A new draft regulation on “anthropomorphic AI” could impose significant new compliance burdens on the makers of AI companions and chatbots.

Scott Singer, Matt Sheehan

Source: Getty

China’s economy is in for a bumpy ride. But if Chinese leaders implement the right macroeconomic policies and structural reforms, the challenges should be manageable.

Much of the media coverage of China’s economy suggests that the country is headed for a financial crisis. China’s mountain of debt is decried, local government finances are labeled menacing, and a property bubble is called disastrous. But this picture is misleading. While China has serious debt problems, with prudent macroeconomic policies and productivity-enhancing structural reforms, the challenges should be manageable if underlying fiscal issues and growth-related reforms are addressed.

The government should not resort to financial stimulus to stave off the property market correction. China’s property sector is entering a period of structural oversupply that cannot be sustainably remedied by a stimulus package. This would only exacerbate existing debt problems by encouraging continued construction of housing in excess of long-term needs. At some point, the excess stock would lead to much sharper price decline that could destabilize the financial system. The only sustainable solution is to allow excessive housing construction to be scaled back.

China’s medium- to long-term growth outlook depends on the government’s success in implementing its Third Plenum reform agenda. If China enacts major fiscal and financial reforms alongside productivity-enhancing measures to facilitate a more efficient urbanization process, curb the role of state-owned enterprises, and rationalize regional investment patterns, it could see growth of around 7.5 percent in the years following an unavoidable property correction.

Many China hands allege that the country is headed for an imminent debt crisis and has little chance of avoiding it without allowing growth to collapse. Their concerns stem from the fact that China’s level of debt has grown rapidly since 2009, about double the buildup that occurred in the United States before the global financial crisis or in Korea before the Asian financial crisis. At the same time, China’s GDP growth rate has declined from historic double digits to a more modest level of around 7.5 percent. As a result, China’s debt-to-GDP ratio has soared. In nearly all other similar cases this resulted in a financial crisis.

Yet the argument that China is about to fall off a financial cliff is overstated. Generally speaking, only a third of credit booms lead to financial crises. And with respect to China, the world’s largest exporting nation is missing many of the macroeconomic vulnerabilities typically associated with crises, such as large trade deficits or excessive reliance on foreign capital. Although there is anecdotal evidence of nascent financial stress, there is little evidence of widespread insolvency among Chinese firms and local governments that could threaten the broader economy. The risks of shadow banking, which includes the off-the-balance-sheet business of banks and the financial activities of nonbanks, are similarly exaggerated. Most importantly, in all but the most extreme cases, the government has the “fiscal space” in the form of discretionary fiscal and financial resources to bail out the more important distressed state enterprises and local authorities and to recapitalize major banks. This will ensure that any tensions do not turn into the sort of systemic financial crisis that derails the economy.

The process, however, will be messy and costly as the economy slowly hemorrhages financial resources in supporting these bailouts and is forced to throw good money after bad to keep growth in line with official targets. Rapid expansion of shadow banking has also introduced a degree of uncertainty about whether China’s inexperienced new investor class will react to market stresses in unexpected ways. Moreover, upcoming adjustments in an overbuilt property market may further exacerbate vulnerabilities. The origins of all these concerns come from China’s weak fiscal system; the financial stresses are symptoms of the underlying distortions.

These issues point to China’s desperate need for a new round of financial, fiscal, and structural reforms to slow the growth of bad debt, put the finances of local governments on sound footing, and encourage productivity growth. Enacting these reforms and allowing for a period of subdued growth while the property market corrects will unlock sustainable medium-term growth of 7–8 percent, which will ensure that China’s debt burden will remain manageable. The alternative would be continued debt buildup leading to a debt crisis by the end of this decade, accompanied by an economic collapse.

In most countries that have experienced a financial crisis, the credit surge has typically been the culmination of a long-term and broad-based deterioration in financial and fiscal indicators. China simply does not fit that pattern notably in its strong balance of payments, modest fiscal deficits, and high household savings rates.

The country’s debt problems are rooted in the government’s November 2008 announcement of a 4 trillion yuan ($586 billion) stimulus package to counteract the effects of the global financial crisis. Rather than being channeled through the government’s budget, the stimulus took the form of an explosion in bank lending, predominantly to state-owned enterprises and local governments (see figure 1).1

By 2010 the worst of the crisis seemed to be over and the government scaled back bank lending by about a third. But shadow banking or nonbank lending through entities other than government institutions and informal channels quickly emerged to fill the gap, and by 2012 nonbank credit accounted for 40 percent of new credit, more than double its share before the crisis (see figure 1).

Altogether, the bank-credit stimulus and shadow-banking boom have left China’s debt at a little over 200 percent of GDP—higher than most developing countries but well below the major advanced economies (see figure 2).2 The bulk of the increase was in the form of corporate debt (a point discussed later in the paper).

This credit boom comes with some risks. The postcrisis credit boom has resulted in an almost unprecedentedly sharp rise in China’s leverage, or the amount of debt it accrues compared to GDP. The investment bank Goldman Sachs estimates that China’s debt-to-GDP ratio rose by 56 percentage points between 2007 and 2012, a sharper increase in leverage than in most other crisis cases and is projected to rise for at least a few more years.3

However, though credit booms can bring new risks such as increased leverage, they can also bring beneficial financial deepening and economic growth. A recent International Monetary Fund (IMF) report explains that only a third of these booms result in a financial crisis.4 Further, countries that experienced credit booms between 1970 and 2010 saw 50 percent more growth in per capita incomes over the same period than countries that experienced no credit booms.

What is more, while almost all financial crises are preceded by credit booms, implying that China is in store for a crisis because of its debt surge, China has few of the common risk factors for financial crises. Indeed, the country has none of the external vulnerabilities that often trigger a crisis, with a current account surplus of 2 percent of GDP, external debt of only 10 percent of GDP, foreign exchange reserves at 40 percent of GDP, and a currency that is generally seen as being undervalued rather than overvalued.5 Similarly, China’s banks are highly liquid and not particularly vulnerable to a U.S.-style freeze of the interbank lending market because loan-to-deposit ratios are unusually low—below 70 percent—and the banks are minimally dependent on large institutional accounts, drawing instead on a huge population of household savers. Household debt has increased rapidly, but it remains small relative to household incomes and the economy (25 percent of GDP), giving little cause for concern because on a net basis households are financially strong.

The clearest area of concern for China is corporate debt. Over 80 percent of the rise in China’s debt-to-GDP ratio can be attributed to the explosive growth of corporate debt, which rose from 96 percent of GDP in 2007 to 142 percent of GDP in 2012.6 It is much more menacing than household debt, and it now makes up 60 percent of China’s total debt. As of 2014, China has one of the highest corporate-debt-to-GDP ratios in the world, even compared to major developed economies like the United States (see figure 3). Even so, the risks associated with rising corporate debt in China are mitigated by the fact that much of it is concentrated in state-dominated sectors where government support is available and industrial profitability has remained acceptable.

