Ahmed Nagi

{

"authors": [

"Ahmed Nagi"

],

"type": "questionAnswer",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace",

"Malcolm H. Kerr Carnegie Middle East Center"

],

"collections": [],

"englishNewsletterAll": "menaTransitions",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Malcolm H. Kerr Carnegie Middle East Center",

"programAffiliation": "MEP",

"programs": [

"Middle East"

],

"projects": [],

"regions": [

"Gulf",

"Saudi Arabia",

"Yemen",

"North America",

"United States",

"Middle East"

],

"topics": [

"Security",

"Foreign Policy"

]

}

Source: Getty

What Does Biden’s Yemen Policy Mean for Saudi Arabia?

U.S. President Joe Biden seeks to end the six-year war in Yemen by dialing down military interventions and returning to diplomacy. Strange as it may seem, the Saudis’ current strategy is not that different.

How Has Saudi Arabia Reacted to Biden’s Decisions on Yemen?

On the surface, Biden’s announcements on Yemen signal a big policy shift. The most significant move is ending support for a grinding six-year Saudi-led military offensive in Yemen, while still defending Saudi Arabia against any attacks. This decision, coupled with the appointment of Timothy Lenderking—a former deputy assistant secretary for Arabian Gulf affairs—as the special envoy to Yemen, has made it clear the United States wants a return to diplomacy. Revoking the previous administration’s U.S. designation of the Houthis as a foreign terrorist group was a necessary step toward clearing the way for negotiations.

Interestingly, Saudi Arabia has been reserved in its response, primarily welcoming more defense cooperation and the appointment of an envoy. One might expect more of an indignant reaction, especially to the end of U.S. military support for the Saudi offensive. But there are several likely reasons for the Saudis’ muted tone. First, it’s currently unclear which arms sales the Biden administration will focus on and how they will define “offensive” and “defensive” actions by Saudi Arabia.

Second, while Riyadh publically supported the earlier U.S. designation of the Houthis as a terrorist group, this was largely because this was what the Yemeni government and the United States wanted. In fact, back in April 2019, during a Yemen parliamentary session, some members sought to make this designation themselves, but Riyadh put a stop to it from behind the scenes.1 Labeling the Houthis a terrorist group would make it hard for Saudi Arabia to pressure them to cut ties with Iran in return for full Saudi support.

Third—and relatedly—despite Saudi Foreign Minister Faisal bin Farhan’s seemingly cordial meeting with Lenderking, increased U.S. diplomatic engagement creates some unwelcome uncertainty around the Saudis’ long-standing back channel negotiations with the Houthis. The delicate ecosystem the two parties have kept running could be put at risk.

Will Biden’s Halting of Offensive Support Affect Saudi Arabia’s Military Strategy?

One overriding reason for Saudi Arabia’s understated response is that its military strategy has already been changing for some time and partially aligns with Biden’s policy changes. In mid-2019, Saudi Arabia started to shift from a strategy of hard intervention to soft intervention, with a noticeable decline in its military operations against the Houthis.

The economic, humanitarian, and political costs just became too high to be tenable, particularly when the coronavirus pandemic hit. Saudi Arabia’s military spending as a percentage of its GDP has been consistently high (13 percent at the start of the Yemen war in 2015), far exceeding even that of global powers such as the United States (3.5 percent in 2015). Much of this spending is used to counter Iranian threats, including in Yemen. And, of course, the catastrophic loss of life and food and medical shortages in Yemen have been well documented. International nongovernmental organizations are increasingly demanding that the Saudi-led coalition be held accountable for its failures to stem—and sometimes its fueling of—the world’s worst humanitarian crisis. Furthermore, the southern part of Saudi Arabia has come under increasing attack by the encroaching Houthis.

Given these costs and successive failures to stop the Houthis’ advancement, the current Saudi vision focuses on weakening the Houthis rather than defeating them. Direct Saudi-led coalition attacks against the Houthis have decreased dramatically over the last several years. The number of air strikes in 2019 was estimated to be just under 1,200, while in the first year of the war was about 7,000. Although there was an uptick in strikes in 2020, they primarily targeted Yemeni-Saudi border areas instead of inland—reflecting a more defensive posture to protect Saudi borderlands. Riyadh’s long game is to strengthen its influence among all Yemeni factions, so it’s not surprising that it is now more actively pursuing negotiations with the Houthis.

This trend sounds positive, but depending on the details of Biden’s reduced offensive support, Saudi Arabia may still try to secure the weapons it wants from elsewhere—Russia and China, for instance. In these countries, arms deals can occur quietly, without pressure from human rights organizations. The Houthis and other groups in Yemen have already turned to other states to buy and smuggle arms, in violation of the UN arms embargo. This smuggling allows arms suppliers to deny responsibility and will continue to fuel the conflict.

