercial and governmental space cooperation.”15 U.S.-ROK space cooperation is expected to facilitate South Korea’s entry into the huge commercial satellite market and upgrade bilateral commercial and military-based space collaboration. But due to restrictive U.S. export controls and missile technologies from the 1970s, South Korea turned to other countries including Russia for space-technology cooperation that helped launch South Korean satellites and jointly developed South Korea’s launch vehicles in the 2000s and 2010s.16

The ROK is also developing its own Korean Positioning System that will be integrated with the U.S.-led GPS system as another example for “joint architectures and capabilities” in the space domain.17 Altogether, South Korea and the United States signed 23 memoranda of understanding to ramp up technology cooperation in critical high-tech industries such as batteries, self-driving cars, aviation, robots, nuclear power, clean energy, and carbon neutrality.18 How many of these MOUs ultimately result in tangible investments and concrete R&D remains to be seen but signing such a broad array of crucial bilateral tech agreements would have been virtually unthinkable even in the early 1990s.

The Growing Rationale for a Technology Alliance

America’s Asian partners will make critical contributions to this tech competition with China, especially South Korea, Japan, and Taiwan. Although alliance management and alliance politics experienced turbulence, especially during the Trump presidency (2017–2021)—particularly for South Korea given Trump’s camaraderie with North Korean dictator Kim Jong Un—as the U.S.-China technology war intensifies, the United States will need the support of South Korea’s leading high-tech firms more than ever before.

This doesn’t mean, however, that there won’t be any competition between these allies. Indeed, as commercial partners cooperate, they are also competing, at times fiercely, not only to gain greater market share but also to ensure that they stay ahead in R&D. For example, South Korea has grown rapidly as one of the world’s top manufacturers of nuclear power reactors (although the previous administration of former president Moon Jae-in adopted a non-nuclear energy policy that Yoon reversed when he became president in May 2022). A dispute has arisen between a key U.S. nuclear energy firm and a South Korean counterpart. The Westinghouse Electric Company continues to argue that the South Korean reactor model APR1400 was based on its own original technology. In July 2024, Korea Hydro and Nuclear Power (KHNP) was selected for a nearly $20 billion Czech nuclear project, but under the guidelines of the 1978 Nuclear Suppliers Group, South Korea needs U.S. approval for exporting nuclear reactors.19 Westinghouse sued KHNP for infringing on its intellectual property in October 2022, but in September 2023 the case was dismissed by the U.S. District Court for the District of Columbia, which ruled that “export control authority rests solely with the U.S. government and thus [that] Westinghouse lacked standing to sue.” Nonetheless, Westinghouse appealed the decision in October, and an appellate court is now reviewing the case.20 Westinghouse continues to assert that South Korean reactors are based on their proprietary technology, while KHNP asserts that, while it received original input from Westinghouse, it developed its own reactor technology over the past 30 years and owns all intellectual property rights to these nuclear power plant technologies.21

Yet even amid such disputes, multiple factors call for closer technological alignment between South Korea and the United States in critical areas. First and foremost, extending the U.S.-ROK alliance into the technology realm would let the allies build upon one of the most militarily significant alliances the United States has forged and led over the past 75 years. South Korea fields one of Asia’s strongest militaries and can produce an array of sophisticated weapons systems, even though its forces embody key structural deficits such as declining manpower due to rapidly changing demographics.

Strong interoperability with USFK is also a key advantage. Given the need to ensure long-term U.S. military supremacy globally, but particularly in the Indo-Pacific, the United States needs allies such as Japan, South Korea, and Australia that have comprehensive military, economic, and technological capabilities. Transitioning to a leaner, technologically advanced military is not a matter of choice but a matter of national survival since South Korea and Japan—two of Asia’s most cutting-edge economies—also face some of the world’s sharpest dropping birth rates and fastest-aging societies.22 The manpower shortage in the armed forces is the most important obstacle that South Korea must overcome in an age when the security threats the country faces are deepening and expanding. Unless Seoul and Tokyo, for example, restructure their armed forces with a greater infusion of unmanned systems; autonomous weapons systems; and AI-based intelligence, surveillance, and reconnaissance (ISR) capabilities, their abilities to effectively deter North Korea and China (as well as Russia) will weaken over time.

The United States should deepen its defense cooperation with South Korea and Japan so that the partners can take advantage of each other’s core competitiveness, including South Korean and Japanese shipbuilding capabilities that could help build and service U.S. naval vessels. According to a U.S. Office of Naval Intelligence briefing slide from July 2023, the accelerating naval gap between the United States and China is being spurred by “China’s shipbuilders being more than 200 times more capable of producing surface warships and submarines.” The slide deck went on to say, “this underscores longstanding concerns about the U.S. Navy’s ability to challenge Chinese fleets, as well as sustain its forces afloat, in any future high-end conflict.”23

They also illustrated that, while the People’s Liberation Army Navy (PLAN) had 355 battleships compared to the U.S. Navy’s figure of 296, by 2035, the gap was slated to rise to 475 ships for China compared to between 305 and 317 ships for the United States.24 As a U.S. think tank expert put it, “The U.S. Navy is one of the most effective deterrents to Chinese military action against Taiwan. However, if these trends don’t change, and soon, the Indo-Pacific will become more dangerous as Beijing will find itself in a far more advantageous position.”25

Of course, such comparisons don’t consider key technological criteria, the levels of training, and the types of weapons systems each navy could muster in networked warfare. As the U.S. Navy begins to develop, operate, and deploy the world’s leading unmanned surface and submarine forces over the next decade, ensuring maritime superiority will depend on an entirely new class of unmanned surface vehicles. For example, an August 2024 Congressional Research Service report noted, “[unmanned vehicles (UVs)] are one of several new capabilities . . . that the Navy and other U.S. military services are pursuing to meet emerging military challenges, particularly from China. UVs can be equipped with sensors, weapons, or other payloads, and [they] can be operated remotely, semi-autonomously, or (with technological advancements) autonomously.”26 While the United States is the world’s leading space power and has top ISR capabilities, China is also catching up rapidly in these and other high-tech domains. It would be a huge misjudgment to dismiss China’s rapidly growing technological R&D and manufacturing capabilities. Indeed, even after the United States took steps to prevent the transfer of advanced semiconductors to the Chinese market, China’s top chip producers, such as the Semiconductor Manufacturing International Corporation and Hua Hong Semiconductor Group, are bolstering their capacity in anticipation of more U.S. sanctions.27

Although these Chinese companies lag behind the Taiwan Semiconductor Manufacturing Company (TSMC) and South Korea’s Samsung in chip-processing technology, “the total capacity of China-based foundries will grow 15 percent to 8.9 million wafers per month this year, and 14 percent to 10.1 million next year, exceeding the average global growth of 6 percent and 7 percent for the same period, according to a report from SEMI, a U.S.-based industry association. As a result, China is expected to account for about 30 percent of the world’s total wafer capacity next year.”28 Although China’s semiconductor industry will face an uphill struggle as the United States intensifies its tech war with Beijing, it remains highly uncertain if U.S. sanctions will ultimately succeed. As Hanna Dohmen, Jacob Feldgoise, and Charles Kupchan noted in a July 2024 article in Foreign Affairs, high-tech sanctions against China are working, but China is figuring out how to circumvent and overcome them.

