New data from the 2026 Indian American Attitudes Survey show that Democratic support has not fully rebounded from 2020.

- +1

Sumitra Badrinathan, Devesh Kapur, Andy Robaina, …

Source: Getty

The United States lags far behind China in the race for clean energy technologies and critical minerals. It needs a robust domestic industrial policy and international partnerships to make up ground.

Over the past year, the Carnegie Endowment for International Peace convened the U.S. Foreign Policy for Clean Energy Taskforce. This bipartisan group of twenty-three past and potentially future policymakers met monthly to explore how the United States could strengthen clean energy supply chains to enhance its security and prosperity. This paper summarizes for policymakers the key takeaways and recommendations from those taskforce meetings, as well as from the taskforce’s underlying analysis of supply chain and international relations. This summary was written by the Carnegie team, and none of its statements or recommendations may be attributed to any taskforce member.

For more information on the project, please see the project hub, which includes the technical paper that provides analysis of clean energy supply chains; the foreign policy mapping paper that gives a detailed overview of U.S. diplomatic and financial engagement on clean energy; the assessment of opportunities for leapfrog technologies; and a paper providing detailed recommendations for American geopolitical strategy. The project hub also includes other publications by Carnegie scholars and taskforce members.

The rise of clean energy creates enormous economic and diplomatic opportunities for the United States, but also presents significant strategic and geopolitical challenges. We highlight three aspects of the problem: clean energy technologies are essential to America’s economic future, but competition is heating up, and the United States is losing the race to lead in new technologies. In this paper, we argue that a focused industrial strategy supported by international partnerships can help the United States compete for technological leadership in a new age.

Solar, wind, and batteries are proliferating rapidly because they are now cost competitive or even cheaper than other options. These technologies have critical long-term advantages. They are thermodynamically efficient, creating free streams of electrons without combustion, and they can source those electrons from the local environment rather than through a complex fuel supply chain. Solar and wind therefore create economic advantages and enable countries currently dependent on fuel imports to reduce vulnerability.

Even though global fossil fuel consumption is expected to continue, the area of highest growth is clean energy: annual global investment in clean energy is now nearly double fossil fuel investment.1 Grid-scale battery storage is also now being deployed at faster rates. In 2023, global battery storage installations nearly tripled compared to the previous year.2 In 2025, new batteries that can store days—not hours—of intermittent wind and solar energy are expected to be deployed.3 Intermittent renewables are becoming firmer sources of power for electric grids around the world.

Additional clean energy advances are on the horizon. The cost of next generation geothermal power—which is clean and firm—is now falling as quickly as fracking and other renewables did.4 Nuclear, too, is having a renaissance because of its proven ability to provide twenty-four seven power.5 And an arsenal of new technologies are being deployed to efficiently electrify heat in the industrial sector.6 Across the United States, first of a kind cement and steel factories—some of the most challenging industries to decarbonize—are coming online without the need for fossil fuels.7

Electric vehicles (EVs) may prove the most disruptive of these technologies. EVs are not only more energy efficient than internal combustion engines (ICE) but are also reportedly cheaper to maintain because they have fewer moving parts.8 Global ICE sales are now down 23 percent from their peak in 2017, largely thanks to the unstoppable rise of EVs, especially in China and from Chinese firms.9 Once a constraint, the number of global EV chargers quadrupled from 2020 to 2023, and new chargers are being deployed that can top-up a vehicle in twenty minutes.10 By the end of the decade, EVs are projected to be cheaper than their ICE competitors without subsidies.11 The ICE age is thawing.

Investment patterns reveal the depth of the shift to clean energy. Global annual investment in fossil fuels remains stagnant at around $1 trillion, whereas energy transition investment is growing annually at about 25 percent, surpassing an astounding $2 trillion in 2024.12 At this rate, energy transition investment would be triple that of fossil fuels by 2026. Although initially concentrated in Western countries and China, this surge in clean energy investment is permeating across emerging and developing markets, with the majority of new power installations in these countries being clean.13 The impact is already visible. Pakistan deployed 17 gigawatts of solar panels in just nine months in 2024—surpassing Germany’s annual installations, a leading global solar market.14 In 2024, both Türkiye and India were on pace to double their solar deployments compared to the previous year.15 Emerging markets, long thought to be a source of growth in hydrocarbon demand, are increasingly industrializing with clean energy.16