Although corporate leverage in China has risen significantly, it is not clear that it has reached crisis levels. The IMF estimates that in 2012, China’s nonfinancial corporate debt had reached just over 100 percent of equity, slightly above the Asian median of 96 percent.7 Yet this is still quite modest compared to median debt-to-equity ratios of the East Asian financial crisis countries, which were 240 percent in Thailand, 190 in Indonesia, and a shocking 350 in South Korea in the year before the crisis.8

There is also little evidence that this overall rise in corporate leverage has led to widespread financial stress among firms. Wells Fargo bank analyzed the financial position of the industrial sector, which accounts for 60 percent of China’s corporate debt, and found no cause for alarm.9 Revenues have kept pace with debt accumulation in the industrial sector, and contrary to popular perceptions, interest expenses have been declining steadily, holding at about 1 percent of revenue, and giving no indication that the servicing of debt has become an unmanageable burden (see figure 4). And although profit margins have seen slight cyclical fluctuations since the crisis, they are still in line with precrisis levels (see figure 5).10

That said, there are prominent pockets of weakness. The steel, cement, aluminum, sheet glass, and shipbuilding sectors are not as productive as other sectors, utilizing just 72–75 percent of their production capacity compared to typical utilization rates of around 80 percent.11 Firms in these sectors account for 10 percent of industrial assets but only 2 percent of industrial profits, and their return on assets is less than half that of the industrial sector overall.12 Utilities and raw materials producers have also become highly leveraged, and the solar sector suffers from similar issues of excess capacity and falling, if not negative, profits. Overall, there is a significant impact on financial indicators but less of an impact on growth because the valued added in these sectors is relatively less pronounced than in other activities.

These sectors’ struggles largely reflect the fact that they are dominated by state-owned enterprises, which are, as a class, highly leveraged and poorly managed. Given their dominance in high-risk sectors and weaker financials as a group, it is likely that any financial stresses will be concentrated among SOEs.

According to the investment bank Morgan Stanley, at the end of 2012 SOEs’ debt was 4.6 times their earnings, compared to just 2.8 times for private firms.13 The research consultancy firm Gavekal estimates that the debt-to-profit ratio of privately listed firms is 5 percent lower than in 2008 compared to a 33 percent rise for state-listed companies, with similar trends observed in other leverage ratios.14 The contrast between the financial position of private and state companies becomes even sharper when you consider their cash holdings: according to Goldman Sachs, private firms have 60 cents in operating cash flows for each dollar of current liabilities, while central government SOEs had just 30 cents.15 And SOE returns on assets fell from a peak of 7 percent in 2007 to around 4 percent (see figure 6). Even industrial SOEs, which have the strongest incentive to perform because of private sector and international competition, have seen their returns fall from around 6.7 to 4.5 percent, while private firms have seen their returns rise from 8 to 11 percent.16 Narrowing this difference represents a major opportunity for improving productivity (discussed later in the paper).

These trends should not be surprising. In 2003, the newly installed government of President Hu Jintao had put an end to the widespread privatization and shuttering of underperforming SOEs.17 This removed the threat of failure and left SOE managers with little reason to behave in a financially responsible manner. Any remaining incentives to behave prudently were eliminated by the postcrisis bank stimulus, when SOEs were charged with propping up growth.

Also providing a cushion for the SOEs, particularly the larger ones, is the fact that they are likely to be bailed out, shifting the liability for their bad debts onto the government. While the government might consider allowing some minor players to go bust as a means of disciplining financial markets, allowing major players and employers like Sinosteel or Dongfang Electric to fail is hard to imagine.

Yet, it is precisely the firms most likely to be bailed out that are most likely to need a bailout. Some studies have shown that the larger firms have been increasing their net debt-to-earnings ratios in recent years, while smaller ones have actually deleveraged since the financial crisis.18

Even if the financial risks are not entirely concentrated in state enterprises, much of the bad debt is likely to land on the government’s balance sheet in one way or another. For example, the government has been known to bail out private firms that are seen as strategically important. The city of Xinyu, which receives 12 percent of its tax receipts from LDK Solar, arranged to pay off all $80 million of the solar firm’s debt rather than allow it to default.19 Similarly, when the city of Wenzhou’s vibrant underground financial system began to collapse in 2011, the local government pressured state-owned banks to step in and bail out many of the private firms that had relied on informal lending markets rather than allowing their bankruptcies to become a drag on the local economy.20

As in any emerging economy, there will be genuine defaults in the corporate sector that are not absorbed by the government. Gavekal has pointed to three criteria for identifying firms that will suffer defaults: those experiencing financial stress, those in excess capacity sectors, and those small enough to lack friends in high places.21 Applying these criteria to the nonfinancial corporate bond market, Gavekal finds that just 1.2 percent of the bonds coming due this year are at serious risk of default. It is possible that even this moderate level of defaults could spook investors into withdrawing liquidity from the bond market, driving up the cost of borrowing for companies.

But these defaults are not out of the ordinary for an emerging economy, and they are unlikely to have a significant negative impact. At least a portion of these bonds will be paid back and few of those that default will be 100 percent losses, so the risks are not significant enough to seriously disrupt the financial system. What is more, most of these defaults will be well-anticipated—and well-anticipated defaults rarely cause crises. There have already been two defaults by weak borrowers, the first by Chaori Solar and the second by Xuzhou Zhongsen, a construction materials manufacturer.22 Yet despite being China’s landmark first and second onshore bond defaults, the market response was subdued with a very modest increase in the yield on low-rated corporate bonds.23 More defaults, especially in the property sector, are likely in store, but the experiences with Chaori Solar and Xuzhou Zhongsen demonstrate how unremarkable the coming defaults are likely to be.

In reality, the at-risk companies and sectors in China are well-known, and the risks are for the most part already factored into the price of their bonds or stocks. Damage is unlikely to spread far, and any spillovers that occur are likely to be limited to other small, financially weak private companies in similarly excess capacity sectors. That is not an entirely undesirable outcome since China needs a process to weed out nonviable firms.

Government debt, which is incurred predominantly at the local level, is not as high as corporate debt nor has it grown as dramatically. For these and other reasons, central and local government debt is unlikely to prompt a financial crisis. But its complex and opaque structure may hide unpredictable risks.

The strength of the central government’s balance sheet on its own merits is uncontroversial: it had debt of just 29 percent of GDP in 2009, and it fell to below 25 percent at the end of 2013.24 But this is an incomplete picture of the government’s financial health because it does not account for China’s local governments, which take on the majority of the public debt while being implicitly guaranteed by the central government.

Unfortunately, accounting for local debt is easier said than done because local governments have been prohibited from officially running deficits or issuing debt since 1994. This has forced local governments in China to take a more circuitous route to finance their expenditures.

In particular, local governments rely heavily on local government financing vehicles, or LGFVs. These are state-owned enterprises set up by local governments to conduct activities that would normally be undertaken directly by the governments themselves, such as building roads and power plants. Local governments support the LGFVs by injecting cash into or transferring state land to them, which the LGFVs use as collateral to borrow from banks and capital markets. The LGFVs then invest that cash in projects to develop the local economy, particularly in the areas of transportation, energy, and water infrastructure or in new housing developments. The distinction between LGFVs and other local government SOEs is blurred and controversial, but even under the conservative official definition there are well in excess of 10,000 LGFVs active in the country.

The borrowing of LGFVs through bank loans and bond issuance is relatively transparent and easily tracked through periodic financial disclosures by the LGFVs or banks that lend to them. Altogether these transparent sources of credit accounted for about $2.1 trillion in June 2013, up from $1.5 trillion in 2010.25 These modest increases in local governments’ visible debt have been outpaced by economic growth, allowing local government debt in the form of bank loans and bonds to fall from about 24 percent to about 23 percent of GDP between December 2011 and June 2013.

Local governments also borrow through the less transparent shadow-banking system. Such borrowing is not regularly disclosed and is difficult to track, forcing observers to rely on rough estimates and sporadic audits.

However, in December 2013 the government announced the results of the most comprehensive audit of local government debt to date, which indicated that shadow banks and other forms of nonbank financing have grown from $360 billion at the time of the 2011 audit to almost $1.2 trillion in June. Some of this growth is artificial, resulting from the inclusion of village governments in the 2013 but not the 2011 audit and from incorporating a broader range of shadow-banking liabilities.