But the chip controls will probably fall short of achieving either outcome. They are unlikely to substantially slow Beijing’s military modernization, much of which can be accomplished using older legacy chips. Where cutting-edge AI chips are needed, the Chinese military can use previously imported chips, smuggled chips, and domestically designed and produced chips. The controls will likely be more consequential when it comes to enabling the United States to maintain its technological edge. By impeding China’s ability to develop and deploy AI throughout its economy, the export restrictions could slow China’s growth and curb its competitiveness, thereby helping the United States stay ahead.29

The imperative of maintaining technological supremacy in Northeast Asia is also being driven by the AI revolution. One of the least studied but arguably most important facets of adopting AI-driven technologies—such as next-generation unmanned and autonomous weapons, drones, hypersonic missiles, and G6 combat fighters—is the massive disruption such systems will trigger throughout the armed forces, defense policymaking bureaucracies, and the military-industrial complex. The U.S.-ROK alliance is hardly an exception. The rise of dual-use technologies, a wide array of much cheaper asymmetrical weapons systems, and the growing role of commercial enterprises in warfare are going to entail unparalleled reforms within the defense and intelligence communities for all countries with significant implications for military forces and expanding threat spectrums. For example, “as the private-sector money available for research and development has outstripped federal-government spending, particularly in areas like AI, a new cohort of defense startups is using private capital to develop technology for the Pentagon. . . For the startups, proving they can mass-produce will be critical.”30 How the United States and South Korea adapt their alliance in this new environment by pursuing joint R&D, developing new doctrines and strategies, formatting optimal participation for commercial enterprises, and modernizing the concept of combined forces’ operations is going to be as important as focusing on emerging weapons systems.

Together with other key regional allies including Japan and Australia, focusing on the impact of AI on ISR capabilities, for example, will be one way of strengthening military-related situational awareness and of responding much more effectively against growing threats from China, Russia, and North Korea. As these security challenges converge, it makes sense for the North Atlantic Treaty Organization (NATO) and U.S. alliances in Asia (especially those with South Korea, Japan, and Australia) to strengthen ties with key NATO partners. Although security ties between NATO and America’s Asian allies are just beginning to expand, from the standpoint of grand strategy, it makes sense to maximize pressures at both ends of Eurasia, that is, vis-à-vis Russia and China. These Asian-European security partnerships are an added layer of countervailing measures against rising Chinese power and intensifying strategic competition with the United States throughout the Indo-Pacific.

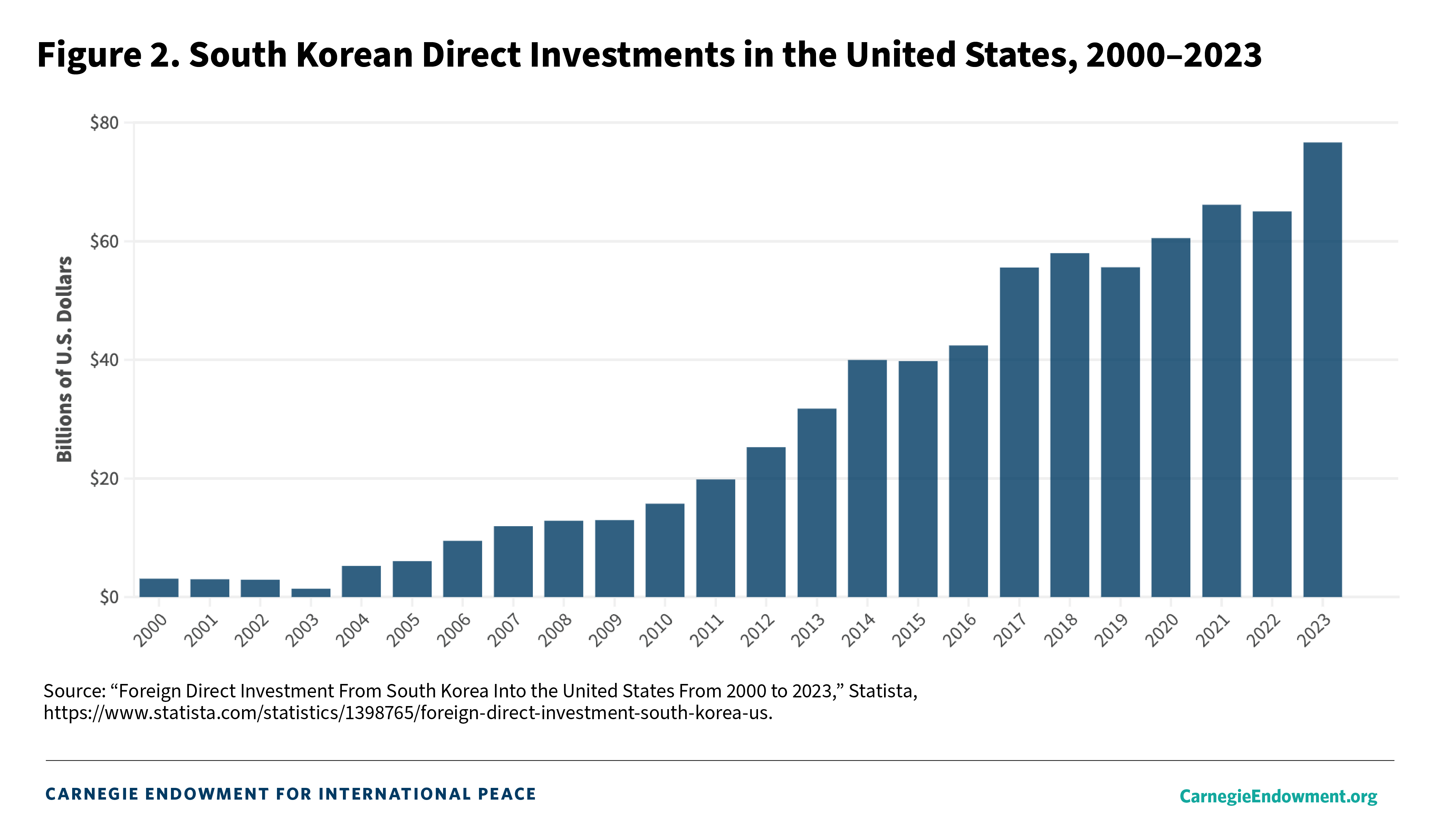

As for the U.S.-ROK alliance’s economic foundation, while South Korean exports to the United States began to take off in the early 1970s and helped propel the ROK into becoming an exporting powerhouse, it wasn’t until the 2010s when South Korean companies began to make serious investments in the United States. As illustrated in figure 1, South Korea’s direct investment in the United States in 2001 was only $3.1 billion, but it rose to $76.7 billion in 2023. (That said, a press release from the South Korean Ministry of Economy and Finance in May 2024 noted that South Korea’s total outbound foreign direct investment (OFDI) was $63.4 billion in 2023, or a difference of more than $13 billion compared to the data provided by Statista.)31