What does this mean for the United States, the world’s largest producer, refiner, and exporter of oil and gas? The Donald Trump administration has made clear that it will remove any potential restrictions on the supply of American hydrocarbons and withdraw regulations that may reduce domestic demand, such as fuel economy standards that disadvantage ICE vehicles vis-a-vis EVs.17

But global demand may be a problem for plans to bolster oil and gas. Nearly every energy forecaster agrees that by around 2030, crude oil demand will plateau, with long-term consequences for U.S. exports and business opportunities abroad.18 One key driver is China’s transition to EVs. China’s gasoline consumption peaked in 2021 and is now down 6.4 percent, with EVs constituting over half of all light-duty sales.19 Both trends will continue to dampen oil demand in the world’s largest market for crude oil.20 These trends also risk impacting emerging and developing markets: from Brazil to Ethiopia, staggering amounts of Chinese EVs are being sold in these countries, which could further impact fuel demand.21 China is also piloting programs for sustainable aviation fuel and marine fuels that would decrease oil demand from those sectors.22

There are also warning signs that the U.S. liquefied natural gas (LNG) boom could be short-lived. While the United States’ export capacity for LNG is slated to double by the end of the decade, analysts have raised concerns that global LNG markets will be well supplied and demand is unlikely to match what the country hopes to unleash.23 Countries may offer LNG deals to the United States as diplomatic negotiating tools, but this will not alter economic realities in power markets. Europe’s transition from Russian pipeline gas to the global LNG market can only happen once. In addition, developing countries including Pakistan and Cameroon are importing record quantities of Chinese solar panels, which unlike gas-fired power plants, do not require the constant exchange of scarce foreign dollars for energy imports.24

Even if oil and gas demand persists above projections, the scale of clean technology growth and opportunity is too big to ignore. In the scenario where clean technologies are most aggressively deployed, annual global investment in low-carbon energy systems will exceed $6 trillion by 2030, according to BloombergNEF.25 This is a market opportunity the United States cannot afford to let slip away; it should take clean energy technology and supply chains seriously.

Since the passage of the U.S. Inflation Reduction Act (IRA), other countries have continued to invest in their bids for technology leadership. Japan, South Korea, the European Union, and, of course, China all have industrial policies for solar, wind, and batteries, among other clean technologies.26 Indonesia, Mexico, Brazil, and India are working on new strategies designed to position their countries in clean energy supply chains.27 India’s Production Linked Incentive scheme, which began before the IRA, has funneled billions of dollars to domestic solar, battery, and hydrogen production in pursuit of developing an industrial base and positioning India as an alternative clean tech producer to China.28 Emerging economies such as Morocco, Vietnam, and Serbia have received investment from both China and Europe in the hopes of emerging as new energy middle powers.29

One clear indication of the transition has been the response of the Gulf states. While petroleum powers such as Saudi Arabia and the United Arab Emirates (UAE) continue to invest in the oil and gas that have made them rich, they also have serious economic diversification strategies focused on clean energy.30 Middle Eastern nations are making strategic investments in solar, financing projects in Indonesia and Egypt and building domestic manufacturing at home.31 These investments are pushing the limits of what clean power can deliver, as seen with the UAE’s recent gargantuan solar project that has enough battery storage to provide round-the-clock power for local data centers.32 Over the rest of the 2020s, Saudi Arabia will invest more in renewable energy and clean hydrogen than in upstream oil and gas.33 Most interestingly, the Gulf states are investing in critical minerals extraction and processing projects. They understand that critical minerals will enable their capital to generate long-term wealth and hedge against the prospect of decreasing hydrocarbon rents.34

Fossil fuels have strengthened the United States throughout history and especially in recent decades, as the shale revolution has turned the nation into the world’s largest oil and gas producer.35 But if investment in fossil fuels today comes at the expense of the investments necessary to win the global battle for clean energy, it would be shortsighted and risks locking the United States out of essential geostrategic technologies and minerals of the twenty-first century. In the long term, it could risk rendering American energy assets outdated incumbents: stallions in the era of Ford’s Model T.

Voices across the political aisle agree: the United States cannot cede leadership in the technologies of the future to China and other countries.36 China’s industrial strategy poses challenges not just to U.S. manufacturing but to long-term technological leadership and economic security. The United States must strategically and selectively compete through a comprehensive response that incorporates industrial policy, technology standards, and coordination with allies.