Even so, the audit results demonstrate that the expansion in local government debt is predominantly occurring through shadow banking and other informal arrangements since generally the local governments are not allowed to borrow from the formal banking system for such investment needs. According to the audit, local government debt by June 2013 stood at just over 33 percent of GDP, up from just under 27 percent in 2010 (see table 1).

Adding the audit’s estimate of central government debt to the estimate of local government debt leaves China’s total public debt at 56 percent of GDP, which is relatively low compared with other major economies (see figure 7). This is still much lower than most developed countries, below the generally recognized prudent ceiling of 60 percent, and lower than the 65 percent level seen in the comparable BRIC economies of India and Brazil. Fully 32 percent of the government’s debt is in the form of contingent liabilities. These are predominantly explicit and implicit guarantees of SOE debts, which is not included in debt estimates for other countries.

Yet even if the share of bad SOE debts the government has to absorb is double the historical average, the government’s “expected debt” for comparison purposes is just 44 percent of GDP (see figure 7). This is in line with the IMF’s estimate of China’s “augmented” public debt, which the organization concludes is eminently manageable and leaves sufficient “fiscal space,” meaning the government has the discretionary resources to assume the debt of local government units that are in trouble and additional losses from the corporate sector as necessary.26

Unlike other countries, China can directly access valuable assets should it actually run into debt-servicing problems. According to the Chinese Academy of Social Sciences,27 China’s foreign exchange reserves, at almost $4 trillion or 40 percent of GDP, are roughly equal in size to China’s expected government debt. The government’s land holdings are also immensely valuable, although the use rights to much of the land have already been sold and some is potentially overvalued by a property bubble. Finally, the combined assets of China’s 100,000 SOEs are worth roughly $13 trillion according to the Ministry of Finance. After accounting for SOE debt, the net asset value of SOEs is $4.4 trillion, or roughly 50 percent of GDP.28

While it is true that many of these assets cannot be easily liquidated during a cash crunch, they can finance a bailout over several years, and their mere existence can head off a sudden loss of confidence. If the economy continues to grow in the mid-to-high single digits and the government’s take in taxes steadily rises, the debt burden would also be more manageable.

Although overall public debt is not particularly worrisome and the government is clearly solvent, LGFVs and the localities that support them do face short-term-liquidity challenges. Much of the debt they have incurred is in the form of short-term loans from banks or borrowing through the shadow-banking system, which involves loans of short maturities. Over 40 percent of local government debt will come due within the coming year according to the recent audit. Meanwhile, many of their investments will not produce returns for years. As a result, many are experiencing liquidity shortages. The ratings firm Moody’s and Nomura Securities estimate that up to half of all local governments have insufficient cash flows to cover their debt repayments due in 2014, and Macquarie Capital estimates that 29 percent of new borrowing by LGFVs is used to discharge existing debts.29

Most LGFVs are strong enough to cover interest payments, so debts are likely to be rolled over.30 Although such rollovers tie up banks’ working capital and prevent them from lending to more productive new projects, they represent a slow restructuring of local government debts rather than a crisis.

Beyond short-term liquidity challenges, there are at least three long-term vulnerabilities associated with local government debt: the misaligned fiscal system, incentives for local officials to overinvest, and the lack of transparency in local finances.

Before 1978, the government relied on the profits of state-owned enterprises to pad its budget. When economic reforms were introduced in 1978 to liberalize the centrally planned economy, SOE profits plummeted. The government’s revenues fell from over 30 percent of GDP in 1978 to less than 12 percent in the mid-1990s, leading to a major fiscal reform in 1994.

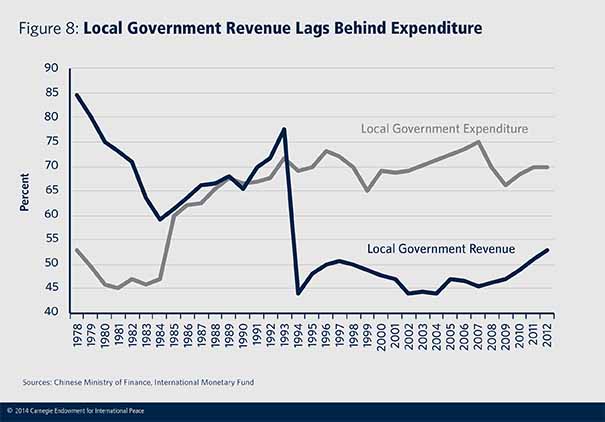

The restructured fiscal system has steadily increased government revenue, which is currently around 22 percent of GDP, but it has also created an imbalance between the central and local governments: while the local governments were left responsible for funding more than 70 percent of government expenditures, they only collect about half of the tax revenue (figure 8).31

Transfers from the central government address some of this gap, but this fiscal misalignment between the expenditure needs and the cash means of local governments drives much of their reliance on borrowing. Giving local governments access to more reliable revenue sources and a larger share of the fiscal pie is necessary to ensuring their long-term financial sustainability.

At the same time, local government officials are evaluated almost entirely on the basis of their ability to produce economic growth. This incentive structure has been integral to China’s economic success over the past three decades, but it has also come at the cost of creating a system that favors short-term growth over long-term financial, environmental, and social sustainability.32 Although much local investment is in fact needed as China rapidly urbanizes and develops its transportation network, local officials’ incentives are more aligned with investing heavily than they are with investing productively, leading to overinvestment and overindebtedness.

Estimates of local government debt vary widely, since those governments do not provide clear and comprehensive statements. This lack of transparency manifests itself not only in the rapidly rising level of debt but also in the way it is managed. The 2011 audit revealed that “of thirty one provincial governments, seven haven’t created debt management systems . . . 14 haven’t established debt repayment funds, and as many as 24 of them haven’t installed risk monitoring and control systems.”33 This dearth of risk management systems has made it easy for unmonitored risks to accumulate.

In addition, local governments are highly exposed to rising interest rates because much of their borrowing has to be refinanced annually and an increasing share of local borrowing has been coming from the lowest levels of government, which are least prepared to manage risks.

These concerns have not gone unaddressed. The economic reform plan announced following the Third Plenum meeting of the party leadership (formally, the Third Plenary Session of the 18th Central Committee) gave pride of place to reforms intended to better align the fiscal system.34 A portion of spending on social services is to be transferred to the central government to lighten the burden on local finances, and local revenues are to be increased through the expansion of property and other taxes that flow directly to local governments. The party also seems to recognize the need for more holistic assessments of local officials’ performance, announcing in December 2013 that a variety of factors, including local debt levels, will be incorporated going forward.35 This will hopefully encourage the development of better risk management systems and help to improve the structure of local debt.

While these steps are not a complete solution, they show that China’s leadership understands the vulnerabilities posed by the structure of the fiscal system and local officials’ incentives and that they are serious about remedying them.

What is less clear is how the leadership intends to improve the transparency of local government debt. China’s leaders have acted on their intention to use more local government bonds, which will help because bond financing involves ratings agencies and formal audits. In early 2014, the government selected a few localities and cities to launch a pilot bond-financing program to supplement their revenue needs. However, the local governments included thus far were specifically selected because of their relatively stronger financial positions. This leaves unresolved how to improve the transparency of the localities most in need of reforms.

