Kenji Kushida

{

"authors": [

"Kenji Kushida"

],

"type": "other",

"centerAffiliationAll": "dc",

"centers": [

"Carnegie Endowment for International Peace"

],

"collections": [

"Startup Japan",

"Innovative Japan, Global Japan"

],

"englishNewsletterAll": "asia",

"nonEnglishNewsletterAll": "",

"primaryCenter": "Carnegie Endowment for International Peace",

"programAffiliation": "AP",

"programs": [

"Asia"

],

"projects": [

"Startup Japan"

],

"regions": [

"East Asia",

"Japan"

],

"topics": [

"Economy",

"Technology"

]

}

Source: Getty

Startup Japan: Series Overview

Japan's startup ecosystem, which grew as a relatively peripheral segment of Japan’s economy throughout much of its recent history, is now front and center in getting attention from the government and big business.

Series Overview

Startup Japan is a multipart series covering Japan’s rapidly maturing startup ecosystem. In the government’s June 7, 2022, announcement of its new economic strategy, Kishida Fumio's administration included an aggressive vision for Japan’s startup ecosystem—a goal to increase the number of startups tenfold over the next five years. It is also set to use part of its $1.5 trillion pension fund, the world’s largest, to provide venture capital financing to boost the startup ecosystem.

So what is the status of Japan’s startup ecosystem, and what is the best way to go about understanding it? While the conventional wisdom and dominant narrative outside Japan—and to many inside Japan—is that Japan’s startup ecosystem is small, failing, or insignificant, the pieces in this series demonstrate that Japan’s startup ecosystem has actually spent years maturing and is currently on track to play a significant role in Japan’s political economy.

However, the role of Japan’s startup ecosystem will not be the same as that of Silicon Valley in the U.S. economy. In the United States, venture-capital-financed, fast-growth startups displaced and disrupted countless industries and incumbent large firms to become a pillar of the entire economy, venture capital became a critical component of the U.S. innovation system, and Silicon Valley produced many of the world’s most highly valued and cash-rich firms. Japan’s large firms are unlikely to be displaced by its startups. Instead, given that Japan’s political economy has suffered from rigidity and inflexibility, now that startups are partnering with large firms in various ways and enjoying social legitimacy of levels unseen in at least the past sixty years, Japan’s startup ecosystem can play a vital role in injecting flexibility, influencing the trajectory of large firms, and providing a much-needed venue for dynamism and growth.

This new framing is solidly supported by a wide range of evidence and company case studies, but since the conventional wisdom about Japan’s “small” startup ecosystem is predominant in most existing analyses and common narratives, a short, simple analysis will not suffice. Hence, this series will cover multiple aspects of Japan’s startup ecosystem in digestible chunks.

Of course, there is still much work to be done to further develop Japan’s startup ecosystem, and there are helpful measures the Japanese government can take. The U.S. government can also be helpful in this regard. It is critical, however, that a proper framing of startup ecosystems and their various components underlie the policy discussions.

In sum:

- Japan’s rapidly maturing startup ecosystem can play a vital role in influencing the trajectory of Japan’s political economy toward a path of greater dynamism and growth.

- Startup ecosystems are one of the important areas of U.S.-Japan cooperation. Growing Japan’s domestic startup ecosystem is also a policy priority for the Kishida administration, outlined explicitly in Japan’s economic growth strategy.

- Japan’s startup ecosystem has matured dramatically over the past two decades, but problems with how it is framed and understood have caused it to be underestimated and often dismissed as small and insignificant by many observers of Japan both inside and outside the country. This is a waste, making it even more difficult to attract international partners and support within Japan.

- Japan’s startup ecosystem is small compared to the United States’ in Silicon Valley, but not notably smaller than those of many other G7 countries in absolute terms.

- Japan’s startup ecosystem shouldn’t be expected to replace the core of Japanese industry, displacing major incumbent firms. Instead, the international community should look for collaboration between large incumbent firms and startups that causes incumbents to shift direction and try new things that they would not otherwise. Japan’s challenge has been the inflexibility of its large firms, and the startup ecosystem adds flexibility.