The bipartisan CHIPS and Science Act recognized a fundamental truth: America’s prosperity and global position depend on technological leadership.37 But simply onshoring the production of incumbent chips, batteries, and reactors misses the point. The United States needs an innovation first policy that can pragmatically target products and processes of the future. With the IRA and the Bipartisan Infrastructure Law, the United States has gained ground in the race for certain future technologies. However, it is still miles behind China and other countries in critical areas such as minerals and subcomponents.38 China intends to be the clean tech hegemon of this century, and it is deploying the resources to get there.39 Table 1 shows that China’s global market share has grown in most supply chain segments since 2021.

While the United States is still a world leader in primary innovation—generating new science and new technologies—it continues to lag in commercializing new technologies, getting things built, and maintaining a manufacturing and industrial base.40 There is an enormous opportunity at stake. U.S. firms are currently innovating breakthrough energy technologies across sectors—from batteries to clean baseload power—that could put the country back in the race for these cutting-edge systems of the future. The United States’ powerful venture capital ecosystem cannot bring new products to market while rebuilding the industrial base on its own.41

To push ahead in this race, the United States needs a bipartisan industrial policy that is consistent across presidencies and Congresses. This industrial policy should diversify supply chains to reduce overreliance on any foreign nation. It must focus on leapfrog opportunities where the United States can win in developing the next generation of technology, rather than trying to compete across the board. And it will require the United States to work with foreign partners who will make win-win deals that make America stronger.

The United States must build clean energy supply chains abroad to achieve the following four goals.

U.S. global leadership hinges on taking a forward-looking approach to international diplomacy. China has built up strong global relationships through its overseas investments and by delivering good products at a low price. By investing in clean energy supply chains, it both secured a strong position in critical supply chains and curried favor with numerous countries.42 The United States and its allies must respond. To be effective, the response must mobilize large amounts of capital to deliver real economic and development value to developing and emerging economies. This means allowing countries to exercise their sovereignty and gain a genuine foothold in global value chains. The United States must be able to offer other countries what they demand, which in many places is not just oil and gas but also clean energy technologies, including nuclear, geothermal, and batteries.

Many clean energy technologies have military applications.43 Lithium-ion batteries, for example, are essential to a modern military force.44 Drones provide a vivid example: the small, cheap, quiet, and agile fighting units are a critical capability enabled by electric technology like batteries and magnetic motors (also two primary components in EVs).45 Advanced nuclear microreactors and geothermal systems could help ensure that U.S. military installations are resilient, prepared, and not subject to fuel cutoffs. The United States cannot allow the electrification of military force to be led and controlled by other states. It must lead in the frontier of such dual use technologies and sufficiently de-risk the supply chains for these elements.

Whether the language used to describe it is “energy dominance” or “energy abundance,” investment in clean energy technologies and their supply chains creates economic spillovers that benefit the whole economy.46 America has prospered in the past by leading energy and technology revolutions, not by propping up old systems.47 Investment in new technologies and their supply chains will create economic spillovers that benefit the whole economy. For example, an offshore wind industry creates demand for steel alloys, ships, and rare earth magnets, while a battery industry could unlock know-how in advanced material production. The countries that benefit from new technologies secure strong industrial positions. The United States can lead in next generation energy technologies with smart, strategic investment in leapfrog opportunities today.

Developing clean energy technologies provides an insurance policy in a world where future oil and gas demand is clouded by China’s rise as a clean tech empire. The United States already has significant clean power in place or under construction, and continued access to these resources and technologies will support U.S. energy generation in the long run, especially to ensure the scale of power needed for AI’s explosive load growth.48 Supporting the supply chains for these technologies, at least up to a level appropriate to their potential significance to U.S. economic and security interests, is smart policy.49

In short, strategic work on overseas supply chains will generate geopolitical, national security, economic, and insurance benefits. The first Trump administration made progress on this issue: working with Congress on the International Development Finance Corporation (DFC), initiating tariffs to protect American manufacturing, and sounding the alarm on America’s critical mineral vulnerabilities.50 The Joe Biden administration built on this legacy by accelerating domestic manufacturing and expanding bilateral and multilateral engagement on mineral security and technological cooperation. This legacy can be continued by reinvigorating U.S. strategy for overseas technology development.