Cutting across both corporate and local government debt is the issue of shadow banking. Broadly construed, shadow banking includes informal lending between individuals and companies, loans made by nonbank financial institutions like trusts and investment funds, and some common banking practices like bankers’ acceptances. In China, there is no formal definition of what activities constitute shadow banking, leading many to simply refer to all lending activities that occur outside of banks or off of bank balance sheets as shadow banking.

The most useful definitions of shadow banking, from the perspective of financial stability, are those that include all systemically important activities while omitting marginal forms of lending. In particular, activities that are strongly linked to the formal banking sector, namely wealth management products (WMPs) and bankers’ acceptances, and those that are large relative to the size of the economy, namely trust products and entrust loans, are the key components of shadow banking, while minor activities, such as underground lending,36 are excluded.37

Estimates that are in line with this definition place shadow banking at around 50–60 percent of GDP or around 25–30 percent of banking assets in China. These figures are not abnormal in international comparisons of shadow banking. The Financial Stability Board (FSB) estimates that globally, shadow banking averaged about 117 percent of GDP, respectively, in the major Organization for Economic Cooperation and Development economies and 52 percent of banking assets, more than double the figures for China. In at least three other major emerging markets, shadow banking represents a larger share of banking assets than it does in China (see figure 9).38

Opinions on the issue of shadow banking in China are divided. Many financial experts have noted that shadow banking is more responsive to the needs of private small and medium enterprises that have traditionally lacked access to the state-dominated banking system and that those enterprises have played a major role in driving productivity growth and employment. An estimated 97 percent of China’s 42 million small and medium enterprises are unable to access traditional bank lending, according to Citic Securities, because they lack a strong track record and there is a bias in favor of state-owned enterprises.39 The People’s Bank of China estimates that half of all the firms it regularly surveys have accessed some form of shadow banking.40 Others are alarmed by the rise of shadow banking in China because it is widely perceived to be more risky than traditional bank lending, which is subject to more stringent oversight.

As with the broader debt, concerns about China’s shadow-banking system often focus on debt’s rapid growth rather than its absolute level. Shadow-banking activities in China have expanded dramatically since the end of the bank-credit stimulus in 2009. Goldman Sachs estimates shadow banking’s share of the flow of new credit has doubled in recent years, from 22 percent in 2008 to 42 percent by June 2013, at which point it accounted for roughly a quarter of the outstanding credit stock.41 In the first quarter of 2014, shadow banking was scaled back modestly,42 although it is unclear whether this is a temporary deviation from the trend toward increased shadow-banking activities or something more permanent.

Regardless, rapid growth of shadow banking is not atypical of emerging markets in recent years. According to the FSB, seven major emerging market countries have experienced growth above 15 percent, and China’s pattern is broadly similar. Such growth rates should not be considered inherently problematic for countries developing their nascent shadow-banking systems from very low bases.

While such aggregate numbers make for good headlines, they are not particularly helpful for assessing the risks associated with shadow banking. There is much more to the story.

An implication of the term “shadow banking” is that diverse and distinct forms of nonbank credit can be grouped together under the same heading and thought of in the same way. In reality, each form of credit exhibits a dramatically different risk profile. Pointing to the riskiness of one form of shadow banking (usually trust products or wealth management products) and then citing the overall amount of shadow banking gives a misleading perception of the magnitude of the risks.

Broadly, there are two ways in which a shadow-banking sector can pose a risk. The first is direct: credit risk is increased by lending to financially weak borrowers. For this to become a serious issue, such lending must also be large in magnitude so that the potential losses are significant relative to the economy. The second form of risk comes when a shadow-banking sector is strongly interconnected with the rest of the financial system. This channel was key, for instance, to transforming relatively modest losses on mortgage portfolios in the United States into a systemic financial crisis in 2008.43 In China’s heavily bank-based financial system, the primary risk is of interconnectedness between shadow banking and the commercial banks.

Each individual form of shadow financing—entrust loans, bankers’ acceptances, trust companies, and wealth management products—should be analyzed in terms of these risks. And it should be analyzed on its own merits.

Entrust loans are a means by which nonfinancial corporations lend to each other, amounting to 14 percent of China’s GDP as of the end of 2012. They are often portrayed as riskier than traditional bank loans, but in reality, as much as 80 percent of entrust loans are between related companies and are low risk.44 As such, lending through entrust loans is arguably safer and more efficient than the average bank loan due to lower information asymmetries since the relevant companies are familiar with each other.

The underlying borrowers may be risky, but financial institutions bear no credit risk for entrust loans. Although banks play an important role in facilitating and overseeing such loans, all of the credit risk is borne by the company doing the lending. That means entrust loans pose virtually no direct threat to financial stability—even if the borrower is a high credit risk, the hit of a default will land largely on the company that did the lending, with minimal spillover to the wider financial system.

Bankers’ acceptances, which amounted to 12 percent of GDP as of the end of 2012, are a form of short-term credit used to facilitate business activity by having the bank guarantee payment, obviating the need to evaluate whether a business partner is creditworthy. Because of that, banks typically require proof of an underlying commercial transaction before issuing an acceptance, and they often require modest deposits as collateral on the acceptance draft, both of which act to reduce the risks of a credit loss.

Bankers’ acceptances are inherently interconnected with the financial health of banks, which bear the full credit risks of the loans. If losses mount, they could spill over to the broader financial system. However, the market for these products is small and most acceptances are at least partially collateralized by deposits and backed by underlying transactions, so the threat is modest.

In 2013, trust companies—a form of nonbank financial institution unique to China—surpassed insurance companies to become the second-largest type of financial institution in the country after commercial banks.45 Trust companies function in a way somewhat analogous to investment funds in the West and are authorized to manage assets for enterprises and individuals. But, unlike banks, they are prohibited from taking deposits. Instead of collecting deposits and issuing loans, trusts make loans, purchase securities, or invest in private equity, which they then sell to investors in the form of “trust products” that often offer interest rates as high as 9–11 percent.46 Because their investment activities are generally riskier, this aspect of shadow banking warrants more attention and regulatory oversight.

Trust products are frequently invested in a single project loan, but some involve packaging together multiple loans and investments in a particular sector. There is a wide range of restrictions on marketing and advertising trust products, and trusts rely on banks to sell their products to investors.

Trusts have been growing rapidly—46 percent in 2013. But their growth has also been moderating rapidly, coming down from 71 percent in June 2013 and 60 percent in September 2013.47 Even with this decline, by the end of 2013, China’s trust companies had assets under management worth almost 20 percent of GDP.48

Credit extension through trusts amounts to about 9–13 percent of GDP or 3–5 percent of all banking assets. That is because less than half of trust assets are trust loans, which is the only component of trusts’ business that involves extending credit.49 The rest of trust assets are invested in bonds (whether for short-term trading or held to maturity investment), equity investment (typically private equity rather than publically traded stocks), bank deposits, and a hodgepodge of other assets. Some analysts have alleged that some of these nonloan activities have suspiciously loan-like structures and have argued that as much as 67 percent of trust assets should be considered loans.50

An outdated concern about this form of shadow banking is that trusts are just a way for banks to circumvent quantitative limits on their lending or restrictions on lending to particular sectors by moving loans off of their balance sheets as wealth management products (which leads to some double-counting in the size of shadow banking as discussed later) or into the interbank market to reduce their capital requirements. Such bank-trust cooperation, somewhat analogous to American banks’ use of “special investment vehicles” before the global financial crisis, accounted for two-thirds of all trust assets in 2010 and helped drive the early growth of the trust industry following the 2009 stimulus.51

Another concern is that trusts are disproportionately invested in risky sectors like real estate, raw materials, and infrastructure, and much of this is flowing to LGFVs. This is true, but trust assets are not as concentrated in these sectors as is often perceived: less than 40 percent of trust assets are invested in real estate, raw minerals, and infrastructure.52 Moreover, trusts’ investments in real estate grew more slowly than any other category in 2013, as trusts pulled back from the sector.53 This has continued into 2014, with issuance of property-based collective trusts falling by half in the first quarter.54

Even outside of those vulnerable sectors, credit risk is likely higher for trusts than banks because financially stronger businesses are more likely to have access to the cheap loans from the formal banking sector while more marginal firms are forced to borrow at higher rates from trusts. Thus defaults are a very real risk for investors in trust products, particularly with 4.5 trillion yuan (approximately $730 billion) worth of trust products maturing this year, up 77 percent on 2013.55

How much of a threat do defaults in the trust sector pose to financial stability? Defaults or other losses on the assets underlying trust products accrue to the investors in those products rather than the trusts themselves, which are forbidden to guarantee the principle or return on products they issue.56 This, combined with the lack of leverage in trusts, means that a systemic impact has to come from spillovers to the rest of the financial system, particularly the banks.

