Another attempt of Moscow to talk the Chinese into accepting the idea of the Altai gas pipeline has failed. The Russian plan is to connect the traditional gas producing areas in the north of Western Siberia to China via a short common border segment between Kazakhstan and Mongolia. President Vladimir Putin has been saying since 2006 that Russia would like to be able to switch the export gas flows from Europe to China at will, depending on whichever could offer a better price.

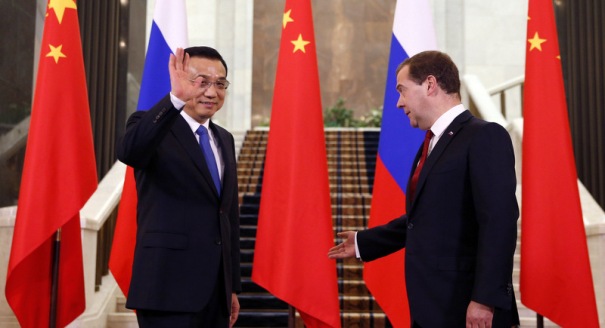

The Moscow media quoted quite a few Russian government officials before the visit of Chinese Premier Li Kequiang for negotiations with Prime Minister Dmitry Medvedev on October 13, insisting that the agreement on the Altai project, dubbed the Western Route, would certainly be signed. The Chinese guest, however, stated that new consultations were needed to examine the project. It was a polite but adamant form of rejection.

The idea of switching the gas flows from the west to the east and backwards was last voiced by Putin on September 1. Regarded in perspective, it is hardly a viable plan. Even if the Russians build the Altai pipeline, the volume of natural gas China would be willing to import from Russia can never replace the European sales of Gazprom.

It took BP experts about three years to change their mind about China’s gas consuming potential. In 2011, they admitted in their annual world energy outlook that the tempo of growth of Chinese gas demand was an “uncertainty” that affected all global prognoses. A year later, they said China’s northeastern provinces would not want more than 30 billion cubic meters a year of Russian gas. In September 2014, Vice President and Chief Economist of BP Russia, Vladimir Drebentsov, presented new charts and graphics showing that China could meet its requirements for natural gas through 2035 without any Russian supply.

Economists of Russia’s Lukoil agreed. According to their estimate, China’s appetite for imported gas would amount to 170 billion cubic meters in 2020, and this demand would be satisfied with 80 billion cubic meters of piped gas from Central Asia, another 12 billion from Myanmar, and 81.6 billion in the form of liquefied natural gas (LNG). These imports already make Gazprom’s supply irrelevant and unnecessary in China.

These economists assumed that Russia would be able to deliver 38 billion cubic meters a year in 2020, which is not true. The initial volume of annual supply from Russia will be less than five billion cubic meters that year. To reach the promised volume of 38 billion cubic meters a year, it will take Gazprom over a decade to develop the reserves in Yakutia and Irkutsk and to equip the pipeline with an adequate compressor capacity.

Essentially, this is a dubious battle between Moscow’s political ambition of blackmailing the Europeans with “alternative” Chinese sales and elementary arithmetic that ridicules the weak arguments of Gazprom and the Russian government.

To avoid the humiliation of seeing all their plans of cooperation with China in the gas export sector thwarted, the Russians persuaded the Chinese delegation to sign a few papers in support of the Eastern Route, that is, the Power of Siberia gas pipeline. Gazprom and CNPC had signed a classified document, tentatively named “a contract,” to launch the project in May 2014 in Shanghai, and now added an intergovernmental agreement to it. The vaguely-worded unbinding agreement promises assistance to the Power of Siberia without specifying any details.

Gazprom had said it needed the intergovernmental agreement to start working on the Power of Siberia—even though Putin already inaugurated the construction of that pipeline in September. Anyhow, the project is going ahead, and the Russian government admitted it would help finance it out of the 2015 budget.

As to the Chinese delegation, it stopped short of subscribing to the financing plan of the Power of Siberia (Gazprom had announced Beijing would give 25 billion dollars) and made an offer to Gazprom instead to co-finance the construction of pipelines on Chinese soil.

Was it a joke?

Mikhail Krutikhin is a partner at the independent RusEnergy consulting agency.