The Ministry of Economy and Finance’s press release noted that there were several reasons that contributed to a dip in South Korea’s OFDI in 2023, including high interest rates worldwide (including in the United States though rates there have recently begun to fall), the economic slowdown in China and ongoing geopolitical risks, and the restructuring of critical global supply chains.32 But overall, South Korean exports to the United States have risen significantly over the past decade, and according to a report published by the Korea International Trade Association (KITA) in May 2024, South Korean investments in the United States hit a 35-year high in 2023, driven by the Biden administration’s incentives through the Inflation Reduction Act and the CHIPS and Science Act.33 The same report noted that 2,432 South Korean companies operated businesses in the United States, with the largest share of them in three states: California (24.7 percent), Texas (11.1 percent), and New York (7.9 percent).34

One of the most significant transformations in the U.S.-ROK relationship is the magnitude of economic ties between the two allies. According to an update by the Congressional Research Service in June 2024, some 88,000 U.S. workers were employed by South Korean multinational companies in 2021, and the report also found that “since 2021, ROK companies have reportedly announced at least $100 billion in new investment in key industries including electric vehicles (EVs), semiconductors, and biotechnology.”35 As reshoring and near-shoring became increasingly important objectives after the pandemic (especially in the United States), the Reshoring Initiative’s 2023 annual report found that South Korea was among the top five countries that led reshoring to the United States and created 20,360 jobs in 2023, or some 14 percent of all new jobs created by such reshoring.36 Coincidentally, the top five reshoring industries by sector were electrical equipment appliances and components, computer and electronic products, transportation equipment, chemicals, and machinery—areas where South Korean companies have demonstrated leading capabilities especially over the past decade.37

A major impetus for growing South Korean investments in the United States is the need to reduce South Korea’s very high dependence on the Chinese market. Data from Trading Economics show that, in 2022, 24 percent of South Korean exports were destined for China compared to 17 percent headed for the United States.38 Yet South Korean exports to China have dropped in the post-pandemic era, while “exports to the United States hit a record high of $11.4 billion in April 2024,” a figure that marked an increase of 24.3 percent from 2023. Although “China was traditionally Korea’s largest export destination for decades . . . the United States has now emerged as the country’s largest export market on a monthly basis in 2024. The reversal occurred in December 2023 for the first time in 20 years, and exports to the United States continued to surpass those to China from February to April 2024.”39 According to an exports official from the Ministry of Trade, Industry, and Energy, “Korea increased its exports of low-power, high-capacity, and high-value-added memory chips, mainly for AI servers, as many U.S. companies such as Amazon . . . Microsoft . . . and Google . . . imported DRAM [dynamic random access memory chips] from [South] Korean companies.”40

The Five Pillars of a U.S.-ROK Technology Alliance

Following up on the Biden-Yoon statement of April 2023, the national security advisors of the United States and South Korea chaired the inaugural U.S.-ROK Next Generation Critical and Emerging Technologies (CET) Dialogue in Seoul in December 2023. U.S. National Security Advisor Jake Sullivan and ROK National Security Advisor Cho Tae-yong focused their discussion on the following areas: “(1) semiconductor supply chains and technology; (2) biotechnology; (3) batteries and clean energy technology; (4) quantum science and technology; (5) digital connectivity; and (6) artificial intelligence.”41 The two officials also discussed expanding partnerships with like-minded states. In May 2024, a U.S.–South Korea–Japan vice ministers’ meeting was held in Washington to specify avenues of trilateral cooperation following the first explicit trilateral summit between the partners, which was held at Camp David in August 2023. With specific regard to technology cooperation, the joint statement issued at Camp David noted, in part:

We are now cooperating trilaterally on supply chain resilience, particularly on semiconductors and batteries, as well as on technology security and standards, clean energy and energy security, biotechnology, critical minerals, pharmaceuticals, artificial intelligence (AI), quantum computing, and scientific research. . . . We will also enhance cooperation on technology protection measures to prevent the cutting-edge technologies we develop from being illegally exported or stolen abroad. To that end, we will conduct inaugural exchanges between the U.S. Disruptive Technology Strike Force and Japanese and ROK counterparts to deepen information-sharing and coordination across our enforcement agencies. We will also continue to strengthen trilateral cooperation on export controls to prevent our technologies from being diverted for military or dual-use capabilities that could potentially threaten international peace and security.42

| Table 1. The Five Pillars of a U.S.-ROK Technology Alliance | |||

| Areas | Main Actors | Actions | Outputs |

| 1. Enhanced counterintelligence coordination (especially on corporate espionage) |

|

|

|

| 2. Focused R&D collaboration on emerging defense technologies |

|

|

|

| 3. Increase bilateral foreign direct investment to strengthen high-tech supply chains |

|

|

|

| 4. Strengthened economic security ties between the United States, South Korea, and Japan |

|

|

|

| 5. A joint approach to multilateral AI regulatory regimes |

|

|

|

Forbes reported at the time of the December 2023 CET Dialogue that “the upshot of the . . . [dialogue] is that the United States and South Korea will collaborate on developing upstream technologies across a wide range of sectors to a greater degree than ever before, elevating the role of technology coordination alongside security as the glue that binds the two allies together.”43 Just months afterward, a small but significant symbol of the alliance’s transformation occurred in June 2024 when South Korea’s Ministry of Trade, Industry, and Energy announced that four research centers focusing on cutting-edge technologies were launched at Yale, Johns Hopkins, Purdue, and the Georgia Institute of Technology and that the number of such centers would increase to a dozen by 2027.44

Technology alliances are much more fluid than military alliances, with multiple nongovernmental actors, competing and conflicting market presence and interests, and (perhaps most importantly) the primary involvement of high-tech private firms, even though government policies are still crucial. As Jorritt Kaminga has noted, “this is the first time ever, in a war, that more of the critical technologies are not coming from federally funded research labs but commercial technologies off the shelf,” and Steve Blank stressed that “there’s a marketplace for this stuff. So the genie’s out of the bottle.”45 But there are pillars that are becoming more visible as the U.S.-China tech war intensifies and as the wave of AI innovation accelerates at all levels. For now, five main areas of cooperation can be articulated in the U.S.-ROK technology alliance as illustrated in Table 1, though the two governments have identified many more areas for collaboration. Focusing on these five pillars offers a sense of urgency in terms of the growing threat matrix and maximizes what both sides can bring to the table.

The U.S.-ROK CET Dialogue lies at the apex of bilateral government-to-government discussions on critical technologies. Enhancing counterintelligence (CI) capabilities is very closely associated with the CET mechanism especially in South Korea, including in terms of government-to-business cooperation on CI. As one analyst observed, “Unlawful data infiltration and exfiltration have heavy financial impacts on companies whose data is stolen. The damage may not always be readily apparent or immediate, but loss of important confidential materials can erode competitiveness and ultimately impact market share—especially when the materials go to a direct competitor, which is often the case.”46 But it is not just cyber-attacks and data breaches that are the key threats; insider threats posed by employees who sell critical technologies to foreign entities are another major one. According to South Korean media reports in September 2024, a former vice president of Samsung Electronics who also served in a similar capacity at SK Hynix set up a chip company together with a local Chinese government. This case is going through an intensive investigation, but this company was accused of siphoning key technologies related to chip manufacturing. And according to the Seoul Metropolitan Police Agency’s director of the Security Investigation Support Division, “the R&D costs alone are estimated at 4.3 trillion won [about $3.3 billion], while the actual economic costs are likely to be far higher and extremely difficult to put a price tag on.”47

In November 2023, the South Korean Ministry of Trade, Industry, and Energy submitted a bill designed to amend the Act on Prevention of Divulgence and Protection of Industrial Technology, and experts noted at the time that “the new punishments were overdue . . . as the rising number of industrial espionage cases shows that not enough is being done to protect home-grown technology, thereby compromising national security.”48 According to the South Korean government, “14 cases of industrial espionage were detected in 2019, but that increased to 23 cases in 2023. The majority of the incidents involved cutting-edge semiconductor technologies, an area in which South Korean firms are among the world leaders.”