To achieve these four, interlinked goals, the United States needs to combine domestic industrial policy and international collaboration to build supply chains and advance leapfrog technologies. Knowing when to onshore (bring production home), friendshore (bring production to trusted partner countries), or develop a new competitive technology pathway requires a strategic framework that identifies strengths and weaknesses.

The United States should onshore when it has existing economic strengths (most importantly, an industrial base, a trained labor force, and valuable intellectual property), high domestic potential to economically produce a technology, or critical national security interests in the technology. The United States should friendshore when it simply cannot produce the material (for example, many critical minerals) or when creating competitive economic advantages would be onerous (such as where the United States lacks the tacit knowledge or cost-effective industrial base to compete). For example, while the United States can and will mine more metal for energy technologies—the Trump administration aims to make the United States the “leading producer”51—it simply lacks the reserves and expertise to onshore all needed production.52 It will need to friendshore nickel, copper, graphite, and other key metals but must do so in a focused, strategic manner.

Onshoring is also limited by the fact that all modern technologies have global value chains because knowledge about how to produce and innovate is highly localized and therefore distributed across countries. While the United States seeks to manufacture solar panels and batteries, it cannot do this without learning from partners and potentially even adversaries. Many U.S. solar and battery projects, for example, are led by Korean, Japanese, and European firms.53 If U.S. firms are to be internationally competitive, some will need to work with foreign companies to transfer the knowledge domestically. Figure 1 illustrates where the United States has, over the past two administrations, enacted bilateral diplomatic efforts for clean energy technologies and measures the number of sectors covered in each country.

This taskforce’s research on supply chain resilience also helps to calibrate the level of ambition that should be pursued in onshoring and friendshoring. The United States should go all-in for some technologies, and merely hedge for others. To compete, the United States must choose strategic priorities, rather than trying to compete across all segments.54 This helps avoid spreading resources too thin while maximizing potential technologies with high levels of opportunity.

In strategic areas, the United States should identify targets for onshoring and friendshoring that create sufficient resilience against geopolitical shocks (for example, onshore 50 percent of expected demand and friendshore 50 percent). In less strategic areas, targets could be lower (for example, 30 percent domestic plus 30 percent friendshoring). This will allow the United States to focus its energies where it has existing innovation advantages that could translate to manufacturing strengths and, eventually, durably competitive industries.

A second critical strategy is to develop leapfrog plays. Rather than trying to catch up to China in current generation technologies (such as conventional solar panels and lithium-ion batteries), the United States should focus on developing and commercializing next generation technologies where supply chains and market dominance are not yet established. This would leverage the United States’ innovation advantage while helping secure a leading edge in the industrial base for clean energy production. In some instances, leapfrogging could entail circumventing supply chain risks—like making solid-state batteries that do not need Chinese graphite—or unlocking new potential from a technology vertical, like geologic hydrogen or supercritical geothermal resources.55

This strategy entails bolstering investment in research and development (R&D) for emerging technologies such as solid-state batteries, next generation geothermal, and advanced nuclear reactors. Second, it requires developing sector-specific know-how, expertise, and regional ecosystems where new advancements can be tested in sandboxes. Third, innovative financing and derisking measures will be needed to address the “missing middle” of bringing first-of-a-kind pilots to demonstration scale.56 Lastly, and most importantly, it will entail creating the demand-pull policies needed to accelerate commercialization of these new technologies both at home and abroad.

Based on supply chain and economic analysis, table 2 demonstrates how different technology verticals score based on five key questions:

These parameters help identify optimal, sector-specific industrial and foreign policy strategies. Although solar photovoltaic (PV) is the fastest growing energy source globally and unilaterally dominated by China, it is not in the interest of the United States to onshore an entire supply chain that has little chance of competing with Chinese incumbents and no national security importance.57 Instead, the United States should focus on diversifying the global solar supply chain—specifically financing upstream components like polysilicon, ingots, and wafers—in third party countries such as India, South Korea, Vietnam, and the Gulf states. Simultaneously, the United States should focus on commercializing next generation, perovskite solar cells with partners in the Quadrilateral Security Dialogue (Quad) and South Korea.

