Yukon Huang, Isaac B. Kardon, Matt Sheehan

{

"authors": [

"Yukon Huang"

],

"type": "legacyinthemedia",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace",

"Carnegie China"

],

"collections": [

"China’s Foreign Relations",

"U.S.-China Relations"

],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie China",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [],

"regions": [

"United States",

"East Asia",

"China"

],

"topics": [

"Economy",

"Trade"

]

}

Source: Getty

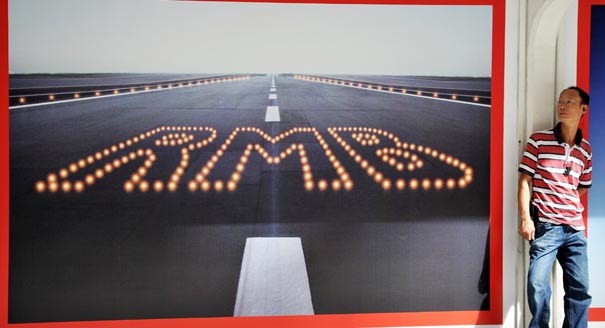

Anti-China Legislation Is Not the Solution

Blaming the undervalued Chinese renminbi for America's economic ills is convenient but counterproductive, given the complicated causes of U.S. trade imbalances.

Source: U.S. News and World Report

About the Author

Senior Fellow, Asia Program

Huang is a senior fellow in the Carnegie Asia Program where his research focuses on China’s economy and its regional and global impact.

- Three Takeaways From the Biden-Xi MeetingCommentary

- Europe Narrowly Navigates De-risking Between Washington and BeijingCommentary

Yukon Huang, Genevieve Slosberg

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

- Iran Is Pushing Its Neighbors Toward the United StatesCommentary

Tehran’s attacks are reshaping the security situation in the Middle East—and forcing the region’s clock to tick backward once again.

Amr Hamzawy

- Modernizing South Asia’s Borders Through Data-Driven ResearchArticle

Cargo time release studies offer a path to greater economic gains and higher trust between neighboring countries.

Nikita Singla

- The Gulf Monarchies Are Caught Between Iran’s Desperation and the U.S.’s RecklessnessCommentary

Only collective security can protect fragile economic models.

Andrew Leber

- Duqm at the Crossroads: Oman’s Strategic Port and Its Role in Vision 2040Commentary

In a volatile Middle East, the Omani port of Duqm offers stability, neutrality, and opportunity. Could this hidden port become the ultimate safe harbor for global trade?

Giorgio Cafiero, Samuel Ramani

- Europe on Iran: Gone with the WindCommentary

Europe’s reaction to the war in Iran has been disunited and meek, a far cry from its previously leading role in diplomacy with Tehran. To avoid being condemned to the sidelines while escalation continues, Brussels needs to stand up for international law.

Pierre Vimont