Spillover is unlikely to come through direct bank-trust cooperation, including partnerships in some lending arrangements. Since 2009, regulations restricting the scope and magnitude of bank-trust cooperation have cut such cooperation to just 20 percent of trust assets, a level that will continue to fall as old cooperation agreements mature.57 As such, exposure to defaults in the trust sector is increasingly shifting away from formerly linked banks to individual retail and corporate investors who are directly responsible for the trust products, reducing the risk of contagion from the trust sector to the financial system as a whole. Bank-trust cooperation appears to be on track to contract still further, particularly given the recent tightening of regulation on interbank transactions between banks and trusts.58

An oft-cited possibility is that spillover could occur through bailouts. That is, to protect their reputation, banks will bail out trust products that were marketed through their branches.

Yet, this does not seem to be what has happened in practice. For example, when a trust product tied to a coal mining project in Shanxi Province approached default in January 2014, the Industrial and Commercial Bank of China, which had marketed the product to investors, steadfastly refused to bail out investors.59 More recently the China Construction Bank refused to make investors whole on another coal-related trust product it had marketed and that experienced payment difficulties in February.60 Both banks, China’s largest, also appear to have temporarily stopped marketing trust products to their customers, further limiting their exposure.61

Such bailouts may yet materialize, but it is hard to imagine them doing serious damage to bank balance sheets. The entire trust sector amounts to less than 8 percent of bank assets, only a small portion of that will default, and only a small portion of those losses will be absorbed by the banks.62

What is more, even a loss of confidence in trusts is not particularly threatening to the banks. In the United States and Europe, banks were heavily reliant on wholesale funding from money market mutual funds, repurchase agreements, and other shadow-banking institutions and activities, so when the shadow-banking system froze up, they suffered a serious contraction of liquidity that spiraled into a systemic banking crisis.63 The story in China is quite different. As the bank UBS has repeatedly pointed out, if investors lose confidence in the trust market, their money will simply flow back into bank deposits because China’s capital controls prevent them from sending it abroad, and they have few alternative investment platforms.64 Thus a loss of confidence in trusts will, if anything, increase liquidity and reduce the cost of capital for banks in China.

The final component of shadow banking is wealth management products, which are investment products created by banks but often confused for a type of deposit.65 They are somewhat analogous to a money market fund offered by a bank. While they may not have introduced additional credit risk, they have generated a variety of other vulnerabilities. What sets WMPs apart is their intrinsic connection to the banks, which creates large spillover risks. A loss of confidence in WMPs could pose significant systemic risk to the banks and the economy.

Wealth management products are quite distinct from the other forms of shadow banking because they do not involve any direct credit extension—WMPs are simply a distribution channel for existing assets. Rather than making loans, as trusts do with a portion of the money they collect through trust products, WMPs invest in a range of underlying assets, including bonds, interbank assets, securitized loans, trust products, discounted bankers’ acceptances, and in some cases equity. This simply shifts the ownership of existing debt rather than creating new debt.66 In principle, banks just manage WMP assets for their customers, who bear the risk of defaults. However, unlike trusts, banks are allowed to guarantee the principal or return on a WMP, although they do so for less than 40 percent of products.67

Wealth management products have been one of the most rapidly expanding elements of the financial system, growing almost sixfold between 2009 and 2013 at more than 50 percent a year.68 The interest rate on WMPs tends to be about 1–2 percentage points higher than that on bank deposits. This has drawn investors into the WMP market, which did not exist before 2005 but now accounts for more than 10 percent of all deposits.69

Roughly half of the funds that have flowed into WMPs are invested in relatively safe interbank assets and financial bonds while the other half are invested in riskier equity stakes (some of which may be disguised loans), corporate bonds (including LGFVs), and “nontraditional credit assets,” primarily trust products and simple securitized bank loans.70 Nontraditional credit assets and LGFV bonds are the primary sources of credit risk for WMPs.

WMP credit risks are significantly lower than those of many other financial products. It is widely assumed that corporates that have issued bonds are less risky than those that have not and that the government is well situated to guarantee the debts of LGFVs when necessary. The risks associated with WMP loans are likely to be lower than trust products. Standard Chartered Bank has argued that the credit standards for WMP “loans” (that is, holdings of trust products and securitized bank loans) are not significantly looser than for traditional on-balance-sheet bank loans, although they are still concentrated in riskier sectors.71 The ratings agency Standard and Poor’s and Goldman Sachs have gone so far as to argue that WMPs have lower credit risk than most traditional bank loan portfolios, though that assessment probably goes too far.72

As with trust products, many analysts of China’s financial system allege that banks are likely to bail out failing WMPs even if they are not guaranteed. The case is much more compelling with WMPs because banks have stronger incentives to preserve confidence in the WMP market. For one thing, the failure of a bank-crafted product, such as a WMP, is a more direct reputational hit to the bank than the failure of a product they simply sold. Banks also rely on WMPs as an integral part of their business,73 whereas sales of trust products simply raise some fee revenue on the side.

It might initially seem that a bailout of and loss of confidence in WMPs would work much as a loss of confidence in trust products: it would simply lead to a flood of cash out of WMPs and into deposits and thus banks would not be adversely affected. However, if non-principal-guaranteed products are bailed out, both deposits and the troubled assets themselves would be brought back onto banks’ balance sheets. This could lead banks’ loan-to-deposit ratios to rise or fall, but their capital adequacy ratios and reserve requirements would be unambiguously eroded, leaving them more vulnerable.

Such bailouts would also create an accelerator effect where banks are forced not only to absorb the losses but also to put aside capital and reserves for the remaining assets and deposits that have been shifted onto their balance sheet unexpectedly, leaving them less flexible than before the bailout.74 Thus problems with some of the assets underpinning WMPs could have negative spillover consequences for the banking sector more generally.

Two aspects of WMPs make them particularly vulnerable to a loss of confidence: maturity mismatches that encourage investors to exit early and a lack of transparency about the underlying assets that in part stems from that mismatch.

At the end of 2012, fully 60 percent of WMPs in China had maturities of three months or less while most of their underlying assets were multiyear loans and securities.75 As a result, investors in maturing WMPs are often paid out with the funds from new WMP issuance, leading the head of the China Securities Regulatory Commission to call WMPs a “Ponzi scheme.”76 If there is a sudden loss of confidence in the WMP sector and new investors cannot be found, existing investors in WMPs may find it impossible to withdraw their capital until the underlying assets mature. This gives investors a strong incentive to be the “first out the door,” a structure inherently prone to runs. This is less of a vulnerability for the majority of WMPs invested in liquid assets that can be sold off to pay out investors. But it is a serious issue for the minority of WMPs invested in nontraditional credit assets, which would be hard-pressed to pay out investors if cash stopped flowing into the sector regardless of underlying asset quality.