Batteries and magnetic motors are key to national and economic security given their importance to defense, automobile, and consumer electronic sectors. While both are developing a domestic industrial base, they come with severe supply chain risks because of Chinese graphite and rare earths.58 The United States should focus its battery strategy on the next generation of chemistries: silicon anode (which can be made without graphite), lithium metal (which does not require graphite), and lithium sulfur (which solely requires lithium).59 As U.S. lithium metal and sulfur firms come to market, the country should promote its companies that can utilize existing lithium-ion factories, especially in Europe, to phase out the importance of Chinese dominated minerals and battery manufacturing. While the United States is developing magnet technologies that do not need rare earths, they are less advanced than next-generation batteries, implying that the United States should work with close security allies (such as the Five Eyes) to onshore a non-Chinese rare magnet supply chain while continuing to experiment with alternatives.60

Other technologies such as wind, heat pumps, and electrolyzers require less aggressive approaches that largely maintain course. The United States has a decent domestic industrial base and resilient supply chains for wind and heat pumps, but there is little present opportunity to innovate these systems and produce export markets.61 Instead, the United States should maintain these industrial bases but design new incentives for them to act as demand drivers for domestic or allied-produced minerals, high-grade alloys, magnets, and ship building (in the case of offshore wind). For clean hydrogen production, the United States should consider friendshoring electrolyzer technology and its mineral supply chains while considering theoretical costs and technology limitations in pursuit of unlocking alternative hydrogen processes.

Clean firm power generation like nuclear and geothermal represent important new opportunities. The United States should continue to revitalize its domestic nuclear industrial base by producing incumbent and next generation reactors, while coordinating with allies in the Sapporo 5 pact to diversify away from Chinese and Russian uranium supply lines. Although recent industrial policy has unleashed enormous opportunities for nuclear energy, our analysis indicates that geothermal energy—which has a massively expanded resource potential thanks to the fracking revolution—represents a unique area of industrial strength, supply resilience, and market opportunity.62 Future policy should act accordingly and focus all efforts on bringing next generation geothermal to market at home and in high-opportunity countries through de-risking measures for drilling and funding for demonstration. Although outside the scope of this analysis, advanced grid technologies including long-duration storage pose a similar and perhaps undervalued opportunity for export.

Industrial products like clean ammonia, steel, and aluminum should be onshored given their macroeconomic importance, present industrial base, and defense demand. Western production will struggle to compete with Chinese overcapacity without explicit efforts to create a non-Chinese market and build new technology pathways to disrupt traditional production methods. The United States should continue to bolster its low-carbon advantage in industrial products through federal government procurement, specifically emboldening new processes to make clean metals.63 Similarly, the United States should maintain its edge in carbon capture and direct air capture technologies, ensuring that projects being developed at home are world-leading while, in the long term, promoting U.S. tech in key markets, particularly in Gulf countries. Sustainable aviation fuels could also represent an opportunity given U.S. expertise in refining and the scale of net-zero opportunity, but cost premiums are presently prohibitive, implying further R&D is necessary.64

Ships are a unique challenge. The United States has lost its ability to manufacture civilian and military ships as China has increased control of the global shipbuilding market and various countries have worked to develop alternative, low-carbon fuels.65 The United States should seize this moment by collaborating with Japanese and South Korean conglomerates to onshore a shipbuilding industrial base to manufacture ships capable of running on low-carbon fuels. In doing so, it should simultaneously develop ammonia- and methanol-ready refueling bunkers in line with clean shipping corridors to Asia and Europe. Both of these fuels present high opportunities for the United States given its dominance in energy production and refinement, existing bunkering infrastructure along the Gulf and Pacific coasts, and early prestige in startups developing alternative engines.66

Friendshoring critical minerals production (including for copper, nickel, lithium, graphite, and rare earths) will require an all-hands-on-deck approach, with the United States and its allies working together. This should include the continuation of onshoring efforts through faster access to financing and permitting, while pursuing multilateral and bilateral mineral partnerships with explicit financial backing via U.S. agencies. The United States should continue efforts to maintain high labor and environmental standards in foreign mining projects that include transparency and strong governance in its dealmaking. For more niche, illiquid, yet strategically relevant metals (such as rare earths), the federal government could continue to investigate opportunities in price insurance, like contracts for difference, to hedge against volatile fluctuations as well as civilian-use stockpiling to stimulate demand drivers akin to the Strategic Petroleum Reserve. All the while, the United States and its partners must accelerate R&D in mineral processing and advanced material production to build the whole supply chain from mines to critical components.