- Building startup ecosystems takes time, and Japan’s startup ecosystem has grown up alongside its large-firm-dominated core for the past twenty years, with each of its components maturing over time.

- Looking at the challenges ahead should not detract from appreciating the accomplishments of the past twenty years.

- There are many reasons to believe that Japan’s startup ecosystem is poised for rapid growth. Most importantly, the underlying components of the ecosystem now enjoy positive feedback loops of growth, also known as virtuous cycles.

- The social legitimacy of Japan’s startup ecosystem is at a level not seen for at least sixty years, opening up opportunities for its growth to accelerate.

This research is based on over ten years of research on Japan’s startup ecosystem, gathering data and following developments, companies, people, governments, and regulations as they evolved.

At the base of every discussion about startup ecosystems needs to be a conception of what their main components are, and how these components fit together. The conception here, based on the Silicon Valley model, involves several main components that depend upon one another, as each component develops over time to experience the positive feedback loops of development that are needed for the component to become self-sustaining.

Components Underlying Startup Ecosystems

| Institution | Silicon Valley Model |

| 1) Finance | Venture capital |

| 2) Labor market | Dynamic, highly educated, top talent from around the world |

| 3) University-government-industry ties | Multifaceted, conducive to forming and growing new companies |

| 4) Industry organization | Symbiosis of large firms and startups, intense competition |

| 5) Social norms surrounding entrepreneurship | Celebration of entrepreneurs and startup ecosystem |

| 6) Professional services supporting startup ecosystem | Professional services supporting startup ecosystem, numerous venues for startups and collaboration |

| Source: Kenji Kushida, “Departing From Silicon Valley: Japan’s New Startup Ecosystem,” in Reinventing Japan: New Directions in Global Leadership, ed. Martin Fackler and Yoichi Funabashi (Santa Barbara: ABC-CLIO, 2018), 81–102. | |

Each part of this series will take a deeper dive into one of the components, as well as introducing the model itself.

Parts of this series:

- Overview and snapshot of Japan’s startup ecosystem

- Understanding startup ecosystems: their components and complementarities

- Japan’s venture capital industry

- Labor mobility

- University-industry relations

- Government support

- Large firm–startup symbiosis

- Social legitimacy of startup ecosystem

- Startup ecosystem support businesses

About the Author

Senior Fellow, Asia Program

Kenji Kushida is a senior fellow in Carnegie’s Asia Program, primarily directing research on Japan along the theme of Innovative Japan, Global Japan, including the new Japan-Silicon Valley Innovation Initiative@Carnegie.

- Is Takaichi Japan’s Future?Article

- What Awaits Japan’s Next Prime MinisterArticle

Kenji Kushida

Recent Work

Carnegie does not take institutional positions on public policy issues; the views represented herein are those of the author(s) and do not necessarily reflect the views of Carnegie, its staff, or its trustees.