Ultimately, Saudi Arabia will protect its interests and likely claim that military attacks are defensive rather than offensive. And it will seek the weapons it needs to retaliate against the Houthis’ increasingly sophisticated drone attacks and other aggressive moves.

How Much Impact Could U.S.-Led Peace Talks Make?

The appointment of a U.S. envoy should help pry open channels of communication with the Houthis. But broadly speaking, talks with the group are not starting from square one. For the past two years, the Houthis and the Saudis have held secret discussions despite the hostilities—either through Omani mediators or through old communication lines between the two parties in the Saudi border city of Dhahran Al-Janoub.

In February 2020, bin Farhan said, “We have a back channel and it’s not yet ready to move to the highest level.” The diplomatic impact of this channel has been evident at times, such as in October 2019 when both sides made some positive remarks following the truce announced by the Houthis. Saudi Deputy Defense Minister Khalid bin Salman tweeted, “The truce declared by Yemen is viewed positively by the Kingdom, since this is what it has always sought and hopes that it will be effectively implemented.” The deputy minister for foreign affairs of the Houthi government welcomed this remark and considered it a positive sign toward peace. More recently, in November 2020, Saudi Arabia told Yemen’s Houthis via a back channel that it would sign a UN proposal for a nationwide ceasefire if the Houthis agree to a buffer zone along the kingdom’s borders. It’s not clear who on the Saudi side leads these talks, but Mohammed Abdulsalam, based in Oman’s capital city Muscat, is often the Houthis chief negotiator.

That said, externally led talks can be fruitful, as shown in recent months, particularly toward the end of 2020. In line with the UN-sponsored Stockholm agreement on Yemen, in a show of good faith, prisoner exchanges have occurred and Saudi Arabia has permitted medical evacuations out of the Houthi-controlled airport in Yemen’s capital. But the progress can easily be undone if skirmishes between the Saudis and Houthis continue to flare up—as they did last month and even this week with the Houthi bombing of Abha International Airport in southwestern Saudi Arabia.

The United States could play at least a tempering role and perhaps a greater one if armed with a comprehensive strategy to account for the numerous actors with stakes in the conflict’s outcome. The Houthis have made huge inroads in the war and are unlikely to accept a power-sharing deal, while many Yemeni citizens may not accept any legitimate governing role for the Houthis given the human atrocities committed by the group. And other outside actors could prove to be more meddlesome. For example, Russia and China have been attempting to play a big role in convening talks given their genial relations with Iran. The new U.S. strategy in Yemen might push Russia and China to further use their leverage on the Houthis to make U.S. engagement more difficult.

Is There a Chance Saudi Arabia Will Eventually Get Out of Yemen?

The simple answer is no. Even if future U.S. actions are in Saudi Arabia’s interest, the security cost of leaving Yemen is more than the cost of staying there. Riyadh will probably further invest in undercover proxy fighters while it continues to reduce its direct military interventions. This pattern resembles the strategy of the UAE, which announced in July 2019 the withdrawal of its troops from Yemen but then left behind a huge number of military forces on its payroll—more than 200,000 deployed on various military bases around the country. The UAE can carry out its strategy without being directly present, thereby dodging any direct responsibility.

This model also clearly applies to Iran, which uses loyal Houthis to exert its influence. Saudi Arabia is unlikely to leave this influence unchecked and will therefore continue to support its own loyal factions in Yemen, including governmental forces. This is evident in Saudi statements that followed Biden’s policy announcements. As such, the military and political scene in Yemen will continue to be full of proxies fighting with the support of behind-the-border sponsors.

Finally, there’s an overarching reality that will be hard to overcome. The Houthis and Saudis appear to be enemies, but in fact they are indirectly partners. The existence of the first party legitimizes the existence of the other; in other words, each provides a convenient bogeyman for the other. The Houthis will find no better excuse to remain dominant than Saudi Arabia, which has made so many huge mistakes during the six years of war. In the same way, Saudi Arabia will find no better excuse to remain in Yemen than the Houthis, given the continuing Iran-backed attacks on Saudi lands and parts of Yemen. Saudi Arabia will not abandon its Yemeni supporters or pass up opportunities to expand its influence.

Notes

1 According to personal communication between the author and two members of parliament at the time of the Yemen parliamentary session.

About the Author

Senior Analyst at the International Crisis Group

Ahmed Nagi is a senior Analyst at the International Crisis Group.

