Dr. Albert Keidel

China's Financial Sector: Contributions to Growth and Downside Risks

Source: Conference Paper

Any evaluation of China’s financial system and its prospects must concentrate on its contribution to China’s economic growth and to related solutions to a range of domestic economic goals. The evolution of China’s financial system, in all its various dimensions, is in midstream, with its many market and non-market aspects reforming simultaneously. Its hybrid nature, which combines policy-directed lending and nascent market-based institutions, has aspects considered by some foreign observers to be not only unconventional but also inefficient. In fact, the system appears to serve China’s current needs well.

[1] James R. Barth, John A. Tatom, and Glenn Yago (eds.), China’s Emerging Financial Markets: Challenges and Opportunities (Santa Monica, CA: Milken Institute, 2009)

About the Author

Former Senior Associate, China Program

Keidel served as acting director and deputy director for the Office of East Asian Nations at the U.S. Department of the Treasury. Before joining Treasury in 2001, he covered economic trends, system reforms, poverty, and country risk as a senior economist in the World Bank office in Beijing.

- As China's Exports Drop, Can Domestic Demand Drive Growth?Article

- China’s Fourth Quarter 2008 Statistical RecordArticle

Dr. Albert Keidel

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

- Beijing Doesn’t Think Like Washington—and the Iran Conflict Shows WhyCommentary

Arguing that Chinese policy is hung on alliances—with imputations of obligation—misses the point.

Evan A. Feigenbaum

- China Is Worried About AI Companions. Here’s What It’s Doing About Them.Article

A new draft regulation on “anthropomorphic AI” could impose significant new compliance burdens on the makers of AI companions and chatbots.

Scott Singer, Matt Sheehan

- Taking the Pulse: Can the EU Attract Foreign Investment and Reduce Dependencies?Commentary

EU member states clash over how to boost the union’s competitiveness: Some want to favor European industries in public procurement, while others worry this could deter foreign investment. So, can the EU simultaneously attract global capital and reduce dependencies?

Rym Momtaz, ed.

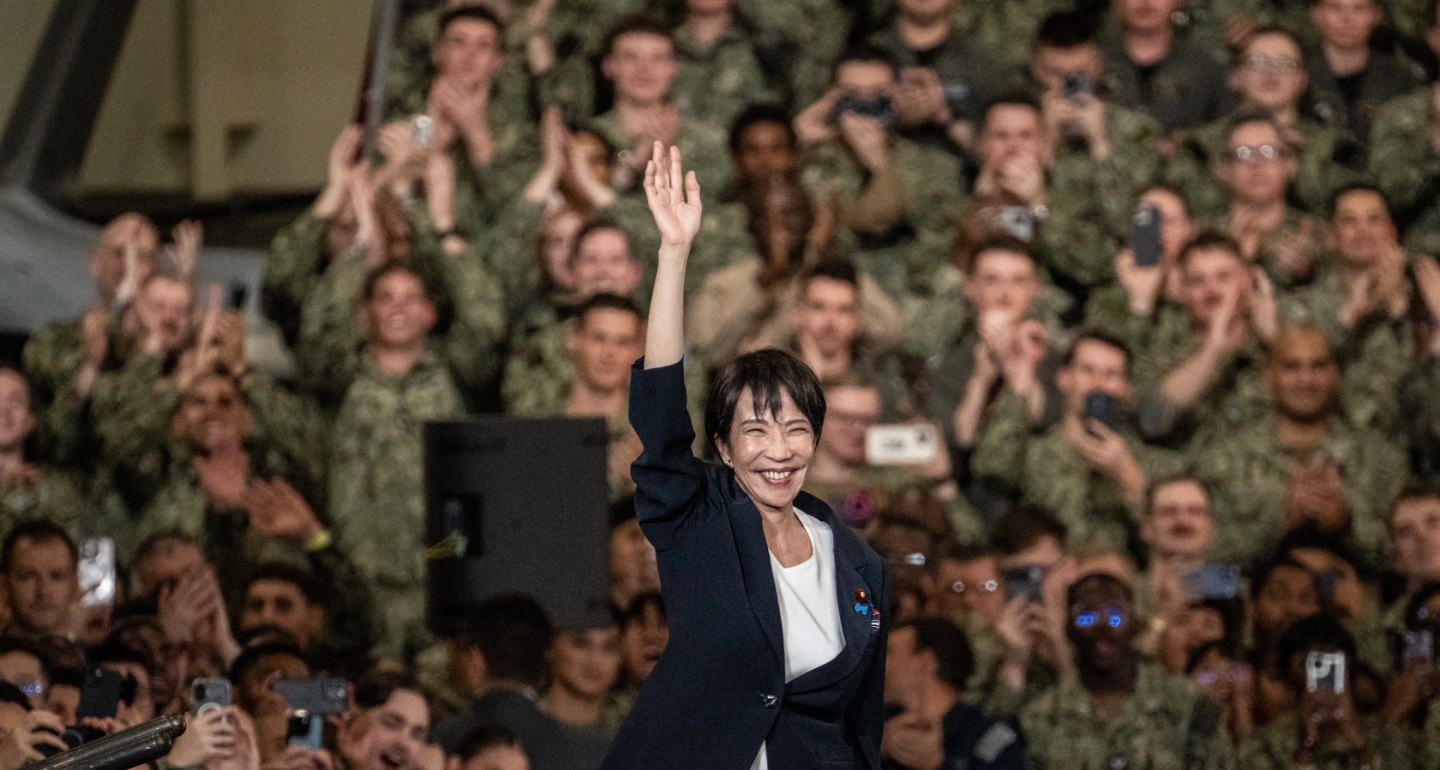

- Japan’s “Militarist Turn” and What It Means for RussiaCommentary

For a real example of political forces engaged in the militarization of society, the Russian leadership might consider looking closer to home.

James D.J. Brown

- A New World Police: How Chinese Security Became a Global ExportCommentary

China has found a unique niche for itself within the global security ecosystem, eschewing military alliances to instead bolster countries’ internal stability using law enforcement. Authoritarian regimes from the Central African Republic to Uzbekistan are signing up.

Temur Umarov