Finally, the United States should continue to collaborate with its allies in mutually unlocking high reward technologies that can trigger step changes in energy and climate power dynamics. Supercritical geothermal, nuclear fusion, and geologic hydrogen all offer potential opportunities for clean, energy abundance and play to America’s strengths of subsurface expertise and advanced fusion science.67 While the United States has a strong early position, these supply chains, like others, will likely be global. The United States can and should work to lead sector specific coalitions for frontier technology alongside countries looking to de-risk from, and compete with, China.

The United States needs a focused, pragmatic, and coordinated foreign policy for clean energy supply chains. Under the past two administrations, the country began to enact foreign policy that advances its interests in energy technology and related minerals—but with shortcomings. Reflecting on these years, some political and financial capital was invested in low-return areas that were not crucial to developing U.S. energy technology, security, or dominance—let alone to reducing emissions. Going forward, U.S. policymakers, diplomats, and trade delegates can leverage their stature and tools to advance high-opportunity sectors by addressing supply chain vulnerabilities and identifying American technologies with export potential.68

Thus far, the United States has focused its diplomatic muscle primarily on several key clean technology verticals—minerals, hydrogen, and nuclear—across a diversity of aligned and non-aligned actors in the BRICS+ and the Organisation for Economic Co-operation and Development (OECD). Alongside this fragmented bilateral strategy, some key minilateral efforts emerged, such as the Mineral Security Partnership (MSP) and coordination with members of the Sapporo 5 agreement on advanced nuclear reactors. Such partnerships are essential to building durable, multi-stakeholder buy-in and non-Chinese pipelines for technological build-out. But they represent piecemeal efforts sometimes informed by low-hanging political fruit and routinely without the financial capital required. They have not yet resulted in a cohesive foreign industrial strategy.69

The United States needs a robust international industrial policy for clean energy supply chains. This can be achieved by transforming the Partnership for Global Infrastructure and Investment (PGI) into a more focused and strategic effort. To deliver on its promise, the PGI needs a clear policy framework to enable the integration of a wide range of existing initiatives into more targeted domestic and international processes.

The goal must be to use the PGI to bring together U.S. foreign tools, bilateral diplomatic initiatives, multilateral partnerships, and international financial institutions into a comprehensive global collaboration. Increased coordination both within the U.S. government and with its external partners is necessary to achieve the level of strategic action and investment scale to compete with China.