The actual number of espionage cases is probably significantly higher due to under-reporting by firms and operational difficulties in maintaining extensive, 24/7 CI capabilities. In June 2023, it was reported that 77 people were arrested in connection with 35 industrial espionage cases (including 27 domestic cases and 8 cases related to selling secret technologies to China and other countries) during an intensive police crackdown.49 Although this information is a bit outdated, the Federal Bureau of Investigation estimated in 2018 that the cost to the U.S. economy of Chinese corporate espionage was between $225 to $600 billion annually, although, as one analyst observed, “estimates must also consider the long-term consequences of stealing R&D building blocks, the true impact of which will be seen five to ten years from now when Beijing already possesses technologies and weapon systems that Washington expected to be cutting-edge.”50

As important as a U.S.-ROK technology alliance is, it reflects a political understanding that highlights the growing importance of economic and technology security and that, therefore, is subject to wide-ranging interpretations; elasticity; and (perhaps most importantly) includes nongovernmental entities such as corporations, national research laboratories, and even academics since they will assume roles that are as important or even more important than those of governmental entities. Therefore, as the alliance expands into the economic, technological, trade, and corporate domains, alliance management will require new policy paradigms, shifts in key domestic laws and regulations, and clashes between political and policy directives and guidelines and the responses of the private sector, especially large tech firms.

Given the growing importance of dependable supply chains, the United States and South Korea have held two U.S.–South Korea Supply Chain and Commercial Dialogue ministerial meetings, the second of which was held in Seoul in June 2024. U.S. Commerce Secretary Gina Raimondo and ROK Minister of Trade, Industry, and Energy Ahn Duk-geun emphasized the critical importance of advanced manufacturing (including semiconductors), dual-use export controls, and healthcare technologies.51 As noted above, Seoul and Washington launched the Next Generation CET Dialogue to bolster bilateral technological cooperation in an era of escalating U.S.-China technological competition.52 But the U.S. and ROK are thinking about a broader picture technology alliance that also includes space-related cooperation. For example, in December 2022, the U.S. Space Forces – Korea was activated and assigned to the USFK, and Chief of Space Operations General Chance Saltzman addressed the importance of space superiority with ROK government and defense officials in Seoul during a visit in May 2024. According to the U.S. Space Force, the two sides discussed “bolstering integration between ROK and U.S. space personnel and operations and continuing the dialogue on space and missile defense capabilities within the broader defense framework of the Korean peninsula.”53

Why the ROK Is a Force Multiplier

When the second Trump administration comes into office in January 2025, one of the most important strategies it must lay out is a comprehensive high-tech policy that includes unparalleled cooperation with key allies that have significant military, economic, and technological capabilities as the U.S.-China technology competition intensifies. But operationalizing such a policy is going to be increasingly difficult, given that every U.S. treaty ally and the United States itself have enormous economic linkages with China. At the same time, Trump is likely to stress why he believes that China is ripping off the United States with trade deficits and that U.S. allies are not contributing sufficiently to bilateral defense cost sharing.54 That said, one can make a strong case that a key component of securing America’s future on the world stage is enlisting the joint efforts of economically developed, technologically advanced, and militarily capable allies—such as South Korea, Japan, and Australia in the Western Pacific—to participate in a coalition of like-minded partners with common interests.

This is particularly true as China’s influence is surging rapidly in virtually all high-tech areas. For example, according to the 2023 Critical Technology Tracker report prepared by the Australian Strategic Policy Institute (ASPI), “Western democracies are losing the global technological competition, including the race for scientific and research breakthroughs, and the ability to retain global talent—crucial ingredients that underpin the development and control of the world’s most important technologies, including those that don’t yet exist” (emphasis added).55 Although such technological trends are hard to project and some observers could conceivably reach different conclusion, the report states:

Our research reveals that China has built the foundations to position itself as the world’s leading science and technology superpower, by establishing a sometimes stunning lead in high-impact research across the majority of critical and emerging technology domains. China’s global lead extends to 37 out of 44 technologies that ASPI is now tracking, covering a range of crucial technology fields spanning defence, space, robotics, energy, the environment, biotechnology, . . . AI, advanced materials and key quantum technology areas . . . [T]here’s a large gap between China and the US, as the leading two countries, and everyone else. The data then indicates a small, second-tier group of countries led by India and the UK: other countries that regularly appear in this group—in many technological fields—include South Korea, Germany, Australia, Italy, and less often, Japan.56 (Emphasis added).