- The Pitfalls of Saudi Arabia’s Security-Centric Strategy in YemenPaper

- Saudi Arabia’s Split-Image Approach to SalafismIn The Media

Ahmed Nagi

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

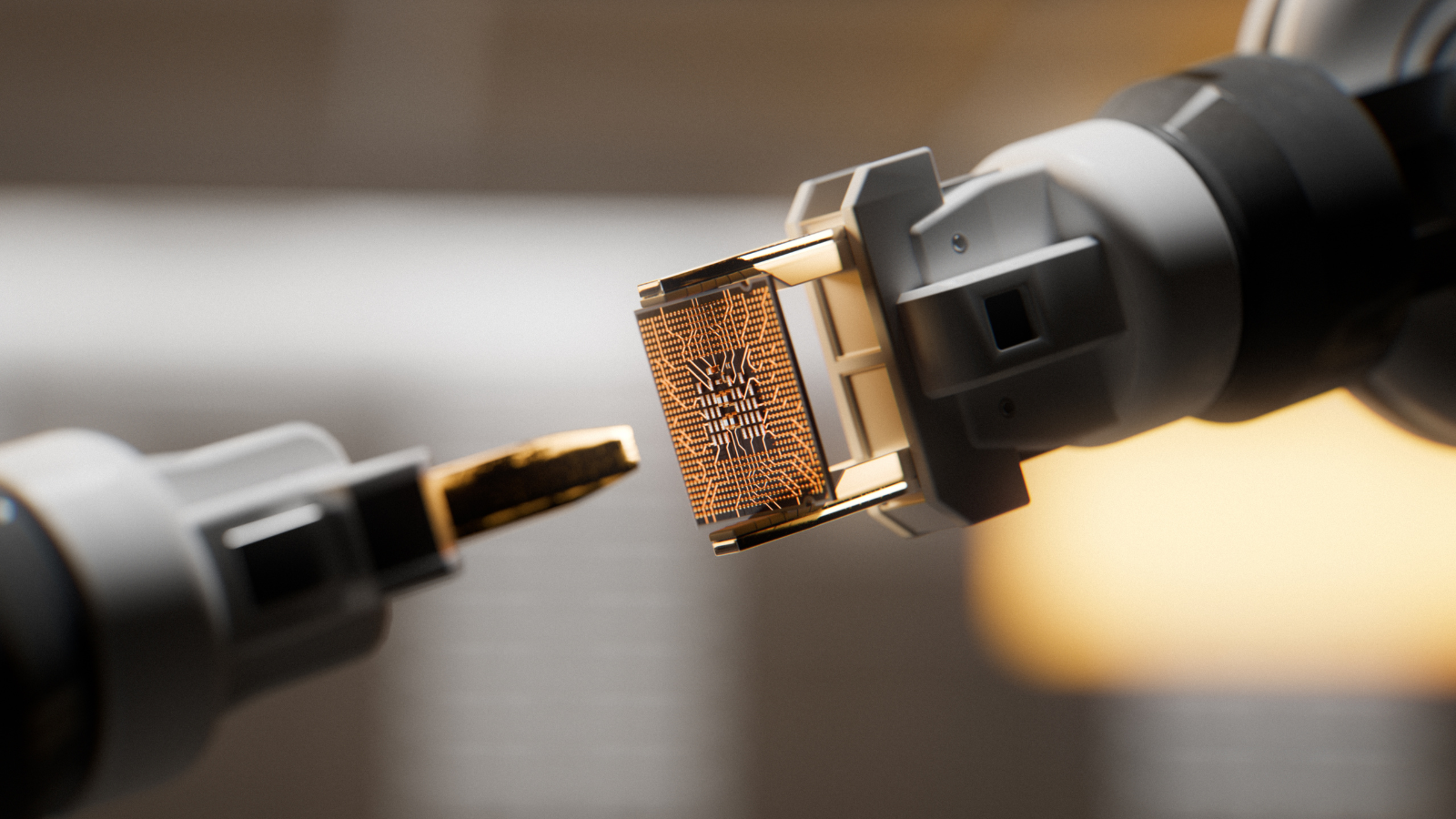

- India Signs the Pax Silica—A Counter to Pax Sinica?Commentary

On the last day of the India AI Impact Summit, India signed Pax Silica, a U.S.-led declaration seemingly focused on semiconductors. While India’s accession to the same was not entirely unforeseen, becoming a signatory nation this quickly was not on the cards either.

Konark Bhandari

- What We Know About Drone Use in the Iran WarCommentary

Two experts discuss how drone technology is shaping yet another conflict and what the United States can learn from Ukraine.

Steve Feldstein, Dara Massicot

- Beijing Doesn’t Think Like Washington—and the Iran Conflict Shows WhyCommentary

Arguing that Chinese policy is hung on alliances—with imputations of obligation—misses the point.

Evan A. Feigenbaum

- Axis of Resistance or Suicide?Commentary

As Iran defends its interests in the region and its regime’s survival, it may push Hezbollah into the abyss.

Michael Young

- How Far Can Russian Arms Help Iran?Commentary

Arms supplies from Russia to Iran will not only continue, but could grow significantly if Russia gets the opportunity.

Nikita Smagin