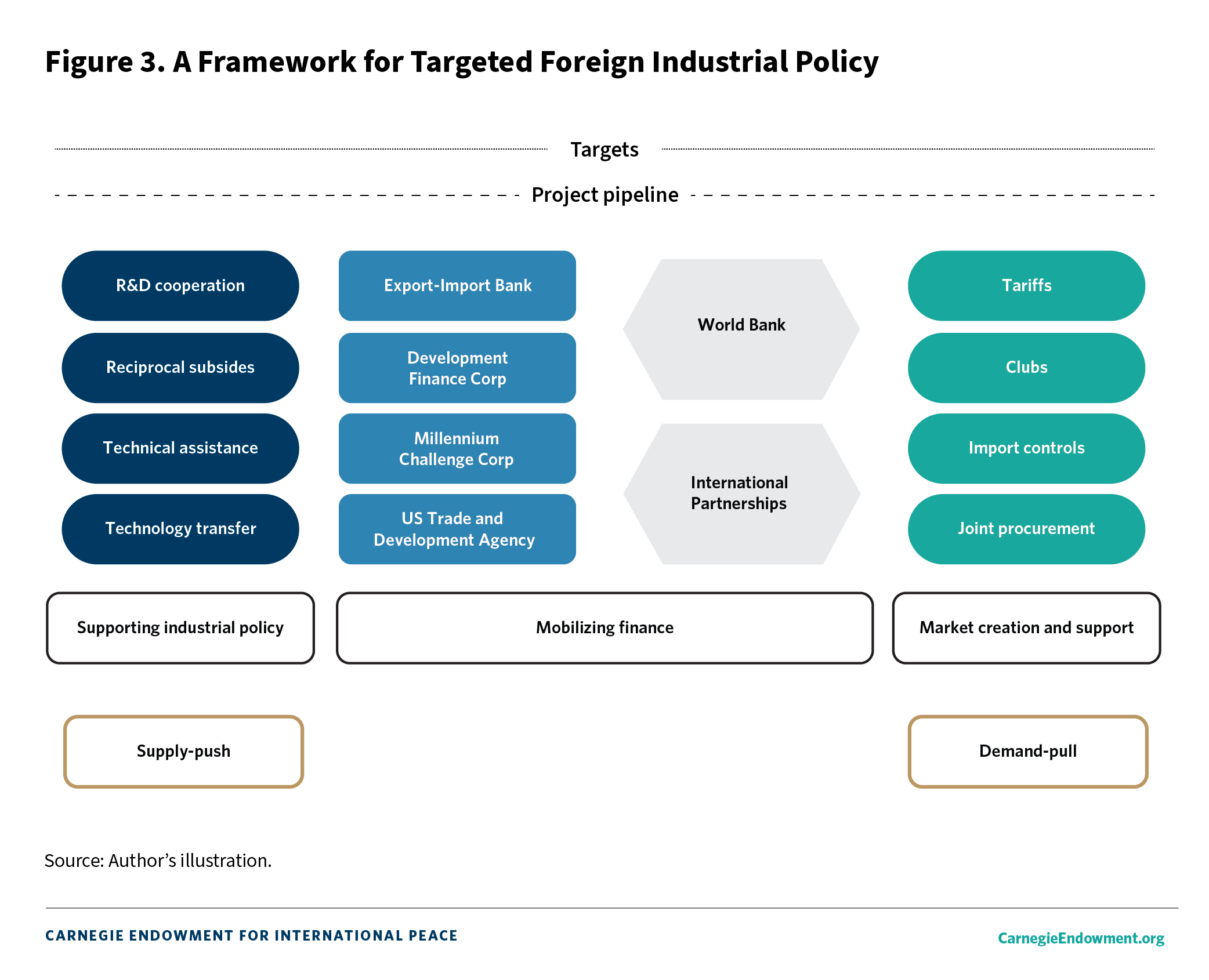

We propose an overarching framework to focus the work of the PGI with five key elements:

Counterintuitively, the PGI needs to be simultaneously broadened and focused. It must be broadened by serving as an umbrella to bring together the foreign policy tools created during the first Trump administration and the Biden administration. It would serve as a coordinating body for the wide variety of foreign policy experiments initiated over the past eight years. It must be focused by being disciplined to meet supply chain targets.

This new PGI needs a project pipeline that flows directly from the targets. It should assign each priority project to a country that will lead on project development and financing. For projects the United States leads, it should organize its foreign policy tools through Katie Auth’s proposal for Energy Security Compacts (ESCs).71 As Auth argues, the United States needs a mechanism to provide holistic support for energy project development abroad. ESCs would take the form of bilateral compacts between the United States and priority countries to create a pipeline of bankable projects. It would create a structured interagency process to assess priorities, developing coordinated investment plans across ten U.S. agencies, and deliver targeted support ranging from early-stage feasibility studies to large-scale project financing.

The compacts would also provide a platform for technical assistance on industrial policy, which was pioneered by the Clean Energy Supply Chain Collaborative in the Biden White House.72 Further, they would increase the impact of the DFC, EXIM, and other agencies while strengthening U.S. influence through more effective investment.

On the supply side, joint industrial policy means coordinating R&D and technical assistance. The United States and its partners do a lot of this right now, but in an opportunistic rather than systematic and targeted fashion. They currently do not do enough to create reciprocal or aligned subsidies. Reciprocal subsidies within clubs allow allies to compete with one another through markets while protecting their industries from Chinese non-market competition.

To fund priority projects coming through the pipeline, the United States and its partners will need to mobilize finance through domestic and international sources. This means strategically aligning the World Bank with clean energy priorities, but also organizing sovereign wealth funds and pension funds. Specific technology partnerships, such as the Sapporo 5 nuclear cooperation group or the Global Partnership for Climate Smart Infrastructure, would also be organized under the broadened PGI umbrella.

Finally, creating secure demand is essential to protect markets outside of China from intense non-market competition. China can, for example, depress the prices of critical minerals or solar modules unless the United States and partners create secure markets. Tariffs are a piece of this, but, on their own, they will not create competitive industries. They risk raising costs and prompting drags on productivity. Joint procurement can also be used to bolster nascent industries and create the critical mass needed to secure ex-China supply.