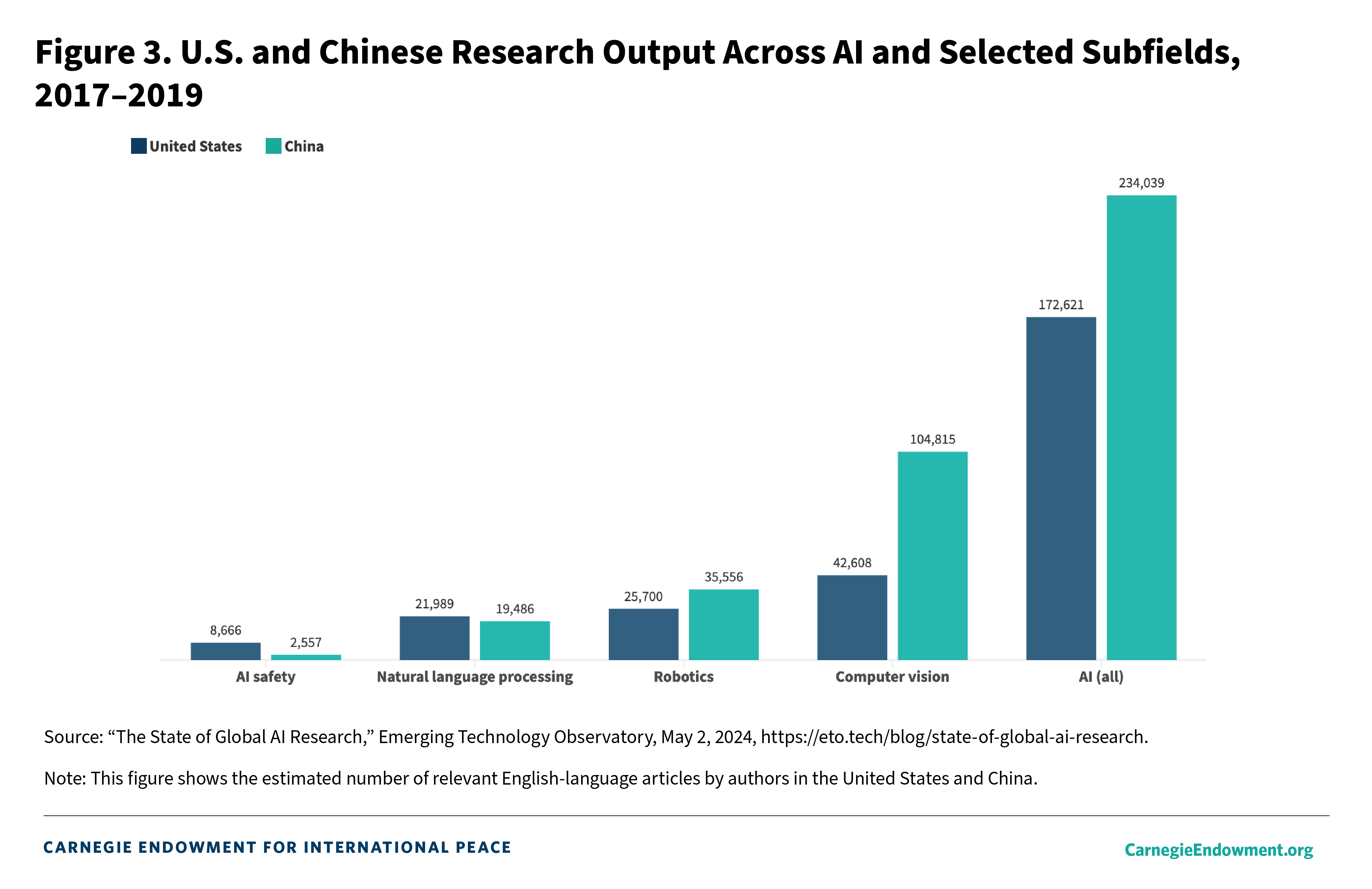

This is not to suggest that the U.S.-China technology competition is over. But other studies such as those conducted by the Center for Security and Emerging Technology at Georgetown University suggest that China leads the United States in “more than half of AI’s hottest fields.”57 According to analysis by the Emerging Technology Observatory in May 2024, among the world’s top 10 AI research institutions, China led with six compared to four for the United States, but all of the top five institutions were Chinese: the Chinese Academy of Sciences, Tsinghua University, Shanghai Jiao Tong University, University of Chinese Academy of Sciences, and Zhejiang University.58 The four U.S. institutions were Carnegie Mellon University (sixth), the Massachusetts Institute of Technology (seventh), Google (ninth), and Stanford University (tenth). U.S. institutions were more competitive in top-cited research, claiming six spots in the top ten, whereas China had four. While China’s sheer magnitude of AI research is impressive, the United States still retains the edge in terms of highly cited articles.59

For America’s Asian allies, one of the side benefits of the growing U.S.-China technology war is the long-festering need to reduce their dependence on the Chinese market although structural factors are also responsible for shifts in South Korea’s trade with China.

South Korea’s exports to China continue to comprise a significant share of its total exports, although the volume has dropped from 2021. According to analysis provided by the Korea International Trade Association (KITA), the share of South Korea’s exports to China as a percentage of its total trade volume peaked at 26.8 percent in 2018 and in 2023, fell to 19.7 percent.60 One major reason for this decline is China’s own growing manufacturing competitiveness and “China has worked to restructure its industrial landscape by nurturing high value-added industries, promoting qualitative growth, and transitioning its overall approach to growth. China’s concerted efforts to localize intermediate goods production through proactive industrial policies have raised concerns about potentially negative impacts on Korea’s exports, of which intermediates constitute an outsize proportion.”61 In the case of other U.S. allies such as Australia, however, the China dilemma is an enduring one since it has enormous interests in preserving robust trade ties with China, given the seminal importance of exporting iron ore and other minerals to the huge Chinese market. It is virtually impossible to imagine any massive decoupling from the Chinese market by America’s Asian allies, even as they align themselves more closely with the United States on critical technology supply chains. Tables 2–7 illustrate how deeply Asia’s major economies are intertwined with China’s economy.

Maximizing South Korea’s Advanced Manufacturing Capabilities

As the United States and the ROK prepare to celebrate the seventy-fifth anniversary of their security alliance in 2025, forging a durable technology alliance will be an increasingly critical element of their partnership. How the technology alliance evolves will depend on how rapidly Trump ramps up a trade war with China. A worsening of the U.S.-China strategic competition would be a critical external driver with multiple ramifications for America’s Asian allies including South Korea. More broadly, the acceleration of the AI revolution, the quantum computing race, the extensive operationalization of unmanned and autonomous weapons systems, the race for nuclear fusion, and innovation in new materials are all factors that will impact the depth, diversity, and longevity of the U.S.-ROK technology alliance. And while an enormous power gap will continue to exist between South Korea and the United States, Seoul has emerged as one of Washington’s most important niche technology partners.

South Korea today is a world leader in advanced manufacturing including in sectors such as shipbuilding, semiconductors, automobiles, and consumer electronics. The United States could, obviously, continue to maintain its global superpower status without South Korea. But the ROK is making and will continue to make vital contributions to U.S. economic and national security as a force multiplier. In an age when national power differentials are measured at subatomic levels, how the United States and South Korea can maximize opportunities for key technological collaboration through governmental, commercial, and educational partnerships will become increasingly vital for ensuring joint technological edge into the middle of the twenty-first century.

One of the most important shifts in the U.S.-ROK relationship is the growing role and importance of South Korean conglomerates such as Samsung, Hyundai Motors, SK Group, LG, and Hanwha that continue to increase their investments in the United States. It would have been nearly impossible to imagine in the 1960s and 1970s that South Korean corporations would end up investing tens of billions of dollars in the United States.

In June 2024, South Korea’s leading defense contractor, Hanwha, acquired a U.S. shipyard for $100 million “to utilize Philly Shipyard’s largest dock in the United States for shipbuilding, maintenance, repair and operations, tapping into the U.S. naval market, which is in need of additional shipbuilding facilities due to a production shortage for the [U.S.] Navy’s fleet.”62 Months earlier, U.S. Secretary of the Navy Carlos Del Toro toured key naval manufacturing sites in South Korea and Japan in February 2024 and said, “Hanwha’s acquisition of Philly Shipyard is a game-changing milestone . . . [and] knowing how they will change the competitive U.S. shipbuilding landscape, I could not be more excited to welcome Hanwha as the first Korean shipbuilder to come to American shores—and I am certain they will not be the last.”63 A Navy Times article reported in August 2024 that the U.S. Navy faces its worst backlog and shipbuilding problems in 25 years, and it asserted that “much of the blame for U.S. shipbuilding’s current woes lies with the Navy, which frequently changes requirements, requests upgrades and tweaks designs after shipbuilders have begun construction.”64 And according to Matthew Paxton of the Shipbuilders Council of America, “the consolidation of shipyards and funding uncertainties have disrupted the cadence of ship construction and stymied long-term investments and planning.”65