One approach the banks have developed to cope with this is to pool funds from multiple WMPs together, which allows the excess returns on some assets to subsidize losses on others. More than half of WMPs are of this mixed form.

This fix reduces transparency of the underlying risks and introduces ambiguity as to what assets are actually backing a particular WMP. It also makes it more difficult for the banks to resist guaranteeing the WMPs—it is much easier to allow a default when they can point to a specific failed investment than when those funds have been mixed into a pool that includes successful and failed projects. This also makes it more likely that investors will lose confidence in these products, forcing banks to bail them out.

There have been positive steps toward curbing these risks. In March 2013, the China Banking Regulatory Commission issued new regulations that required banks to restrict the share of nontraditional credit assets in their WMP portfolio to 35 percent of WMP assets and 4 percent of bank assets. This improved WMP liquidity and reduced, though did not eliminate, the vulnerabilities derived from their maturity mismatches given the short-term nature of the WMPs relative to the multiyear nature of their underlying assets. The commission also required that banks link all WMPs to an underlying asset rather than drawing on an amorphous pool of mixed assets, improving transparency and allowing investors to better assess the risks they are exposed to through their WMP investment. While the first requirement appears to have been successfully implemented and enforced at most banks, the practice of pooling WMP funds still appears to be fairly widespread. More rigorous enforcement of the restriction on pooling is needed to truly address these vulnerabilities.

Yet, these regulations are still insufficient to curb the risks WMPs could pose to financial stability if they continue to grow at their current pace. The China Banking Regulatory Commission must find a way of clearly distinguishing WMPs from deposits to put an end to implicit guarantees, or it should recognize the inherently deposit-like structure of WMPs and begin to regulate them as such. Creating a clear divide seems implausible given banks’ incentives to maintain investor confidence in the WMP market and the government’s concerns that isolated protests over failed WMPs might get out of hand. Thus it would be more practical for the China Banking Regulatory Commission to treat WMPs as a form of deposit subject to capital and reserve requirements similar to those on traditional bank deposits and lending.

Ultimately, the exposure of the traditional banking system to risky shadow-banking activities is not that significant. It would take truly disastrous performance over a short period of time for these assets to pose a serious threat to the stability of the banking system or the economy.

Alongside the high-risk, high-return products that draw most of the attention are a vast number of relatively low-risk investments that play healthy and productive roles in facilitating economic activity. Some shadow-banking activities pose no extraordinary risks: entrust loans cannot easily spill over to impair banks’ balance sheets, and bankers’ acceptances are not acutely risky. The real concerns are more narrowly concentrated in the activities of trust companies and banks’ wealth management products, although even here the risks are often overstated.

In reality, the much-talked-about, high-risk components of the shadow-banking system are overhyped. All forms of shadow banking amount to a total of 84 percent of GDP. By the numbers, the shares of trust companies and WMPs in the broader system seem large, amounting to 36 percent of GDP or about 15 percent of bank assets. But those figures are overestimated, because WMPs’ investment in trust products are double counted, and they could account for as much as 30 percent of WMP assets. Further, over half of WMP investments are in safe interbank assets and government and financial bonds, while less than half of trust assets are in the form of loans or exposed to risky sectors. So ultimately the high-risk components of shadow banking, concentrated among WMPs and trust products and accounting for about 18 percent of the total, are unlikely to exceed 15 percent of GDP or about 6 percent of bank assets (see figure 10).

Granted, there are second-order financial risks associated with the shadow-banking system, and potentially dangerous situations could arise, such as a vicious cycle in which the unraveling of some portion of shadow banking slows economic growth. The ensuing economic slowdown could then damage the fiscal health of marginal borrowers, potentially leading to wider systemic consequences.

Three unlikely things must happen for such a vicious cycle to arise. Each assumption is questionable in its own right, and together they are implausible.

The first two assumptions relate to a collapse in lending. First, there must be a crisis of confidence that leads to a collapse in lending through one or more shadow-banking channels. Second, that collapse must be of sufficient magnitude to have a noticeable impact on the economy.

To reach sufficient magnitude to be of concern, the collapse would have to occur across multiple channels simultaneously—and that is unlikely. A collapse in the bankers’ acceptance market is unlikely given its structure. But a run is possible in the entrust loan, trust product, or WMP markets that are driven by individual and corporate investors because of their spillover effects in the banking system. Even so, only the 30–50 percent of WMPs and trust products that are involved in credit extension would be involved. However, even an implausibly severe collapse of 30 percent in one of these markets would only amount to a few percentage points of GDP. Further, a significant portion of this credit was likely used to buy land or roll over existing debt, activities that do not contribute to GDP, so the true impact could be even smaller.

The third assumption is that the government would not respond to the unraveling of the shadow-banking market and allow bank lending to expand to compensate for the reduction in shadow lending. Under this scenario, the government would simply allow credit, and thus growth, to collapse. This is unlikely because regulators could compensate for much of the resulting contraction in shadow credit by raising banks’ loan quotas and cutting the reserve requirement ratio to allow greater credit growth through traditional bank lending. There would be some damage in the interim, but growth would not be allowed to collapse.

All in all, then, the much-hyped, high risk parts of shadow banking are unlikely to trigger a financial crisis.

Of course, there is always the fallacy of the heap: each individual component of the financial system does not look overly menacing, but the combination of the various risks together could pose a threat. To assess whether the heap is truly more menacing than its individual components, there are stress tests and scenarios that should be explored.

A number of scenarios come from the past. After all, this is not the first time China has faced serious debt strains. Throughout the 1990s, nonperforming loans at China’s banks were steadily rising as a result of excessive lending to poorly managed SOEs. The official nonperforming loans of state-owned commercial banks reached their peak in 1999, when they accounted for more than 30 percent of loans, about 29 percent of GDP.77 Unofficial estimates ranged up to as much as 40–50 percent of total loans.78

China’s current challenges may be more complex, but the financial situation in the late 1990s was much more severe, and even then difficulties proved manageable. The government created four asset management companies to buy up banks’ nonperforming loans at face value. The central government also injected substantial amounts of capital into the biggest state-owned banks so they could write off many of the remaining nonperforming loans. By 2005, the total face cost of these and other efforts to restructure the banks had reached nearly 4 trillion yuan, or over 40 percent of GDP in 1999.79

Although the direct cost of the bailout was immense, it allowed the banks to return to lending and allowed economic growth to accelerate over the coming decade.80 As the banks’ balance sheets expanded with new and better loans, nonperforming loans as a share of total loans steadily declined to under 1 percent in recent years (see figure 11).81 All of this occurred in the context of a modest deleveraging between 2003 and 2008, when nominal GDP growth was outpacing credit growth and gradually pushing down China’s debt-to-GDP ratio.82

So what are the prospects of a repeat of this successful, if costly, cleanup of the financial sector? Quite good, actually. Even the most pessimistic current estimates of credit losses fall far short of what was observed in the late 1990s and early 2000s, with no serious macroeconomic fallout. Goldman Sachs’s comprehensive report on China’s “credit conundrum” estimates the maximum potential credit loss incurred during a bailout would be between 10 and 21 percent of GDP, depending on how aggressively the government responds to the situation.83 A report from RBS lays out moderate and severe stress scenarios and estimates credit losses between 10 and 20 percent of GDP as well.84 And a more recent exercise by the consultancy Oxford Economics also concludes that nonperforming assets in the financial system are likely to reach between 10 and 20 percent of GDP.85

These levels of bad debt would not be an unreasonable burden on public finances. Between 30 and 60 percent of the losses in these scenarios are from LGFVs, which are already accounted for in China’s total public debt of 56 percent of GDP. In fact, the estimate that China’s expected debt is only 44 percent of GDP uses more pessimistic loss assumptions about LGFV debt than any of these scenarios. Thus, adding the non-LGFV losses of between 2 and 15 percentage points of GDP to the expected debt still leaves China’s total public debt well below the accepted threshold of 60 percent of GDP.