More Work from Carnegie Endowment for International Peace

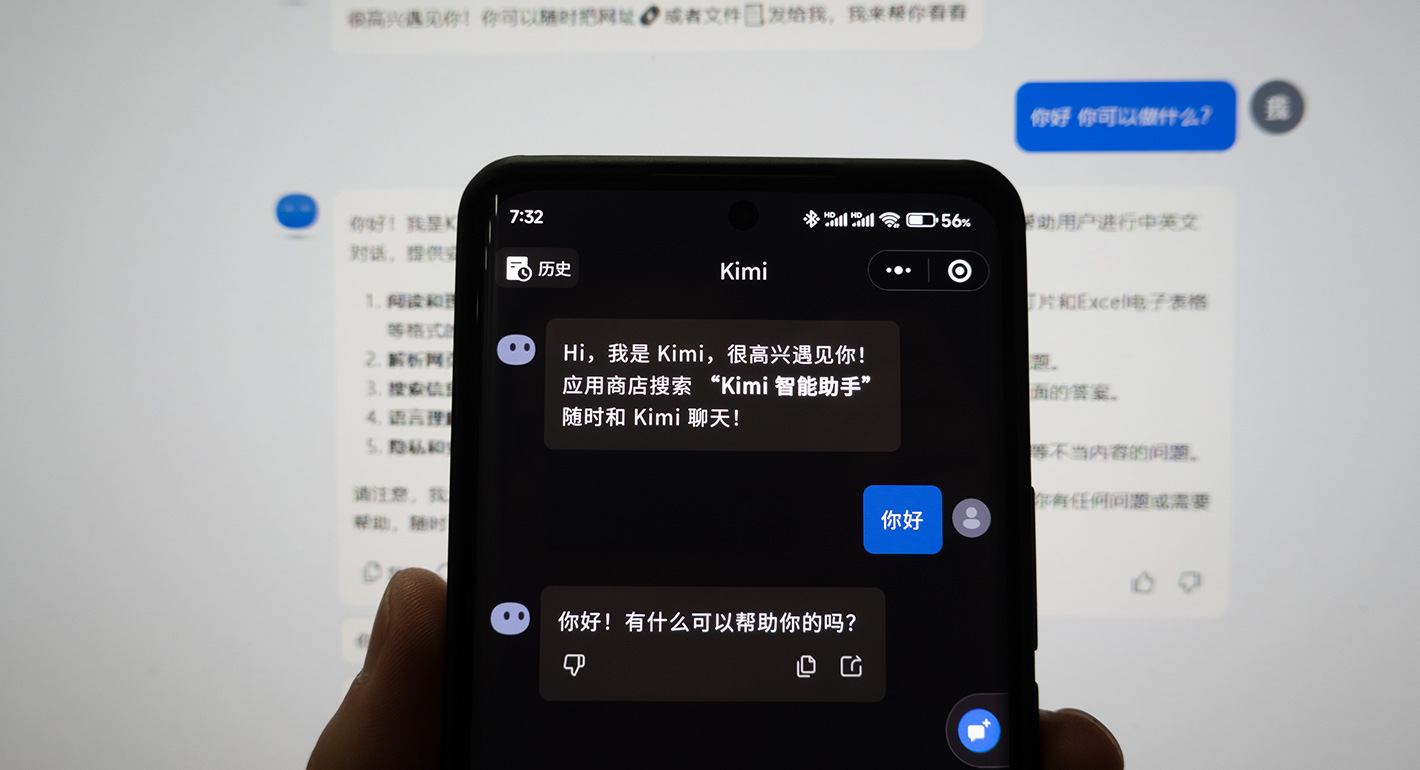

- China Is Worried About AI Companions. Here’s What It’s Doing About Them.Article

A new draft regulation on “anthropomorphic AI” could impose significant new compliance burdens on the makers of AI companions and chatbots.

Scott Singer, Matt Sheehan

- Getting Debt Sustainability Analysis Right: Eight Reforms for the Framework for Low-Income CountriesPaper

The pace of change in the global economy suggests that the IMF and World Bank could be ambitious as they review their debt sustainability framework.

C. Randall Henning

- How Middle Powers Are Responding to Trump’s Tariff ShiftsCommentary

Despite considerable challenges, the CPTPP countries and the EU recognize the need for collective action.

Barbara Weisel

- How Will the Loss of Starlink and Telegram Impact Russia’s Military?Commentary

With the blocking of Starlink terminals and restriction of access to Telegram, Russian troops in Ukraine have suffered a double technological blow. But neither service is irreplaceable.

Maria Kolomychenko

- How Europe Can Survive the AI Labor TransitionCommentary

Integrating AI into the workplace will increase job insecurity, fundamentally reshaping labor markets. To anticipate and manage this transition, the EU must build public trust, provide training infrastructures, and establish social protections.

Amanda Coakley