As the United States contends with China’s accelerating power projection capabilities across the Western Pacific, the fact that its two most important allies in Asia—Japan and South Korea—also happen to be the world’s leading shipbuilding countries is one of the most strategically significant unintended consequences of U.S. security policy in the wake of World War II. Del Toro told a “Navy gathering” in Washington that “he and his team were ‘floored’ at the level of digitalization and real-time monitoring of the shipbuilding progress . . . ‘Their top executives could tell us—to the day—when ships would be delivered.’”66 He also said, “our Korean and Japanese allies build high-quality ships, including Aegis destroyers, for a fraction of the cost that we do . . . [and] we have an opportunity to attract the most advanced shipbuilders in the world to open U.S.-owned subsidiaries and invest in commercial shipyards here at home.”67

No one could have imagined in the early 1970s when Hyundai broke ground in Ulsan to make South Korea’s first major shipyard that not only would Hyundai Heavy Industries operate the world’s biggest shipyard but also that South Korea’s skill at building commercial and naval vessels (including submarines) would serve as a key component in maintaining a global supply chain vital to U.S. and allied interests. Yet South Korea’s edge in shipbuilding remains contested. According to a 2023 report about the shipbuilding industry published by the Korea Institute for Industrial Economics and Trade, China edged out South Korea by less than two points (90.6 to 88.9) on a scale measuring the competitiveness of its shipbuilding industry “for the first time” since the institute began publishing the report in 2020.68

Even so, the South Korean shipping industry remains at the very top of the global supply chain of merchant marines; given its long history of making all classes of ships for the ROK Navy, supporting U.S. naval expansion and carrying out related missions is much more of a political and a regulatory issue rather than a technological one. It will take many years, legislative changes, and policy adjustments for South Korean and Japanese shipping companies to build U.S. naval vessels, but in light of the accelerated growth of the People’s Liberation Army Navy and ongoing deficits in the production of U.S. warships, it makes sense for the United States to seriously consider relying on allied shipbuilding companies. While the Philly Shipyard is now owned by Hanwha, its entire operation will be based in the United States, employ U.S. workers, and work under a wholly American subsidiary—a model that is likely to bear fruit as mutual trust deepens.

In a first for a South Korean company, Hanwha Ocean won a contract in August 2024 to repair a 40,000-ton U.S. Navy logistics support ship. The company announced that this was a crucial milestone since it was the firm’s first maintenance, repair, and overhaul (MRO) contract with the U.S. Navy and since major overhauls can only be handled by companies that have secured a Master Ship Repair Agreement (MSRA).69 Hanwha signed an MSRA with the U.S. Navy in July 2024 after applying for it in January 2024. As one news article put it, “with this contract, Hanwha Ocean has entered the U.S. Navy ship MRO market, marking a significant entry into the global maritime defense market.”70

Given the huge backlog in supplying new ships to the U.S. Navy, the Biden administration has pushed for closer shipbuilding and repair agreements with allies and “is seeking tighter connections with Korean shipbuilders as China aggressively pursues worldwide shipbuilding dominance.”71 The servicing of the U.S. Navy’s Wally Schirra will be done at Hanwha’s major dockyard at Geoje in South Korea and will serve as a pilot project. According to a Hanwha spokesperson,

With the global naval vessels MRO market size projected to exceed $60 billion annually, this U.S. Navy maintenance project represents a stepping stone to a significant leap forward. . . . We have meticulously prepared and refined our MRO services to build trust with the U.S. Navy. We will also work closely with local small and medium-sized enterprises to support the maintenance industry in South Korea.72

Technology Alliances and Asia’s China Dilemma

The challenge that South Korea, Australia, and other American allies in Asia face is how to formulate stronger security ties with the United States while maintaining key economic relationships with China. According to a June 2024 Financial Times article, a former Australian adviser said that Canberra’s approach to Beijing amounted to “cakeism” in the sense that “we want a full-throated military deterrent to China but desperately still want access to that market for our iron ore and wine. . . Stabilisation of the relationship was needed, but what does stabilisation mean with China? This is going to get harder over time.”73 In many respects, squaring this circle lies at the heart of sustaining a viable technology alliance between the United States and its core allies in Asia.

As the U.S.-China tech war intensifies, U.S. allies are grappling with growing difficulties given the almost binary nature of their security dependence on the United States and their deep economic and trade relations with China. Clearly, U.S. allies also have deep economic and technological ties with the United States that are expanding. But unlike the Cold War period when the Soviet Union didn’t provide real economic incentives to any of America’s allies, China is in a very different league. Although many characterize the U.S.-China tech war as a binary choice of being either with the United States or with China, no major U.S. ally in Europe or Asia can afford to or is willing to significantly reduce its economic ties with China.

In the U.S.-China strategic competition, almost everything is now considered to be a key national security threat. In an entangled world where economic and technological security are becoming as important as traditional security (if not more so if one includes the accelerating impact of AI in the defense realm), national security has become more expansive than ever before. As Daniel Drezner argued in the September/October 2024 issue of Foreign Affairs, “if everything is defined as national security, nothing is a national security priority.”74 He went on to suggest a few ways to address this challenge:

One improvement would be for U.S. officials to sort national security issues by timescale and degree of urgency. Some concerns, such as terrorism and Russian revanchism, pose immediate and pressing risks. Others, such as artificial intelligence and China’s rising power, are medium-term concerns. Still others, such as climate change, create challenges in the here and now but will have their greatest effect over the long term. The more explicit policymakers are about the anticipated timing of specific threats, the easier it will be for the government to properly allocate resources.75

Another major challenge for policymakers in key Asian capitals is asking firms to write off potentially huge losses in China to meet U.S. export control requirements. Moreover, in an era of proliferating dual-use technologies, adapting business strategies to various export controls is going to become increasingly difficult. South Korea’s semiconductor industry leaders such as Samsung and SK Hynix:

have major investments in production facilities in China, and China has become the biggest export market for them. With advanced semiconductors being a central focus of U.S. export control policies, these companies face challenges to their revenue and profitability, potentially hindering their R&D and innovation investments. South Korean policymakers are aware of the disproportionate effects of these unilateral U.S. export control policies, which create obstacles to deeper U.S.-ROK collaboration on critical emerging technologies.76

South Korea and Taiwan are global leaders in the semiconductor sector, and Japan is a global technology leader as well. All of these U.S. partners depend to varying degrees on their formal and informal alignments with the United States. But as pressure grows to realign their supply chains more with U.S. export controls, the ROK and other allies must traverse a challenging tightrope act reminiscent of a Mission Impossible movie: satisfying U.S. national security concerns while ensuring that their companies can maintain critical economic ties with China.

Can America’s Allies Reduce Their Dependence on China?