Further, the actual cost to the government is likely to be significantly lower than the estimated credit losses under these scenarios because the government will force the financial industry to absorb a share of the losses. The RBS estimates assume that the financial industry will absorb losses on the first 2.3 percent of assets to go bad, based on the fact that banks currently have provisions for losses on 2.8 percent of their loan books. What is more, as was seen in the previous bank restructuring from 1999 to 2005, the costs are likely to be spread over a number of years, which will allow time for bank earnings to absorb a larger share of the losses.

All these scenarios are meant to be extreme stress tests and do not represent expected outcomes, so the credit loss estimates themselves are likely overestimates. China’s financial and fiscal metrics simply do not point to a looming “Lehman moment.”

Although financial woes are unlikely to bring China to its knees, the property market may pose a serious obstacle to short-term growth.

Over the past decade, land prices in China have surged fivefold according to the Wharton/NUS/Tsinghua Chinese Residential Land Price Index (see figure 12), while the construction sector has expanded from 10 to 13 percent of GDP.86 With such a dramatic increase in land and property prices and a potential glut of housing in the cards, this has understandably led to concerns that China may be experiencing a property bubble. These concerns have been brought to a boil by deteriorating sales figures and media accounts of large price cuts during the first few months of 2014. In April 2014, Nomura Securities declared that it is no longer a question of “if” or “when” but “how severe” the property correction will be.87

A correction does indeed appear to be coming, but the severity of the correction may be limited. For a number of reasons, China’s situation is not particularly worrisome.

Unlike other bubble-afflicted economies, the growth in China’s land prices coincided with the emergence of a real property market that did not exist until housing was privatized a decade ago. Because of this, the sharp rise in property prices may be indicative of the market trying to establish appropriate prices for an asset whose value had previously been hidden by the socialist system, a pattern also observed in Russia after the fall of the Soviet Union.88 Although this does not rule out the possibility of a bubble, it does suggest that much of the rise could reflect the true underlying value of land. Further, it means that rapidly rising land prices alone cannot be interpreted as evidence of a bubble.

And there are strong fundamental drivers of urban housing demand that suggest China has suffered from undersupply until quite recently, indicating that the expansion of the sector is driven by real demand. Over the past decade China has been experiencing the largest population movement in history with an average of 21 million migrants a year moving into urban areas, driving exceptionally strong demand for new housing.89 Similarly explosive growth of urban wages, which have doubled since 2009, has increased the affordability of housing despite rising prices and has driven massive upgrading demand as households seek out more spacious and modern apartments.90 Even more demand comes from the need to replace old communist-era housing stock and other shoddy construction; the average Chinese building only lasts twenty-five to thirty years, compared to an average of seventy to seventy-five years in the United States.91 Gavekal estimates that these three factors together added up to underlying demand for over 1.1 billion square meters of floor space a year between 2000 and 2010, compared to an average supply of less than 700 million square meters a year.92

Thanks to easing urbanization pressures and a construction boom following the global financial crisis, Gavekal now believes that China is entering a period of modest oversupply, but it still expects strong fundamental demand of around 10 million units a year (see figure 13).93 It is fairly clear that China’s housing supply has overshot the market, but it is not clear that it has done so by a dramatic margin.

Widespread distortions could also be artificially inflating demand for property. For one, Chinese households have limited investment options; the closed capital account leaves few avenues for savers seeking returns higher than savings deposits can provide. Real estate is treated as an investment vehicle in China to fill the gap. According to the China Household Finance Survey, 18 percent of households own more than one home, suggesting that demand for property as an investment vehicle is substantial.94 Moreover, the fact that China does not tax property, aside from pilot programs in Shanghai and Chongqing, means that there are lower costs to purchasing and holding unused property. Much of this activity has been curbed in recent years as the government has gradually tightened restrictions on multiple home ownership and mortgage standards.95 The dip in housing prices in 2011–2012 is generally attributed to the tightening of these regulations.

A correction is likely in the short term. As China moves into a period of structural oversupply, especially in the second and third tier cities rather than major cities like Beijing and Shanghai, prices will begin to fall and the investment incentives that fed the bubble will evaporate and cause a severe collapse in both prices and construction activity. It is difficult to evaluate the balance between the fundamental drivers of the expansion of the property market and irrational distortions, making a confident assessment of how severe the correction might be impossible. Still, there are a number of reasons to believe that the correction will not be destabilizing.

First, the trends in land and housing prices in China are inconsistent with the typical pattern of a bubble. In a typical bubble, investors buy in not because they see value in what they are buying but because they expect the price to continue rising. Thus, when prices show signs of falling (or even just slowing growth), investors rush for the door and cause a collapse.

Prices in China did show signs of falling. Despite a general trend toward higher prices, over the course of 2011, land prices fell by 10 percent, and a portion of that decline was passed along to homebuyers as the price of newly constructed housing fell in late 2011 and early 2012 (see figure 14). It is difficult to find any precedent of a bubble in which prices declined significantly and persistently before continuing to inflate; it is certainly not the pattern observed with U.S. housing before the global financial crisis or in Japan before its lost decade (see figure 15).

What is more, falling prices in China did not precipitate a collapse of the market in 2011–2012, which suggests that the high prices up to 2012 are supported by something more real and persistent than “irrational exuberance.” This also suggests that 2012 levels may be a reasonable floor for prices during the coming correction, implying that prices will fall by less than 20 percent from early 2013 levels. Such a fall would have serious economic consequences, but it is dwarfed by 30–50 percent collapses in the United States and Japan.

The other reason to be relatively sanguine about the severity of a price correction is that China’s property market is not highly dependent on leverage since down payments on property as a share of the purchase price are much higher in China than in the United States, making it less likely that banks will be drawn into a foreclosure process in the event of a major downturn. The results of the China Household Finance Survey indicate that even after a 30 percent decline in prices, only 2.9 percent of households would be underwater thanks to high down payments and the equity that accumulated over the course of their ownership.96 The robustness of household balance sheets helps to insulate the banks from a property downturn because two-thirds of their direct exposure to the sector is in the form of mortgages.97

The highly leveraged property developers that account for the other third of banks’ direct exposure are more concerning. Although those developers have been building up large liquidity buffers, they will certainly see high default rates during the correction.98

Even with this result, the direct impact on banks’ balance sheets would be limited. The strength of the household balance sheets, combined with the fact that only 20 percent of bank credit goes to the property sector, has led the Bank of China to estimate that even a 30 percent drop in real estate prices would have a negligible impact on banks’ nonperforming loan ratios.99

The indirect impact of a correction would likely be more severe but still manageable. The falling price of land would erode the value of collateral that is backing other loans, particularly those to LGFVs, and there would be knock-on effects in steel, cement, and other industries closely tied to construction.100 While these indirect effects would increase the damage done by a correction, the workout scenarios discussed already assumed losses of between 10 and 35 percent on the LGFV and shadow bank lending. A 20 percent price correction in the property sector would be unlikely to result in financial scenarios any more severe than those already considered—and China remains relatively stable under those scenarios.