To operationalize this plan, the PGI needs to be upgraded from an initiative housed within the State Department to a directorate of the national security advisor or an independent coordinating office within the White House. A critical problem, however, is that the National Security Council team or another coordinating office does not have direct access to the complex supply chain analysis and project evaluation teams that would be needed to make the PGI more strategic. Such teams are currently dispersed across the Department of Energy, the Department of State, the Department of Commerce, the DFC, and so on. Instead, a consolidated international industrial policy secretariat must be created within the National Security Council or an independent Energy Security Compacts Coordinators Office (as proposed by Auth and Moss).73 Dedicated expert capacities bringing together technological, financial, and supply chain knowledge must be built to inform and coordinate all the aspects of this framework.

In the absence of a strong, independent office, the PGI will continue to be driven by the schedules of the principals instead of the national interests of the United States. If the country is to regain geopolitical advantage, strategic investments need to be coordinated and executed in a more focused way and backed with larger and more flexible financial tools.

Four main recommendations flow from this analysis.

1. Focus domestic industrial policy on leapfrog opportunities and use foreign policy to stimulate export markets and advance joint R&D.74

2. Broaden and focus the Partnership for Global Infrastructure and Investment with clear supply chain targets, an improved domestic policy process, and an integrated set of foreign policy tools.

3. Create a domestic interagency process, such as the one proposed for Energy Security Compacts, to generate a project pipeline for building out overseas supply chains.75

4. Bolster the International Development Finance Corporation, the Export-Import Bank, and other agencies to make them proper tools of strategic industrial policy overseas.76

The U.S. Foreign Policy for Clean Energy Taskforce has made more detailed recommendations on leapfrog technologies; how a broadened and focused PGI could help rebuild geopolitical advantage; how to improve the DFC and EXIM, which can be found in our U.S. foreign policy mapping paper; and how ESCs can improve grants and aid.

Nonresident Scholar, Sustainability, Climate, and Geopolitics Program

Bentley Allan is a nonresident scholar in the Sustainability, Climate, and Geopolitics Program at the Carnegie Endowment for International Peace.

Fellow, Sustainability, Climate, and Geopolitics Program

Milo McBride is a fellow in the Sustainability, Climate, and Geopolitics Program at the Carnegie Endowment for International Peace in Washington, DC.

Fellow, Sustainability, Climate, and Geopolitics Program and Fellow, Europe Program

Noah J. Gordon is a fellow in the Sustainability, Climate, and Geopolitics Program at the Carnegie Endowment for International Peace in Washington, DC.

Daniel Helmeci

Research Assistant, Sustainability, Climate, and Geopolitics Program

Daniel Helmeci is a research assistant in the Carnegie Sustainability, Climate, and Geopolitics Program.

Jonas Goldman

Jonas Goldman is a policy analyst with experience in public service, academia, and electoral politics in the United States and Canada. He has served as a researcher on climate industrial policy for the Smart Prosperity Institute, the International Institute for Sustainable Development, and is a senior research associate at the Johns Hopkins Net-Zero Industrial Policy Lab.

Daevan Mangalmurti

Research Assistant, Sustainability, Climate and Geopolitics Program

Daevan Mangalmurti is a research assistant in the Sustainability, Climate and Geopolitics Program.

Debbra Goh

Research Assistant, Sustainability, Climate and Geopolitics Program

Debbra Goh is a research assistant in the Sustainability, Climate and Geopolitics Program.

Senior Fellow and Director, Sustainability, Climate, and Geopolitics Program

Leonardo Martinez-Diaz is senior fellow and director of the Sustainability, Climate, and Geopolitics Program at the Carnegie Endowment for International Peace. His fields of expertise include climate politics and diplomacy, climate finance, and mitigating and managing the risks of climate change to economies and communities.

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

New data from the 2026 Indian American Attitudes Survey show that Democratic support has not fully rebounded from 2020.

Sumitra Badrinathan, Devesh Kapur, Andy Robaina, …

The speech addressed Iran but said little about Ukraine, China, Gaza, or other global sources of tension.

Aaron David Miller

Because of this, the costs and risks of an attack merit far more public scrutiny than they are receiving.

Nicole Grajewski

Despite considerable challenges, the CPTPP countries and the EU recognize the need for collective action.

Barbara Weisel

Donald Trump’s trade protectionism has provoked a remarkable range of appeals to history, but none fully captures the nature of Trumpian protectionism, even if there are echoes from the past in different aspects of its content.

Eric Helleiner