The U.S.-China trade war has coincided with a growing need for key U.S. allies like South Korea and Japan to reduce their reliance on the Chinese market (see tables 2–5). This is particularly relevant for South Korea given its high dependence on exports to China. In 2023, China’s share of South Korea’s total exports was 19.7 percent, although South Korea’s desire to lower its export dependence on China and China’s growing technological prowess have contributed to a decline in South Korean exports to China (see tables 2 and 3).77 As a report by the Korea Institute for Industrial Economics and Trade put it,

In high-tech industries, primarily focusing on IT products like semiconductors, displays, and home appliances, the RCA gap has widened, indicating that Korea has expanded its lead over China. Thus, while Korea maintains an overall competitive advantage, China retains its competitive edge in global high-tech industries, and the competitiveness gap between the two nations has narrowed in medium-tech industries. This suggests a possibility of Korean products eventually being replaced by Chinese ones in the domestic Chinese market.78

| Table 2. South Korean Exports to China, 2022 | ||

| Total | $150 billion | |

| Integrated circuits | 33.6% | |

| Cyclic hydrocarbons | 4.2% | |

| Broadcasting equipment | 4.1% | |

| Machinery | 3.6% | |

| Broadcasting accessories | 2.9% | |

| Source: “South Korea/China,” OEC, June 2024, https://oec.world/en/profile/bilateral-country/kor/partner/chn. | ||

| Table 3. Chinese Exports to South Korea, 2022 | ||

| Total | $150 billion | |

| Integrated circuits | 15.5% | |

| Broadcasting equipment | 3.9% | |

| Electric batteries | 3.7% | |

| Computers | 3.2% | |

| Office machine parts | 2.3% | |

| Source: “South Korea/China,” OEC, June 2024, https://oec.world/en/profile/bilateral-country/kor/partner/chn. | ||

For the first time since 2004, the United States became South Korea’s largest export destination in December 2023.79 For the first time in three decades, South Korea recorded its first trade deficit with China, and exports to China fell by “20 percent year-on-year, to $124.8 billion,” while imports from China also declined by “8 percent year-on-year, to $142.8 billion.”80 Whether this trend will be sustained over the long run remains to be seen, since even with a downturn in South Korean exports to China, the Chinese market is something South Korean firms cannot ignore. But as South Korea’s geopolitical alignment with the United States has become a central facet of Yoon’s foreign policy, “major conglomerates such as Samsung, Hyundai Motor, LG, SK, and Lotte have been increasing their investments in the U.S.”81

| Table 4. Japanese Exports to China, 2022 | ||

| Total | $135 billion | |

| Machinery | 9.7% | |

| Integrated circuits | 6.2% | |

| Cars | 5.7% | |

| Motor vehicle parts | 3.4% | |

| Beauty products | 1.7% | |

| Source: “Japan/China,” OEC, 2022, https://oec.world/en/profile/bilateral-country/jpn/partner/chn. | ||

| Table 5. Chinese Exports to Japan, 2022 | |

| Total | $178 billion |

| Broadcasting equipment | 8.4% |

| Computers | 5.9% |

| Office machine parts | 2.1% |

| Integrated circuits | 1.8% |

| Semiconductor devices | 1.4% |

| Source: “Japan/China,” OEC, 2022, https://oec.world/en/profile/bilateral-country/jpn/partner/chn. | |

| Table 6. Australian Exports to China, 2022 | ||

| Item | Amount | Percentage |

| Iron ore | $72.5 billion | 58.8% |

| Petroleum gas | $14.2 billion | 11.6% |

| Other minerals | $8.1 billion | 6.57% |

| Source: “Australia/China,” OEC, 2022,https://oec.world/en/profile/bilateral-country/aus/partner/chn. | ||

| Table 7. Chinese Exports to Australia, 2022 | ||

| Item | Amount | Percentage |

| Computers | $5.14 billion | 6.30% |

| Broadcasting equipment | $4.42 billion | 5.40% |

| Cars | $2.61 billion | 3.20% |

| Source: “Australia/China,” OEC, 2022, https://oec.world/en/profile/bilateral-country/aus/partner/chn. | ||

By contrast, after Australian Prime Minister Anthony Albanese first met with Chinese President Xi Jinping in November 2022, Albanese emphasized that Australia’s trade with China was worth more than its trade with the United States, Japan, and South Korea combined and that normalizing relations between the “two highly complementary economies” was a “priority for his government” (see tables 6 and 7).82 Sino-Australian trade began to grow rapidly between 2005 and 2020, as China displaced Japan and the United States—two of Australia’s largest trading partners historically—and Sino-Australian trade has continued to surge since then. In 2023, Australian-Chinese trade reached a record level of $145 billion, and while a drop was visible following the pandemic and China’s imposition of tariffs, the two trading partners cannot do without each other.83

What U.S. Allies Can Do in the Intensifying U.S.-China Tech War

While shipbuilding is one key area of South Korean (and Japanese) competitive advantage, South Korea’s chipmaking prowess is arguably the most important aspect of a resilient U.S.-ROK technology alliance. As the AI revolution unfolds in earnest, South Korea is one of the world’s leading countries for AI-related patents that is a major selling point as a U.S. technology partner. How South Korea emerges over the next decade in the AI competition will depend on numerous factors, but if current trend lines can serve as a guide, South Korea is likely to remain one of the world’s leading AI-related R&D countries. The cluster of countries that will ultimately become leaders in quantum computing will have an outsized role in shaping the world’s top AI-based ecosystems into the 2030s and beyond. In this respect, ensuring close collaboration between the United States and South Korea on AI, quantum computing, and new materials will likely result in key dividends for both countries. This is particularly true in the military domain given the inevitable structural and strategic changes that will affect the entire defense sector.

According to Martin Chorzempa, when the Biden administration passed the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act of 2022, it became “one of the world’s most ambitious industrial policies today, with subsidies, loans, tax credits, and support for research and development . . . estimated to total $79.3 billion” from 2022 to 2031.84 In May 2024, Yoon announced a $19 billion package to support the South Korean semiconductor industry as it seeks to catch up with international rivals amid soaring demand for advanced chips to power AI algorithms and other computing tasks. Although South Korea’s chip exports rose sharply from April 2023 to April 2024, its share of the global fabless industry is only 1 percent,85 and both SK Hynix and Samsung announced billions of new investments in South Korea to increase their global competitiveness.

| Table 8. Global Top 10 Countries for AI Patent Applications and Granted AI Patents, 2010–2021 | |||

| Patent Applications | Granted Patents | ||

| China | 242,249 | China | 63,755 |

| United States | 71,841 | United States | 35,804 |

| South Korea | 24,178 | South Korea | 13,720 |

| Japan | 15,136 | Japan | 7,122 |

| Germany | 3,673 | Australia | 2,152 |

| Australia | 3,114 | Canada | 1,245 |

| Canada | 2,835 | Germany | 1,100 |

| United Kingdom | 1,966 | United Kingdom | 664 |

| France | 1,024 | France | 562 |

| Taiwan | 1,000 | India | 561 |

Source: Cole McFaul, et. al, “Assessing South Korea’s AI Ecosystem,” Center for Security and Emerging Technology, August 2023, https://cset.georgetown.edu/publication/assessing-south-koreas-ai-ecosystem. |

|||

Through the CHIPS and Science Act, Samsung alone has received $6.4 billion, and while South Korean investments in the United States continue to grow, “they are among a handful of leading countries in the global semiconductor supply chain, with different and complementary strengths.”86 The main South Korean concern is the intensifying U.S.-China tech war and the need to adhere to U.S. guidelines, including ten-year restrictions on expanding South Korean chip operations in China.87 As South Korea aligns more closely with the United States on critical technologies, China has shot back with claims that Seoul should not buckle under “pressure” from Washington in order to preserve “mutually beneficial” ties between South Korea and China.88

But given the seminal importance of South Korea’s security and defense alliance with the United States and the expanding role of economic and technological cooperation between Seoul and Washington, South Korea is highly unlikely to reduce the scope of its alliance with the United States.