While the likely price correction may not be a major issue, correction in the volume of construction will have a negative impact on growth. Construction and real estate have been gradually rising as a share of GDP over the past three decades (see figure 16).101 As with property prices, these sectors have not exhibited the pattern common to other bubble countries of a sharp increase in share over a short period. However, amounting to 13 percent of GDP as of 2013, construction and real estate have become important components of China’s economy. And accounting for related industries, such as steel, cement, and construction equipment, would show that construction’s contribution approaches 20 percent of GDP. This makes China’s economy quite vulnerable to a construction downturn.

That downturn is likely to happen soon. Given that underlying demand totals roughly 10 million units a year, and 11 million units came onto the market last year, it seems clear that construction volume must slow by roughly 10 percent. UBS estimates that such a decline could subtract 2.5 percentage points from GDP growth.102

But the actual impact of the correction on GDP growth is likely to be relatively muted because the entire correction need not occur in a single year and because an anticipated increase in infrastructure investment will compensate for a portion of the decline in housing construction. Demand is also likely to rise as China’s urbanization plan is further implemented, which will reduce the magnitude of the adjustment that must take place.103

As a result of these factors, it would be reasonable to expect growth to decline to 6–6.5 percent in the short term as the property sector works through the oversupply of housing. But the darker scenarios in which growth collapses to 5 percent or lower are unlikely to come to pass.

Looking at China as a whole, alarmist rhetoric around the country’s short-term debt outlook overstates the system’s vulnerabilities, and the coming property correction is mostly an issue for real production rather than the financial system. That means that while there are likely to be defaults and a rise in nonperforming loans—legitimate concerns for investors in China—it is difficult to see how the situation could deteriorate so much that it would lead to a systemic financial crisis and derail the economy.

Many bears on China retort that even if the current situation is manageable, it is just a matter of time until China hits its debt constraint. Some analysts argue that the only way China can avoid a financial crisis is for growth to collapse to the low single digits.104 Similarly, the Fitch Ratings’ Report that has generated much of the alarm about China’s debt warns that “the longer that credit outpaces GDP, the greater the longer-term challenges.”105 The argument goes that since the financial crisis, the only thing that has kept growth so high in China is the even faster growth of credit. This framework indicates that, so long as rapid growth remains the government’s priority, leverage must continue rising until there is a crisis.

To the extent that growth truly has become dependent on credit-fueled investment, these analysts are right. However, one need not be so pessimistic about how quickly the economy can wean itself off credit while still generating growth.

The more pessimistic narrative misunderstands how credit is being used in China. Much of the credit surge has been financing rising prices for property and other assets, but such increases are not included in calculating GDP growth. If these asset price increases are sustainable, however, current concerns over the debt buildup are not really an issue.

Here, the difference between fixed asset investment (FAI) and gross fixed capital formation (GFCF) is key. Both concepts are measures of investment, but FAI measures investment in physical assets, including land, while GFCF measures investment in new equipment and structures, excluding the value of land. Further, while GFCF feeds directly into GDP, only a portion of FAI shows up in GDP accounts.

For some time, the distinction between the two concepts did not matter in interpreting economic trends because the two measures moved in lockstep, reaching 35 percent of GDP by 2003. Since then, however, the two have diverged, and GFCF now stands at around 45 percent of GDP while the share of FAI has jumped to over 70 percent (see figure 17). According to Goldman Sachs, fully two-thirds of this divergence can be attributed to growing differences in asset prices, particularly the increasing value of land.106

Overall credit levels have increased in line with the rapid growth in FAI rather than the more modest growth in GFCF. Given that the major distinction between the two measures of investment is the inclusion of land-related transactions, this suggests that such transactions account for an increasingly large share of credit, which is not surprising given the fivefold increase in the price of land over the past decade. Since these land transactions do not contribute to GDP, and much of the recent credit growth relates to such transactions, this explains much of the decline in the growth impact of credit.

Since 2008, a lot of credit has been channeled into investment in assets that are not accounted for in GDP. While some of this was wasted on speculative real estate projects, the bulk of it was used productively and unlocked real value.

As such, much of the recent surge in China’s credit-to-GDP ratio can be thought of as financial deepening as China moves toward more market-based asset values. Once those values are established, land price growth and the amount of credit being channeled to these uses will level off. This will lead to a gradual shift in the allocation of credit back toward growth-enhancing GFCF investment and to a rebound in the growth impact of credit, allowing over 7 percent growth to continue even as credit slows.

Another reason to be optimistic about China’s ability to curb credit while generating growth is its potential to ratchet up productivity through structural reforms. Some observers believe that there is a trade-off between near-term growth objectives and implementing reforms. However, this is a false dichotomy. While some reforms may be contradictory to growth, most are complementary.

China’s run of more than 10 percent annual growth since 2003 was driven by growth in labor, capital, and productivity. China has exhausted its demographic dividend and is now seeing its returns on investment decline. Moreover, while increases in China’s total factor productivity have been well above the international norm, coming partly from the transfer of workers from agriculture to more productive industrial jobs, these gains have fallen in recent years.

Even so, there are still significant gains to be realized from the more efficient use of labor and other resources. The challenge for Beijing is increasing productivity again so the economy can grow at a sustainable rate of over 7 percent in the coming decade without relying on ever-increasing debt.

Reforms that improve the efficiency of the urbanization process would help generate some of the needed gains. Productivity increases from urbanization have been declining in recent years due to waste from the excessive conversion of agricultural land for urban use and policies preventing China from fully reaping the benefits that come from concentrating workers and activities in specific areas. The consequence has been urban sprawl, potential property bubbles, and “ghost cities.” The gains from migration have also declined because China’s unique residency restrictions inhibit workers from relocating to the largest cities that generate the most productive jobs.107

A more efficient urbanization process would promote denser settlement patterns and allow market forces to shape growth in China’s megacities rather than artificially spreading out development.108 This would help capture the large differences between the productivity of workers in rural areas and their urban counterparts. Although China has been urbanizing rapidly, only 52 percent of people currently live in cities, which suggests that potential productivity gains are still substantial.109

Allowing the private sector to play a more prominent role could also unlock massive gains in productivity. This has been a recurring theme, but the case for empowering the private sector has never been as strong as it is now. Productivity differences between private and state firms did not matter as much when returns on assets were rising for both groups and differences were narrowing in the years before the financial crisis. Both cohorts took a hit during the crisis, but rates of return for private firms have since rebounded sharply and are now around 11 percent compared with state firms, whose rates have fallen to 4–5 percent (see figure 6 above). This difference illustrates the potential productivity and growth benefits that would come from a rebalancing in favor of the private sector.

Reforms that simply call for leveling the playing field between state and private firms will not increase productivity significantly. Many of the reforms undertaken so far, including simplifying investment procedures and liberalizing capital movements, will help. But bolder policy actions—such as getting the state out of a range of commercial activities and opening up other areas, especially services, for private entry by both domestic and foreign firms—must be part of the productivity-boosting agenda. Unless Beijing shows a willingness to tackle major structural distortions that warp incentives to favor state enterprises, the economy cannot realize the efficiency increases it needs for rapid and sustained growth.

Reforms to curb the privileged position of SOEs will also address many of the issues with China’s financial markets. Most SOEs benefit from explicit or implicit government guarantees that give them and their creditors few incentives to limit their leverage. This has made SOEs the primary bad actors driving the excessive accumulation of corporate debt, and curbing them will free up capital for more productive small and medium private enterprises.