Conclusion

In June 2025, South Korea, the United States, and other allies will mark the seventy-fifth anniversary of the outbreak of the Korean War and the beginning of the U.S.-ROK alliance. The United States can look to Europe’s postwar economic rebirth and NATO as the two major pillars of Washington’s transatlantic grand strategy that ultimately led to the downfall of the Soviet Union. In Asia, America’s alliances with Japan, Australia, and South Korea—Washington’s three principal treaty allies in the region—served as the backbone of U.S. Cold War strategy in the Western Pacific. But among all of America’s allies, South Korea was never expected to succeed economically. Unlike Japan, which opened to the world in the late 1860s and industrialized rapidly, the ROK only began to industrialize in earnest in the mid-1960s, a full century after Japan did so. Notably, for the transatlantic alliance, Europe was destroyed during World War II, but the United Kingdom, Germany, France, and Italy were all major industrial powers before the Second World War.

In 2023 South Korea was Asia’s fourth-largest economy and among the world’s ten largest trading nations, that is, the eighth largest exporter with $646 billion and the tenth largest importer with $642 billion, and it is also among the world’s top technology and military powers.89 This is arguably one of the most visible examples of postwar U.S. foreign policy successes given the enormous sacrifice—some 37,000 U.S. troops killed in action—made by the United States to help defend South Korea during the Korean War.90 Unique among all the countries where the United States went to war after World War II, South Korea is the only ally that has become a top-notch technology power and that has transitioned from being a recipient of foreign aid to a major dispenser of foreign aid. It is difficult to imagine in 2024, but when South Korea’s first five-year economic plan was launched in 1962, nearly 50 percent of the South Korean government’s annual budget was based on U.S. aid.91

There is a wide range of channels for facilitating technology cooperation including at the presidential level as well as among expert working groups, governmental agencies, think tanks, academia, and corporations. Although defining and shaping a common roadmap is necessary, the level of technology cooperation depends on the science and technology policy guidelines of each country, the agility of research and innovation clusters, and companies’ capacity and willingness to engage in multiple cooperative ventures. In the 2023 rankings of the Global Innovation Index, South Korea ranked tenth out of 132 economies and second in Asia after Singapore, while China came in third place.92 While there are multiple ways that South Korea can contribute to a technology alliance with the United States, maximizing Seoul’s core science and technology strengths should be the starting point. Fostering innovation—either by South Korea on its own or jointly with the United States and other allies and partners—lies at the heart of a future technology alliance roadmap. According to the 2023 Global Innovation Index report, South Korea had the third-largest science and technology cluster and ranked twenty-fifth in science and technology cluster by intensity.93 What South Korea really needs is a mindset, organizational culture, and support from an extremely divided political body to emerge as a global innovation hub. As a World Economic Forum article noted in January 2022:

South Korea is now at a critical inflection point. The country has succeeded in becoming an economic powerhouse, with a technological edge in manufacturing and hardware-based industries primarily led by large corporations. However, in the era of the Fourth Industrial Revolution, where innovative disrupters could overthrow strong incumbents, the country has been striving to use startups to foster such disruptive innovation; making the balance between industrial conglomerates and startups ever more crucial . . . [But] South Korea has not yet achieved a spot in the top tier of the global startup ecosystem—unlike its peers Israel and Singapore. Korea is largely a homogenous country and is hesitant to embrace foreigners; as such, it lacks diversity, a known impetus in driving creativity and resilience.94

Why a Technology Alliance Is Necessary Amid the Wave of AI Innovation

There is a consensus in South Korea that a strong technology alliance with the United States is essential for long-term economic security, but many have also argued that such an alliance should not come at the expense of South Korean firms, especially those that are exposed to the huge Chinese market. South Korea’s passage of the K-Chips Act in March 2023 was one of the very few bipartisan bills passed by the National Assembly since Yoon came into office in May 2022. Former National Assembly member Yang Hyang-ja, who worked previously as a senior executive at Samsung, argued that South Korea was becoming a “victim” of the U.S.-China trade war and that the South Korean government should use the K-Chips Act to provide key incentives for South Korean firms to minimize any fallout from the ongoing U.S.-China tech war.95 The United States’ push to strengthen critical supply chains with allies and partners enables South Korea to reduce its dependence on the Chinese market while aligning itself with the United States on emerging technologies.

| Table 9. Number of Granted AI Patents and Share of Global Granted AI Patents, 2010–2021 | ||||

| Category | Number of Granted AI Patents | Share of South Korea’s Total Granted AI Patents | Share of Global Granted AI Patents | Global Rank |

| Machine learning | 105,764 | 77.0% | 10.6% | 3 |

| Computer vision | 3,974 | 29.0% | 9.8% | 3 |

| Personal devices and computing | 3,682 | 26.8% | 9.5% | 3 |

| Telecommunications | 2,704 | 19.7% | 12.7% | 3 |

| Business | 2,294 | 16.7% | 17.4% | 3 |

| Energy management | 889 | 6.5% | 16.7% | 2 |

| Industrial manufacturing | 889 | 6.5% | 16.6% | 3 |

| Education | 366 | 2.7% | 25.5% | 2 |

| Semiconductors | 192 | 1.4% | 17.1% | 3 |

| Military | 31 | 0.2% | 29% | 2 |

Source: Cole McFaul, et. al, “Assessing South Korea’s AI Ecosystem,” Center for Security and Emerging Technology, August 2023, https://cset.georgetown.edu/publication/assessing-south-koreas-ai-ecosystem. |

||||

According to Mark Lundstrom of Purdue University, “collaboration is essential to achieving breakthroughs in semiconductors, which have reached their technological limits;” he also said that “Korean semiconductor companies such as Samsung and SK will have opportunities if they develop chips that combine computing and memory, moving away from the low-margin memory semiconductor industry. We need to break out of traditional thinking because semiconductor technology is changing dynamically.”96 As South Korea and the United States intensify their high-tech cooperation, the European Union (EU) has also reached out to the ROK to strengthen digital collaboration. The EU announced three joint semiconductor research programs that include South Korea involving “heterogeneous integration and neuromorphic computing technologies for future semiconductor components and systems.”97 South Korea is the largest producer of memory chips, and Samsung and SK Hynix hold “half of global DRAM capacity;” together with U.S.-based Micron, as of September 2022, these three companies “made up close to 96 percent of all DRAM revenues.”98 Based on analysis from the Center for Security and Technology at Georgetown University, South Korea ranked third in the world after China and the United States in AI patent applications and granted AI patents (see table 8).

Even though the United States is a world leader in AI research, China is catching up rapidly. According to data from the Emerging Technology Observatory, while the United States still leads China when measured by articles in the top journals, 25 percent of “AI-related articles in the Research Almanac dataset” had Chinese authors, compared to 18 percent by American authors and 17 percent by Europeans.99 Figure 3 illustrates U.S. and Chinese outputs across AI and related fields. According to a Nature article published in August 2024 based on data from the Emerging Technology Observatory, the U.S. tech giants Microsoft and Alphabet produce more cited research articles on AI than any other corporations, although Chinese big tech leaders such as Baidu and Tencent “are ahead on patents.”100